If the US were to experience another “Great Recession,” New Residential could get hit significantly harder than others. However, we’re not expecting another Great Recession anytime soon, and as such we expect NRZ to keep paying huge dividends for the foreseeable future. In fact, we’ve ranked it #6 on our list of Top 10 Big-Dividend REITs. Nonetheless, a look under NRZ’s hood shows an increasingly diverse portfolio of highly levered opportunistic mortgage-related assets with significant “tail risks” that investors should be aware of and monitoring.

What does NRZ do?

If you don’t understand NRZ’s business, here is a look at the company’s investment portfolio of mortgage-related assets, and a glance at the “Targeted Lifetime Net Yield” for each asset class (see graphic, below) should immediately help you see how NRZ supports its big 12.3% dividend yield (i.e. NRZ earns high returns on its investments).

But to understand, to achieve these big yields, NRZ uses very large amounts of leverage (i.e. borrowed money). For perspective, the company’s book value (according to slide 26 of its latest investor presentation) was $6.8 billion at the end of the third quarter, but its total assets were $41.3 billion. That is a lot of liabilities on NRZ’s balance sheet, and that ratio is up significantly from just the previous quarter).

However, for a little more perspective, NRZ’s book value, relative to its market value, remains relatively attractive, hovering close to (and at times just below) its market price.

But also understand that discount exists because the market is acknowledging some of the risks associated with the investment portfolio (i.e. the price to book value would be much higher if the risks were lower).

For a little historical perspective on the risk associated with NRZ’s investment portfolio, understand the business came to exist following the Great Recession when big banks were forced to get rid of their riskiest investment assets. And as big banks (and the market in general) were puking risky assets, NRZ was brilliantly there buying in buckets (brilliant because NRZ earned huge returns).

How is NRZ’s business changing?

And as NRZ came into existence as an opportunistic investor, it has continued to expand its investment portfolio opportunistically over time. For example, here is a look at what NRZ’s investment portfolio looked like in 2013 versus today (you can see the many new opportunities in which NRZ has expanded its business).

To explain the above graphic, and according to CEO Michael Nierenberg during the most recent quarterly call:

“If you go to the right side of the page today, not only do we have the same asset classes, but we’ve added a number of things notably our mortgage origination capability, our mortgage servicer, ancillary mortgage services, again, consistent with our theme of capturing the whole pie. As we go forward, we’ll continue to be opportunistic and try to figure out ways to grow earnings in different areas.”

For a little color, NRZ was making money hand over first in its Mortgage Servicing and Excess Mortgage Servicing Rights (MSRs and Excess MSRs) in the years following the Great Recession as it worked diligently to expand its approval to profit from these attractively priced assets on a state by state basis. And as growth in that lucrative assets class slowed, NRZ expanded into other asset classes, as you can see in the graphic above, and as consistent with NRZ’s “opportunistic” investment approach (see graphic below).

How does NRZ make money?

In a nutshell, NRZ makes money by borrowing at a low rate, and then investing at a higher rate. The spread that NRZ earns (the difference between the rate they borrow at and the rate of return they earn) is derived from the higher risk (and differing timeframes) of the higher return assets, and then that spread is magnified by the high leverage NRZ employs. Big banks would love to do what NRZ does, but they are limited by regulatory risk mandates (the whole “too big to fail” thing).

How do interest rates impact NRZ

Before the US Fed reversed course on interest rates over the last year (i.e. they went from suggesting rates were obviously going higher, to actually cutting rates), NRZ was bragging about how traditional bonds were going to get slaughtered in a rising interest rate environment (as rates rise, bond values fall), but NRZ‘s assets would actually increase in value because higher interest rates would lead to lower mortgage prepayments speeds thereby extending the period by which they collect those high returns on MRSs and extended MSRs (as shown in our earlier chart).

As a result of the interest rate posture change by the fed, NRZ’s share price hit some bumps in the road throughout 2019 (see chart below). However, the Fed is now conveying more stability in rates going forward (they said interest rate changes were on hold for now), and therefore NRZ’s future is looking a little brighter. For example, here is a chart of NRZ’s historical share price versus aggregate Wall Street analyst estimates (according to FactSet), and things are looking considerably better (i.e. the share price is up, and analyst believe it can go much higher).

However, it is important to remember interest rates do impact NRZ’s business thereby adding risk. For a little more perspective, here is a quote from NRZ’s most recent annual report explaining how a small move in interest rates would impact the business:

“As of December 31, 2018, an immediate 50 basis point increase in short term interest rates, based on a shift in the yield curve, would decrease our cash flows by approximately $18.4 million in 2019, whereas a 50 basis point decrease in short term interest rates would increase our cash flows by approximately $18.4 million in 2019, based solely on our current net floating rate exposure and assuming a static portfolio of investments (including fixed rate repurchase agreements that mature within 60 days of December 31, 2018 and assuming a LIBOR floor of 0.0%).

