Top Growth Stocks have been getting volatile in the last few trading sessions. To some, this is a “buy the dip” opportunity, but to others it’s a warning of something more dangerous to come. My personal investment philosophy is to always buy good businesses and then hang on (despite potential volatility) the for long term. And in this article, I will rank my top 10 growth stocks. However, I’ll also share specific options trading strategies that I believe are particularly compelling (based on current market conditions), potentially very lucrative and also consistent with my long-term philosophy. But before we start counting down the Top 10, it’s worth considering the tremendous and wide-ranging recent performance, valuation and expected revenue growth for top growth stock opportunities.

The Market Has Been Volatile

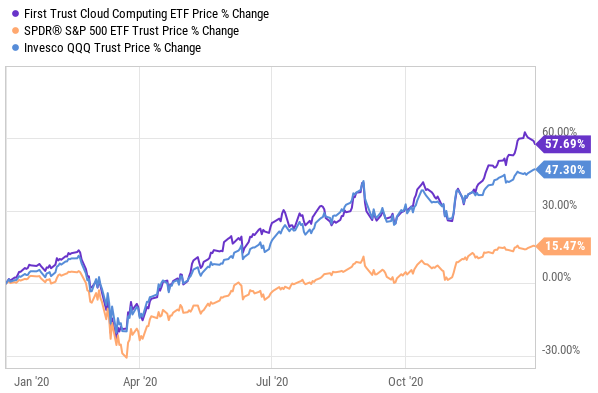

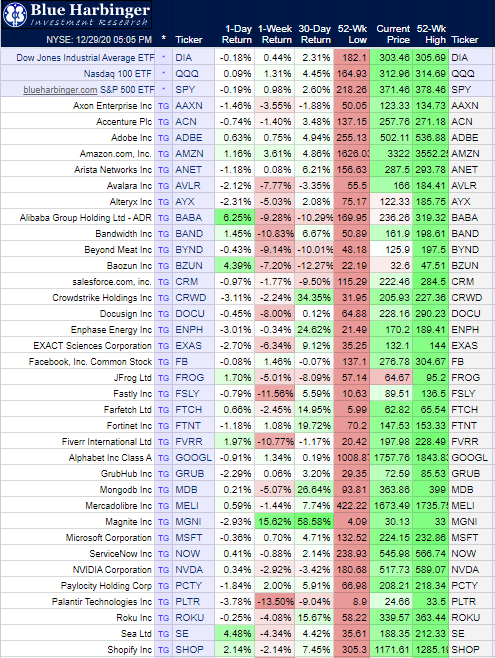

Obviously, the market was volatile in 2020 due to the global pandemic, but it has also been particularly volatile in recent trading sessions for many top growth stocks—those with the highest revenue growth that have been performing so extremely well in recent months. For starters, here is a performance chart for the overall market in 2020 (including the S&P 500 (SPY), the Nasdaq 100 (QQQ) and a Cloud Computing ETF (SKYY)—one of the hottest groups of stocks in 2020, which happens to have very high revenue growth numbers), followed by a table showing recent performance of a handful of recent top revenue-growth stocks.

Source: Access this google doc table in real time here.

As you can see above, many of the top revenue-growth stocks have sold off hard in the last week, but still sit very far above their 52-week lows.

Valuation: Is Now a Good Time to Buy?

