Bandwidth is a high-growth CPaaS (Communication Platform as a Service) solutions provider that offers a suite of software APIs to support the mission-critical communications needs of a diverse and impressive set of enterprise-grade customers that includes the likes of Google, Microsoft, Zoom, Arlo, and RingCentral, to name a few. The company has experienced a strong boost in its business this year as a result of the enhanced digital communications need that has resulted from the pandemic. This has led its share price to more than double this year and valuation to expand from a Price-to-Sales multiple of 6.3x at the start of this year to 13.0x currently. Nonetheless, with a strong presence in the US, where it is the only CPaaS player to own an all-IP voice network, and an expanded international reach, we believe Bandwidth is well-positioned to benefit from the many secular growth opportunities in a large addressable market. This article reviews the health of the business, growth prospects, valuation, risks, and concludes with our opinion about why an investment in Bandwidth shares may be worth considering if you are a long-term growth-oriented investor.

Share Price:

Overview: Bandwidth (BAND)

Bandwidth Inc. (Nasdaq: BAND) is a cloud-based communications platform as a service (CPaaS) provider that offers a suite of software application programming interfaces (APIs) for voice and text functionalities, as well as 911 response capabilities primarily to enterprise-grade customers. The company’s business operations are organized into two segments:

CPaaS (~87% of TTM revenue): offers voice usage, phone numbers, 911-enabled phone number services and messaging services through the proprietary CPaaS software APIs.

Other (~13% of TTM revenue): offers Session Initiation Protocol (SIP) trunking, data resale, a hosted Voice-over-Internet Protocol (VoIP) and other miscellaneous product lines.

The company has historically generated most of its business from the US market (~96% of TTM revenue), where it owns a nationwide all-IP voice network, while its international presence has been limited to a few large Western European markets. However, the recent acquisition of Voxbone, an international cloud communications company, has expanded the geographical footprint to over 60 countries, thereby creating a stronger position in the ~$17.7 billion global CPaaS market.

Owned Network Provides Distinct Competitive Advantages

Bandwidth is the only CPaaS provider offering a robust selection of communications APIs built around its own nationwide IP voice network. The network includes a purpose-built cloud-based software layer that facilitates cloud-based hosting and management of voice and messaging APIs. This enables enterprises offering products in the cloud-native communications space to seamlessly embed these APIs into their applications to offer real-time communication and messaging with unmatched quality, reliability and scalability.

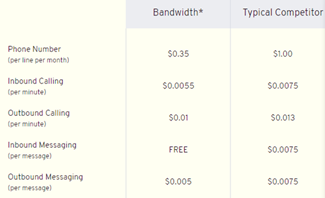

Further, as the network is owned, Bandwidth’s customers do not have to pay for a third-party upcharge that most of the other CPaaS providers that secure capacity via wholesale relationships would normally charge. Also, the company prices its services on a usage basis, i.e. the price is based on per message sent or per minute of VoIP used. This makes Bandwidth’s offerings highly cost-effective to enterprises that are looking for mission-critical communications and that is the reason why some of the largest digital communication service providers such as Microsoft (enterprise apps), Google, Zoom, RingCentral, etc., and other hyper-scale cloud application companies in the areas of home monitoring, pet sitting and food delivery that require a robust messaging platform have chosen Bandwidth as their communications network provider.

Pricing vs. Competitors

Some of the Key Customers

Source: Company website

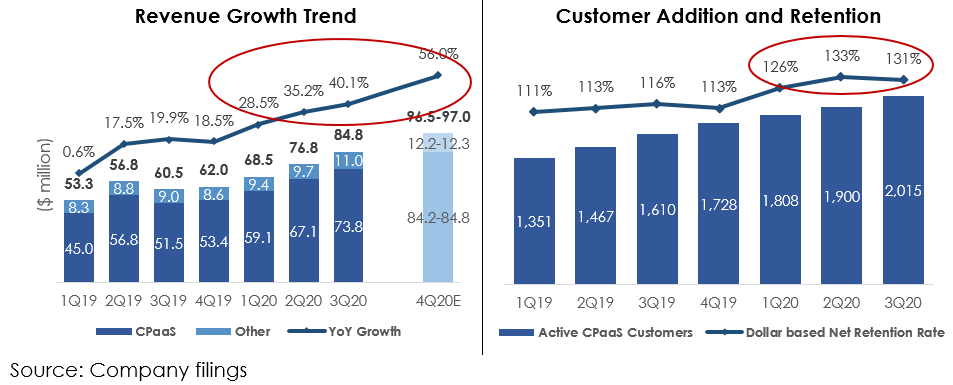

3Q Results and Forward Guidance Showcases Fundamental Strength of Bandwidth’s Business

