Recent trading sessions have been terrible for Top Growth Stocks, with many of them down 5% to 10%, as you can see in the following table. And that doesn't mean things can't still get a lot worse (they can). However, rather than worrying about near-term market volatility, a better strategy is to simply select attractive stocks--and then hang on for the long-term (despite any short-term market gyrations). That may sound easier said than done, but in this article we attempt to help. Specifically, we rank our top 10 growth stocks for you to consider, starting with #10 and counting down to our top idea.

Before we get into the ranking, it’s worth mentioning, we ran a Top 10 Growth Stocks report last month, and many of those stocks are up significantly. Of course, 1-month is a short timeframe, and any gains or losses during that period can have a lot more to do with noise than actual fundamentals. Nonetheless, a few stocks from last month’s list are up a lot since we released the report, such as Exact Sciences (EXAS) (up 15%), Magnite (MGNI) (up 30%) and Paylocity (PCTY) (up 13%). Additionally, a few names from last month’s report remain in the top 10 again this month, although some of the rankings have changed (for example, there is a new #1).

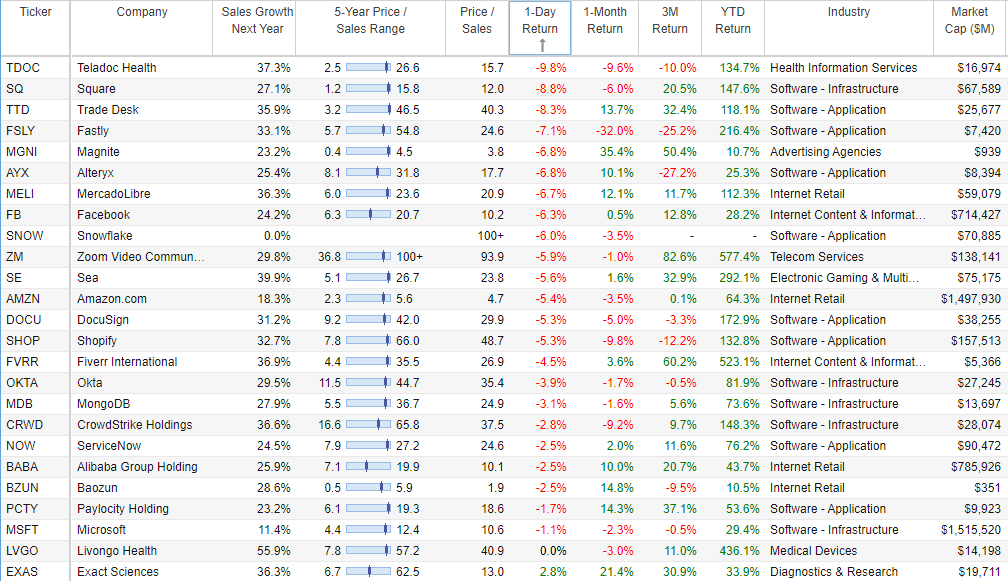

One theme to keep in mind as you review this list is sales growth versus valuation. In particular, all of the names on the list have very high expected future sales growth rates (and the leadership and big market opportunities to back them up) combined with attractive valuations (as compared to their long-term growth potential). For perspective, here are some growth and valuation (price-to-sales) metrics on a handful of top growth stocks.

(source: StockRover, see also: Top Growth Stocks)

And despite what many short-term valuation naysayers will decry, if you’re going to “talk the talk” of being a long-term growth investor, you also need to “walk the walk,” which means having the conviction and nerves of steel to hang on through any short-term volatility, because in the long-term, the bumpy ride will be forgotten, and only the long-term price gains will be remembered.

Without further ado, here is our latest ranking of top 10 growth stocks, starting with an “honorable mention” and then counting down from #10 to our #1 top idea.

Honorable Mention: Snowflake (SNOW)

Snowflake recently completed its initial public offering at $120 per share on September 18, 2020. However demand was so strong that the shares immediately began trading at more than double that price, and they have since risen even further.

