Value and income stocks have been challenged this year as the COVID-19 pandemic has made life difficult for many of them and as many growth and technology stocks have sailed higher. However, if you are a contrarian, there are select opportunities among the wreckage that are absolutely worth considering. Especially as many value and income stocks have started to perk up lately as news of a COVID-19 vaccine is spurring some capitulation between high-flying growth stocks and beaten down value and income names. In this report, we provide an overview of this year’s divergent performance, our view on what to expect going forward, and then count down our top 10 big dividend contrarian opportunities.

This Year’s Divergent Market Performance:

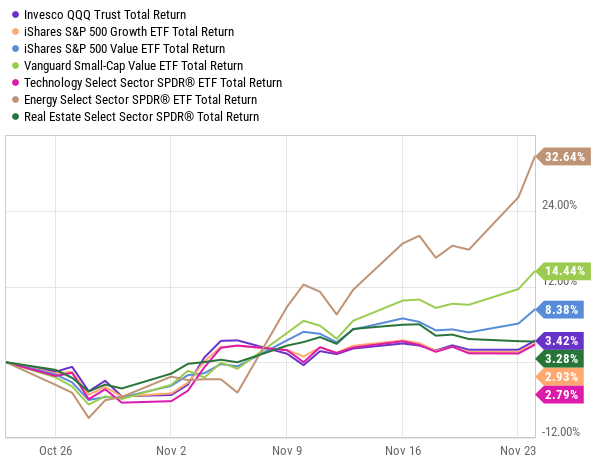

For starters, here is a look at the dominant year-to-date performance of growth and technology stocks, as represented by the Nasdaq 100 (QQQ) S&P 500 Growth Stocks and the Technology sector (XLK).

However, over the last month the story has almost exactly reversed as positive news on the vaccine front has led to stronger performance by beaten down market segments such as small caps, energy and real estate (i.e. the sectors that can pay higher dividends, especially energy and real estate, but also select small caps).

And what may be particularly interesting to some investors, many of the names that have just started to rebound—have a long way to go, considering some of these businesses remain strong and were simply trading too low in the first place.

To add a little more explanation to the story, growth and tech stocks (QQQ) (XLK) (IVW) were doing well in a social distancing world as people were forced (and had more time) to use new and critical technologies. In our view, the pandemic accelerated the business of many of these growth and tech stocks, and they still have more long-term upside ahead, but in the near-term it is the beaten down value and income stocks that have captured our attention.

For example, even if you count dividends (total returns) real estate investment trusts are still down this year. But not all REITs are created equally, and considering the positive vaccine news—there are some very attractive low-priced opportunities in the REIT space, which we will discuss later in this report. Furthermore, there are additional high income stocks that still trade at relatively depressed levels (energy, small caps and even agency securities)—and we’ll highlight our top ideas in those area as well.

Our Expectations Going Forward

In the paragraphs above, we have painted the market with broad brushes. Specifically, we used ETFs to highlight some of the dramatically different performance this year among market sectors. However, individual stocks can provide far better opportunities (due to their own specific financial situations, valuations and health). Going forward, we will not be surprised at all to see a continuing rebound for energy (as more people eventually start to drive to work again, for example), real estate (as stay-at-home orders eventually decline, thanks to the vaccine news) and small caps (as small businesses get back to work), and in the remainder of this report we highlight our top 10 “stock-specific” high-income investment opportunities that are currently trading at attractive “contrarian” prices.

Top 10 Big Dividends: Contrarian Value Opportunities

Without further ado…

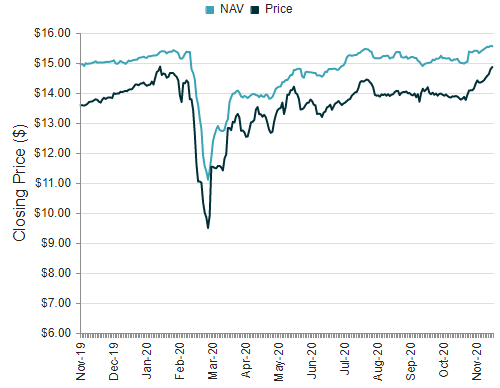

10b. BlackRock Credit Income (BTZ), Yield: 6.8%

If you like big income at a discounted price, this closed-end fund is worth considering. It offers a 6.8% yield, it pays monthly and it trades at a discounted price versus its net asset value (i.e. you get access to the income stream of the underlying holdings at a discounted price).

