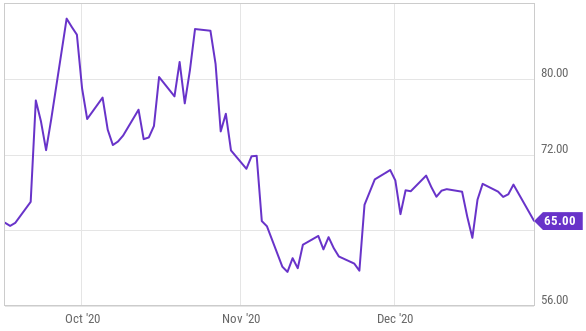

Shares of this newly public “DevOps” company debuted in September and swiftly traded approximately 100% above the $44 initial public offering price. However, given the impressive high growth rate, product offerings and expanding opportunity in a very large and nascent industry—the shares are worth a closer look (especially considering the share price has been quietly reverting back towards its initial IPO level in recent weeks). In this report, we analyze company’s business model, market opportunity, competitive position, valuation and risks before finally concluding with our opinion on investing.

Overview:

JFrog is a technology company that provides B2B enterprise SaaS solutions that enable organizations to continuously deliver software updates across any system. Cofounded by Shlomi Ben Hain (CEO), Yoav Landman (CTO), and Frederic Simon (Chief Data Scientist) in 2008, JFrog raised $3.5M through its Series A funding in 2012 from Gemini Israeli Ventures. After several years of traction and strong growth, the company finally went public in 2020 at a market valuation of over $6 billion. In 2008, the company provided the software development community with the first package repository solution and software distribution platform called “Artifactory”, and since then has expanded its suite of portfolio offerings to include adjacent products such as build integration, workflow automation, security, and deployment to build a unified platform for meeting the end-to-end software release needs of its customers.

Software development and its deployment is a complex process. Software is written by developers in source code which cannot be directly deployed on hardware, rather it first needs to be transformed into executable binary files before distribution. Organizations need specific tools to convert source code into binary files, group them into software packages, and then store and manage these packages so that they can be deployed into runtime environments. This is where JFrog comes into the picture. It enables software developers to store, edit, track, and manage binary files in a central repository from where they can be quickly and efficiently released and deployed whenever required. JFrog believes that the technology world is quickly moving towards ‘Liquid Software’, an era where software upgrades will be automatically pushed from the organization’s back-end continuously throughout the day. To support this new way of updating software, JFrog aims to develop a unified platform called Continuous Software Release Management (CSRM) which will facilitate automated, fast, secure, and efficient deployment of software packages without any downtime.

JFrog’s suite of offerings—7 primary products:

JFrog Artifactory: Artifactory is the core product offered by the company. It is a binary repository manager that is used to store, update, and manage binary files by organizations during the software development process. It supports several programming languages, package formats and can be easily deployed in the public cloud, on-premise, private cloud, and hybrid environments.

JFrog Pipelines: Pipelines are Continuous Integration/Continuous Delivery tools offered by the company that are used to automate and control every phase of software development workflow including build time, production, and final deployment.

JFrog Xray: Xray is an analysis tool that performs security scans on all software packages across the CI/CD pipeline to find any vulnerabilities or non-compliances. When software/binary packages are uploaded on the JFrog Artifactory, Xray automatically detects and warns the developers of any security flaws in the coding structure of these files, thereby preventing any flawed releases. Moreover, Developers often use third-party coding libraries for building their software and it is necessary to confirm that they have the license to use these third-party libraries for commercial purposes. Xray also performs scans on software codes to check for license compliances and flags any irregularities.

JFrog Distribution: Once the software packages are compiled and tested for the runtime environment, they are ready for deployment in the real world. JFrog offers tools to distribute software packages securely and reliably to multiple locations for deployment and update them when new versions are released.

JFrog Artifactory Edge: This works in conjunction with JFrog Distribution and is located closer to the users in the runtime environment to create a content delivery network (CDN) of edge nodes for accelerating the deployment process. Artifactory Edge facilitates deployment of only incremental changes in the package over their previous versions rather than the entire application itself thereby increasing the efficiency of the entire process.

