It’s one thing to identify stocks with big dividend yields, but it’s something very different to identify big dividend yields that are also healthy and strong. In this report, we highlight the 40 biggest dividend yield stocks (from the NYSE and Nasdaq) that also have healthy dividend growth numbers and healthy dividend coverage ratios (which is saying a lot considering covid). After reviewing some important takeaways from the list, we then dig deeper into three specific names that are particularly attractive and worth considering for income-focused investors. We conclude with an important overall takeaway for investors.

The 40 Biggest Strong Dividends:

Finding the “biggest” yields is pretty straightforward, but finding “strong” yields is somewhat subjective. Some investors might suggest that the biggest strong yields are simply the biggest yields that haven’t cut their dividends in a very long time, for example 10 years or more. Those are the stocks we have included in this first list, but this list is not our “official list” for this article (that comes later in this report).

While the names on the above list might seem attractive, in many instances the list may be putting too much emphasis on what has happened in the past (say 10 or more years ago) than what might happen going forward. You’ll also notice that names on the above list tend to be not that big (a lot of them are less than 4% yields), and a lot of popular big dividend payers seem to be missing.

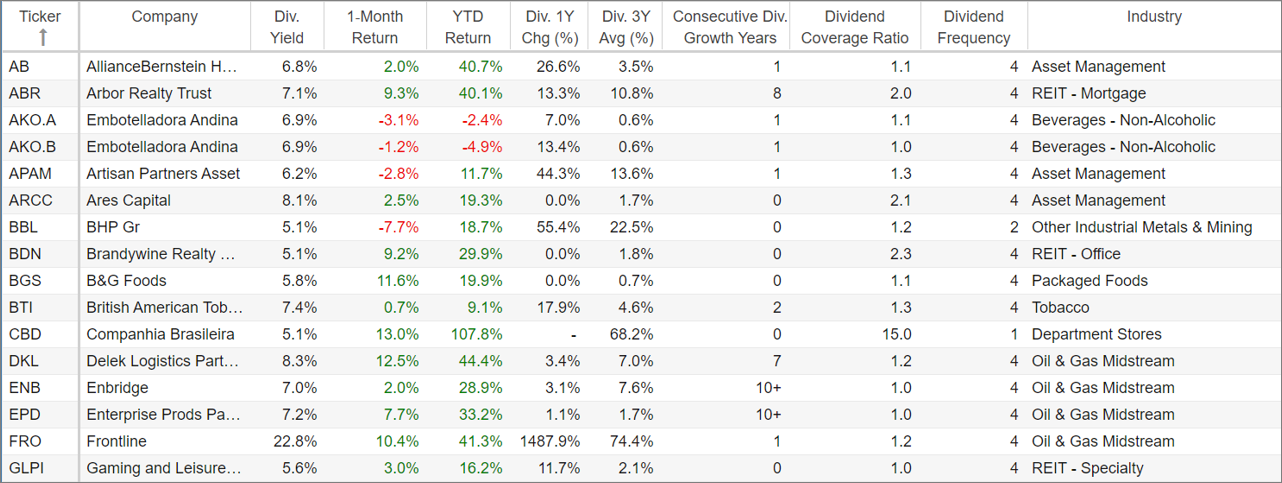

For this report, we define the 40 biggest strong yields differently. Specifically, we ran a screen to find the 40 biggest dividend yield stocks on the NYSE or Nasdaq that have healthy dividend growth numbers and healthy dividend coverage ratios. More specifically, we exclude companies with negative dividend growth numbers over the last one and three year periods (that’s saying a lot considering the havoc caused by the pandemic), and we require healthy dividend coverage ratios (for example, is the dividend smaller than EPS—or FFO in the case of REITs). Here is a look at the specific names that made our list.

(source: StockRover. Data as of 10-Jun-21)

As you can see, our list includes many more “popular” big dividend names that you’ve likely heard of (not necessarily a good thing) and it also includes higher overall yields in general. In addition to recent performance, you’ll also notice the dividend coverage ratio (as well as FFO per share for REITs).