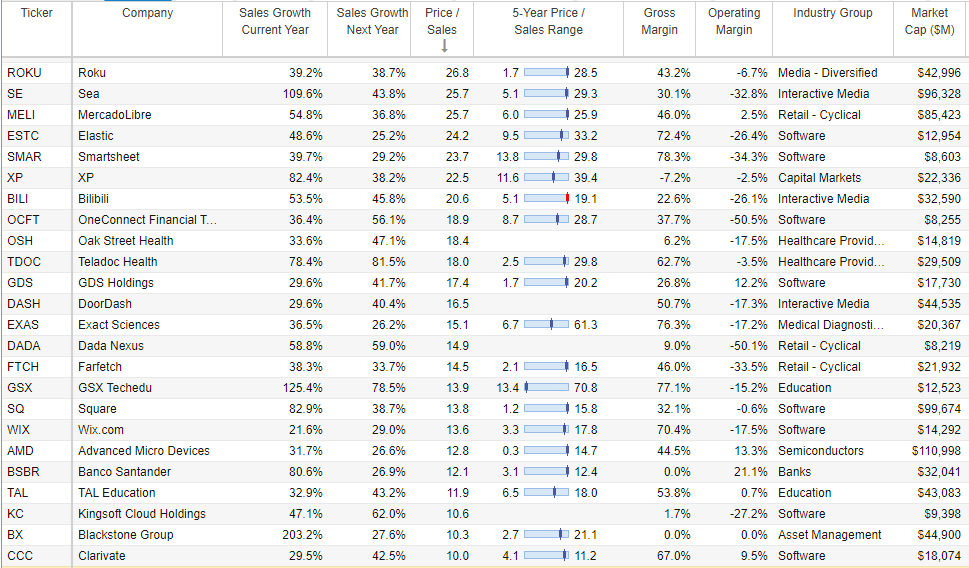

And if you are wondering if this latest price pullback (for top growth stocks, in particular) provides enough margin of safety for you to add shares to your portfolio, consider this price-to-sales valuation table (below). It shows the top sales growth stocks are still generally expensive on a price-to-sales basis.

Source: StockRover, data as of 12/30/20

However, these high price-to-sales ratios are not necessarily a bad thing for all of the companies on the list, especially when you consider their high sales growth rates this year and next (as shown in the table), plus their high potential growth for many more years into the future based on their leadership positions in their respective large and growing total addressable markets.

In particular, it’s worth mentioning, Wall Street analysts chronically underestimate the long-term potential of top growth stocks because they are too focused on modeling the latest quarterly earnings announcements and guidance, instead of the actual long-term potential (this is why, sadly, most Wall Street Analyst price targets just follow the sensationalized short-term information flow instead of the actual long-term opportunities).

Long-Term Investors: Buy and Hang On

One simple strategy for long-term investors is to selectively buy the best top growth stocks now (we’ll highlight 10 of them in this article) based on your conviction that the individual businesses will eventually drive the share prices much higher.

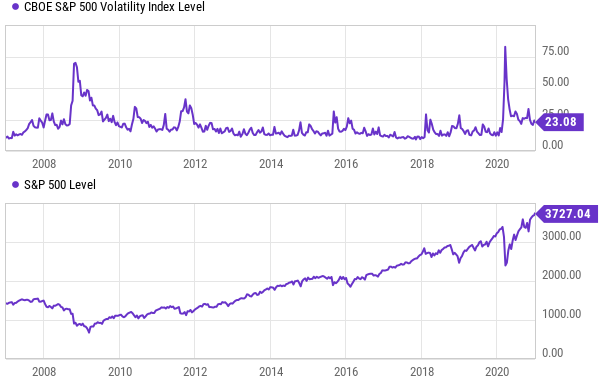

This is actually a very good strategy if you are a long-term investor with the stomach to handle a lot of potential volatility in the weeks, months and years ahead. For example, as you can see in the chart below, over the last 15 years, every time fear and volatility spike (as measured by the VIX), the market sells off but then ultimately rebounds thereafter.

And our most current market sell off (over the last few trading sessions) has been relatively tame in comparison to other big sell-offs. In particular, of course things can get worse before they get better—but short-term market moves are impossible to predict (if anyone tells you they can—they’re full of it), and simply buying good businesses for the long-term is a well proven strategy for success. However, if you want to invest in the top growth stocks ranked in this report, but you are still overly nervous about a pullback—you might consider the options trading strategies described below (it is consistent with our long-term philosophy, but can give nervous investors a little extra peace of mind—and a shot at picking up very attractive long-term stocks at an even lower price).

Options Trading Strategies: Volatility Can Be Good

An alternative strategy for investing in top growth stock opportunities is through the use of simple options trades. For example, if there are businesses you really like, but you are nervous that near-term valuations are too high, you could sell out-of-the money put options now, which generate very attractive upfront premium income (that you get to keep no matter what) and give you a chance to pick up shares at an even lower price (if they fall even further—below your strike price—and get put to you before expiration). And importantly, the upfront premium income you receive for this type of trade generally increases when volatility increases—like it just has—a good thing for the strategy.

