Ashford Hospitality Trust (AHT) is a real estate investment trust (REIT) that invests opportunistically in upper scale full-service hotels. The company’s common stock took a hit in mid-2019 when management proactively reduced the dividend. However, this action was positive for the 8.5% yielding cumulative preferred shares, and so too is the company’s debt reduction and investment strategy. This report reviews the business, the share price appreciation potential, the dividend safety, the risks, and concludes with our ranking of Ashford relative to our list of Top 10 Safe Big Dividends.

(image source: company website)

About Ashford:

As mentioned, Ashford is a REIT focused on opportunistic upper scale hotels. As you can see in the following graphic, Ashford has 118 hotels diversified by brands and types.

(image source: Investor Presentation)

The portfolio is also diversified geographically across the United States.

And the cap rates of the hotels are attractive, generally in the cap rate range of 6.5% to 8.5%.

Why the Share Price declined:

As you can see in the following chart, Ashford’s common shares took a sharp fall in mid-2019 when the company proactively reduced the dividend.

According to management, the reason for the cut was as follows:

"For some time, our dividend has significantly exceeded what we would have needed to distribute from a taxable income standpoint. This adjustment effectively preserves capital for more advantageous purposes including strengthening our balance sheet and enhancing our ability to pursue more opportunistic growth”

And this explanation is consistent with Ashford’s stated core objective “to maximize long-term total shareholder returns.” This is an important distinction because the goal is not to maximize the common share dividend, it is to maximize shareholder value, and this bodes extremely well for the preferred shares. Specifically, it preserves more cash to grow the business and to support the preferred shares which are higher in the capital structure and cumulative (cumulative in the sense that even if management were to reduce of eliminate the preferred stock dividend, they still have to make it up and pay it later). Here is additional important language about the preferred shares from Quantumonline:

“Ashford Hospitality Trust, Inc., 7.375% Series F Cumulative Preferred Stock, liquidation preference $25 per share, redeemable at the issuer's option on or after 7/15/2021 at $25 per share plus accrued and unpaid dividends, and with no stated maturity.”

There is more information (basically a summary) of the preferred shares at the Quantumonline link provided above.

Important to note, we believe the decision to cut the common dividend was actually a good thing for the safety of the preferred shares (because it frees up more cash). And there are more attractive things about the business that bode well for the preferred shares, such as management’s continued successes in reducing the company’s overall debt and strengthening the balance sheet.

Strengthening Balance Sheet:

Below is a high-level summary of the actions Ashford has been taking to strengthen its balance sheet, and we consider these actions attractive, particularly for the preferred shares:

(source: Ashford Investor Presentation)

In particular, Ashford has been refinancing its properties on attractive terms. For example, the company has now refinanced its debt so the majority of maturities are not due for years into the future (and at lower rates) so the company has more room to implement its strategy.

For added perspective, Ashford has maintained a disciplined level of leverage in its history, as shown in the following chart.

Implementing the Strategy:

As an opportunistic investor, AshforD is active in managing (and working to improve) its investment portfolio. For example, here is a look at the company’s capital recycling program in recent years, which has helped the business increase its cap rates, lower its financing costs, and improve the business for investors.

As a specific example, Ashford successfully implemented its Renaissance Nashville strategy to the benefit of shareholders.

Valuation, Working Capital and Dividend Safety

From a valuation standpoint, Ashford common shares trade at a price to book value of below 1.0 (currently ~0.92x), and the series F preferred shares trade at $21.65 (a 13.3% discount to the $25 issuer redemption price). And according to data from FactSet, the average price target for the common shares by the six analysts covering the stock is $3.56, thereby suggesting 28.5% upside for the common shares (which also bodes well for the business and the preferred shares).