During 3Q20, Bandwidth saw strong broad-based growth as it reported its best-ever YoY revenue growth of 40% to $84.8 million, with CPaaS revenue growing by a record 43% to $73.8 million. Demand for messaging was particularly strong at 164% during the quarter due to the unprecedented levels of political messaging traffic, which was further bolstered by an expanding relationship with a customer well known for its point-of-sale solutions. The elevated political messaging volumes contributed to a ~7% uptick in revenue, while ~5% of the growth came from COVID-related usage (vs. ~6% in the previous quarter), and the remaining from new customer acquisitions and higher usage, both on the voice and messaging side, by existing customers, indicating an organic growth of ~28% YoY. This comes on the heels of a very impressive 131% dollar-based net retention rate, which improved from 116% a year ago, and 115 net new CPaaS customer additions during the quarter.

For 4Q20, the company guided to a revenue range of $96.5-$97.0 million, which indicates a growth of ~56% YoY at mid-point. While this includes an anticipated $14.0 million contribution from the Voxbone acquisition, the revenue numbers even without Voxbone’s contribution points to a solid 33.5% fundamental growth YoY, and this is despite the anticipated tick down in COVID-related elevated demand (as has happened in the previous quarters).

On the profitability front, the company continued to perform well as non-GAAP gross margins improved to 49% from 48% in the previous year comparable quarter, while adjusted EBITDA stood at $9.3 million, which compares favorably to -$0.6 million in 3Q19 and $5.5 million in 2Q20. Overall, revenue growth and operating line performance culminated into non-GAAP net income of $6.5 million, or $0.24 per share, compared to non-GAAP net loss of $1.4 million, or -$0.06 per share in 3Q19. For the fourth quarter, the company estimates its gross margins to be in the high 40s range, and non-GAAP EPS to be in the $0.03-$0.05 range.

The solid operational performance resulted in strong cash flow generation as Bandwidth generated about $11.6 million in cash from its operations (YTD cash flows of $11.3 million), and $9.3 million in free cash flows (FCF) during the quarter (YTD FCF of -$0.5 million).

Multiple Growth Drivers for Sustainable High Double-Digit Growth Amid Dissipating COVID Tailwinds

While most of the COVID related tailwinds are temporary, Bandwidth’s recent results, as well as the general industry trends, point toward robust adoption of CPaaS despite the pandemic as organizations have been leading a CPaaS-driven digital transformation to tackle some of the more permanent challenges brought by the pandemic to stay afloat in the post-COVID world.

The pandemic has caused major redundancy of legacy telecommunications hardware systems as many organizations have been adopting more permanent work from anywhere models due to the flexibility of the model, and the margin improvements caused as a result of lesser use of physical office space. This has necessitated the use of alternative communication systems such as VoIP, video/audio conferencing, etc., and along with the continued shift towards moving applications to the cloud, has provided major longer-term tailwinds to providers of unified communications as a service (UCaaS), contact center as a service (CCaaS), as well as to other companies offering products in the cloud-native communications space. We believe Bandwidth is uniquely positioned to benefit from this trend as its owned IP network provides scalability, reliability as well as major cost savings to these players.

Additionally, the recent purchase of Voxbone has accelerated Bandwidth’s international expansion, an area where it was lagging historically. We believe, with the acquisition, Bandwidth is better positioned to take advantage of the growth opportunities in the global CPaaS market. According to CEO David Morken, during the 3Q earnings call:

“I couldn’t be more excited about our opportunities as we unite Bandwidth’s deep U.S. presence with Voxbone’s world-wide presence to create a global software platform, network and team unlike any other…

…The networks are complementary in the protocols and the stack that each use. The data centers are located where you find important carrier meeting points and where there's good aggregation of traffic. So I think intuitively, their architecture has made great sense to our team, and we're very excited about growing the business together.”

