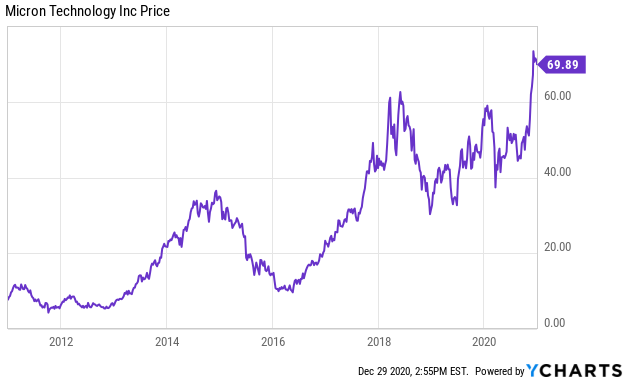

In recent years, Micron Technologies (MU) has transformed itself into a leader in the semiconductor industry. And despite industry challenges (such as competitive supply and demand cycles), the company has positioned itself for long-term success in memory and storage products. Micron has many moving parts (e.g. new products, value-add offerings, 5G impacts, cloud and AI), but also has a strong balance sheet and distinct competitive advantages. This report reviews the business, growth prospects, valuation, risks, and concludes with our opinion on investing.

Overview:

Micron Technology, Inc. (MU) is a manufacturer of memory and storage products based on semiconductor technologies such as DRAM, NAND, 3D XPoint memory, NOR and others. Micron is headquartered in Boise, Idaho and its products are manufactured in its owned facilities located in Taiwan, Singapore, Japan, US, China and Malaysia, and also through certain subcontractors. The company sells its products under the Micron and Crucial brand names in the form of wafers, components, modules, SSDs, managed NAND and MCP products.

Micron generated $21.4 billion in revenue in the fiscal year ended September 2020 (68% NAND, 29% NAND), and its total market cap was recently $78.9 billion. And 88% of the company’s revenue came from products shipped to customers located outside the US.

The company operates through four business segments:

Compute and Networking (~43% of revenue): includes memory products and solutions sold into client, cloud server, enterprise, graphics and networking markets.

Mobile (~27% of revenue): includes memory products sold into smartphone and other mobile-device markets and includes discrete NAND, DRAM and managed NAND.

Storage (~18% of revenues): includes SSDs and component-level solutions sold into enterprise and cloud, client and consumer storage markets and other discrete storage products sold in component and wafer forms to removable storage markets.

Embedded (~13% of revenue): includes memory and storage products sold into industrial, automotive and consumer markets and includes discrete and module DRAM, discrete NAND, managed NAND, SSDs and NOR.

Improving DRAM Industry Dynamics:

The company is the only American player in the oligopolistic DRAM market where the top three players (Samsung (SSNLF), SK Hynix and Micron), control ~95% of the market. Micron has developed distinct competitive advantages over its competitors due to a continuous focus on building DRAM technology leadership over the past few years, diversified manufacturing facilities spread across geographies, as well as better access to the US market which accounts for a major portion of demand for memory and storage products.

Source: TrendForce, Nov 2020 (NNYAF)

Today, Micron’s DRAM capabilities include the fastest graphics DRAM (GDDR6X, built in partnership with NVIDIA (NVDA)), lowest power DRAM, as well as the industry’s most advanced DRAM technology - the 1-alpha node (which gives a 40% bits per wafer advantage versus the current 1Z node), among others, which is expected to provide significant cost efficiencies to Micron.

