Ventas (VTR) is a big-dividend healthcare REIT, and the shares are down 27% in the last 2 months. Near-term headwinds seem to have caused the price to detach from the long-term value, but is there still more pain to come? We don’t think so, and we’ve ranked it #8 on list of Top 10 Big-Dividend REITs. In this report, we analyze the company’s income profile, current portfolio trends, market dynamics, dividend prospects and finally conclude with our opinion on investing.

Note: this article was originally released to members on December 14th.

Overview:

Ventas is a real estate investment trust catering primarily to the healthcare industry. It owns 1194 properties across U.S. (1112), Canada (70) and United Kingdom (12). The company operates through three business segments: triple net (NNN), senior housing operations (SHOP), and office.

Triple net (NNN): In this segment, Ventas invests in senior housing and healthcare properties and leases them to healthcare operating companies on a net lease basis. This is a highly stable business as the company’s cash flows are based on a largely fixed base fees as the operator bears the expenditure of running the property and gets majority of the profits.

Senior housing operations (SHOP): In this segment, Ventas invests in senior housing communities and outsources just operations and management to other specialized operators such as Atria, Sunrise, and ESL while still being responsible for the P/L. In this segment, the company bears risk from changes in rental, occupancy and operating expenses directly.

Office: In this segment, Ventas invests in office properties and leases them to Medical Office Buildings, healthcare research & innovation centers. As with SHOP, changes in rentals and occupancy flow through directly to the bottom line.

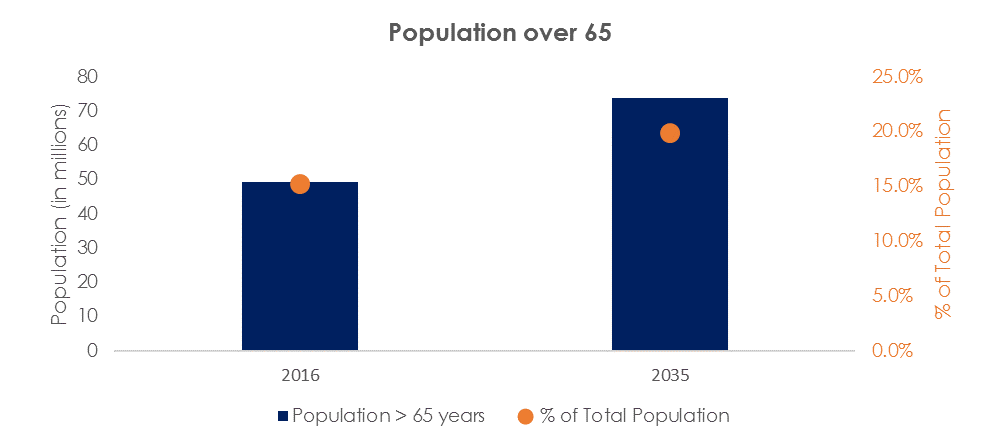

Solid demographic tailwinds over the next couple decades

Senior living facilities benefit from structural growth driven by aging of population in the US as well as Canada and Europe. As evident in the chart below, the number of people above the age of 65 in the US will likely grow from 49.2 million in 2016 to 73.6 million in 2035. That translates into a CAGR of 2.1% as compared to overall population CAGR of just 0.7% during the same period. Despite the high levels of supply growth over the last few years, occupancy in the space has remained between 85-90% which is a testament to the underlying demand drivers.

Source: Census Bureau

Bullish long-term outlook led to near term demand/supply mismatch over the last few years

Source: CBRE

As a result of the attractiveness of the space, construction growth over the last few years got ahead of demand which has led to pressure on rentals and occupancy levels in the industry as evident in the chart on the right. This decline is an industry wide phenomenon and not specific to Ventas alone. In Q3 2019, Ventas reported a decline in same-store occupancy rates from 86.4% to 85.6% on a YoY basis in SHOP segment. Increased supply has impacted the SHOP segment’s occupancy levels for the last several quarters. The decline has been more pronounced in the secondary markets as compared to the company’s primary market, especially in the second half of this year.

