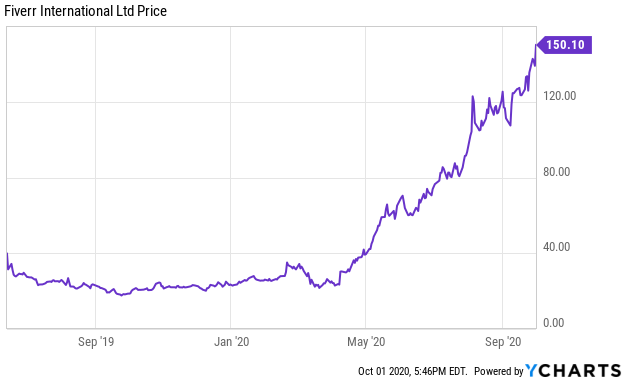

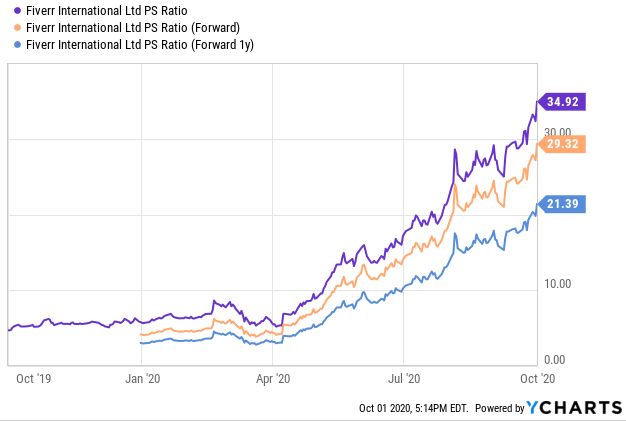

Fiverr (FVRR) is a global marketplace connecting freelancers and businesses for their digital service needs. The business was already growing rapidly, and now growth has been accelerated by the pandemic as high unemployment and alternative working needs have driven people to the platform. The share price has increased rapidly (see chart below), and some investors are nervous, especially considering heightened volatility expectations as we head into the US election season. Rather than purchasing shares outright, the extremely high upfront premium income available in the options market (for selling puts) is compelling because it gives us a chance to own the shares at a significantly lower price, and we get to keep that extremely high upfront income, no matter what.

About the Business:

image source: Fiverr.com

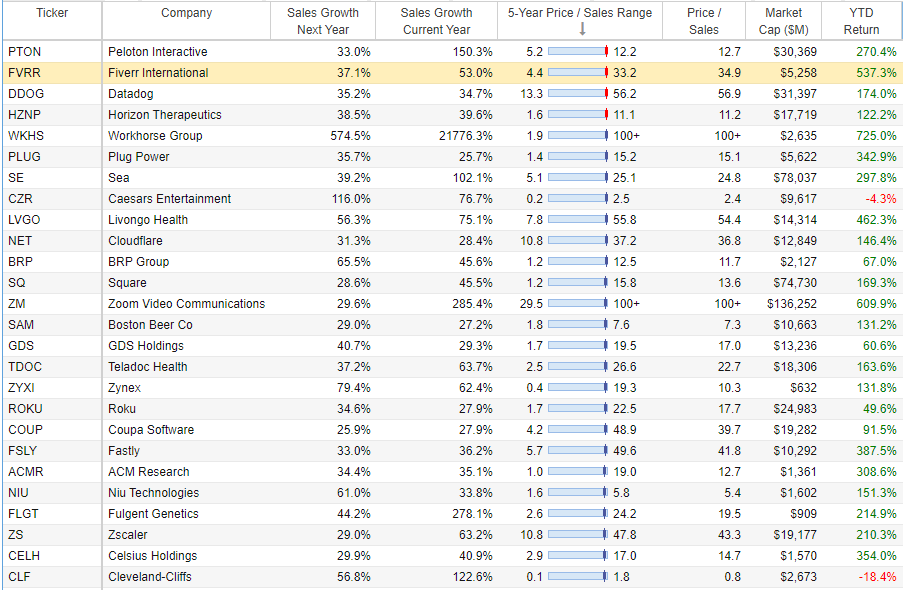

As mentioned, Fiverr connects freelancers and buyers via an online platform. The company offers over 400 categories ranging from digital marketing, to writing and translation, to programming and technology, to name a few. Fiverr is still only a $4.75 billion market cap company, but it has been growing revenues very rapidly. For a little perspective, Fiverr is near the very top of our list of fast revenue growers (in terms of year-to-date returns and price-to-sales ratio).

