If you are looking for a steady dividend-growth stock, this report is not for you. However, if you are looking to add a little powerful long-term price appreciation to your portfolio, these shares are worth considering, especially on the recent price pullback. The company is well-positioned as a premium brand in China, it enjoys rapid sales growth and a large and growing total addressable market, and it has the backing of the Chinese government. In this report, we review the company’s business model, market opportunity, COVID-19 impacts, competitive position, valuation and risks. We conclude with our opinion on whether the company offers an attractive risk-reward versus its long-term growth opportunity.

Overview: NIO Inc. (NIO)

NIO is a Chinese automobile company that designs and manufactures electric vehicles primarily targeting premium markets. Founded as Nextev Inc. in 2014 by Willian Li, NIO raised money from several companies including Tencent, Sequoia, Temasek, Baidu, Lenovo and TPG, and finally went public in 2018. Apart from vehicles, it also provides a wide range of power management solutions such as Battery as a service (BaaS), power chargers, and other value-added services such as vehicle damage insurance, repair, and routine maintenance. The company’s manufacturing facilities are located in China and it derives the majority of its income locally; however, initiatives are being taken to expand into export markets. NIO is also focusing on autonomous driving solutions such as the NIO pilot, NIO Autonomous driving (NAD), Autonomous Driving as a Service (ADaaS). The company conducts its business under 2 primary operating segments:

Automotive: In this segment, NIO sells a range of electric SUVs and crossover vehicles targeted towards the fast-growing premium EV market in China. Since its first large-scale delivery of ES8, a 6 and 7-seater premium electric SUV in 2018, NIO has launched various models such as ES6, a 5-seater smart premium electric SUV, and EC6 which is a premium coupe SUV. More recently the company revealed its first smart premium EV sedan, ET7 which is expected to begin volume delivery by 2022 and will be equipped with NIOs latest inhouse full-stack NIO Autonomous driving (NAD). As of February 2021, the company has made a total cumulative delivery of 88,444 vehicles including ES8, ES6, and EC6 models. This is NIO’s primary segment and contributes 93% of the company’s top-line.

Other Sales: In this segment, NIO derives revenue from the sale of power management solutions and service packages for its EVs. This segment came into the spotlight recently due to the introduction of Battery-as-a-Service (BaaS) which is discussed below. This segment accounted for 7% of total revenue for FY 2020.

Source: Company filings

Unique strategy to reduce cost and facilitate EV adoption

Electric vehicles are priced significantly higher than conventional vehicles. According to insideevs.com, battery cost accounts for almost one-third of the total manufacturing cost of a Tesla Model 3. Besides, batteries EVs are prone to degradation, and regular electricity charging expenses. To mitigate these negatives, NIO has come up with a way to reduce the total upfront cost of its EVs with BaaS business model where the customer buys the vehicle without batteries and batteries are procured on rental basis. This helps to significantly reduce upfront vehicle costs making it more affordable for a larger audience. For NIO, BaaS also leads to steady and recurring cash flows because of its subscription-like business model. In the long run, the company will be able to generate more revenue than what it would have generated if the batteries were sold along with the car. Below is a table showing the cost-efficiency achieved by customers that use BaaS. While BaaS is the core of NIO’s EV business model, the company also provides other power management solutions such as power chargers at home and on-demand charging on roads.

NIO is also a beneficiary of recent changes in China’s EV policy. Earlier, Government subsidies were only available for electrical vehicles costing more than RMB 300,000 (~$46,400), but because of NIO’s BaaS business model, the upfront cost of its vehicles was less than the specified level and so its products were not eligible for subsidies. Now the policy has been revised to include vehicles with battery swapping capabilities which will make NIO’s electric vehicle cheaper. Here is a table showing the effects of both initiatives:

In order to facilitate the adoption of battery swapping technology, NIO has already created a swapping network of more than 190 automatic battery swapping stations in 76 Chinese cities with the capability of enabling 312 battery swaps per day. It also possesses more than 1,200 patents related to swapping technology. BaaS has been gaining traction in recent months amongst NIO’s customers. In February 2021, more than 55% of NIO’s customers opted for BaaS facility as compared to just 35% in November 2020.