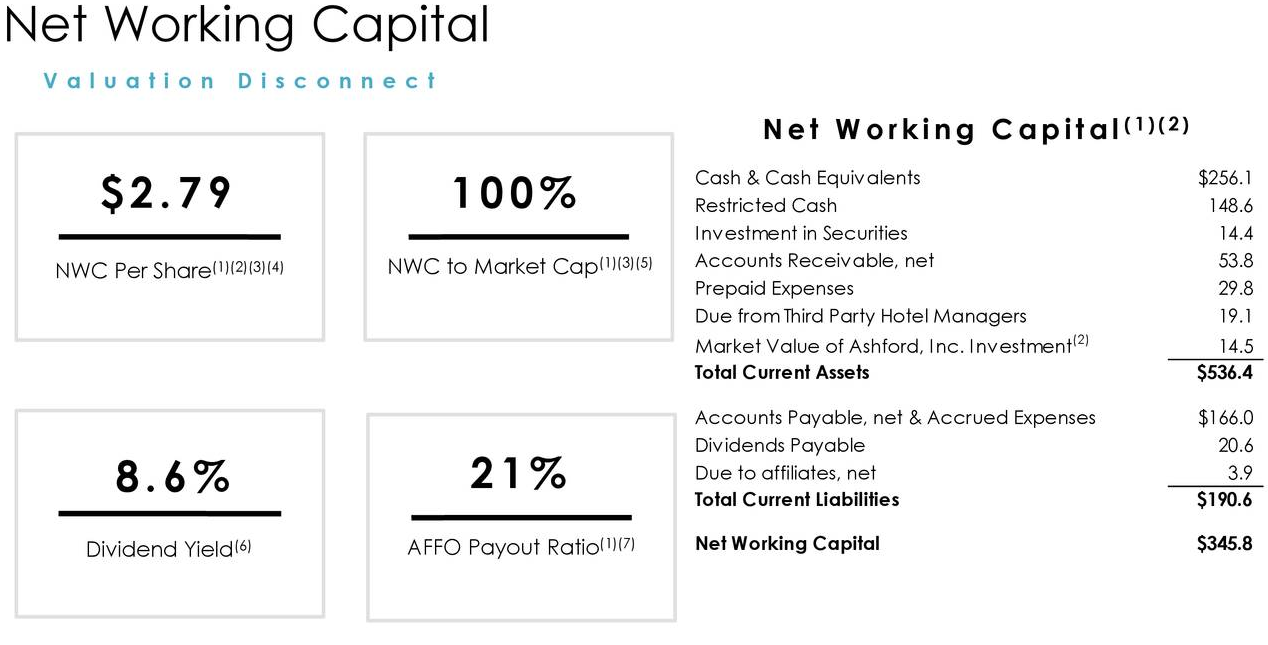

Also worth mentioning, the company has a significant amount of working capital right now which reduces risks and opens up increasing investment opportunities (it also makes Ashford a potential buyout target, considering the large cash and low share price—and this would be a good thing for both the common and preferred shares).

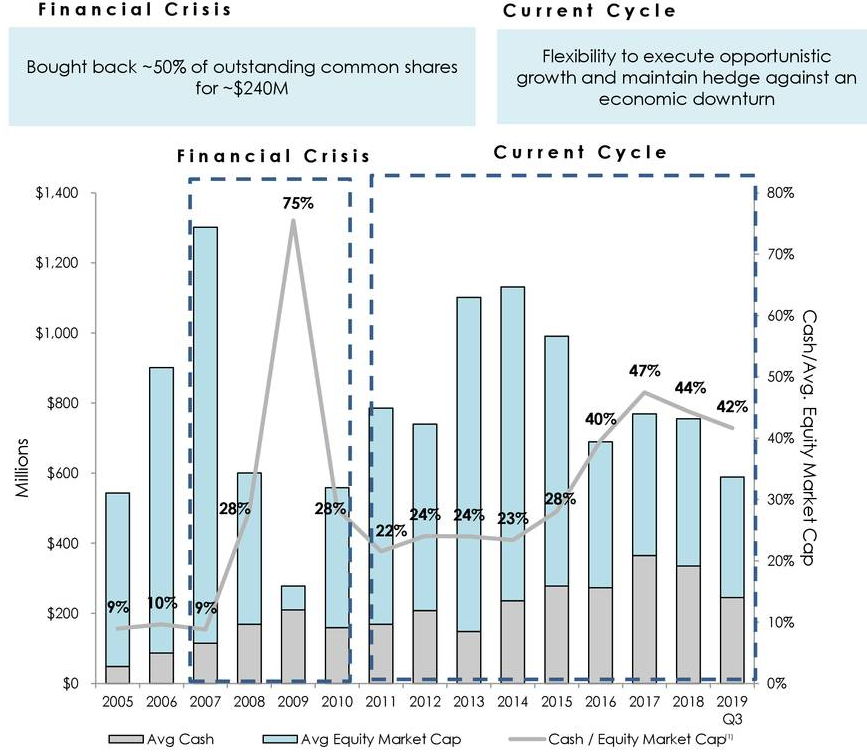

And for more perspective, the company currently has an attractively large amount of cash relative to its market value (another reason why the valuation is attractive, and the business is a potential buyout target).

