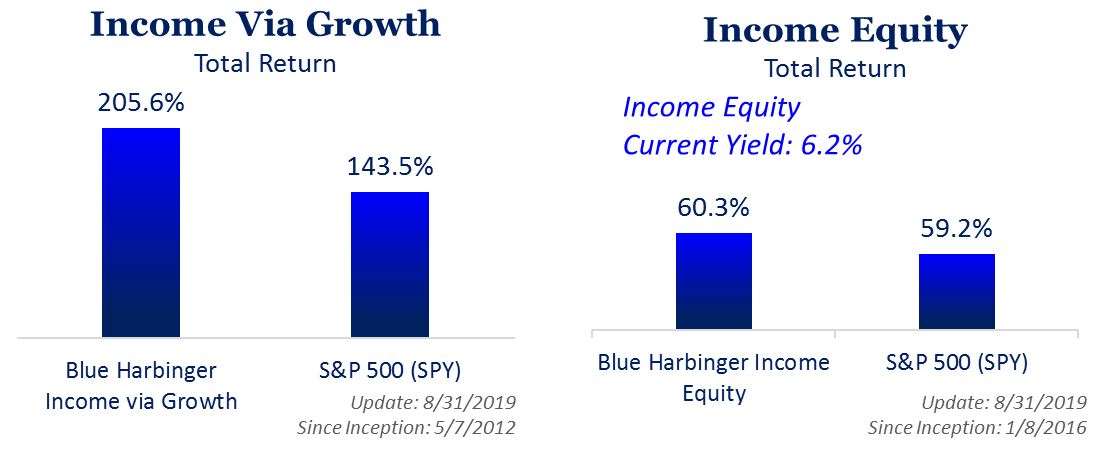

This week’s Weekly doubles as our monthly performance update. We first compare the dueling narratives on interest rates from the Federal Reserve versus the President, and then consider whether your investments were impacted by your decision to believe one story or the other. Next we review the recent performance of our three investment strategies (including every single position). All three strategies continue to deliver market-beating performance and deliver high income for investors. We also share several attractive investment ideas.

Sensationalized Narratives:

Everyone knows the media creates sensationalized stories in attempt to garner views and more advertising dollars. They’re absolutely not looking out for your best interest. In 2018, one of the top narratives was how the Fed was raising interest rates from exceptionally low levels and back up to more normal (higher) levels so they would have some dry powder to cut rates if/when the economy hit a few bumps in the road. That was the conventional wisdom and the popular narrative.

In 2019, the new interest rate narrative, led by the Twitter-In-Chief, has done a complete 180. The narrative has reversed course from the importance of raising rates, to the new course of lowering rates to make the US competitive with other economies around the world who continue to have interest rates near zero. The new narrative says it’s harder for US businesses to compete globally when they have to borrow at interest rates that are significantly higher than other international economies. And in case you’re wondering, lower rates (in many cases negative interest rates) for other international economies were happening in 2018 too, that just wasn’t the narrative focus back then—go figure!

Low Rates Punish Savers:

If you are an income-focused investor, low rates can be painful because your bank accounts, certificates of deposit, and investment-grade bonds all offer very low rates compared to what they have been historically (in the early 1980’s the 10-year Treasury offered a yield of around 15%!). Theoretically, this is the Fed’s way of encouraging investors to take their money out of their bank account (because rates are so low), and to instead invest in things like the stock market which will theoretically help grow the economy (the whole, a rising tide is good for all ships thing).

Have You Let The “Narrative Change” Hurt Your Investment Performance?

The big question is whether you’ve been able to stick to your long-term goal-oriented investment strategy throughout the big narrative change from 2018 to 2019, or have you haphazardly traded your account according to whatever sensationalized story the media punditry was spouting off at the time? Diversified, goal-oriented, long-term investing has proven to be a winning strategy over and over again throughout history, but it’s a lot easier said than done. For example, when the market was plummeting in the fourth quarter of 2018 did you panic, and hit the sell button, and then miss out on the powerful rebound in 2019? Or, did your “fear of missing out” cause you to forget your long-term goals and instead invest in all high growth stocks right before they sold off in August (we’ll review August performance momentarily).