For a little more perspective on the business, this graphic from the company’s investor presentation shows how the traditional workplace is changing.

And Fiverr’s unique e-commerce approach to freelancing helps solve the challenges of traditional “offline” freelancing, such as finding the right talent to facilitating payments.

source: investor presentation

In particular, Fiverr’s “Service-as-a-Product” model also helps solve these challenges for both freelancers and buyers of their work.

source: investor presentation

A quick glance at Fiverr’s website makes the business and process fairly clear and easy. And the value added to both buyers and freelancer’s is further explained in the graphic below.

source: investor presentation

To be clear, the majority of Fiverr’s revenue comes from its core freelancer-buyer marketplace, but the company is also innovating and expanding through additional products such as learn, And.Co and ClearVoice, as shown in the graphic below.

source: investor presentation

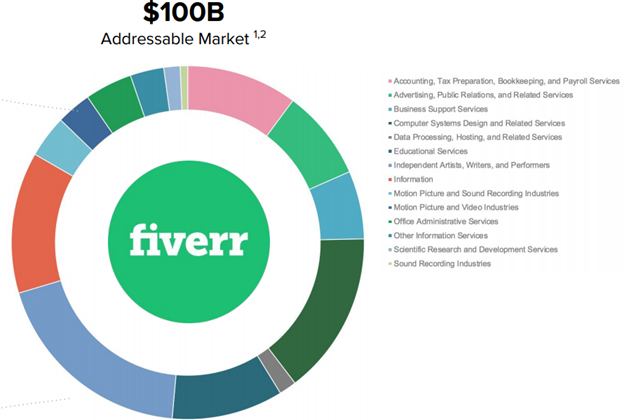

Large Market Opportunity:

One of the things that makes Fiverr’s business particularly attractive is its very large total addressable market (i.e. the business still has a lot of “room to run”). For starters, the majority of freelancing still happens offline, as shown in the graphic below.

source: investor presentation

Next, Fiverr estimates its own total addressable market at $100 billion, as shown in the next graphic (for perspective, Fiverr’s 2019 total revenue was only $107 million).

source: investor presentation

Furthermore, Fiverr has multiple levers for long-term grown, such as bringing new buyers on to the platform, expanding products, expanding categories, and expanding geographies, to name a few.

source: investor presentation

Overall, despite Fiverr’s rapid growth, the business still has a lot more room to run (a good thing for investors).

Valuation:

From a valuation standpoint, Fiverr is attractive. For starters, not only is revenue growing, but it is growing for multiple positive reasons. Specifically, not only does the business continue to attract new buyers at an impressive rate, but relationships with existing buyers continue for multiple years.

source: investor presentation

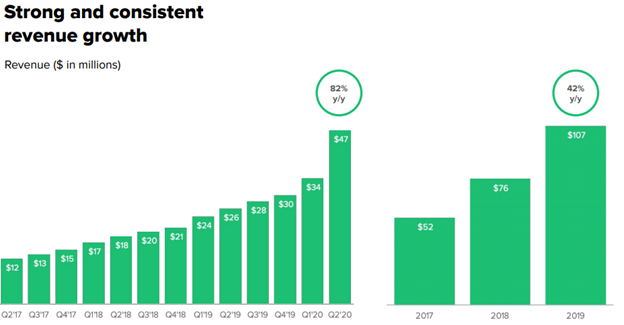

In aggregate, the company’s total revenue grew by 42% year-over-year in 2019 (as shown in the chart below), and that growth rate has been accelerated in 2020 by the COVID-19 pandemic (thanks to a combination of factors, including unemployment, work-from-home, and social distancing).