Top 10 Growth Stocks:

Before getting into the top 10 growth stocks, we start with a couple honorable mentions. These are extraordinarily attractive businesses, but they’re not quite attractive enough to make it onto our list, as we explain below.

*Honorable Mention: Snowflake (SNOW)

Kicking off our countdown is an honorable mention—Snowflake. This company provides a cloud-based data platform, addressing the rising data management needs of enterprises, and the share price has been hot and volatile since public trading of the shares began in the second half of 2020.

Attractively, Snowflake is clearly seeing strong topline trends as it benefits from a superior product in a large and growing addressable market (as we describe in our full report, linked below). Having said that, we can only rank it as an “honorable mention” on this list because growing competition (from much larger competitors) and rich valuation multiples (even for a very high growth stock) temper our optimism somewhat. For your reference, here is a link to our previous full report on Snowflake:

10. Palantir (PLTR)

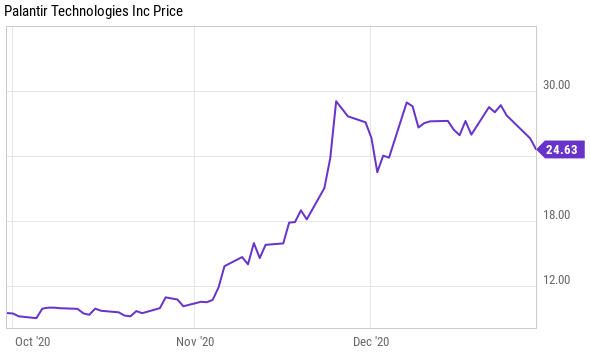

Palantir is a data-analytics software company, it just recently began trading publicly, and it is known for its highly secretive work with the US government. It was also a recent Twitter darling until recently when the share price began to fall and trigger-finger traders have started to sell.

We believe the business remains extremely attractive, but the price is still a bit ahead of itself.

For a little more perspective, Palantir trades at around 42 times this years sales estimate (which is extremely high), but its growth rate (estimated to be 31.8% next year) is also very high, and so is its total addressable market (i.e. it has a lot of room to continue growing rapidly).

It probably won’t be your worst investment idea ever if you were to buy shares now and then hang on for the long-term (this one has huge long-term upside potential). However, if you’re nervous about short-term volatility, you might consider selling upfront-income-generating put options to give yourself a chance to pick up shares at a lower price. This is a strategy we have been successfully sharing with our members. For example, here is an excerpt from a report we shared just a few weeks ago:

Sell Put Options on PLTR with a strike price of $14 (~50% out of the money, it currently trades at ~$27.66), and with an expiration date of January 15, 2021, and for a premium of $0.60 (this comes out to approximately 4.3% of extra income in just 46 days, and approximately 34% extra income on an annualized basis). This trade not only generates attractive upfront premium income for us now, but it gives us a chance at buying shares of this very attractive business at a much more reasonable price ($14—the strike price) if the market price falls below $14 and the shares get put to us before this option contract expires in 46 days. And we get to keep the upfront premium income no matter what.

And you can read our previous full report on Palantir here:

9. Unity (U)

The next name on our list is Unity Software—a company that provides tools to videogame developers. The company recently completed its initial public offering in September. The business is healthy, revenue is growing rapidly, and it has a large total addressable market.

And as you can see in the following chart, Unity’s shares were climbing rapidly, until the price pullback in recent trading sessions that has driven so many top growth stocks lower (including Unity).