A Rapidly Growing and Large Addressable Market Provides Multi-Year Growth Runway

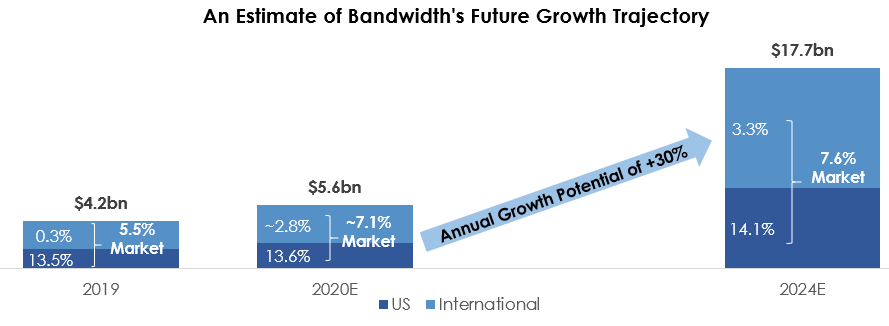

As per IDC, the CPaaS market is estimated to grow from $4.2 billion in 2019 to $17.7 billion in 2024, representing a 33% annual growth. Around 60% of this market is estimated to come from geographies outside of North America. Considering its 2019 sales, Bandwidth’s CPaaS market penetration is just about 5.5%, with about 13.5% share in the US CPaaS market and a negligible 0.3% international market share. We estimate that on a pro forma basis, the Voxbone acquisition will expand Bandwidth’s market share in the international market materially to ~2.8% in 2020 and the overall market share to ~7.1%.

Going forward, with a conservative assumption that Bandwidth will be able to capture an additional 0.5% share of the CPaaS market across geographies by 2024, we estimate it has a runway to grow its revenue at a +30% annual growth rate, which of course will depend on the execution capabilities of the management team.

Source: IDC and Blue Harbinger Research

Valuation:

