Although this company lags Amazon in global e-commerce sales, it is a rapidly growing ecommerce juggernaut in its own right, and its expanding list of highly valuable add on services is benefiting customers and the company itself. 2020 was obviously an aberration year, as e-commerce sales spiked due to the pandemic. But 2021 revenue growth is expected to be higher than pre-2020 years, and the large total addressable market opportunity gives the shares plenty of room to run. And although we expect volatility in the short-term, the recent price pullback provides some additional margin of safety for long-term investors. In this report, we review the business, growth prospects, valuation, risks and conclude with our opinion on investing.

Overview: Shopfiy (SHOP)

Shopify (SHOP) is a cloud-based e-commerce platform. It offers a multi-channel front end (that enables merchants to display, manage and sell their products across over a dozen different sales channels) and an integrated back end (that allows merchants to manage most of their e-commerce functions). The company generated $2.9 billion in revenues in 2020, from the following two streams:

Subscription Solutions (31% of 2020 revenues): encompasses a recurring subscription component of revenues primarily from the sale of variable platform fee-based subscriptions under Basic, Shopify, Advanced and Shopify Plus plans. Revenues are also generated from the sale of subscriptions to point-of-sale (POS) offering, sale of themes and apps, and registration of domain names.

Merchant Solutions (69% of 2020 revenues): encompasses a number of fees generating value-add functionalities that augment the solutions provided under subscription and also increase the use of platform by merchants. These include accepting payments via Shopify Payments, shipping via Shopify Shipping, order fulfillment via Shopify Fulfillment Network, securing working capital via Shopify Capital, mobile shopping via its app Shop, etc.

Shopify’s platform is engineered to enterprise level standards that allows it to deliver its offerings to businesses of all sizes, including individual entrepreneurs, small and medium businesses (SMBs), as well as large enterprises. Presently, Shopify’s platform powers over 1.7 million businesses, including over 10,000 enterprise grade businesses/brands, in more than 175 countries, mostly concentrated in North America (US 50%, Canada 6%) and Europe (25%). Shopify was founded in 2004 by Tobias Lütke, who still serves as its CEO. The company is headquartered in Ottawa, Canada.

Strong Value Proposition

Increasing consumer preference for online shopping has made it absolutely essential for most businesses to digitize. However, individual entrepreneurs and SMBs (small and mid-sized businesses) often lack the robust IT infrastructure to support their digital business models. Shopify focuses primarily on these businesses, and offers a turnkey solution (in the form of an easy-to-use digital commerce software platform). This makes the Shopify platform not only attractive, but also mission critical to their operations.

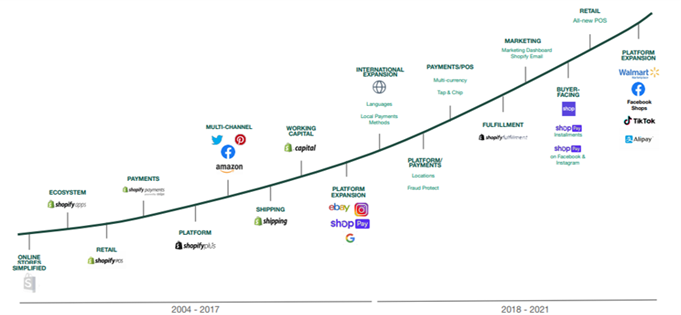

Source: 1Q21 Investor Presentation

Further, Shopify’s wide array of add-on functionality also adds significant value to merchants (for example, by significantly increasing upselling opportunities). Additionally, the company has recently been expanding its platform capabilities by integrating with online sales channels such as Walmart (WMT), and a number of social media platforms such as Facebook (FB), Tiktok and Pinterest (PINS). These integrations further enhance the value proposition of the platform to merchants by providing them additional sales and marketing channels, while still seamlessly managing their products, inventory and fulfillment directly within the Shopify platform.

Source: 1Q21 Investor Presentation

All of this combines to lower operational barriers, and has resulted in a significant increase in the number of merchants on the platform (in a relatively short span of time). Today, Shopify has the largest number of merchants for any e-commerce platform in the US, and it is second (behind only Amazon (AMZN)) in terms of gross merchandise value.

Staggering Q1 Results Point to Sustainable Post-Pandemic Growth

Since its IPO in 2015, Shopify has consistently delivered high double-digit revenue growth (led by a growing number of merchants on the platform and the increasing adoption of its add-on offerings). And this growth rate accelerated in 2020 (as the pandemic led an increasing number of consumers and suppliers to shift business online). And the trend has continued into the first quarter of 2021 as Shopify registered a staggering 114% y/y growth in GMV (to $37.3 billion) and consequently 110% y/y growth in revenue (to $988.6 million). This is extremely impressive, especially considering there were serious concerns surrounding growth, particularly as the first quarter is typically weak, and as economies began to re-open with the roll-out of vaccines.