JFrog Mission Control and JFrog Insight: Additionally, the company also offers JFrog Mission Control which is a single dashboard to have a holistic view and control over the entire software release workflow, and JFrog Insight which is an intelligence tool that shows key metrics of the software release flow and can be used to improve process efficiency.

Source: JFrog Ltd.

All of JFrog’s revenue is earned through subscription fees that are charged to its customers for using its platform. Recurring revenue helps the company generate stable and predictable cash flows. It follows a ‘freemium’ or ‘land & expand’ business model where its basic services are available for free for customers to try out, however in order to use JFrog’s advanced features or services, customers are required to upgrade to premium plans. As of September 2020, JFrog had over 5,800 paying customers which include organizations of all sizes and are highly diversified across industry verticals including Finance, Technology, Entertainment, Software, Retail, and Education. Large customers (i.e., enterprises from which JFrog generates over $100K in annual revenue) totaled 315, whereas enterprises contributing over $1M in annual revenue totaled 9 at the end of the recent quarter. Geographically, the company’s revenue sources are diversified across regions, however, the US continues to remain the largest market contributing 62% of the overall top-line.

Large and expanding TAM offers long-term growth potential

JFrog operates in a nascent but fast-growing DevOps technology market segment. The digital transformation of global organizations has made software applications an integral part of business operations for managing internal workflows as well as interacting with end-customers. Therefore, to have an edge over their competitors, organizations in most industry verticals are searching for ways to improve the software development process.

Continuous and reliable release of upgraded software with no bugs or other flaws has become critical for business stakeholders. This has given rise to ‘DevOps’. DevOps is a combination of two words ‘Development’ and ‘Operations’. It refers to a set of practices that aims to increase the organization's speed of delivering software applications and services by automating and integrating the workflow between software development and IT teams.

Source: JFrog Ltd., Investor Presentation

Supported by secular tailwinds primarily led by an increasing need for fast application delivery, IDC believes that the global market opportunity for all DevOps tools stood at $8.5B in 2019 and is expected to expand to $18B by 2024, thereby growing at a CAGR of over 16%. As per Evans Data, the number of developers globally is expected to increase from 23.9M in 2019 to 28.7M in 2024. IDC also estimates that as compared to only 3% in 2019, 40% of organizations will ship code to production daily by 2023. JFrog being the first mover and one of the most popular DevOps platforms in the world is well placed to benefit from this growing secular trend. As per the company, its product offering has a target market that expands beyond DevOps and has estimated a TAM of $22B. With market penetration of less than 1%, JFrog has a large runway to continue growing rapidly in the future.

Agnostic approach offers significant competitive advantage

JFrog competes with several companies across the software development workflow cycle, however, it has emerged as one of the best alternatives by offering a unified platform meeting the end-to-end software release needs of its customers. Regarding its core product offering ‘Artifactory’, JFrog faces competition from GitHub, GitLab, Bintray, to name a few. However, its agnostic approach towards programming languages, source code repositories, development technologies, and the production environment provides it with a significant competitive advantage over its peers.

Artifactory is an industry-leading product and provides support for 25 package formats as compared to GitLab which supports 8 package types and GitHub which supports 6. Further, consistent portfolio expansion through product innovation and upgradation has helped JFrog become a one-stop-shop solution for most software development and deployment needs, making it the preferable choice for customers. JFrog has already done business with 75% of the Fortune 100 companies including all 10 of the top 10 tech organizations, 8 of the top 10 financial companies, 9 of the top 10 retailers, 8 of the top 10 healthcare organizations, and 7 of the top nine telecommunications companies.

Impressive top-line growth through strong customer acquisition and high net retention

The attractive secular tailwinds combined with the superiority of its product offerings are driving JFrog’s strong and growing financials. For example, in Q3 2020, JFrog reported total revenue of $39M, which represents an impressive annual increase of 40% on a YoY basis. This growth was primarily driven by the addition of new paying customers as well as high net retention rates among existing customers. The number of customers generating over $100K in annual revenue increased from just 234 in Q4 2019 to 315 in Q3 2020. The addition of larger customers is beneficial for the company as these customers generally enter into long-term contracts which leads to a stickier top-line.

