The stock market just completed an absolutely fantastic year. The S&P 500 was up 31.49% on a total returns basis. Energy stocks were the weakest sector gaining only 11.81%, while tech stocks put up an astounding 50.29% total return for 2019. Wow! That's an impressive rebound following the terrible Q4-2018, but what now does 2020 have in store?

Full-Year 2019 Performance:

(image source: S&P)

Anybody can make bold predictions about the future of the stock market, and support their views with mountains of statistics and data. But of course, NO ONE knows where the market is going in 2020.

One thing every investor can do is structure their own investment portfolio to meet their own needs and then stick to their disciplined strategy. Long-term, low-cost, goal-focused investing has proven to be a winning strategy over and over again throughout history. And that means if you have the stomach and time horizon to handle some serious volatility then high-beta growth stocks may be right for you.

On the other hand, if you want to enjoy the fruits of your nest egg, you might prefer investments that kick off some serious income to you. Like now... not 10 years from now. The trick of course is finding safe high yields that won't get crushed if/when the stock market sells off. Does anyone miss the +15% yields offered by US treasuries in the early 1980's?

As a general tendency, if something pays a very high yield these days, it's inevitably got at least some warts on it. But again, the one thing you can do is build a prudently diversified portfolio to reduce risks and meet your personal goals. Another thing you can do, if you are concerned the market might sell-off, is to invest in "low-beta" stocks.

According to Wikipedia, "the beta (β or beta coefficient) of an investment is a measure of the risk arising from exposure to general market movements as opposed to idiosyncratic [or stock/bond specific] factors." Basically, if something has a high beta, there is a good chance it will sell-off hard when the market sells-off hard. And if it has a low beta, then it'll likely be less impacted by any dramatic stock market moves. For reference, the stock market's beta (such as the S&P 500) is 1.0. Anything above 1.0 (such as aggressive zero-dividend growth stocks) has more market risk. And anything below 1.0 is generally considered to have less market risk.

The 10 attractive investment ideas we are about to share have varying degrees of risks-versus-reward for you to consider. But the two things they have in common is they all offer yields in excess of 8% (several of them paid monthly), and they all have very low "beta risk." Said succinctly, they're high income investments with low market risk. Without further ado, here is the list.

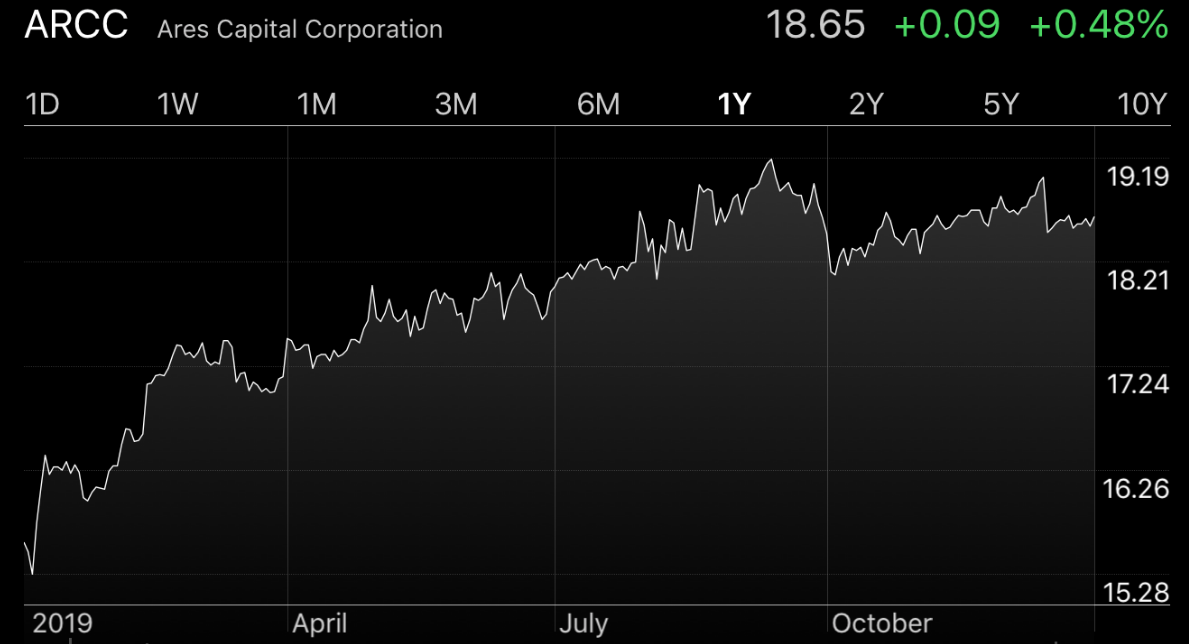

10. Ares Capital (ARCC), Beta: 0.46, Yield: 8.6%

Ares Capital Corporation, part of the $142 billion Ares Management, L.P. is the largest BDC in the US by assets. The company holds a well-diversified, low risk portfolio of assets and has provided sustained income to investors since its IPO in 2004.

You can access our report on Ares Capital here:

9. Oxford Square (OXSQ), Beta: 0.39, Yield: 14.8%

This business development company (BDC) invests in syndicated bank loans and both equity and debt tranches of collateralized loan obligations (CLO); and the shares have been dragged sharply lower because of its exposure to underperforming market segments including healthcare, software and high yield credit in general.

We view OXSQ as very attractive on a risk-reward basis, but recognize there are signficant uncertainties, and that’s why we ranked it only #9. You can access our report on Oxford Square here:

8. Ashford Hospitality (AHT.PF), Beta 0.20, Yield: 8.5%

Ashford Hospitality Trust (AHT) is a real estate investment trust (REIT) that invests opportunistically in upper scale full-service hotels. The company’s common stock took a hit in mid-2019 when management proactively reduced the dividend. However, this action was positive for the 9.1% yielding cumulative preferred shares, and so too is the company’s debt reduction and investment strategy.

The following report reviews the business, the share price appreciation potential, the dividend safety, the risks, and concludes with our opinion on investing.

7. Saratoga Investments (SAR), Beta: 0.40, Yield: 8.7%

Saratoga Investment Corp (SAR) is a diversified, business development company and a CLO manager that has experienced strong portfolio and dividend growth over the last several years.

You can access our full report on Saratoga here:

6. Tsakos Energy (TNP.PE), Beta: 0.17, Yield: 9.9%

We’re going with a lessor known preferred stock with a huge dividend yield and a discounted price for our number 6 pick.

Tsakos operates a fleet of 68 marine transportation vessels for crude oil, LNG and other petroleum products, and serves oil companies worldwide on long, medium and short term charters. The dividend on these Tsakos preferred shares is cumulative, and preferred stock is higher than common stock in the capital structure. We also think the shares haven’t risen enough following the sharp rise in shipping rates in early October and a recent charter extension for one of its LNG carriers. You can read our full write-up on Tsakos here:

The Top 5

The Top 5 Safe 8% Yields (low beta-risk edition) are reserved for members only. We currently own 4 of the top 5, and believe they are all particularly attractive opportunities for income-focused investors, considering the big dividends, compelling prices and low market risk.