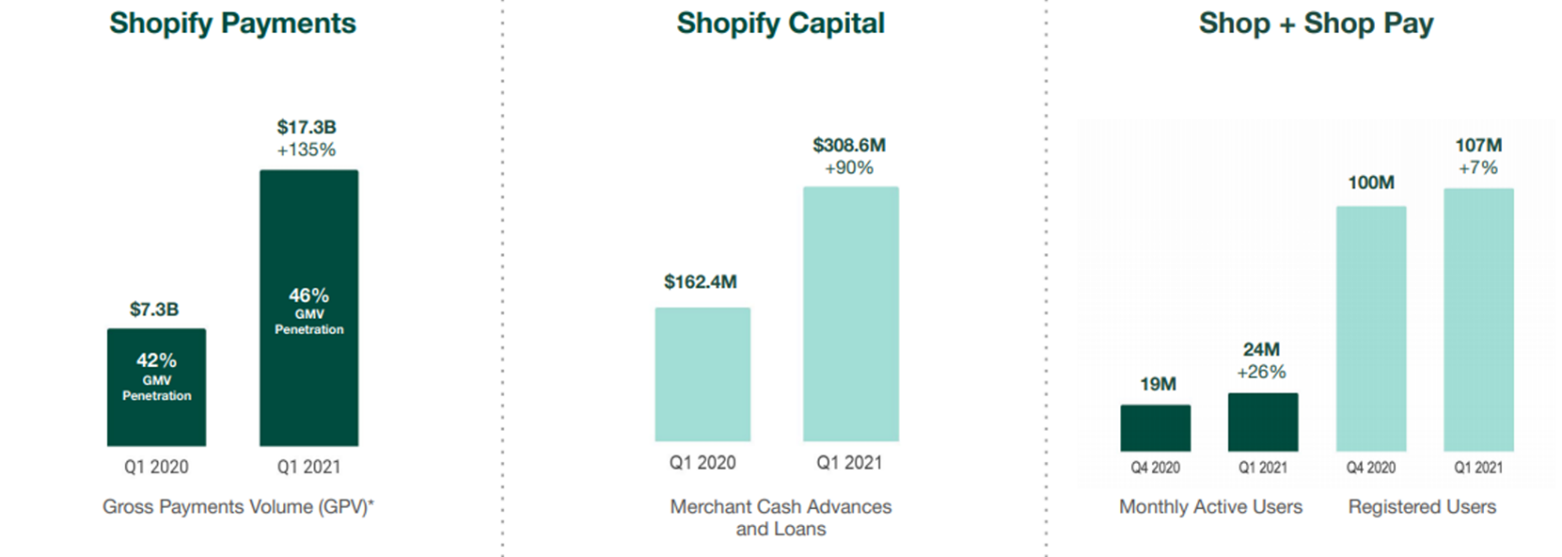

Source: 1Q21 Investor Presentation

Importantly, Shopify’s growth remained broad-based across all operational areas and financial metrics, as was seen throughout 2020. For example, Q1 Subscription solutions revenue grew by 71% y/y (to $320.7 million), driven by strong growth in monthly recurring revenue (MRR), which accelerated to 62% y/y (to $89.9 million), and benefitted from a significantly higher number of merchants on standard plans joining the platform in 2020.

The Shopify Plus subscription plan also saw very strong uptake as a significant number of existing merchants graduated from standard plans. Also, a record number of high-volume brands (including brands from outside North America such as Japan’s sports brand Mizuno, and Unilever's Indian DTC store) signed on as Shopify continued to to expand internationally. Shopify Plus contributed $23.1 million or 26% of the MRR.

Merchant Solutions revenue experienced massive acceleration (137% y/y to $668.0 million). And the share of Merchant Solutions (as a percent of total revenue) continued to grow (68% in 1Q21 vs. 60% in 1Q20) with a growing contribution from value-add solutions such as Shopify Payments (its biggest revenue contributor), as well as from Shopify Capital. The segment also benefitted from the growing number of users on the company’s mobile app, Shop and increasing adoption of the mobile payment functionality, Shop Pay.

Shopify also continued to progress well on building the Shopify Fulfillment Network and saw more merchants joining the service as it fulfilled volumes similar to the holiday quarter of 4Q20. Overall, the increasing adoption of value-add solutions bodes well for the company as we believe these will be the key longer-term business drivers.