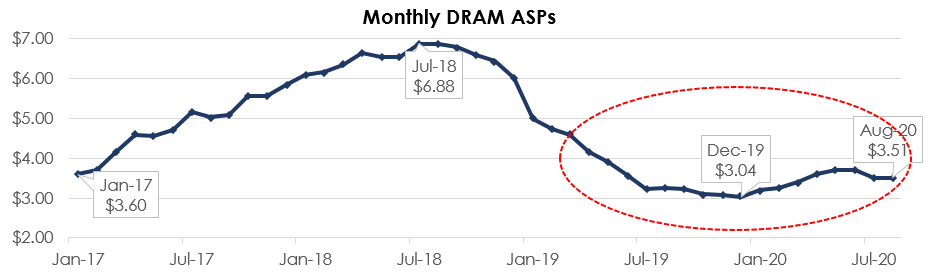

DRAM Supply Cycle: Over the past several months, the DRAM market has been grappling with certain oversupply issues caused by too much capex spending by the manufacturers to increase capacity in order to be in a better position to compete. The server DRAM segment in particular has been the worst effected, as server manufacturers have been unable to offload their excess inventory on account of lower server demand in a growing cloud environment. This has led to persistent downward pressure on the overall average selling prices (ASPs) of DRAM since it peaked in July 2018.

Source: WSTS, IC Insights

Nonetheless, the industry is expected to follow a disciplined approach to capex, going forward, which will result in improving market conditions throughout 2021. Also (after the seasonally weak 4Q), the demand for most other DRAM applications (including PC, mobile, graphics, for example) is expected to improve and remain healthy in the future due to a number of positive trends, such as:

5G expansion (in 2021 alone about 500 million 5G enabled smartphones are expected to be sold);

robust gaming demand;

the emergence of data center, particularly in cloud applications, as a driver of bit growth in memory and storage (as per IDC, the total amount of data will grow at a CAGR of 61% to 175 zettabytes in 2025, with as much of the data residing in the cloud as in data centers);

and the increasing importance of memory in AI optimized CPU architectures.

Consistent with these trends, the company expects DRAM industry bit demand growth of ~20% in 2021, and longer-term bit demand growth of mid-to-high teens annually. Also, Frank Huang, chairman for Taiwan-based foundry Powerchip Semiconductor Manufacturing (PSMC), estimates that the global supply of DRAM memory will likely fall short of demand in the second half of 2021. These trends point to improvement in ASPs in the future, which will be highly positive for storage and memory products manufacturers such as Micron.

Source: TrendForce, Dev 2020

NAND Market Position:

On the NAND side, Micron has a rather smaller market share of 10.5% in a highly consolidated market. The recent acquisition of Intel’s NAND business by SK Hynix has further added to the consolidation in the market, which bodes well for the remaining NAND manufacturers as they will have better pricing power amid reduced chances of oversupply happening in the market, which already remains challenged from supply mismanagement and the consequent dropping ASPs. The company expects the risk of excess supply to continue in 2021, unless industry capex moderates.

Source: TrendForce, Nov 2020

Nevertheless, NAND has been an important part of Micron’s long-term growth strategy as it expects industry bit demand growth of ~30% both in 2021 and in the long-term, and has accordingly been focused on delivering industry leading NAND products. It has been transitioning from a floating gate to the replacement gate technology, which provides cost scalability, and has also introduced the world’s first 176-Layer NAND, which essentially positions it ahead of the NAND leaders in terms of technological advancement, enabling it to deliver performance leadership.

In addition, the company continues to be focused on its high value-add solutions for the mobile market, which represent a sizable ~58% of a $39 billion mobile market opportunity and continues to outpace the industry growth. Micron has already achieved its high-value solutions mix target for FY21, as NAND high-value solutions now make up ~80% of its quarterly NAND bits.

Positioned to Benefit From Growing Demand:

Altogether, Micron’s technology leadership, both in DRAM and NAND, and the focus on high value-add solutions positions it well to benefit from growing memory and storage demand, and also from DRAM-specific and NAND-specific industry tailwinds expected to accrue over the course of the next several quarters. We agree with the company’s management team that memory and storage demand growth trends are secular in nature, and expect these growth trends to will be sustainable in the longer-term. According to CEO, Sanjay Mehrotra, during a fireside chat at the Credit Suisse 24th Annual Technology Virtual Brokers Conference:

“With all the applications of AI, with 5G, autonomous, IoT, from consumer to business, from data center to edge, you are seeing more and more applications where more data is being created, more data is being used, more intelligence is being derived from data, more processing is being done across all verticals across all industries, which just points to more need for data solutions, which is memory and storage, which is where Micron is a pioneer. So when you look at the backdrop of this secular trend of growth in memory and storage and how Micron has transformed itself with respect to technology and product leader and applying the discipline of growing our bits in line with the market demand, we believe we are well-poised for continuing to drive financial strength through the cycles of our industry.”