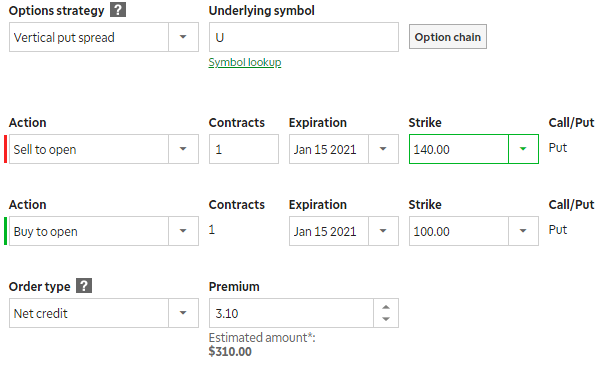

Unity is another example of a stock that you many want to consider selling out-of-the-money put options on—if you’re nervous there could be more downside ahead (and you want to collect an attractive amount of upfront premium income while you wait for the share price to take a short-term dip. And if you want get a little more sophisticated in your trading strategy, you might consider setting up a “Bullish Vertical Put Spread” on Unity, as we recently wrote about in great detail for our members a few weeks ago (don’t worry—it’s not as complicated as it sounds):

Sell AND Buy Put Options on Unity Software (U) with a strike price of $140 (sell) and $100 (buy), and an expiration date of January 15, 2021 (roughly 2 weeks away), and for a net premium (upfront cash in your pocket) of at least $3.10 (or $310 because options contracts trade in lots of 100). Your broker will make you keep $4,000 cash on hand (($140 - $100) x 100 (assuming you don’t want to use margin). The trade generates ~7.75% of extra income over the next 2 weeks (this is a lot!… $310/$4,000). And this trade not only generates attractive income for us now, but it gives us the possibility of owning shares of attractive Unity at an even lower price if the shares fall even further than they already recently have, and they get put to us (and we’d be happy to own Unity, especially if it falls to a purchase price of below $140 (it currently trades around $153.47) but above $100 (if it falls below $100 we’d take the cash difference between our $100 strike put and the market price at expiration—this is basically insurance)). Again, the trade may sound complicated, but it’s not, and your broker likely makes all the calculations and execution easy as you can see in the graphic below.

Overall, we believe Unity is an attractive long-term investment, and you can read our previous full report on Unity here:

8. Alibaba (BABA)

Alibaba (BABA), often referred to as “the Amazon (AMZN) of China,” is the country’s largest e-commerce, cloud, and digital advertising company (it controls almost 50% of the Chinese online commerce market). However, the share price recently took a hit after CEO Jack Ma apparently fell out of favor with the Chinese government and they hit the company with monopoly charges thereby causing the share price to fall.

For a little more detail, BABA’s e-commerce business has been the growth and profit engine for years, but cloud computing is positioned to increasingly contribute meaningfully to high-margin growth in the future. We believe the current valuation and business model present a very attractive opportunity for long-term investors. We believe the recent share price performance makes the investment even more attractive, and you can read our previous full report on BABA here.

*Honorable Mention: Micron Technologies (MU)

In recent years, Micron Technologies (MU) has transformed itself into a leader in the semiconductor industry. And despite industry challenges (such as competitive supply and demand cycles), the company has positioned itself for long-term success in memory and storage products.

Micron has many moving parts (e.g. new products, value-add offerings, 5G impacts, cloud and AI), but also has a strong balance sheet and distinct competitive advantages.

Quite frankly, we like this business, but we’re only able to rank it as an “honorable mention” because this report is chock full of more attractive investment opportunities. The following link will take you to our full report on Micron—it reviews the business, growth prospects, valuation, risks, and concludes with our opinion on investing.

The Top 7

The remainder of this report (i.e. The Top 7) is reserved for members-only and it can be accessed here. I currently own 6 of the top 7 stocks. More specifically, the list includes leading businesses, with very high growth rates, attractive valuations (especially after the market’s recent choppiness), and very large total addressable markets. I include detailed research reports for each name. Overall, I believe the upside return potential for each idea is extremely attractive, especially considering current market conditions.

If you are not already a member, you can get instant access to 100% of my content here here.

The Bottom Line

There are a lot of very attractive long-term growth opportunities in the market, despite the constant drumbeat of fear mongers and fortune tellers attempting to predict the exact timing of market’s next big pullback. However, rather than attempting to time the market’s short-term moves, we prefer to select attractive individual businesses that can thrive despite broader macroeconomic market conditions. In the long-term, this is a well-proven strategy for success.

And if you have the emotional strength to deal with higher volatility, then many of the growth stock ideas listed in this report may be right for you (I currently own most of them). You might also be interested in taking advantage of the growing volatility in the market by utilizing some of the options trading strategies described in this report too.