Source: 1Q21 Investor Presentation

On the profitability front, Shopify recorded its highest ever adjusted gross profit increase of 114% y/y (to $565.1 million), which represented a margin of 57%. Subscription solution gross margins remained firmly over 80%, but what was particularly encouragingly was the fact that merchant solutions contributed over half of the gross profits and posted improved gross margins of ~44% vs. ~38% a year ago. While merchant solutions gross margins are expected to decline in the short term, particularly as Shopify develops its fulfillment network, higher gross profits from the segment are important from the perspective of longer-term improvement in the company’s operating margins due to its high flow through to the operating income line compared to subscription solutions gross profit.

“Gross profit margins on Shopify Payments, the biggest driver of merchant solutions revenue, are typically lower than on subscription solutions due to the associated third-party costs of providing this solution. We view this revenue stream as beneficial to our operating margins, as Shopify Payments requires significantly less sales and marketing and research and development expense than Shopify’s core subscription business.” – Shopify 1Q21 6K Filing

This had a positive impact on operating margins, which were also accentuated by leverage on sales and marketing spend because of the high degree of network referrals (up 73% y/y), and the overall operating expense leverage because of the higher sales level. Specifically, adjusted operating profit in the quarter was $210.8 million, and represented a margin of 21% vs. an adjusted operating loss of $7.3 million or 1.5% negative margin in 1Q20. Overall, we believe the strong underlying trends behind the operating line performance clearly demonstrate the company’s longer-term earnings power.

Source: 1Q21 Investor Presentation

From a cash flow perspective, Shopify generated $136 million in cash from operations during the quarter, and on an LTM basis the amount stands at $650 million. Its balance sheet position is also sound with $7.9 billion in cash and marketable securities and long-term debt of $909 million, all in convertible notes.

Going forward, Shopify expects some consumer spending will likely rotate back to offline retail and the accelerated shift to ecommerce will resume a more normalized pace of growth. Accordingly, it expects growth across its business in 2021 to moderate from the exceptional highs of 2020, but still to be higher than any of the previous years. It plans to keep building on the growth momentum for the longer haul through aggressive investments in sales and marketing and innovation. It also plans to make strategic investments in companies within its partner ecosystem.

“We see tremendous growth opportunities. And so we will continue to invest back into the business as aggressively as we can. As I said from my opening remarks, we do expect OpEx spend to accelerate each quarter for the remainder of the year. We are seeing velocity in engineering, hiring and sales and marketing hiring as we lean into the opportunities, and we resource those growth initiatives that I talked about earlier, Shopify Fulfillment Network, Shop app, International. Across the board, we have these opportunities and we will lean into them.” - Amy Shapero, CFO on 1Q21 earnings call.

Expanding Total Addressable Market (TAM) Opportunities

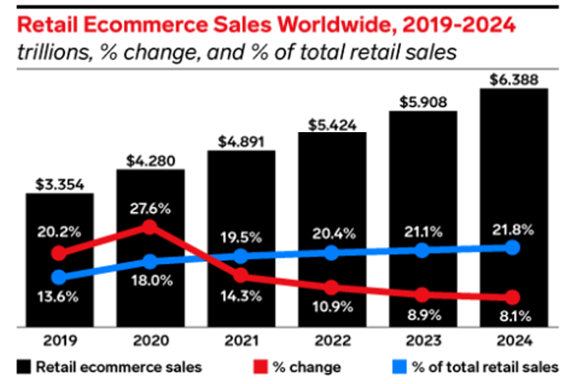

Recently there have been some concerns surrounding the growth of worldwide e-commerce, considering economic re-openings in a post-pandemic world. As per a recent global ecommerce report by e-marketer, worldwide ecommerce growth is expected to decelerate substantially in 2021 and beyond, partially because of a brick-and-mortar rebound and also because a lot of the growth was pulled forward to 2020 due to the pandemic. Nonetheless, ecommerce is expected to outpace the growth in offline retail and continue to grow its share of worldwide retail sales.

Source: e-marketer, Dec 2020

In its 1Q21 presentation, Shopify mentioned it has an SMB TAM of ~$153 billion, based on an ARPU of $2,258 from about 68 million retail businesses globally, which is only about 3.5% of the total worldwide retail e-commerce sales of $4.3 trillion. Going forward, we believe Shopify is well-positioned to grow this ARPU and consequently its TAM within retail e-commerce as it expands its add-on functionalities, opens them up into new geographies and most importantly, as it continues to integrate its platform with multiple sales channels and social media channels that have billions of daily users.

