They say almost everything becomes attractive at the right price. And considering the 21% sell off in 13.4% yield Monroe Capital (MRCC) (due to its company-specific challenges, combined with the overall industry and market sell off), it is increasingly tempting to consider the shares of this diversified business development company (“BDC”). This article provides a background on Monroe, analyzes its portfolio and finally concludes with our opinion on whether investors should consider buying shares given its high dividend yield and low valuation.

Overview:

Monroe Capital Corp. is a closed-end, externally managed business development company ("BDC") incorporated in Feb 2011. It is a diversified investment company which primarily invests in senior, unitranche and junior secured debt, and unsecured subordinated debt as well as equity of lower middle market companies in the US and Canada. As of December 31, 2018, the company’s portfolio was valued around $553.6 million, consisting of 74 different companies with 79.3% senior secured debt, 10.6% unitranche secured debt, 3.8% junior secured debt and 6.3% equity securities. High Tech Industries, Business Services, and Banking, Finance, Insurance & Real Estate industries represent approximately 16.9%, 10.4%, and 10.1% respectively, of the investment portfolio.

What Is A Business Development Company?

Generally speaking, a business development company is a closed end investment company that invests in privately owned, middle market companies, providing them capital to grow or recapitalize.

What Are the Advantages of Investing via a BDC?

High dividend yield as BDCs are required to distribute 90% of their profits to shareholders as per the governing law.

Being a regulated investment company, a BDC is not required to pay corporate income tax on profits.

They offer diversification as the portfolio consists of companies belonging to varied industries.

Experienced Investment management teams.

Fair amount of liquidity and transparency as BDCs are traded on public exchanges, unlike venture capital funds which are privately placed.

As they are traded on stock exchanges, periods of volatility can lead to shares of BDCs trading at attractive discounts to NAVs.

MRCC’s recent trends have been weak

The company’s portfolio has undergone a period of stress since the end of 2016 with multiple investments facing challenges and liquidity concerns. For example, details on several of MRCC’s strained past and current large holdings are provided below:

TPP Operating Inc.

In the quarter ending March 2016, the company placed its investment in TPP Operating, Inc under non-accrual status. TPP operated professional photographic portrait studios across the US. The business was highly seasonal and was mall-based where it was subject to high fixed costs. In September 2016, it entered bankruptcy. Despite best efforts, out of other financial challenges and adverse business conditions, it discontinued its operations in 2018 and MRCC stopped funding it thereon. MRCC’s investment has been written down completely and as such does not represent further source of downward portfolio revaluation.

Rockdale Blackhawk, LLC

On July 24, 2018, Rockdale Blackhawk, the largest portfolio position filed for bankruptcy as part of a restructuring process. The company faced severe liquidity pressures out of non-payment of outstanding account receivables by an insurance company, forcing it to file for bankruptcy. Despite write downs, the position still accounts for 6.6% of net portfolio for the quarter ended June 30, 2019 and as such the portfolio is susceptible to downward portfolio valuations.

Incipio Technologies, Inc

Incipio, accounting for 3.4% of the portfolio, while majority of it still in accrual status, is undergoing a restructuring and has faced financial difficulty. Below is a review on Glassdoor by a former manager of the company.

“As other reviewers have mentioned, company used to be good, until 2017 when the true effect of multiple company acquisition took effect. Now, company is failing without much clue how to survive in the mature industry. The only thing the new CEO could do after he came onboard was to start laying off smart and hard-working employees, leaving less-waged & less-experienced ones. The price of the products is now extremely low due to competition and low-demand of the brand (check on Amazon,) and the future of the company is just bleak. Bank now owns more than 75% of the company, and all they want is to make the company look good until they can sell it at a price point with limited loss.”

Former Manager in Irvine, CA on Glassdoor

American Community Homes, Inc. (ACH)

ACH, accounting for 3.4% of the portfolio, while currently in accrual status, is facing liquidity issues as a result of slowdown in mortgage activity and MRCC’s investment in the company has been written down and is currently valued at 75 cents to a dollar.

“The company was unfortunately slow to make adjustment to its business model to account for the reduction in new mortgages and fees associated with that and so that created some liquidity pressure, which have fund into the business.”