Large and growing total addressable market helped by supportive government policies

The global electric vehicle fleet has expanded significantly in the last decade and China has taken center stage in this growing trend being the largest electric vehicle market in the world. As per an IEA report, there were 7.2 million active electric cars globally and China accounted for almost 45% of the global EV stock. In 2020, EV sales growth plummeted to just 3.5% in China because of unprecedented economic challenges, however with the coronavirus crisis now receding, EV demand is expected to see a significant boost in the coming years. SP global estimates that Chinese EV sales will grow by over 42% to reach 1.8 million in 2021 as compared to 1.3 million in 2020. Further, it estimates EV sales in China to grow at a CAGR of 35% to reach 6 million units by 2025 primarily driven by general economic demand supported by positive government policies such as subsidies and a national charging network. Additionally, in an effort to reduce congestion and pollution in large Chinese cities, the government has made it easier to get a license plate for an electric vehicle as compared to fuel-powered cars.

Passenger EVs still comprise just 5.4% and 4.2% of the total number of new car sales in China and worldwide respectively, and a Bloomberg NEF report estimates this number will expand to over 30% by 2040. NIO being a prominent and growing player is expected to achieve significant growth in the medium to long term as the transition from fuel-based engines to battery takes shape, especially in China. NIO has disrupted the EV market through its innovative BaaS and ADaaS. More recently, the company has partnered with NVIDIA (NVDA) to use NVIDIA’s Drive Orin System on Chip (SoC) to implement fully autonomous driving technology in its new ET7 model. Moreover, NIO’s continuous innovation, and consistent support from the Chinese government, will further assist the company in gaining significant EV market share in the country in the future.

Competition heating up, however there is room for all to grow

NIO operates in a highly competitive automobile industry where it competes with legacy Internal Combustion Engine (ICE) vehicle manufacturers as well as small and established EV players such as Tesla (TLSA), BYD Auto Co., Ltd (BYD), Xiaopeng Motors (XPeng), Wuling Motors, and Guangzhou Automobile Group. Tesla, BYD, and GAC are major players in the EV market together holding a majority of the market share as shown below. Although NIO holds a smaller market share, it has been consistently gaining prominence in recent years.

Source: Cleantechnica

While XPeng and Wuling manufacture “budget EVs,” Tesla and BYD pose more direct competition to NIO with their Model 3 and Qin Pro EV, respectively. Competition in China is further heating up as legacy automobile giant Volkswagen starts delivering its made-in-China ID.4 crossover model in March, whereas Ford is also expected to start manufacturing its Mustang Mach-E model in China. NIO Inc. though a young EV manufacturer has positioned itself as a premium EV brand along with Tesla and BYD. NIO’s latest ET7 model which is expected to embark on large-scale delivery by 2022 and is considered a direct competitor to Tesla Model 3 due to instilled smart solutions and has a starting price of $69,350. This price is significantly higher than the starting price of Tesla’s premium Model 3. We believe that NIOs value added offerings as well as power management and smart solutions will play a key part in justifying its premium price.

Despite EV competition heating up, Investors must note that the primary competition is not between EV vendors themselves, rather it is between EV and traditional fuel-based vehicle manufacturers. The TAM for EVs is massive and major players have enough room to grow in the longer term.

Consistent improvement in top and bottom line

While NIO faced a tough first quarter in FY 2020 due to the coronavirus pandemic, growth returned in the back half of the year. In Q4, NIO reported total sales of $1.02B which represents a YoY increase of 133%. The positive performance was mainly driven by an increase in delivery volumes of ES8, ES6, and EC6 vehicles. NIO delivered 17,353 and 43,278 vehicles in Q4 2020 and full year 2020 which is 111% and 113% more than last year’s vehicle sales respectively. The company expects to have a healthy Q1 FY 2021 and has estimated delivery of 20,500 vehicles during the quarter representing an increase of over 400% YoY. Please note that the Q1 growth surge is also due to the base effect because of the challenging first quarter last year when the pandemic was at its peak.

Although the company has been consistently delivering strong top line growth, it is yet to turn a profit, however, its operating losses have been narrowing. The company’s operating margin improved from -97% in Q4 2019 to -13% in the most recent quarter, primarily driven by increasing vehicle margins which expanded from -6% in Q4 last year to 17.2% in the recent quarter. While we expect NIO operating margins to improve as it further scales up its business in the longer term, in the short-term, profits generation will be restricted as the company plans to double down on R&D to upgrade its offerings and invest in its swappable battery business.