Additionally, Shopify has a large untapped wholesale e-commerce opportunity in front of it, stemming from the growth of larger brands on its platform. B2B e-commerce has seen rapid growth in recent years and is currently estimated to be over a $1 trillion opportunity in the US alone. Some of the key trends underlying B2B e-commerce such as preference for mobile commerce, integration for multi-channel selling, and demand for fast B2B order fulfillment are all within the domain of Shopify’s platform. As Shopify penetrates more into larger brands it will have a larger play area to grow its market, although this is not a primary focus area of the company currently.

Strong Founder CEO Led Company, But Recent Management Churn is Concerning

Shopify has a strong CEO in Tobi Lütke who had initially created the software for the launch of an online snowboard store and later pivoted the underlying software into the Shopify platform. He has been instrumental in guiding the initial adoption of the platform and later its rapid growth, which has mostly been organic, except for a few small acquisitions that were perceived as extremely important for the platform’s further enhancements. For example, the 6 River Systems acquisition in 2019 enhances Shopify’s service to merchants in the realm of shipping and fulfillment.

Shopify has recently experienced a considerable amount of churn in its top management team, with three of the top seven executives including its Chief Technology Officer Jean-Michel Lemieux, Chief Talent Officer Brittany Forsyth and Chief Legal Officer Joe Frasca leaving the company in the next few months. These departures come on the heels of the departure of its long serving Chief Product Officer Craig Miller in September 2020, a position which was later taken over by Mr. Lütke himself. While the CEO has termed the departures as “totally OK” and has mentioned that the company has a strong bench of leaders who will step up into larger roles, he is yet to announce a replacements for these important roles, which we find a little concerning. Nonetheless, on being asked about his own plans at the company on the 1Q21 earnings call in view of the departures, the CEO firmly put forward his point on staying with the company for the long haul and we find this encouraging.

“I'm committed. I'm in for a long term here. I've never in my life come up with a better idea than the one of Shopify. So I'm all in.”- on 1Q21 earnings call.

Also, Mr. Lütke has a fairly large ownership stake (0.22% in Class A and 65.56% in class B shares) and a 33.9% voting interest in the company, which certainly aligns his interests with that of Shopify’s investors.

Valuation

Shopify trades at a premium valuation multiple, which is not surprising given the company’s high revenue growth rate and large market opportunity. For example, the shares currently trade at 39.8 times sales, a number which seems exorbitant to some traditional investors. However, Shopify is unique considering it’s ecommerce business model allows it to grow much faster than more traditional “old economy” businesses.

source: Ycharts

Further, this price to sales multiple falls when compared to forward sales (which is indicative of the company’s high sales growth trajectory) as you can see in the chart above. Additionally, this is a high margin business (very attractive), and you can see some additional important data points in the table below.

source: StockRover

The shares have sold off a bit this year (as you can see in the chart above) which provides an additional margin of safety for long-term investors. However, given the premium valuation multiple, these shares will likely see continued volatility as the price rises in the long-term, in our expectation.

Perhaps worth noting, even the street has a fairly positive outlook on Shopify, as more than half of the Wall Street analysts covering it are bullish and have a consensus price target of $1,483.80, which represents over 30% upside potential from the current price.

Source: Seeking Alpha

Risks

Competition: While no competitor currently offers an integrated, multi-channel, cloud-based e-commerce platform with comparable functionality, Shopify still faces intense competition from e-commerce platform providers such as BigCommerce, as well as larger companies seeking to provide e-commerce software and services. For example, Adobe (ADBE) forayed into e-commerce tech when it acquired Magento in 2018, Facebook introduced Facebook Shops and Instagram Shops in 2020.

Reopening of Economies: As vaccines have begun to roll out in several countries, the overall economic environment has improved. Vaccinated consumers are moving more freely and have been spending heavily on offline purchases, and this is likely to impact Shopify’s growth to some extent, going forward. However, Shopify has already factored this in and expects to deliver growth higher than what it had experienced in years prior to 2020.

Inflation: As per the Organization for Economic Co-operation and Development (OECD), inflation is expected to rise in the future. Rising inflation typically curtails consumer spending. This is likely to limit the business of merchants on Shopify’s platform and thus hurt its gross merchandise value.

Source: OECD

Conclusion

At the end of the day, Shopify is a very attractive high-growth business with a lot of room to keep growing per its large TAM. In the short-term, the revenue growth rate will slow as compared to the pandemic year (2020), but that is to be expected, and the 2021 growth rate will still be above years prior to 2020. We view the recent share price pullback as creating some additional margin of safety, but expect the price will remain volatile in the short-term. Nonetheless, short-term volatility is the price you often pay for the most attractive long-term gains, and we believe Shopify continues to have a lot of long-term gains and share price appreciation in the years ahead. We currently own shares of Shopify, and you can view all of our current holdings here.