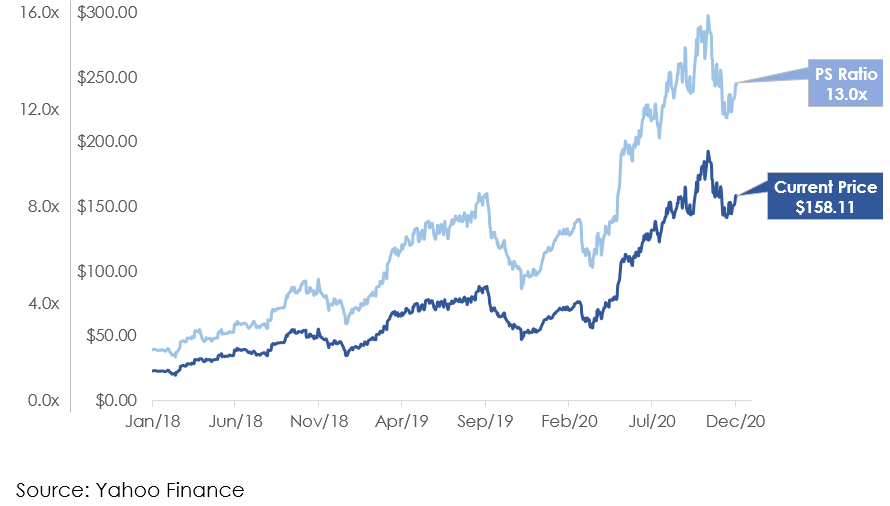

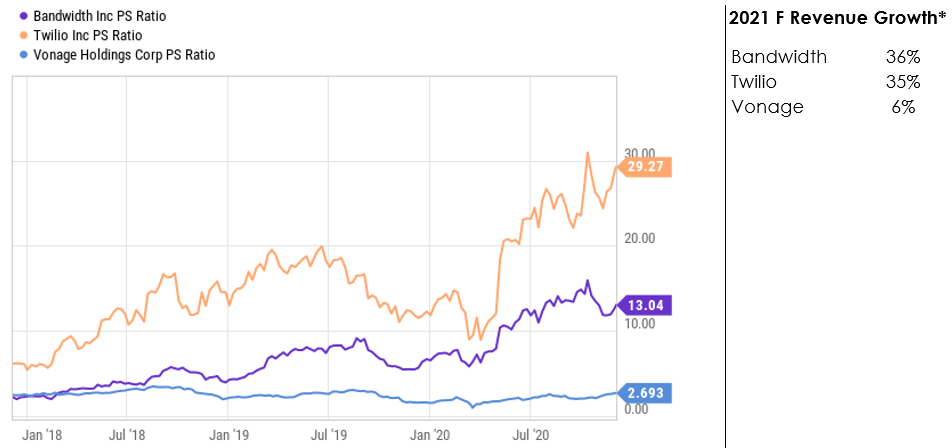

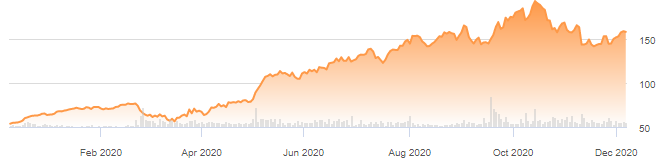

Bandwidth’s stock price has risen by ~196% this year as it has been one of the major beneficiaries of the COVID-induced digital transformation of businesses. As the stock’s price has grown, its valuation has also expanded. At its current price of $158.11, the stock trades at a TTM Price to Sales multiple of 13.0x, which is at the higher end of its historic Price to Sales (P/S) multiple range, as can be seen from the chart below.

To assess the company’s valuation on a relative basis, we compare Bandwidth’s P/S multiple with that of the other major CPaaS players Twilio (TWLO) and Vonage (VG). Bandwidth’s P/S multiple compares favorably to Twilio, which at 29.3x, trades at more than twice of Bandwidth’s multiple, albeit a similar expected revenue growth forecast for the next year. The other CPaaS peer, Vonage, trades at a much lower multiple of 2.7x, and adequately so given its significantly lower growth profile.

* Represents growth based on consensus revenue forecast for 2021

Source: Yahoo Finance, yCharts

We think the current valuation adequately reflects the growth Bandwidth has witnessed over the past few quarters, and believe there is scope for further multiple expansion as the company takes advantage of the aforementioned market opportunities and benefits from an enhanced scale in international markets to grow at above market average rates.

Risks:

Competition: Bandwidth operates in a highly competitive industry and competes against larger CPaaS players such as Twilio and Vonage, and also against the communications behemoth AT&T (T) which launched its CPaaS offering branded AT&T API Marketplace in the first quarter of 2019. Also, many new entrants offer innovative CPaaS products, which further intensifies the competition. The rising competition can cause revenue growth to be lower than expected in the future.

Slower Transition to CPaaS Infrastructure: The pandemic has accelerated enterprise-wide transitions from legacy communication systems to could-based digital communication systems which has resulted in increased adoption of the CPaaS infrastructure. However, the transition might take longer than expected, and this can slow the growth of the company.

Market Correction: The stock markets (particularly for high growth stocks) are near their all-time high levels. Stocks that trade at rich valuations can be the most impacted during a market correction. Bandwidth’s stock has been trading at expanded valuations and could be impacted should a share market correction occur. However, the recent pullback in share price (see chart below), gives us some added comfort for anyone adding a new position. And any further correction will create an opportunity to own Bandwidth’s shares at an even more attractive price.

Bandwidth Share Price

Conclusion:

Bandwidth supports the mission-critical communications needs of business organizations. It has a diverse and impressive set of customers that includes Google, Microsoft, Zoom, Arlo, RingCentral, and many more that have leveraged Bandwidth’s API infrastructure for several years. Being the only CPaaS player to own an all-IP network in the US, and now with an expanded geographical footprint with the acquisition of Voxbone, we believe the company is well-positioned to take advantage of the many secular growth opportunities, going forward. Accordingly, we believe an investment in Bandwidth’s shares, even at the current valuation, could pay off handsomely for shareholders in the near to mid-term, while the longer-term wealth creation potential is immense.