One good thing about running a screen like this second one is that you get a good idea of what businesses are healthy enough to weather extreme conditions (such as the pandemic), but you also get some idea if they have enough earnings to actually make the dividend sustainable in the longer-term. Often times, business can get overly focused on maintaining a steady growing dividend that the rest of their business is weak because so much cash flow is drained away by the dividend (for example, AT&T (T) has faced challenges in this regard).

Of course, one of the downsides of using a screen like this is that you run the risk of screening out well-managed companies that proactively reduced their dividends during the pandemic in order to maximize long-term value (instead of stubbornly sticking to a high dividend payment that would drain too much cash flow from the rest of the business). Simon Property Group (SPG) is arguably one example that comes to mind (SPG reduced its dividend during the pandemic, but is now in a much better cash position than some other REITs that were not so proactive). This is why quantitative screening alone is not enough, and it’s also why we dig deeper into the fundamentals when explaining the three specific big strong dividends that view as particularly attractive and worth considering for investment (later in this report).

On a similar note, another risk of this type of big dividend screen is that you focus too much on the dividend, and not enough on total returns (i.e. dividends plus share price appreciation). However, if you are reading a report like this one then chances are you are an income-focused investor that cares a lot about getting those big steady cash dividend payments (we’ll have more to say about individual investor goals in the conclusion of this report). As the saying goes, a bird in the hand is worth two in the bush (especially in a rising inflationary environment).

As you review the results of our screen, you may notice a few of your personal favorite dividend payers on the list. And before we get into a discussion of the three specific names that we considering particularly attractive, we first share the same data on a few popular dividend payers that did not make the list.

The Also-Ran Dividends:

For good measure, there are a lot of popular big-dividend payers that did not make our list because they have recently decreased their dividend or they don’t have strong enough dividend coverage ratios, such as several of the names listed below.

(source: StockRover. Data as of 10-Jun-21)

And you may actually like several of the names on this “also-ran” list for various reasons. For example, we mentioned retail REIT Simon Property Group earlier. SPG did reduce its dividend significantly, but it has experienced strong price appreciation recently (as re-openings continue) and looks strong going forward. Energy Transfer (ET) is another name on the also-ran list that is compelling. Despite the fact that ET reduced its dividend, it has increased strength as the overall industry benefits from higher energy prices, higher demand and the potential for rising inflation.

3 Big Strong Dividends Worth Considering

With that data backdrop in mind, we next dive into three specific big strong dividend payers that are attractive and worth considering for investment.

Ares Capital (ARCC), Yield: 8.1%

Ares Capital is a business development company (“BDC”), which means it basically provides financing to smaller and mid-sized businesses in the form of debt and equity investments. And Ares has some pretty clear advantages over its peers, such as its large size, seasoned management team and strong balance sheet (more on these in a moment). And as you can see in our earlier list of the 40 biggest strong dividends, Ares has both a solid dividend growth track record as well as earnings per share that greatly exceeds its dividend per share (and its net investment income per share also exceeds its dividend per share over the last two quarters in aggregate). In fact, Ares recently grew its track record to 46 consecutive quarters with stable to growing dividends (i.e. no dividend cuts).

source: Ycharts

For a little more perspective, here is a look (see table below) at how Ares compares to other BDCs in terms of important metrics like market cap, dividend yield, valuation (price-to-book ratio) and recent performance.

(source: StockRover.com, data as of 09-Jun-21)

First, Ares is the largest BDC in terms of market capitalization. This is both the result of, and a reason for, Ares outstanding resources, including capital and access to deal flow. As we wrote in our recent subscriber-only report on Ares:

Also very important, ARCC derives significant benefits from its relationship with global alternative investment manager, Ares Management Corporation (ARES). Ares Management Corp. operates integrated businesses across multiple asset classes such as credit, private equity, real estate and strategic initiatives. And as a part of the Ares group, ARCC derives multiple benefits in the form of investment origination leads, flexible access to capital, augmented market reach and also a pool of highly experienced investment professionals that help drive long-term performance.

Another thing you’ll notice about Ares is its relatively attractive valuation. For example, it currently trades at only 1.0x its book value, which is low compared to its all time highs, and low compared to many of its peers. Additionally, considering our current economic environment (e.g. low credit spreads and ongoing re-opening recovery) there are lots of things to like about Ares. You can read all the details (including about the business, the balance sheet, liquidity, valuation and risks) in our recent subscriber-only full report on Ares (link provided above), but know that we like it enough to own it (we currently own shares) and to highlight its attractiveness in this report.