source: investor presentation

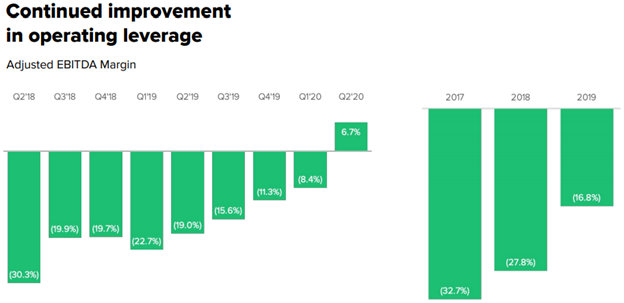

Importantly, we believe the higher revenue brought about by the pandemic is permanent and will continue to grow from here. Fiverr management agrees as they recently raised full-2020 revenue guidance (“revenue is now expected to grow 66-68% for FY20 with expected FY20 Adjusted EBITDA profitability.”)

source: investor presentation

Many investors have been turned off by Fiverr’s lack of profitability, but this is normal (and actually preferred) for a high growth company that is currently focused on building long-term growth instead of maximizing short-term profits.

A closer look at the business shows that gross margins are very high and improving (a good thing). And Research & Development and Sales & Marketing costs continue to decline (as a percent of total revenue) as revenue continues to grow rapidly (i.e. the company increasingly benefits from economies of scale).

source: investor presentation

From a price-to-sales (and an enterprise value to sales) standpoint, Fiverr’s high multiples continue to frighten short-sighted investors.

Recall from our earlier table, Fiverr’s growth rates and valuation metrics are near the top of the list among other top growth stocks.

Furthermore, as you can see (in the FactSet graphic below) the average price target of Wall Street analysts tends to just follow the actual share price around in the short-term. In our view, this is a classic case of short-sighted Wall Street analysts (these analysts chronically undervalue high growth leaders like Fiverr).

source: Factset

In our view, if you extrapolate Fiverr’s high growth rate for just a few years into the future (which we believe is very reasonable considering the opportunity) then the high valuation metrics quickly drop down to more palatable levels. In a nutshell, despite the recent rapid price appreciation, the market is still to short-sighted and undervaluing the business.

Risks

Volatility: For starters, as we head into an election in the United States, volatility is expected to continue to rise, and this can put significant pressure on high-growth companies (such as Fiverr) as they tend to be more sensitive to market ups and downs. However, for a little perspective, we personally prefer a lumpy 20% return versus a smooth 6% every time. Furthermore, this heightened volatility creates opportunity in the options market, as we will discuss later in this report.

COVID-19 Bump: Another risk for Fiverr is simply that stay-at-home work declines (as the pandemic recedes). Some investors may fear that the revenue acceleration from the pandemic is temporary, however we believe it has simply accelerated the growth of the business and established a new base from which to add further growth.

Competition is another risk. Fiverr competitors include companies such as UpWork (UPWK), 99designs, toptal, and outsourcely, to name a few. However, Fiverr and UpWork tend to be the two leaders, and there is plenty of room for both to grow at this time (the total addressable market is huge). In its most recent shareholder letter, Fiverr acknowledged the competition by explaining:

“Our expansive and ever-growing service catalog continues to be our key competitive advantage. During Q2’20, we launched nearly 30 new categories and added depth in certain popular areas including e-commerce management, social media marketing and music and music videos. We now have over 400 categories on our marketplace.”