Additionally, the transition to higher nodes in DRAM and NAND (both are set for volume production in 2021) creates a clear path for cost structure improvement starting in the second half of 2021, which will lead to higher gross margins that will be further augmented by the expected improvement in ASPs. According to CEO, Sanjay Mehrotra:

“Both of these nodes position us very well for future cost reduction. They both, our 176-layer NAND as well as our 1-alpha node, will be very strong nodes with respect to cost reduction capability for Micron.”

Solid Q4 Performance, Improved Q1 Outlook:

Recently, the company provided an update on the expected results for the first quarter of FY21 (ended 3 Dec 2020), where it raised its previously announced revenue, gross margin and EPS guidance on improved pricing and volume growth due to stronger than expected demand for both DRAM and NAND in mobile, auto, industrials and PCs, partially offset by the continuing soft enterprise demand. We note that 1QFY21 is a seasonally weak quarter for the company (2QFY21 also falls in the seasonally weak category), and is also impacted by the Huawei ban in September this year (Huawei accounted for ~10% of Micron’s revenues before the ban). The company’s new 1QFY21 revenue guidance points to a ~6.5% sequential revenue decline. However, on a pro forma basis (i.e., excluding Huawei revenue from 4QFY20 results), we calculate that the results actually point to a ~6% sequential growth, which is very impressive. The overall strength in expected results points to further improvements over the course of FY21 and beyond as incremental demand builds up for DRAM owing to the improving industry dynamics, as discussed earlier in this report.

Source: Company website

Earlier, after a series of clumsy performances, Micron had reported strong financial results for the fourth quarter of FY20. 4QFY20 was the second straight quarter of robust revenue growth (+11% QoQ and +24% YoY to $6.1 billion), which was driven by strength in DRAM, which grew by 22% QoQ (+29% on a YoY basis) despite the lower-single-digit percent sequential decline in ASPs, as demand boost, primarily from cloud, PC and gaming, led to increase in bit shipments in the mid-20% range on a sequential basis. The strength was also a result of some demand pull-forward from Huawei ahead of the ban. Notably, Micron was the only company in the DRAM oligopoly peer group that saw its DRAM revenue grow during the quarter (Samsung’s DRAM revenue fell 3.1% and SK Hynix’s DRAM revenue fell 4.4% on a sequential basis). NAND, however, continued to be affected by the challenging industry dynamics and was a drag on 4QFY20 revenues as it saw an 8% sequential decline (+27% YoY) on flat bit shipments and upper-single-digit percent sequential decline in ASPs.

Healthy Margins:

Gross margins improved to 34.9% (+170 bps QoQ and +430 bps YoY) as a result of the strong cost execution in DRAM, which benefitted from the 1Z ramp, and was partially offset by a 220 bps headwind from under-utilization of the company’s Lehi, Utah facility. Operating margins improved to 21.5% from 18% in 3QFY20 as a result of cost control measures as well as OPEX leverage due to the higher revenue base. However, the company expects OPEX to trend higher over the course of FY21 as it continues to make R&D investments to fund technology spending and to further grow and improve its product portfolio.

Strong Balance Sheet, Disciplined Capex Strategy:

Micron has a solid balance sheet with approximately $9.3 billion in total cash and $11.8 billion in available liquidity, providing it with ample optionality to deploy its capital. In line with industry wide discipline regarding capex, Micron also adopted a conservative capex stance as it expects FY21 capex at about $9 billion, which is lower than its pre-COVID expectations. Understandably, a large portion of the expenditure will be weighted toward the first half of 2021, when it ramps up production of higher nodes in DRAM and NAND. As a result, its cash flows will be impacted during this time period, but will eventually return to healthy levels as the company benefits from improved market conditions, declining costs and lower capital spending during the second half of 2021.

