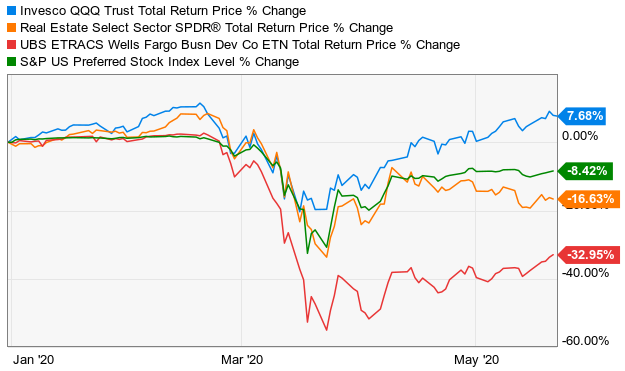

It’s not possible to overstate the negative impacts COVID-19 has had on many people’s lives. And certainly, it has impacted different people and different business, differently. But if you look at the tech-heavy Nasdaq 100 (QQQ), it’s almost as if it were not impacted by the virus at all. The Nasdaq 100 is up this year (it’s very close to setting new all time highs), while other segments of the market struggle (such as value stocks (IWD), which are still down ~20% year-to-date).

And of course, the Nasdaq 100 is dominated by a small handful of mega-cap stocks, such as Facebook (FB), Amazon (AMZN), Apple (AAPL), Netflix and Google/Alphabet (GOOGL) (sometimes collectively referred to as “FAANG” stocks). And the FAANG stocks continue to perform very well.

However, some investors believe FAANG stocks (and social distancing stocks, in general) have rallied too far, too fast, and are now due for a pullback—especially considering potential government actions against Google, for example. Unfortunately, predicting daily, monthly or even quarterly market moves by volatile FAANG stocks can be challenging, especially as compared to forecasting approximate future dividend payments from dividend stocks—which are often a lot more predictable. Further, dividend stocks may be particularly attractive for income-hungry retirees—especially with central banks holding interest rates artificially low.

Even if FAANG stocks do have a lot more long-term price appreciation potential (which we believe several of them do—albeit very volatile potential), many investors simply can’t stomach the possible future volatility, and prefer instead to focus on big-dividend stocks, especially those with a contrarian mindset that believe there are some particularly attractive opportunities during this current market sell-off (again, value stocks and a lot of dividend stocks are down significantly).

In this article, we share our Top 12 big-dividend stocks from the categories of Real Estate Investment Trusts (REITs), Business Development Companies (BDCs) and Preferred Stocks. These are categories generally known for providing “less volatile” big dividends, although the “less volatile” part has been put to the test this year, as they are among the worst performing segments of the market. This makes some investors want to puke, while others see opportunity.

Without further ado, here is our ranking of Top 12 Big Dividend Stocks (REITs, BDCs and Preferred Shares).

12. Main Street Capital (MAIN), Yield: 8.0%

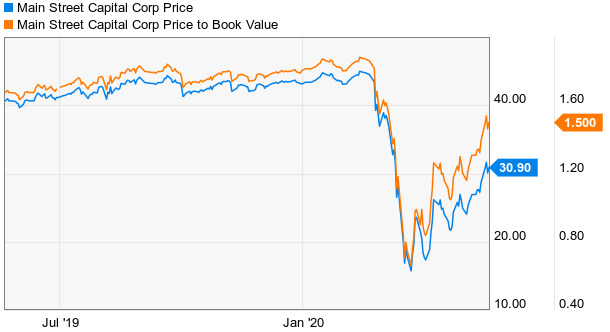

Income investors had grown to love BDC Main Street Capital’s (MAIN) big, safe, monthly dividend so much that its share price consistently traded at a significant premium relative to its book value. Then the coronavirus hit. The share price plunged, the once loved supplemental dividends have been suspended, and the price to book value ratio plummeted.

However, following Main Street’s most recent quarterly earnings announcement, the price and valuation have accelerated their trend towards stabilization as management provided some reassurance that the business can whether the current storm. Despite, the recent share price rally (off the lows) we believe Main Street still has share price upside, and the dividend is likely healthier than the share price suggests. You can access our recent full report on Main Street Capital using the following link:

11. Altera Preferred Shares (ALIN-B), Yield: 13.3%

You probably haven’t heard of Altera Infrastructure (ALIN.PB), but it is an international midstream service provider (it owns and operates assets used in storage, production as well as transportation of products by the offshore oil and gas industry—such as the image below). Altera was incorporated as Teekay Offshore Partners L.P. with Teekay Corporation as the general partner (the company’s common stock was listed in 2006), however Brookfield Business Partners (BBU), part of the Brookfield Asset Management (BAM) group, has accumulated 99% of the common shares of the company since 2017 and has recently rebranded it as Altera Infrastructures L.P. The company’s common stock was de-listed this year after its acquisition by Brookfield.

image source: Altera

Importantly, the coronavirus outbreak has led to a sharp decrease in demand for oil, a surge in its supply and a resultant drop in oil prices to record lows. And Altera’s shares were hit hard, although the business is largely insulated in the near term as a result of long-term contracts with blue chip customers and a temporary lift from the tanker business.