Source: Ventas

However, not all is gloomy out there - The other two segments provide stability as SHOP undergoes weakness

While the company primarily operates in the senior living space, the company’s cash flows are of a more diversified nature. The Triple-Net (NNN) segment has a base rent with annual escalators linked to CPI which partially insulates the segment’s cash flows from cyclical changes. The segment’s same store cash NOI was up 2.3% YTD as compared to a 3.5% decline in SHOP.

Additionally, the office segment is showing strong performance. The segment reported a 10.8% increase in rental income in Q3 2019 and a 11.4% increase in NOI on a YoY basis. This increase was primarily because of new acquisitions and the commencement of operations in properties that were under development. Same-store rental income also grew by 2.7% in Q3 2019 on a YoY basis because of an increase in occupancy levels from 91% to 92%. The average rent per occupied square feet increased from $33 to $35 YoY in Q3. The office segment is further sub-divided into 2 parts: MOBs and research buildings. Although MOB is showing growth, the research segment has been an outperformer. In Q3 2019, rental revenue increased by 30.3% on a YoY basis in the research segment. This increase was a result of the addition of 3 new properties consisting of approx. 0.4 million square feet as well as 11.5% increase in average revenue per occupied square feet. On a same-store basis, revenue increased by 11% on a YoY basis in Q3 2019.

Demand/supply mismatch in senior housing starting to correct

While supply growth has been elevated since 2015, the gap between supply and demand is starting to shrink. As evident in the charts below, it is clear that construction starts of senior housing facilities over the last few quarters has come down while demand has scaled up and that is leading to progress in the goal of reaching market equilibrium.

Source: CBRE

Recent Canadian acquisition diversifies geographical exposure

In September 2019, Ventas acquired 31 senior housing facilities in Canada which are being managed by Le Groupe Maurice (LGM). The acquisition will add roughly 9% to the company’s 2018 normalized FFO and is expected to be accretive to FFO per share by $0.03 in 2020. The acquired portfolio’s NOI is expected to grow at a CAGR of 4% in the foreseeable future.

Attractive dividend yield above the industry average

Ventas has increased its dividend every year for the last 10 years. It is currently trading at a 5.8% dividend yield which is more than the median of its peers and considerably more than the NAREIT index. Given the favorable long-term dynamics in the senior housing space, we believe the company’s current yield is attractive.

Source: Yahoo Finance, Seeking Alpha

Risks:

Near term results could be weaker than expected

The company reported a worsening of trends in the senior housing operations segment in September and the near-term deterioration could cause the company to provide a 2020 outlook that is below market expectations, which will have an impact on the stock’s valuation. We believe investors could use such an opportunity to add to their positions as the longer-term outlook of the company is positive.

Interest rate impacts

REITs, such as Ventas, rely heavily on the capital markets to fund growth, and uncertainty around US interest rates has absolutely had an impact on the shares, both operationally and psychologically from the standpoint of investors. REITS had been performing extremely well in 2019 until recent weeks and months as the US fed has adjusted its interest rate messaging to the market (higher rates mean its more expensive for Ventas to fund growth). However, the strong long-term demographics combined with the doubly lower share price (the shares have been negatively impacted as REITs in general have sold-off and as Ventas faces its own near-term company-specific challenges) make for an increasingly compelling entry point for this compelling long-term big-dividend business.

Conclusion

The company’s stock has come under pressure in recent months as a supply/demand mismatch has caused occupancy and NOI to fall in the company’s senior housing operations (SHOP) segment. The near-term issues have taken precedence over long-term secular growth drivers in the space in the minds of investors. While admittedly the near-term outlook in the senior housing space is cloudy and visibility is low, it is important to note that roughly 70% of the portfolio is stable and reporting growth while temporary cyclical factors play themselves out.

Source: Seeking Alpha, Blue Harbinger Research

Finally, the company is trading at an attractive dividend yield of 5.8% and the valuation as measured by price to FFO on the stock is near the lows of the peer group, indicating a potentially very attractive risk-reward at these levels. We’ve ranked Ventas #8 on our list of Top 10 Big-Dividend REITs.