The stock market just completed an amazing year, up over 31% in 2019. However, if you are an income-focused investor, you may have an eerie feeling in the back of your mind that we’re due for a big correction. Of course, no one can predict what will happen to the stock market tomorrow—let alone for all of 2020. But what we can do is assess an investment’s tendency to rise and fall with the market through its beta risk (defined as the measure of risk arising from exposure to general market movements as opposed to idiosyncratic (or stock-specific) factors). And to some extent, low-beta investments have a tendency to not be pulled as much lower when the market sells-off. This report ranks our Top 10 Safe (low-beta risk) Investments that offer yields of at least 8%.

Note: Before we get into the countdown, and for a little perspective, the beta of the overall stock market (such as the the S&P 500, for example) is 1.0 and the current yield on the S&P 500 is 1.9%.

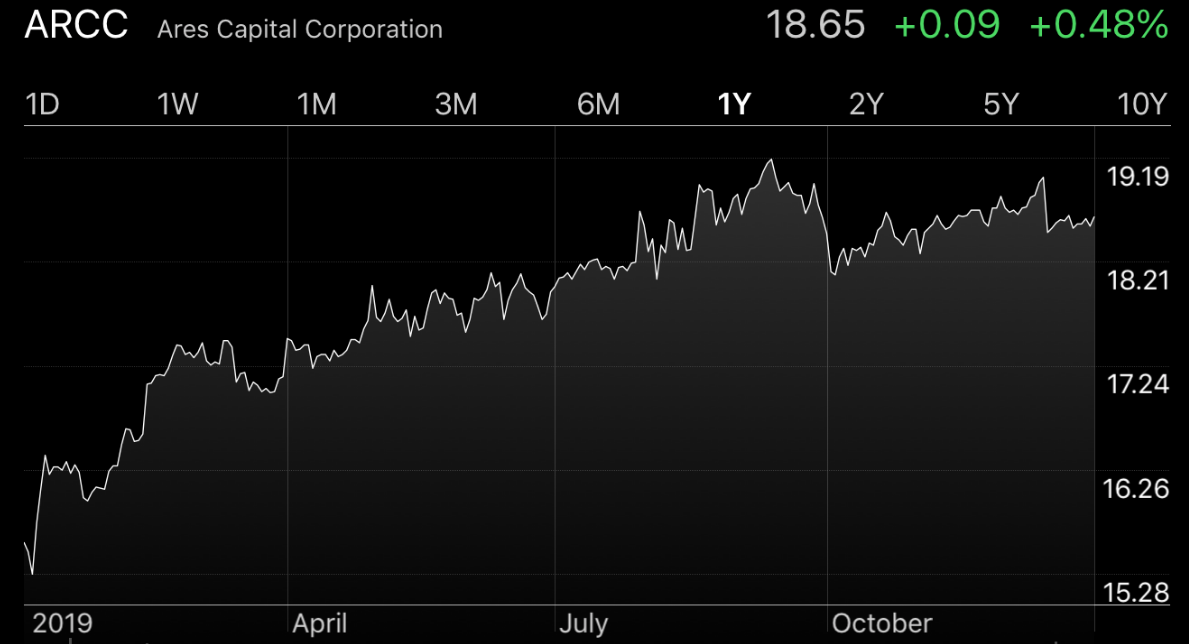

10. Ares Capital (ARCC), Beta: 0.46, Yield: 8.6%

Ares Capital Corporation, part of the $142 billion Ares Management, L.P. is the largest BDC in the US by assets. The company holds a well-diversified, low risk portfolio of assets and has provided sustained income to investors since its IPO in 2004.

You can access our report on Ares Capital here.

9. Oxford Square (OXSQ), Beta: 0.39, Yield: 14.8%

This business development company (BDC) invests in syndicated bank loans and both equity and debt tranches of collateralized loan obligations (CLO); and the shares have been dragged sharply lower because of its exposure to underperforming market segments including healthcare, software and high yield credit in general.