The bottom line here is to stick to your goal-based investment strategy and not make foolish mistakes. For example, trading frequently is expensive due to commissions, fees, bid-ask spreads, and additional implicit and explicit trading costs. Not to mention people often make costly “fat finger” trading mistakes as well as end up sitting in too much cash when the market is rallying. If you are a diversified income-focused long-term investor, we often share attractive investment ideas for you to consider. For example, in the last week we shared the following ideas for readers to consider:

Forget ZIRP: Top 10 Big Yields (BDCs, CEFs and REITs)

MAIN’s 6.8% Yield: Consistent Dividends, Lower Middle-Market Investments

Ares Capital: 8.4% Yield, Stable Income Potential

Of the names above (including the ones on that “Forget ZIRP” list), we currently own several of them, including MAIN, NRZ and RVT. And if you are looking for more investment ideas, Part 2 of this report (for members-only) reviews all of our current holdings (65 names) across all three our strategies, which continue to beat the market and offer high income to investors. We share a few high-income-generating options trade ideas too.

Monthly Performance Review:

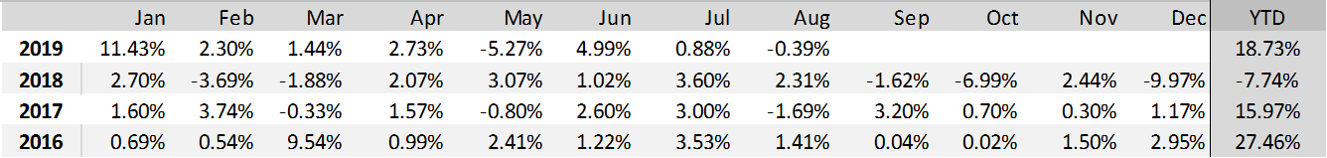

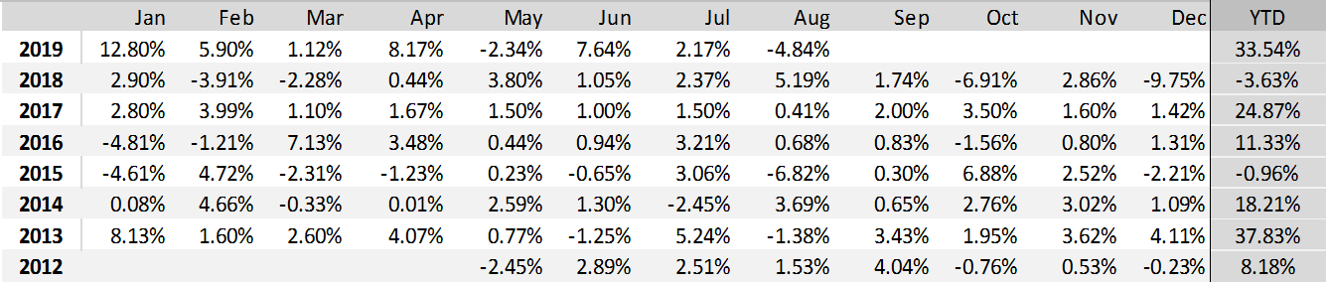

As of the end of August, all three of our investment strategies continue to deliver powerful, market-beating returns and income. Each of the strategies has a different goal. Specifically, the Income Equity strategy (currently yielding 6.2%) is a top ideas portfolio (25 stocks) designed for investors seeking high current income and powerful long-term returns. The Alternative Fixed Income strategy is designed for investors seeking high current income from “non-stock market” investments (it currently yields 7.6%, and has 15 holdings), and the Income Via Growth strategy (25 stocks) is designed to generate powerful long-term income through price gains (and it continue to crush the S&P 500). The following part 2 edition of this report reviews the recent performance of every single position, and shares some important investing takeaways as well as a few specific attractive opportunities.

For starters, here is a look at the recent performance of each strategy, as well as the performance of every single position.

Income Equity Monthly Performance:

Income Via Growth Monthly Performance:

Current Holdings (Members-Only):

If you are a member, here is the link to the full members-only report. If you are not already a member, you can click here to learn more about becoming a member and accessing Part 2 of This Week's Blue Harbinger Weekly.