2020 was a challenging year for Real Estate Investment Trusts (“REITs”). The sector (as measured by (XLRE)) was down ~3.2% (and that includes dividends) as compared to +17.8% for the overall S&P 500 (SPY). And the performance was even more sharply divergent by REIT subsectors (for example, retail REITs performed even worse) versus the tech-heavy Nasdaq (QQQ) for example which gained 48.3% for the year. Obviously, the social-distancing aspects of the terrible coronavirus pandemic had a big impact on market performance, and with the continuing rollout of vaccines there are some reasons for increased optimism. However, the story is much deeper and much more nuanced than that. In this report, we countdown our top 10 big-dividend REITs (starting with #10 and concluding with our top #1 idea), including our careful consideration for current market conditions combined with company-specific opportunities.

REIT Market Performance

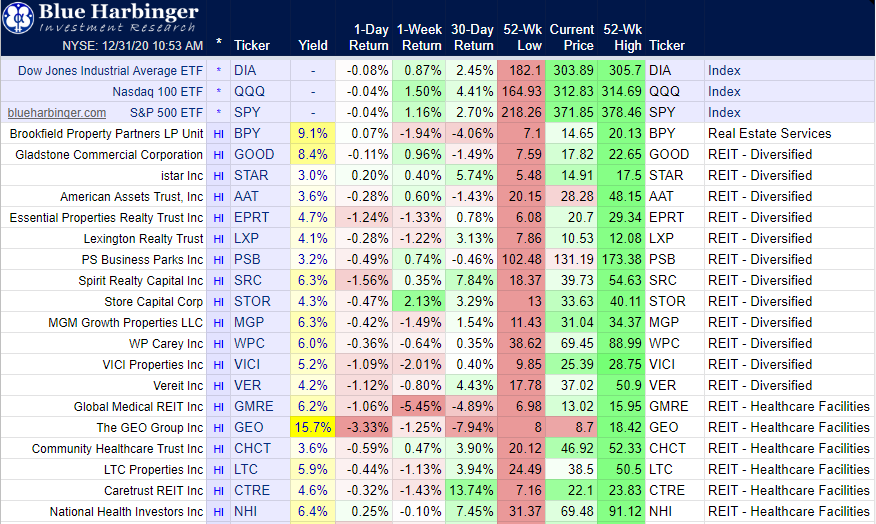

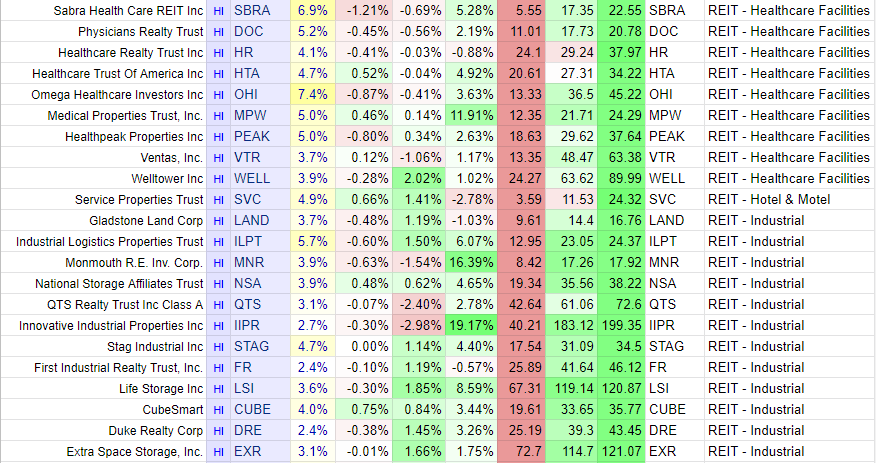

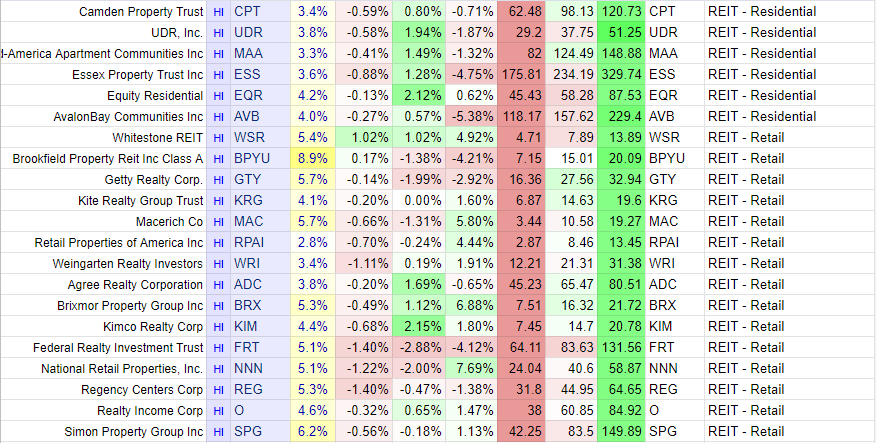

To give you a better flavor for how REITs have been performing, here is a list of 85 big-dividend REITs (organized first by REIT industry).

And for those of you that prefer real-time pricing, here is a link to the above “google doc” spreadsheet with real-time data.

Retail REITs

One of the first things that stands out about this data is that retail REITs performed really bad. This is a sub-sector of REITs, that includes many brick-and-mortar retail buildings that were already getting hit hard by the secular shift to online shopping, and then got doubly slammed by the pandemic. For a little more perspective, the following chart shows the ongoing shift long-term shift to online shopping as a percent of total retail.