Aaron Peck, CFO & CIO on Q3 2018 call

Education Corporation of America (ECA)

ACH, accounting for around 0.6% of the portfolio, shut its campuses nationwide in December 2018. Aaron Peck on Q2 2019 call said “look, the ECA situation is going to be ongoing for a period of time. That's going to be extended.”

Source: Inside Higher Ed

Portfolio Stress Has Impacted Book Value and Income

As a result of the above portfolio issues, MRCC’s book value has eroded and non-accruals investments have grown over the last several quarters.

Source: Blue Harbinger Research

Company’s outlook on dividend has become less certain

Given portfolio write downs as well as rise in non-accruals, the company’s net income has barely covered dividends in the most recent quarters. As a result of the lack of earnings cushion, management’s commentary on dividends has become less certain on recent calls from not seeing any risks to dividend to indicating that the board may “revisit” dividends in the future. We believe the company may cut dividends in order to maintain a more sustainable dividend coverage longer term. The magnitude of cut will be dependent on resolution of non-accruals and performance of new investments over the next few quarters.

MRC dividend yield moderately higher than the industry

MRCC’s dividend yield has gone up from 10.5% in the first half of 2017 to 13.4% as dividend sustainability has come under scanner and health of the portfolio has deteriorated. Assuming that management cuts dividend by ~20% to regain 120% dividend coverage that existed before portfolio issues surfaced, the resultant dividend yield turns out to be 10.6% as compared sector average of 10%. Given the lack of visibility on resolution of non-accruals with further downside risk associated with key investments, we are cautiously optimistic that the dividend yield at MRCC reflects value for investors to adequately compensates for potential future risks.

Source: Company Reports, Yahoo Finance, Blue Harbinger Research

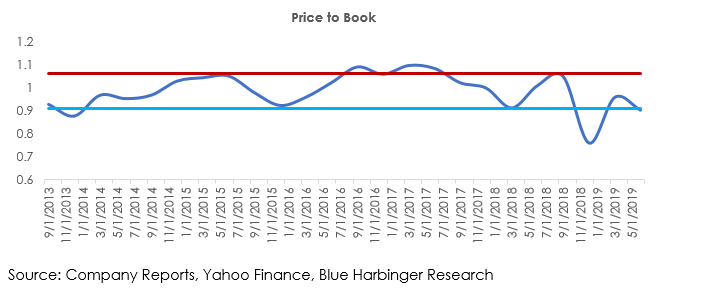

Additionally, the company’s price to book was recently within its historical valuation band (thereby not necessarily adequately reflecting downside risks), but it has fallen outside that band following this week’s market wide sell off (see more on current price-to-book later in this report; it currently sits at ~0.8x).

Valuation Following This Week’s Sell Off:

Per the following graphics, MRCC’s valuation has become increasingly attractive relative to its risks as a result of this week’s market wide sell off. For starters, here is a look at its share price performance (total returns) versus a BDC index and the S&P 500 (SPY), as well as its historical dividend yield.

And here is a look at MRCC’s price-to-book value valuation relative to itself (historically) and industry peers as of the market close on Wednesday.

(source: StockRover)

And also worth considering, here is a look at the historical sensitivity of Monroe (and a BDC index) to credit spreads and interest rates. In particular, it’s worth noting the extent to which credit spreads have recently widened versus historical levels and the potential impact this has on MRCC considering it is essentially a book of higher yielding loans.

Conclusion:

Monroe Capital shares have gotten relatively inexpensive (compared to book value) and the dividend yield has gotten relatively juicy. However, given the challenges for the business (e.g. liquidity constraints at some of the portfolio companies, as described earlier) as well as where we likely are in the business cycle (late), the question becomes “have the shares gotten cheap enough to compensate for the risks?” Thanks to the recent sharp market wide sell off, shares of Monroe Capital have gotten increasingly tempting in our view. Even if the dividend is reduced to a level more in line with the income the portfolio is generating (perhaps a 20% dividend reduction), that’s still a lot of income relative to the share price. We haven’t yet pulled the trigger on this one, but if the market (and MRCC shares) decline much further in the days and weeks ahead, this one is increasingly tempting for a spot in long-term income-focused investment portfolios.

All of our Blue Harbinger portfolios have continued to perform very well in terms of both attractive income and continuing price appreciation, and we believe they are attractively positioned going forward. As our members are aware, we have been taking advantage of recent volatility to deploy capital to highly attractive opportunities.

Note: a pdf version of this article is available here.