Robust Liquidity and positive cash flow from operations

Plummeting sales due to the coronavirus almost pushed the company to the brink of bankruptcy until it was rescued by the Chinese city of Hefei through a $1B investment. Since then, the company has seen a significant turnaround as market demand for EV has recovered. NIO has also raised around $3B through a secondary offering of ADS in December 2020 and is planning to raise another $1.3B in convertible senior notes. The company ended FY 2020 with a liquidity position of $6.5B, in the form of cash and marketable securities, and a total debt position of $1.45B. It also recorded positive cash flow from operations for Q4 2020 and FY 2020.

Valuation Conisderations

NIO shares have posted powerful gains over the last year, despite the pandemic challenges, and they now trade at over 19 times sales, as you can see in the chart below.

However, considering the impressive growth rate, this valuation is not entirely unreasonable. For example, the price to 1-year forward sales is only around 7 times. For a little more perspective, here is a look at NIO’s price-to-sales valuation metric as compared to Tesla.

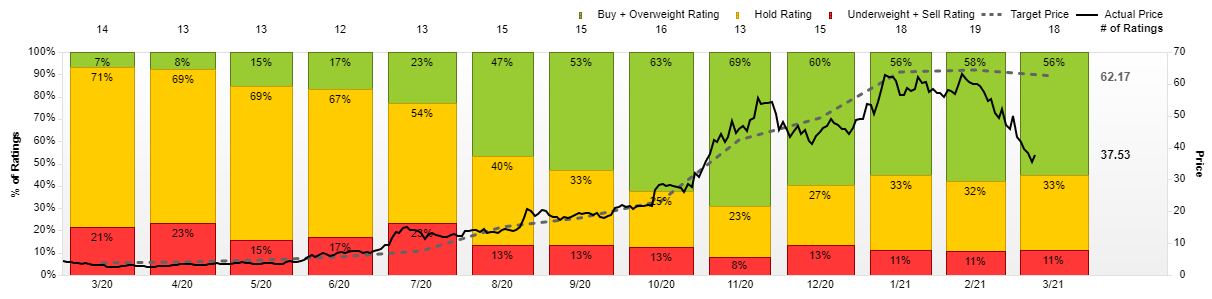

And considering the recent share price pullback in recent weeks, the shares are increasingly tempting for purchase (in terms of the long-term growth potential). For a little more perspective, here is a look at the average rating (mostly “Buys” and price target ($62.17)as per the 18 Wall Street analysts covering the shares and reporting to Factset (the recent price decline (solid line) has created some margin of safety and near-term upside potential versus the analyst price targets (the dotted line)).

Risks

Intense competition: NIO Inc. faces intense competition not only from major EV manufacturers such as Tesla, BYD, and XPeng but also from the mainstream automakers who are transitioning into the EV business. We believe that to stay competitive in this business, NIO will have to continue to innovate in terms of superior user centric and smart solutions.

Shortage of Chips: Currently, there is a shortage of semiconductor chipsets and global automakers are being forced to slow down or even shutdown vehicle production in the short-term. If the current situation persists for a prolonged period, it may lead to production bottlenecks as well as rising input costs for NIO.

Rollback of subsidies: The Chinese government has announced the phase out of electrical vehicle subsidies by 2022. It has already cut subsidies by 20% for 2021 and plans to cut another 30% in 2022. Any accelerated removal of EV subsidies in China may impact NIO’s sales in coming years. Having said that, we believe the Chinese government will continue to support the EV market in one form or another given environmental concerns.

Conclusion

NIO Inc. is a leading play on the traditional engine to battery transition. We expect the company to see above average sales growth driven by secular tailwinds in the industry and support from the local governments. And while the shares trade at somewhat of a premium valuation we believe the current price pullback has created a tempting entry point for long-term investors. This is not a steady dividend stocks (it pays zero dividend), but it has the potential to add significant long-term gains to your portfolio if you are patient and can handle some price volatility. We do not currently own shares, but we are considering nibbling at a very small long-term position based on this most recent share price pullback.