Arguably, the continuing rollout of COVID-19 vaccines will help return life towards the way it used to be (when restaurants and malls weren’t mandatorily shut down by governments), but take this with a grain of salt because the long-term shift away from brick-and-mortar retail (and towards online shopping) continues.

Industrial and Office REITs

Another outlier among REIT performance has been data center REITs (such as Digital Realty (DLR)). In some instances, this unique sub-category of REITs has performed relatively quite well as it has benefited from the massive digitization of worldwide data, which has only been accelerated by the pandemic.

Somewhat similarly, select industrial REITs tied to the online shopping supply chain have also performed well considering Amazon (AMZN) (and other online marketplaces) have still needed physical locations to store items in transit along the supply chain. This is a category of REITs that will likely remain strong.

Mortgage REITs

Mortgage REITs are another unique sub-category of REITs that can perform quite differently that traditions property REITs, and they can also provide unique streams of high income to investors. However, mortgage REITs faced unique challenges in February and March of this year as liquidity dried up in certain securities markets in which they deal. This led to some distinctly attractive “buy low” opportunities earlier in 2020 that still persist (to a lessor extent) today, as we will review later in this report. Examples of mortgage REITs we follow include New Residential (NRZ), Annaly Capital (NLY) and AGNC Corp (AGNC).

Healthcare REITs

In many cases, healthcare REITs were also hit extraordinarily hard in 2020. For example, senior living properties house a portion of the population most vulnerable to the coronavirus, and their shares have certainly reflected the challenges. However, they now present select attractive investment opportunities as vaccines rollout and conditions improve.

Top 10 Big-Dividend REITs

With the above backdrop in mind, we countdown our top 10 big-dividend REITs for you to consider. And we start off with a very controversial retail REIT.

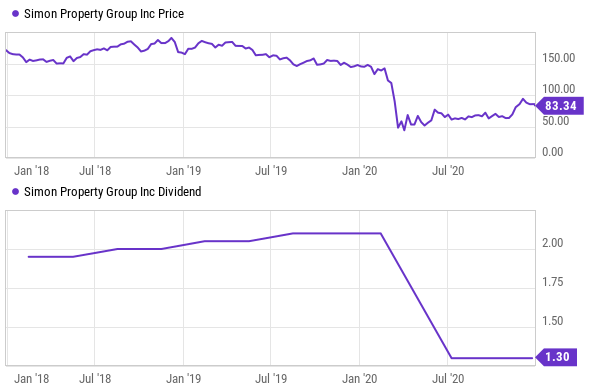

10. Simon Property Group (SPG), Yield:6.1%

Simon Property Group (SPG) has faced extreme challenges this year. Not only did it have to deal with pandemic “stay at home” orders that halted operations at its properties, but it was already dealing with the ongoing shirt from brick-and-mortar to online shopping. Further, it had to renegotiate what originally appeared to be a sweetheart deal to basically acquire Taubman Centers. Sadly, SPG reduced it’s dividend this year (something many earlier believed would never happen).

However, with coronavirus vaccines on the way, the dividend now “right sized,” the dividend yield quite large, and less competition in the industry, the valuation is arguably quite compelling. You can view our earlier Simon Property Group report here:

9. Digital Realty (DLR), Yield: 3.2%

Digital Realty has the lowest yield of any REIT on our list, but it arguably has one of the most attractive valuations. This data center REIT was helped in many ways by the social-distancing aspects of the pandemic, and it has a long runway for continued growth.

You can read our recent Digital Realty report here:

8. Monmouth (MNR), Yield: 3.8%

Monmouth is one of those industrial REITS that has actually benefitted from online shopping because many of its properties are part of the online shopping infrastructure. Furthermore, we believe industrial REITs have a lot more room to run long after the coronavirus pandemic is behind us. Monmouth’s yield is also one of the lowest on our list, but that’s because it has ample healthy growth in the years ahead.

You can access our recent full report on Monmouth here:

7. STAG Industrial (STAG), Yield: 4.6% Yield

Yet another attractive Industrial REIT, a lot of investors like STAG for its steady montly dividend payments (most REITs pay quarterly). STAG is also unique because its properties are generally Not located in the most popular geographic hubs—something that has benefited the company during the pandemic, and positions it well for the future.

You can access our full report on STAG Industrial here:

6. Annaly Preferred (NLY.PF), Yield: 7.0%

Annaly is unique because it is a mortgage REIT. Unlike traditional property REITs, mortgage REITs own mortgage related assets, and in Annaly’s case a lot of its mortgage assets are US government agency securities that are extremely safe relative to other types of mortgage assets. Annaly took it on the chin (largely unjustly) earlier this year as the pandemic created a liquidity crises in certain financial markets and thereby driving down the share price of Annaly. However, the company offers both common and preferred shares that are absolutely worth considering in our opinon.

Annalys Common Stock Share Price:

Annaly Preferred Stock Share Price:

You can access our full report on Annaly here:

The Top 5

The remainder of this report (i.e. The Top 5) is reserved for members-only and it can be accessed here. The top 5 includes an attractive mix of REITs from across industries (as well as common and preferred shares) that offer very attractive dividend yields, combined with the potential for compelling price appreciation. If you are a contrarian income-focused investor, these REITs are worth considering.

If you are not already a member, you can get instant access to 100% of my content here here.

The Bottom Line

Despite the extremely challenging conditions for many REITs (created, in large part, by the coronavirus pandemic), many of them have maintained big healthy dividends, and offer attractive dividend increases and share price gains going forward. In particular, the Real Estate sector is out of favor—and this has created some extremely attractive opportunities for contrarian income-focused investors.