The once standard 60/40 portfolio (e.g. 60% stocks and 40% bonds) is far less appealing to many investors than it used to be—simply because bond yield are so unattractively low, especially as compared to where they were just a few decades ago (see chart below). Of course stocks and bonds are fundamentally different types of investments, but if it’s simply safe steady income you seek, it may behoove you to consider the attractive income provided by owning certain blue chips dividend stocks in lieu of bonds. In this article, we review four specific blue chip stocks (two popular classic examples, plus two more that we really like going forward), and then conclude with a few ideas on how you may want to structure your own investment portfolio, especially considering the traditional 60/40 split just isn’t cutting it for a lot of investors.

Historical Yield Perspective

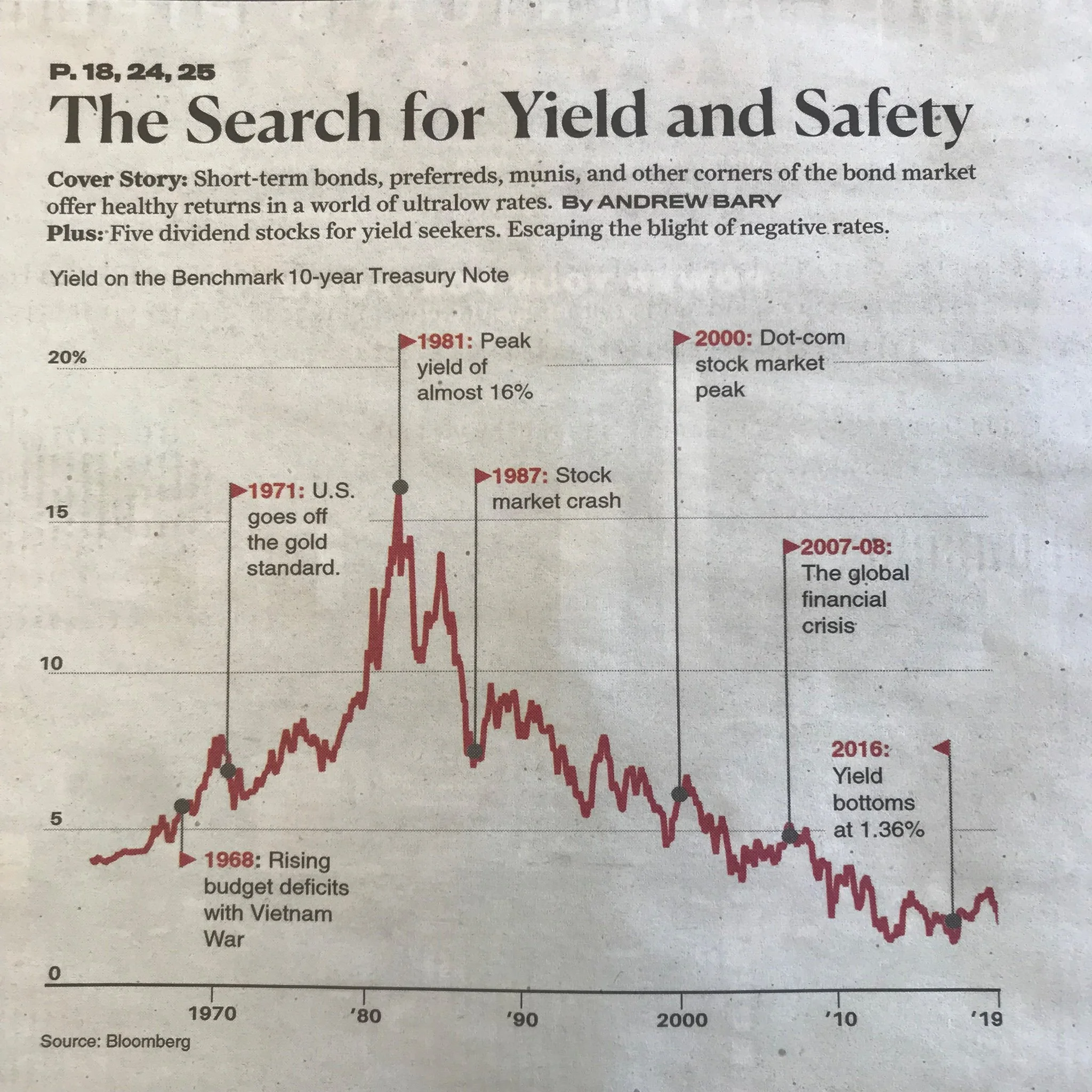

For a little perspective, here is a look at the historical yield on 10-year US treasury bonds. As you can see, it has fallen from almost 16% in the early 1980’s to its current very low rate (0.87%).