Also, JFrog was able to maintain a high net retention rate of 136% in Q3 2020 which implies that apart from growing the number of customers, it was also able to expand revenue generation within its existing customer base by upselling its premium offerings. A high retention ratio also is a sign of customer stickiness to JFrog’s platform. Given JFrog’s leading position in the DevOps market segment, combined with secular growth of the software development industry, the company will continue its strong momentum in the medium to long term. The management team expects its trailing 12 months net dollar retention to remain above 130% for the next several quarters, which will continue to boost top-line growth.

Expanding margins through economies of scale

Like other top SaaS companies, JFrog generates high gross profit margins. However, it has deferred its full potential on the operating level as it has been consistently investing in R&D to broaden and upgrade its product portfolio, as well as sales & marketing to onboard larger customers to its platform. Having said that, the operating margin picture is improving. For example, in Q3 2020, adjusted operating profits more than doubled to $5.1M as compared to $2.5M in Q3 last year. And on a percentage of sales basis, operating margins improved from 8.8% last year to 13.2% in Q3 2020 (i.e. an increase of 440 bps).

In addition to strong top-line growth, JFrog’s margin expansion is also the result of better control over operating costs (such as travel expenditures and reduced new hiring) during the quarter because of the pandemic. While operating margins will slightly decline when COVID-led restrictions are lifted and normal business operations resume, JFrog’s profitability will keep on improving in the coming quarters as it enjoys the advantage of operating leverage on a fast growing top-line. The company has a target of achieving over 20% operating profitability in the longer term.

Robust financial position with enough liquidity cushion

JFrog has remained free cash flow positive consistently for the last 5 years which is rarely seen in high growth tech companies. For the first 9 months of 2020, the company reported free cash flow of $14M as compared to $4M during the same period last year. Free cash flow margin also expanded from 5.4% in YTD 2019 to 13% in YTD 2020. This increase was primarily a result of growing operating margins, increasing top-line along with favorable working capital changes. JFrog ended the most recent quarter with liquidity of $578M in the form of cash and short-term investments, including $393M it was able to raise from its IPO in September 2020. As the company does not have any debt on its balance sheet and is already free cash flow positive, the current liquidity position is enough to fund any growth investment needs of the company in the near to medium term.

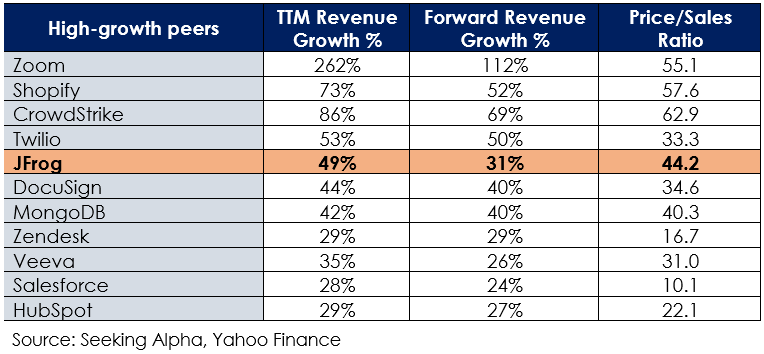

Premium valuation justified due to long-term growth potential and a superior product

JFrog’s stock debuted in September 47% above the IPO price fixed by the company. It is currently trading at a price to sales multiple of over 44x, which is higher than many of its technology peers. While the valuation is at a premium, we believe JFrog has secured a market leading position in a nascent but fast-growing DevOps industry segment and boasts immense long-term growth potential with robust business fundamentals. As such, we believe the shares continue to offer significant long-term upside.

Competitive Risks:

JFrog operates in the dynamic technology industry where it competes with several large and small DevOps players. In order to maintain its leading position, JFrog will need to consistently innovate and upgrade its portfolio offerings.

Conclusion

JFrog has consistently delivered impressive top-line and bottom-line growth in recent quarters driven by strong customer acquisition along with consistent upselling. We continue to remain impressed by the robust business model and the company’s ability to expand its portfolio offerings through research & development. While the shares currently trade at a premium, the premium has shrunk considerably in recent weeks (as the shares have reverted back towards their IPO price) and the company’s large and increasing total addressable market provides a long runway for growth. We do NOT currently own shares, but JFrog is high on our watch list because of the extremely attractive long-term growth potential ahead.