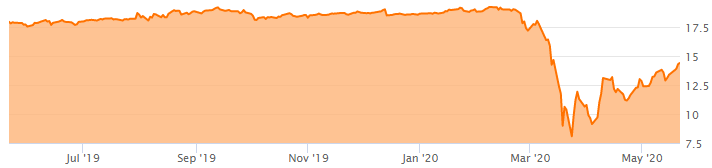

Altera Preferred Shares (Series B) (ALIN-PB) Stock Performance:

Also, the company’s preferred shares are trading at a fairly large discount to their pre-COVID 19 yields. And as such, we believe the company’s preferreds offer a strong risk reward and also provide investors an opportunity to gain low risk exposure to energy. You can read our full report on Altera using the following link:

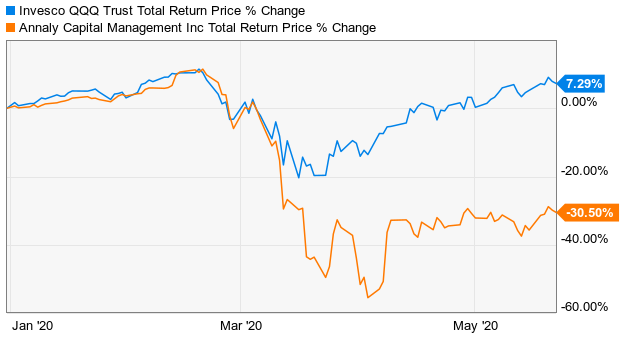

10. Annaly Capital (NLY), Yield: 15.8%

Annaly is a mortgage REIT (they own mortgage-related financial assets/ securities), and Annaly shares have been hit particularly hard this year, as basically all mortgage REITs have sold off indiscriminately.

The market drama for mREITs was magnified dramatically by low-liquidity in the bond market, whereby many safe (government agency) mortgage-related securities traded at huge discounts, and mREIT investors panicked because they feared margin calls on levered mREITs would roil the industry. In some cases they were right, but in some cases they were wrong. Annaly is in much better financial shape than many mREITs, and the shares are worth considering. You can read more about our Annaly and mREIT views using the following link:

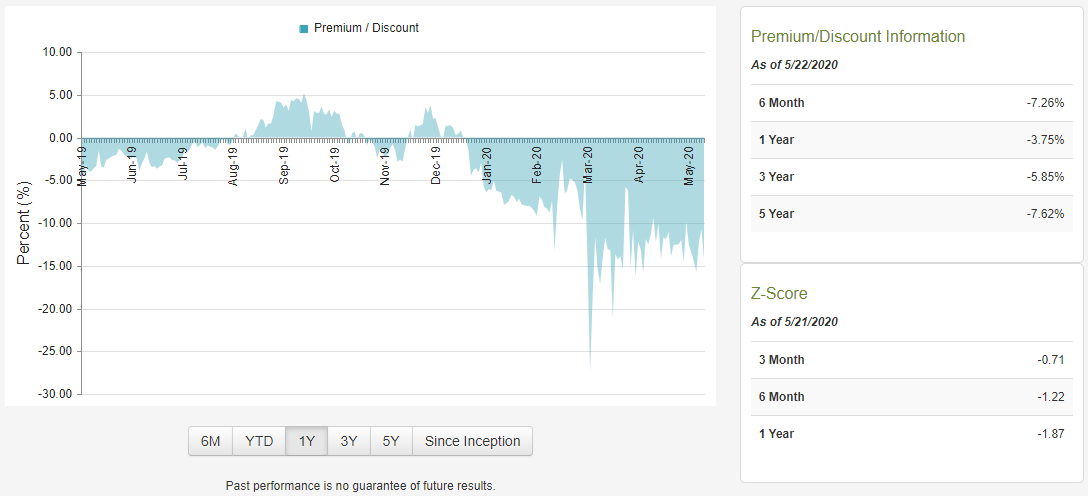

9. Quality Income Realty Fund (RQI), Yield: 10.4%

RQI is a Closed-End Fund (“CEF”) that owns mostly REITs (and some REIT preferred shares). It is attractive because of its big yield and its price. Its price is attractive for two reasons. First, REITs are trading at too low of a price in general (in our view), and the eventual rebound will drive REIT prices—and this CEF—higher. Second, RQI trades at an attractive discount to its net asset value (NAV). NAV is the aggregate value of all of the CEF’s underlying holdings, and because of the unique closed-end nature of a CEF (unlike ETFs, there is no mechanism to bring CEF market prices in line with NAV, other than buying and selling pressure), RQI can trade at significant discounts and premiums—in this case an attractive discount, as shown in the chart below.

There are a lot more details about this CEF on CEFConnect. If you like the instant diversification of owning a basket of securities (that’s what RQI owns) instead of picking individual names. From time to time, CEFs can present very interesting investment opportunities.

8. Ares Capital (ARCC), Yield: 11.1%

Ares Capital is a big-dividend BDC, and it is attractive. We like it for its discounted price, upside potential, strong management team, and of course the income it provides to investors.

We recently completed a detailed members-only report on Ares, and here is a quote:

Ares sticks out like a sore thumb within the BDC space because of its attractive big dividend and relatively lower risk as compared to other BDCs. Ares doesn’t have the highest yield in the BDC space, but it is one of the safest, most-well established and liquid BDCs, and the risk-reward trade-off makes it a highly compelling investment opportunity during this coronavirus sell-off. In our view.

Ares is worth considering for a spot in your prudently-diversified income-focused investment portfolio. We own shares in ours. You can access our full Ares Capital report using the following link:

The Top 7:

Our Top 7 Big Dividend REITs, BDCs and Preferred Stocks are reserved for members only. Members can access the full report here. If you are not currently a member, you can learn more about a membership here:

Important Takeaways:

FAANG stocks can be wonderful if you can handle the long-term volatility and zero dividend income from most of them. However, they have rallied particularly hard as compared to dividend and value stocks. If you are a contrarian, and you like to select attractive stocks when they are on sale, we believe there are currently some very attractive opportunities in the market. Of course there will be winners and losers of this pandemic, but dividend investing isn’t going away as retirees look for alternatives to near-zero interest rates, and volatile FAANG stocks often just don’t fit the bill.