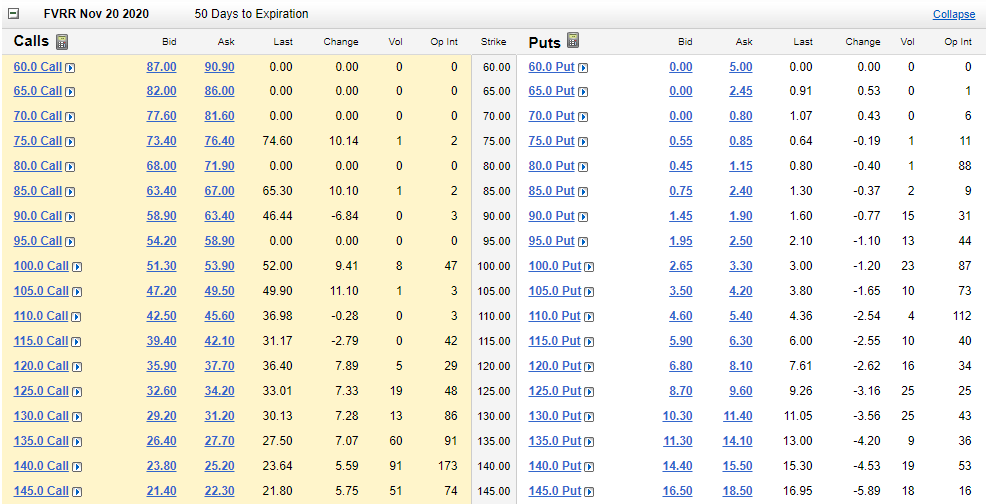

The Trade

For those of you that like the business, but are nervous about the relatively high valuation and heightened volatility as we head into a US presidential election, you might consider selling out-of-the-money, income-generating, put options. This strategy will generate significant upfront income (premium income in the options market increases when volatility increases) and it will give you a chance to own the shares at a lower price. For example, we like the November 20th put options with a strike price of $110, as shown in the table below.

image source: TD Ameritrade

Specifically, these puts are 26.6% out of the money (the share price has to fall at least that much to get put to you), and by selling them, you generate upfront income of $4.60 per options contract (option contracts trade in lots of 100). And considering you need to set aside $11,000 in your account to secure this trade with cash (assuming you’re not using margin), that comes out to an extra 4.2% upfront return on your cash (about 30% if you annualize it), and it gives you a chance to own these shares of this attractive business if they fall below $110 and get put to you before expiration.

The two big volatility risks on this trade are (1) the volatility risk of the upcoming presidential election in the US on November 3rd (a lot of people are fearful), and (2) the volatility risk of the company’s earnings announcement (expected around November 13th). Both of these events occur before this contract expires, and thereby add significant uncertainty to the share price, but it is that uncertainty that makes the upfront premium income so attractive, and at a price of $110 per share, we’d be happy to have a position in Fiverr. And whether or not the shares get put to you, you still get to keep the attractive upfront premium income generated by the trade.

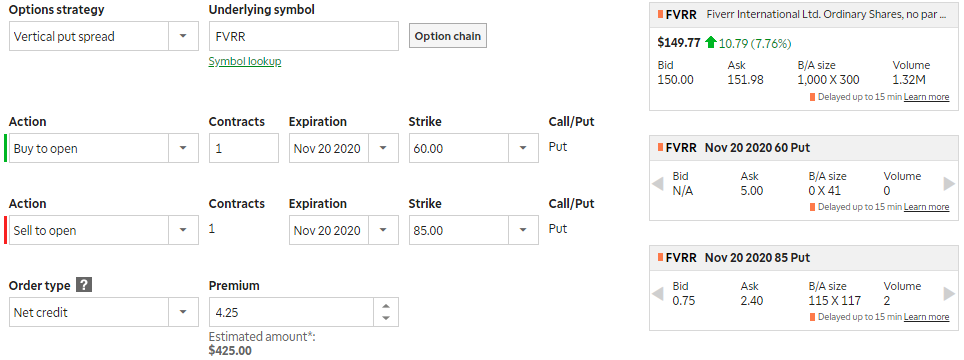

Perhaps worth mentioning, if $11,000 is too rich for your blood, you could try a bullish vertical put spread whereby you only need to set aside $2,500 to secure the trade and you get a little insurance (i.e. you can put the shares at $60 if they fall that far), as shown in the following table (note: in this trade you generate $425 of upfront income by selling a put with an $85 strike and buying a put with a $60 strike).

image source: TD Ameritrade

Conclusion

Fiverr is an attractive business. It is in the right place at the right time (as the nature of work changes), and it is growing its leadership position (with differentiation and a long runway for continued growth).

Some investors are worried about the very strong price performance in recent months (they’re concerned the valuation is too high) and the upcoming volatility (that is expected to be elevated in the weeks and months ahead). One way to play this short-term uncertainty is by selling income-generating put options. The premium income available is very high (because the expected volatility is high), and the trade gives you a chance to own the shares at a significantly lower price.

Of course, we cannot predict short-term market moves (no one can), but because of the high sales growth, large total addressable market, and improving EBITDA margins, we’ve included Fiverr on our recent ranking of top 10 long-term growth stocks (ahead of our report on Microsoft and behind our report on Exact Sciences). More specifically, if you are a long-term investor, and you can handle the volatility, Fiverr shares are worth considering for a spot in your portfolio. The long-term pathway for growth remains highly compelling as the nature of work is evolving in Fiverr’s direction at an accelerated pace.