If you don’t know, Snowflake provides a cloud-based data platform, addressing the rising data management needs of enterprises. Specifically, the company’s platform stands out for its ability to streamline, share and analyze data to get meaningful insights. The platform is “cloud-only,” and it operates on public cloud infrastructures provided by Amazon Web Services (AMZN), Microsoft Azure (MSFT) and Google Cloud (GOOGL). The growth potential of this business is truly enormous, but we’ve only included it as an honorable mention in this report because its valuation is extremely high (even for a top growth stock list, such as this one), and we’re waiting for a few quarters of operation as a public company, and hopefully a better entry price. You can read our new full report on Snowflake here:

10. Alibaba (BABA)

Alibaba is one of the largest e-commerce platforms in the world (it has an ~$850 billion+ market capitalization), and it controls almost 50% of the Chinese online commerce market. It has consistently delivered strong top-line and bottom-line growth since its listing in 2014, benefiting both from growth in the Chinese internet as well as company specific growth initiatives.

The company has multiple sources of growth as it rides the cloud trend plus secular growth in global e-commerce in the foreseeable future. We believe the current valuation and business model present an attractive opportunity for long-term investors. You can read our recent full report on Alibaba here:

9. Paylocity (PCTY)

Paylocity was ranked #7 on our top 10 growth stock report last month, but it has fallen to #9 this month as the shares have rallied a healthy 15% since last month’s report was released.

As we mentioned last month:

Paylocity is in the right business, at the right time, and with the right strategy. This is a cloud-based, payroll processing company that has been (and will continue) benefiting tremendously as an increasingly number of businesses move towards digital cloud-based automation for simplicity and cost-savings purposes.

We’ve owned these shares since late 2015, when they were trading at ~$29 (here’s a report we wrote way back then), and the stock has not disappointed in the gains department (as you can see in the chart above). We believe this one still has a lot more growth in the years ahead (if it doesn’t get acquired at a hefty premium before then), and we continue to own the shares going forward. You can access our more recent previous Paylocity report here:

8. Fiverr (FVRR)

This “global online freelancer marketplace” company was #9 on our ranking last month, but has risen 1 slot to #8 as the share price is back near where it started, but the newly released earnings results were positive.

In particular, Fiverr beat earnings and revenue expectations (revenue was up 87.8% year-over-year), and raised revenue guidance for the full year. We recently wrote in detail about this company (including our thoughts on a specific income-generating options trading strategy), and you can access that report here:

7. Magnite (MGNI)

This small cap digital advertising company was ranked #6 last month, but has fallen to #7 this month as the shares have gained ~+30% since the previous report.

Magnite appears to be getting its ducks in a row after the recent Telaria merger, and it also has a massive total addressable market (i.e. it’s in the right place at the right time). You can read out recent Magnite report (which was previously only available to members) here:

The Top 6

The remainder of this report (i.e. The Top 6) is reserved for members-only and it can be accessed here. I currently own all 6 of the top 6 stocks, and all of them are also included in the Top Growth Stock table included earlier in this report (above). More specifically, the list includes leading businesses, with very high growth rates, attractive valuations (especially after Friday’s sell-off), and very large total addressable markets. I include detailed research reports for each name. Overall, I believe the upside return potential for each idea is extremely attractive, especially considering current market conditions.

*Special Offer: Get 25% Off all new memberships.

At checkout, use Coupon Code: BH25

The Bottom Line

The type of high growth stocks described in this report are NOT for the faint of heart. They will likely be highly volatile with enough violent ups and downs to make a lot of people sick. But if you are truly a long-term investor, with the fortitude to hang on despite the volatility, you’ll likely be very grateful in the years ahead. These are stocks with a lot of upside, and except for two (Snowflake and Fiverr), we currently own all of them in our Blue Harbinger Disciplined Growth portfolio. You can attempt to wait for a better price on all of these stocks, but a very successful long-term strategy (that has worked extremely well) is simply to buy and hang on. And with the attractiveness of these businesses—you’re future self might thank you for sprinkling a few into your portfolio.

Note: Members can continue reading this report here.