considering the large amount of cash and working capital, we view the preferred share dividend as particularly safe. Especially considering it is cumulative, and considering the recent common share dividend cut actually makes the preferred dividend even safer (because it frees up more cash flow to cover the preferreds and growth the business).

Enhanced Return Funding Program (“ERFP”)

We also believe the company’s ERFP program adds to the safety and attractiveness of the business. According to Ashford’s annual report:

“The highlights of this program are clear, simple and impactful. Ashford Inc. committed to provide up to $50 million to Ashford Trust on a programmatic basis, equating to approximately 10% of each new investment’s acquisition price. We believe the ERFP program has the potential to significantly improve investment returns on hotel acquisitions. We expect the program to be another key step to enhance our long-term total shareholder return performance relative to our peers.”

More details on this program are available in the annual report linked above, but we essentially view it as a net strong positive for the business considering management’s expertise and the alignment of interests.

High Inside Ownership:

Worth mentioning, there is a high level of inside ownership at Ashford, which we view as another positive considering it helps align management and investor interests (a good thing). In particular, according to the annual report:

“Our Board, management team, and affiliates are aligned with this goal given our high insider ownership of 17%, which exceeds the peer average by approximately five times. This alignment motivates our performance and continues to be one of our many key differentiators.

Risks:

If you are going to invest in Ashford, there are a variety of risk factors you should be aware of. For example, the hotel industry is sensitive to the economic cycle, and in an economic downturn hotel REITs can get hit harder than other types of REITs. For example, according to y-charts, Ashford common shares have a 3-year beta of 0.93 which is higher than many other REITs (but still lower than the overall market, which has a beta of 1.0). Also, the price of the preferred shares are less volatile because as long as the dividend remains relatively safe (which we believe it is) the price will not stray too far from the $25 issuer redemption price, all else equal.

The debt level is another concern for Ashford. However, given the high level of working capital, cash, and the ERFP program, we are comfortable with the debt level (especially after the proactive dividend cut, and the significant debt restructuring the company has recently completed on favorable terms). Ashford’s “opportunistic” strategy makes the business (and the debt) a little riskier than other “less opportunistic” strategies, but we are very comfortable with the risks versus the rewards in this case.

Conflicts of interest are another risk factor. Ashford is essentially externally managed, and the terms were not negotiated at arms-length terms. According to the company’s annual report:

“Because we depend upon our advisor and its affiliates to conduct our operations, any adverse changes in the financial condition of our advisor or its affiliates or our relationship with them could hinder our operating performance.”

Further, the company explains:

“Our agreements with our external advisor, as well as our mutual exclusivity agreement and management agreements with Remington Lodging and Premier Project Management LLC, a subsidiary of Ashford Inc. (“Premier”), were not negotiated on an arm’s-length basis, and we may pursue less vigorous enforcement of their terms because of conflicts of interest with certain of our executive officers and directors and key employees of our advisor.”

Nonetheless, in aggregate, we view Ashford’s relationship with its external management as a net positive, given the expertise and considering the ERFP program, and we also believe there are a variety of attractive reasons to own (as stated above and described in the chart below).

Conclusion:

If you are looking for an attractive big yield, trading at a discounted price, Ashford series-F preferred shares are interesting. In addition to the attractive yield and price, and because of management's opportunistic strategy and healthy balance sheet, we've ranked the shares No. 8 on our list of Top 10 Safe 8% yields (ahead of our write-up on Oxford Square's 14.8% yield at No. 9, and behind our write-up on the 9.9% yield of Tsakos Energy Navigation at No 6. If you are an income-focused investor searching for a high-yielder that may be less impacted by a market sell-off, the 8.5% dividend yield on Ashford Hospitality's series F preferred stock is worth considering for a spot in your prudently-diversified portfolio.