Valuation:

Although the somewhat commoditized nature of Micron’s products, combined with the significant cyclicality of the industry, temper our optimism to some extent, Micron is still expected to generate significant sales growth next year (+25.3%), and we are not turned off by the company’s significant spend on research and development (to the contrary, we like it). The table below shows several important financial metrics for Micron versus other semiconductor businesses, but take them with some degree of salt as the businesses are actually quite different in terms of products and end users.

source: StockRover as of 29-Dec-20

For a little more perspective, here is a look at Micron’s historical price-to-sales ratio—which is currently near the higher end of the range. However, expected forward growth is also high which gives us an added degree of comfort.

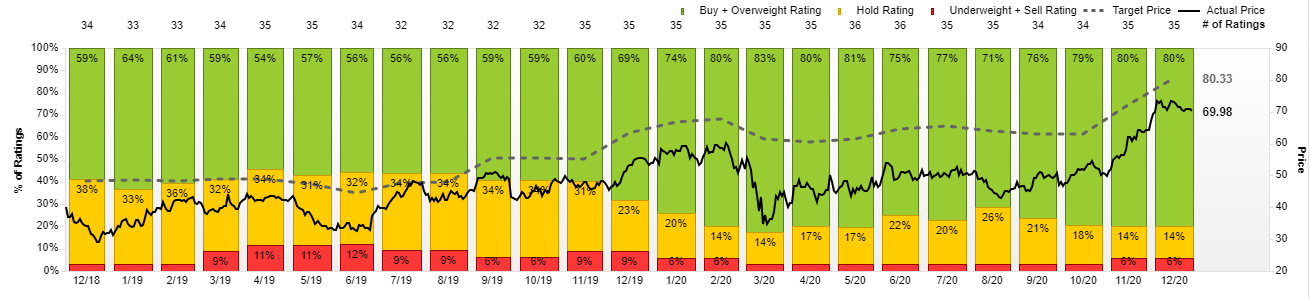

Wall Street analysts remain optimistic on the shares, as the 35 analysts reporting to Factset have an aggregate “buy” rating, and believe the shares are approximately 15% undervalued. We believe the shares have even more long-term upside, especially considering these analyst are notoriously mid to short-term focused (i.e. there price targets are heavily weighted on the most current quarterly operating results).

image source: Factset

Risks:

Volatility in ASPs: Because of the commoditized nature of Micron’s products, their prices are highly leveraged to supply and demand dynamics. As a result, it has experienced significant volatility in its ASPs (average selling price) in the past. In fact, in certain periods ASPs have been below the manufacturing costs. Should such a scenario repeat in the future, it could have a material adverse impact on the business. However, the company’s higher value solutions, and patented new products such as the GDDR6X relatively protects it from extreme ASP related downside.

Competition: Micron operates in intensely competitive semiconductor memory and storage markets where it competes with a number of companies, including Intel, Samsung, SK Hynix, Kioxia (spinoff of Toshiba) and Western Digital Corporation. Should any of these competitors increase their capital spending to increase their production in the already over-supplied markets, it would put further downward pressure on the ASPs, leading to depressed margins. Also, the company faces the threat of increasing competition from Chinese players as a result of significant investment in the semiconductor industry by the Chinese government.

Unfavorable Macro Scenario: The worldwide COVID pandemic has led to declining demand for certain products used in smartphones, consumer electronics and automotive. If further unfavorable macroeconomic conditions arise (perhaps due to the new strain of the virus) the demand for Micron’s products could decline, which would adversely impact the business.

Supply Chain Risks: Micron purchases a significant portion of its equipment and supplies from suppliers outside the US and also has a significant portion of its manufacturing facilities and fabricators located outside the US, including in Taiwan, Singapore, Japan, and China. This exposes the company to inherent supply chain risks to some extent.

Conclusion:

Micron has been a profitable company through the industry-wide cyclical troughs as well as during the COVID pandemic. It has transformed itself into a technology leader over the past few years and has positioned itself extremely well to benefit from the visible secular growth trends in demand for memory and storage products. Further, the company’s stock price has broken out of a narrow range and is tracking higher with every announcement the company makes, and the valuation also looks reasonable. Altogether, we believe that Micron is a very good investment case for investors looking to benefit from a cyclical uptrend and also to grow their wealth in the longer-term.

Micron is an “Honorable Mention” on our recent Ranking: Top 10 Growth Stocks.