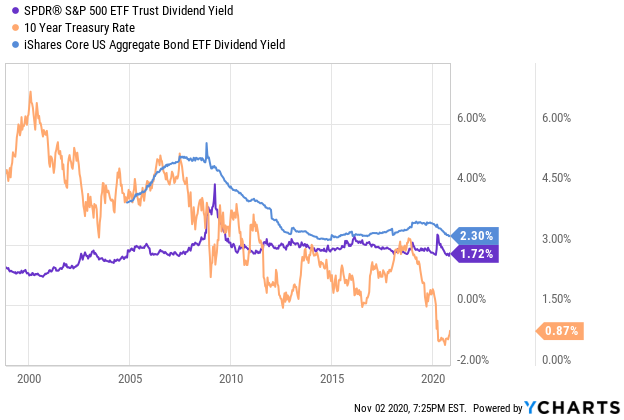

And here is a more current look at bond yields versus the dividend yield on the S&P 500 index of stocks (you’ll notice we also threw in the yield on the Core US Aggregate Bond ETF (AGG)—this index/ETF basically represents the total US investment-grade bond market).

And compared to the near 16% yield on 10-year treasuries back in the early 1980’s, current yields are certainly not what they used to be.

Bonds Are Becoming Less Safe

Compounding the challenges created by low bond yields, many bonds are also becoming less safe from a credit rating standpoint. For example, just a few decades ago, dozens of publicly-traded companies had “AAA” credit ratings, but currently that number has fallen to just two companies (more on this later). Further, even the USA lost its “AAA” credit rating from Standard & Poor’s back in 2011. So not only have bond yields been falling, in many regards—safety has been deteriorating too. And this leads us back to the same 60/40 portfolio dilemma. Specifically, does a 60/40 portfolio still make sense for investors?

Blue Chip Stocks as a Bond Replacement?

Obviously, everyone’s personal situation is different, and stocks and bonds are fundamentally different investment types. But if you are retired and looking to generate safe income from your investments, you may want to consider a few blue-chip dividend stocks for the “safe income” portion of your investment portfolio—in lieu of bonds. A few reasons why this might make sense for you are:

Greater Yields: Select blue-chip stocks offer higher “safe yields” than bonds. This may sound absurd, but to put it in perspective, their are blue chip stocks with higher yields and higher credit ratings than the investment-grade US Aggregate Bond Index (AGG) and US treasuries.

Growing Income Payments: Unlike bonds, there are blue chip dividend stocks that are committed to consistently increasing their dividend payments every year. They have a long track record of doing this, and they have the financial wherewithal to keep doing it (more on this in a moment).

Price Appreciation: If it is simply safe income you are seeking, many blue-chip-stocks deliver better yields than bonds (they’re bigger, safer and they grow), so who cares about stock price fluctuations—as long as you keep getting those steady growing income payments. Furthermore, if you hang on for the long-term, and despite the short-term fluctuations, many blue-chip-dividend stocks are likely to increase in value over the long-term. They’ll never give you the skyrocket returns of some super aggressive growth stocks, but they won’t give you the volatility and headaches either.

Two (2) Classic Blue Chip Dividend Stocks

Two classic examples of blue-chip-dividend stocks are AT&T (T) and Verizon (VZ). These stocks offer yields of 7.7% and 4.4%, respectively, and they have been increasing their dividend payments for 36 and 14 years, respectively. These are both very special businesses that have helped many investors meet their personal cash flow needs by delivering big steady growing dividend payments for a very long-term. We’ve recently written in detail about the attractive qualities of both of these stocks. For example, with regards to AT&T, we wrote the following in our August 27th report:

AT&T is a special stock… It has increased its dividend for 36 consecutive years, and is on track to keep increasing it based on its high free cash flow and its low dividend payout ratio. Furthermore, the current pandemic has driven the share price too low, thereby creating the potential for share price appreciation. Of course, there are risks such as cord-cutting and less new content creation as the pandemic has forced social distancing. However, HBO Max will help offset cord cutting, and new content creation will eventually ramp back up. If you're searching for the next Google (GOOGL) or Facebook (FB), AT&T is not for you. But if you're simply looking for safe income, AT&T shares are attractive and worth considering.