BTZ holds fixed income securities including mainly corporate bonds but also bank loans and convertible bonds, to name a few. And it’s also well diversified across bond issuers and maturity dates. Also, the share price has moved past the distress of the covid-induced bond market liquidity crisis earlier this year (as you can see in the chart above—Feb/March sell off) as the US Fed appropriately pumped massive liquidity into the bonds market. It also kept paying a big healthy steady dividend throughout the price volatility (very important if you are investing for the income). Furthermore, it is managed by BlackRock, a trusted firm with vast resources and expertise. You can read more about the important details of this closed-end fund in our new detailed write-up here.

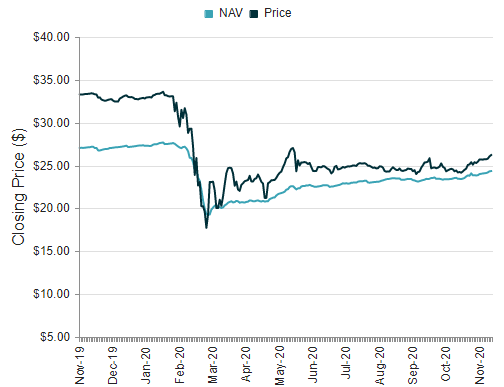

10a. PIMCO Dynamic Income Fund (PDI), Yield: 10.9%

PDI is another attractive closed-end fund that is worth considering. It offers a big 10.9% yield (also paid monthly), and it is managed by the highly reputable firm, PIMCO. And while the shares of this one trade at a slight premium versus is net asset value, the premium is smaller than its historical level (a good thing).

Also very important, a look under the hood shows the underlying holdings trade at over a 10% discount to their par value, thereby suggesting room for healthy share price appreciation (this one hasn’t yet recovered as quickly as BTZ above, but we think the recovery is coming). You can read our latest detailed report on PDI here.

9. Simon Property Group (SPG), Yield: 5.9%

Simon owns shopping malls and outlets which have been among the hardest hit (and most hated) during pandemic due to social distancing. Furthermore, the challenges created by the secular shift to online shopping are not going away. However, there are reasons for income-focused contrarians to be positive on the shares.

Simon recently right-sized its dividend, and the company has plenty plenty of financial strength to support (and raise) the dividend going forward. And this will be helped by the recent good news on the vaccine front, as well as Simon’s win with regard to lowering the purchase price of Taubman (the original deal was struck pre-covid). We wrote up Simon back at the start of September, and the shares have already rebounded very significantly since then. However, there is more upside ahead for Simon, and the dividend yield is big, healthy and attractive.

8. W.P. Carey REIT (WPC), Yield: 5.8%

W.P Carey is one of the largest net-lease REITs benefiting from the unmatched diversity in its portfolio and its deep expertise in sale-leasebacks. The portfolio has displayed very strong resilience to the pandemic, as its rent collections have remained strong throughout. It also has an impressive dividend history with consecutive dividend increases every year since it went public in 1998. We are also encouraged by its successful track record of operating through economic downturns and using them to build and grow a high-quality portfolio through opportunistic investing. Despite all the odds in favor, the stock has underperformed this year.

We believe at the current price, the REIT offers an attractive investment opportunity from an income generation, capital preservation, and capital appreciation perspective. We review the health of the business, valuation, risks, dividend safety, and conclude with on our opinion on investing in this report.

7. Annaly Capital (NLY) (NLY.G), Yield: 10.8%, 7.2%

We like the common and preferred shares of Annaly Capital. The common shares of this mortgage REIT currently trade at a discount to their book value, and this bodes will for the future price appreciation potential, considering over 90% of its book consists of very safe agency mortgage backed securities.

We believe Annaly is an attractive “buy” for income-focused investors, and you can read our previous detailed report (explaining why) here.

The Top 6

The remainder of this report is reserved for members only. Existing members can access the full report here. If you are not already a member, join now—get instant access.

*Special Offer: Get 25% Off all new memberships.

At checkout, use Coupon Code: BH25

The Bottom Line

If you are an income-focused investor, plenty of attractive contrarian opportunities remain. The market for many value and income stocks has not yet recovered from the pandemic, but there are reasons to believe select opportunities will more-than-recover in the months and quarters ahead, and many of them pay attractive dividends to hold you over while you wait for more price appreciation (such as the ones we’ve highlighted in this report).