We view OXSQ as very attractive on a risk-reward basis, but recognize there are signficant uncertainties, and that’s why we ranked it only #9. You can access our report on Oxford Square here.

8. Ashford Hospitality (AHT.PF), Beta 0.20, Yield: 9.1%

Ashford Hospitality Trust (AHT) is a real estate investment trust (REIT) that invests opportunistically in upper scale full-service hotels. The company’s common stock took a hit in mid-2019 when management proactively reduced the dividend. However, this action was positive for the 9.1% yielding cumulative preferred shares, and so too is the company’s debt reduction and investment strategy.

The following report reviews the business, the share price appreciation potential, the dividend safety, the risks, and concludes with our opinion on investing.

7. Saratoga Investments (SAR), Beta: 0.40, Yield: 8.7%

Saratoga Investment Corp (SAR) is a diversified, business development company and a CLO manager that has experienced strong portfolio and dividend growth over the last several years.

You can access our full report on Saratoga here.

6. Tsakos Energy (TNP.PE), Beta: 0.17, Yield: 9.9%

We’re going with a lessor known preferred stock with a huge dividend yield and a discounted price for our number 6 pick.

Tsakos operates a fleet of 68 marine transportation vessels for crude oil, LNG and other petroleum products, and serves oil companies worldwide on long, medium and short term charters. The dividend on these Tsakos preferred shares is cumulative, and preferred stock is higher than common stock in the capital structure. We also think the shares haven’t risen enough following the sharp rise in shipping rates in early October and a recent charter extension for one of its LNG carriers. You can read our full write-up on Tsakos here:

5. PIMCO CEF (PCI), Beta: 0.37, Yield: 8.3%

Dynamic Credit and Mortgage Income Fund (PCI): If you are an income-hungry investor, PIMCO offers a variety of low-beta, fixed-income Closed-End Funds (“CEFs”) that are worth considering, such as PCI

In the following report, we analyze three of them, multi-sector funds (PFL) (PHK) and (PCI), considering sector allocations, pricing, distribution prospects, leverage, and finally conclude with our opinion on why PCI is the most attractive.

4. Teekay Offshore (TOO.PB), Beta: 0.23 Yield: 9.4%

The price of these preferred shares rebounded extremely hard in late September following some additional clarity from institutional investor Brookfield Business Partners (BPU). Basically Teekay agreed to be acquired by Brookfield, and this dramatically improved Teekay’s financial wherewithal. However the shares still trade at an attractively discounted price and offer a huge yield (and we continue to own them).

We owned these shares and benefited from the big rebound earlier this year, and you can view our fearless report from immediately before the big rebound here:

3. Geo Group Bonds, Non-Stock Market, Yield: 8.3%

This is our only individual bond on the list, and it is attractive. The Geo Group is a Real Estate Investment Trust (“REIT”) specializing in the ownership, lease, and management of correctional, detention, and reentry facilities. And bond the stock and bonds have come under pressure thanks to a political outcry against the concept of “for-profit-prisons.”

2. NuStar Energy (NS.PC), Beta:0.24, Yield: 9.1%

These preferred stock shares (NS.PC) are attractive. Nustar is one the largest independent terminal and pipeline operators in the US, owning ~9,850 miles of pipeline and has a storage capacity of 61.5 million barrels.

The business is growing at an attractive pace, it has laid the foundation for expansion, all the while working to reduce leverage. You can read our full report on Nustar here:

1. BlackRock CEF (BIT), Beta: 0.21, Yield: 9.1%

The BlackRock Multi-Sector Income Trust (BIT) offers a big monthly dividend payment by investing in an actively managed portfolio of fixed income securities (bonds). Not only does this fund pay monthly, but it’s never reduced its monthly payments in its 6-year history, and it actually just raised them.

You can access our full report on BIT here.