Here is a look at the long history of growing dividend payments from both AT&T and from Verizon:

And with regards to Verizon, we recently wrote:

Verizon's relative strength comes from the scale of its wireless business, which has positioned it on strong footing as compared to its rivals. We believe that because of a largely resilient business model with a recurring revenue stream, the company should be able to generate robust free cash flows in the future, thereby strengthening regular dividend payouts. Also, there is plenty of room for dividend growth given that Verizon currently pays just over half of its free cash flows in dividends. Accordingly, we believe the stock is worth considering if you are a long-term income-focused investor (we own shares).

AT&T and Verizon are special dividends stocks, and we believe they will continue to pay attractive dividends going forward.

Two (2) Blue Chip Dividend Stocks For the Future

Importantly, there are blue chip dividend stocks with higher expected future growth rates, and longer track records of dividend increases than AT&T and Verizon. And while the next two stocks we review offer lower dividend yields than Verizon and AT&T, the yields are still higher than US treasuries, plus they are SAFER than US treasuries from a credit rating standpoint (something Verizon and AT&T cannot say). And what’s more, these next two stocks offer more long-term price appreciation potential, plus vastly more future dividend growth potential.

image source: Stock Rover

Johnson & Johnson (JNJ)

Johnson & Johnson has an “AAA” credit rating (better than US treasuries), it has a higher yield than US treasuries (and a higher yield than the Aggregate US Bond Index (AGG)), and it has increased its dividend for 58 years in a row.

Furthermore, Johnson & Johnson is very well positioned to keep delivering strong dividend increases and price appreciation in the future. Specifically, the company has incredibly strong fundamentals derived from its well-diversified three-pronged business model that contributes to consistent profitability and a very strong balance sheet. We recently wrote in great detail about Johnson & Johnson, and shared an attractive income-generating options trade idea is this report: J&J: Time to Sell Calls.

Microsoft (MSFT)

Microsoft is the other “AAA” credit rating company (higher than US treasuries), and it has increased its dividend for 17 years in a row. And while some investors may claim the dividend yield (currently 1.1%) is simply too low for their needs, they might be better served to keep the concept of “Yield on Cost” in mind. Specifically, Microsoft’s dividend yield was also only around 1.1% 17 years ago, but the actual dividend payment amount has increased dramatically, and the only reason the yield is still only 1.1% is because the price has also increased dramatically.

From a “Yield on Cost” standpoint, if you bought Microsoft 17 years ago at $24.71, the current dividend—divided by the cost back then—gives you a Yield on Cost of 9.1%—that’s a lot and it’s more than AT&T. Microsoft’s price has increased around 640% in the last 17 years while AT&T is up around 7%. Furthermore, on a go forward basis, Microsoft is very well positioned for dramatic price and dividend increases in the years ahead, as we recently wrote in great detail in this report (titled: Microsoft: If I Could Own Just One Stock). For a little more perspective, here is a look at how fast Microsoft’s dividend has been growing over the last 17 years, versus how fast AT&T’s dividend has been growing.

And again, Microsoft has significant continued dividend growth opportunities in the years ahead. Overall, dividend growth, yield on cost, and total returns (dividends plus price appreciation) are all a big deal for income-focused investors to keep in mind.

Conclusion

There are plenty of investors that would gladly take the near 16% yield offered by US treasuries back in the early 1980’s instead of the sub 1% yield they offer today. In fact, yields on bonds have dropped so low that many investors are left wondering if the traditional 60/40 portfolio still makes sense.

Depending on your situation, it can make sense to use a few blue chip dividend stocks (such as Johnson & Johnson) to replace part of your bond allocation. It can even make sense to sprinkle a few pure growth stocks (see: Top 10 Growth Stocks) into your portfolio (to generate some of your spending cash needs though long-term price appreciation). However, at the end of the day, it’s your money, and you need to come up with a plan to meet your own specific needs and preferences, especially considering the traditional 60/40 portfolio just isn’t cutting it for a lot of investors.