Main Street Capital (MAIN), Yield: 5.9%

The next name on our list is also a BDC, but this one is attractive for similar and different reasons. Similar to Ares (and as you can see in our earlier table of the 40 biggest strong dividends), Main Street (MAIN) also maintained its dividend throughout the pandemic crisis (it’s actually never reduced its dividend throughout its entire 13 year history as a public company) and its dividend is well covered by its earnings per share (it’s well covered by its distributable net investment income per share too). However, Main Street is different because it pays dividends monthly and because it is internally managed (both of these qualities have their advantages). Additionally, Main Street’s target loan size niche is generally smaller than Ares (another important differentiator).

Another thing you’ll notice about Main Street (in our BDC table in the Ares section), is that it has the highest price-to-book value among the major BDCs. This is nothing new, in fact this premium valuation has persisted throughout most of the company’s history, as investors are willing to pay a premium for access to Main Street’s niche portfolio investments, internal management team and monthly dividend. For a little more perspective, here is a look at Main Street’s historical price-to-book value.

(source: YCharts)

We are comfortable with the price-to-book value of Main Street, despite the risk factors (as we described in our recent full report to members of Big Dividends PLUS), such as the inherently higher risks of the smaller companies Main Street lends to, interest rates and sensitivity to overall macroeconomic conditions, to name a few. In our view, the risks are outweighed by the attractive qualities (including the dividend) and we continue to own shares of Main Street Capital.

Another Risk of Screening for Big Strong Dividends:

We mentioned earlier a few of the risks of running a screen like this one (such as the unique situations of Simon Property Group and Energy Transfer, for example). However, another big risk is that some attractive opportunities get missed altogether. For example, our screener omitted closed-end funds, and in doing so it missed an exceptionally attractive and unique opportunity that offers a big safe dividend yield.

Reaves Utility Income Fund (UTG), Yield: 6.2%

As mentioned, the Reaves Utility Income Fund doesn’t show up on our screen (because it’s a closed-end fund, not a stock), but it does offer an extremely attractive big strong distribution yield (paid monthly) that is absolutely worth considering.

For starters, the Reaves Utility Income Fund is a closed-end fund that focuses on the utilities sector (currently among the highest yielding sectors, and generally considered a very “safe” sector). Next, the big dividends are paid monthly (attractive) and they are healthy (generally based on long-term gains and income, not short-term gains or a return of capital). Further, this fund uses a little bit of prudent leverage (borrowed money, currently 15.7%) to magnify the income paid to investors (also attractive). Finally, the shares trade at a relatively attractive price as compared to the net asset value of the fund (the 3-month, 6-month and 12-month z-stats are all fairly close to zero). And finally, the utilities sector remains increasingly attractive if and when inflation ramps up (as many investors increasingly believe it will). We recently completed a detailed subscribers-only report on UTG, and concluded it with the following:

If you are an income-focused investor, there’s lots to like about the Reaves Utility Income Fund, including its big monthly dividend (it currently yields 6.2%), the steadiness of the utilities sector, the prudent use of leverage, the tax-advantages (particularly if you’re going to own it in a taxable account), and the current price (considering inflation may bode well for the utilities sector in general).

Conclusion:

Finding the biggest dividend yields is easy, but finding big dividend yields that are also healthy and strong is more challenging. Running stock screens (such as the ones in this article) can be helpful, but be careful to put too much emphasis on them because the metrics can be misleading (for example, is past dividend performance really the best indicator of future dividend success?), and they can also omit attractive opportunities (for example, our screener missed UTG). That’s why it is so important to dig deeper with fundamental research, rather than to simply let quantitative screeners go wild.

If you liked the three specific big-dividend stock ideas in this report, you might also be interested to know we recently ranked them #9 #8 and #7 in our new members-only report: Top 10 Big Dividends (Income Ahead of Inflation). However, at the end of the day it’s critically important to know your own personal goals as an investor, and to then select prudent opportunities for you. Discipled, goal-focused, long-term investing will continue to be a winning strategy.