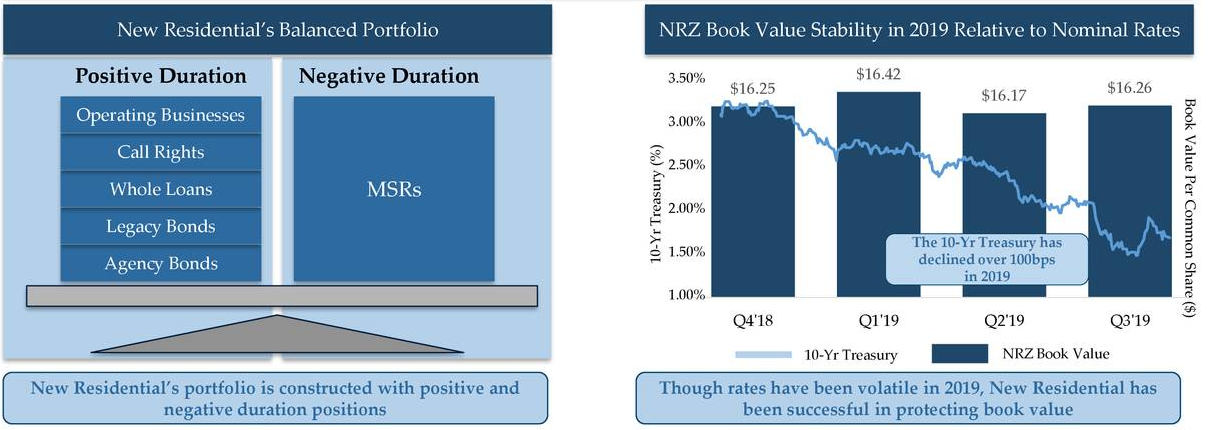

Generally speaking, NRZ is impacted both positively and negatively as rates both rise and fall, and the company makes an effort to prudently balance its interest rate risk (duration) as shown in the following graphics (this is a good, and necessary practice).

Risks:

Aside from the ones we’ve already mentioned (interest rates and high leverage), NRZ does face a variety of risks that should be monitored. For one, NRZ may be not be able to identify as many attractive investment opportunities as the market cycle progresses. For example, we saw the expected returns chart by investment type earlier in this report, but here is the same data from a 2015 NRZ investor presentation, and you can see that the expected rates of return have clearly been lowered as the market cycle progresses.

NRZ was very opportunistic back then, and continues to be opportunistic today, and it constantly searches for new attractive mortgage-related investment opportunities. Worth mentioning, the above pie chart also shows how the types of investments NRZ makes have been shifting over time.

Consistent with NRZ’s opportunistic approach, but also a risk to be monitored, the company continues to make acquisitions (and expand into new businesses) to help grow its investment book. For example, NRZ has a history of acquiring assets at distressed prices, and they’ve recently acquired Ditech, Shellpoint, SpringCastle and others, which represent new opportunities but introduce new risks (mainly integration risks, the risk that they we not good decisions, and the risk that there are far few attractive opportunities available in the market going forward).

Also, worth mentioning, NRZ has recently been introducing new preferred shares as a way to raise capital. And while preferred shares can be attractive to bondholders (because it introduces new liquidity to the company, and preferred shares come after bonds in the capital structure), it also introduces dilution risks to common shareholders (preferreds are ahead of common in the capital structure).

CEO Mike Nierenberg’s non-stop positive-spin attitude is a bit of a risk to the company. Reading through quarter after quarter of earnings call transcripts leaves the author of this article feeling concerned that no matter what happens to NRZ in the market, Nierenberg always tries to define it with an overly positive spin. While Nierenberg is smart and very experienced, investors should not forget that he previously “ran the adjustable-rate mortgage trading desk” at now defunct Bear Stearns and “was a key player in ensuring the defaulting loans Bear was buying would move off their books right after they bought them, with little concern for the firm’s due diligence standards,” according to this article by The Atlantic.

Finally, one huge risk is the threat of another Great Recession, which could cause extreme and irreparable damage to NRZ. To be clear, we don’t expect another Great Recession anytime in the foreseeable future, but if interest rates were to move too dramatically and too quickly in either direction, it could throw off NRZ’s balance sheet (asset values) and leverage ratios, thereby forcing asset sales at fire sale prices and basically leaving the company insolvent (i.e. the dividend payments would stop and the share price could go to zero). Again, the chances of this happening anytime soon seem negligible, but real (i.e. big banks were forced to get rid of NRZ type assets for a reason following the financial crisis—tail risk!).

Conclusion:

Considering current market conditions (i.e. no obvious Great Recessions on the immediate horizon), NRZ’s yield continues to be safe and attractive, in our view. The price remains compelling relative to book value, and it becomes especially attractive on dips (i.e. there is some volatility to the share price that creates even more compelling buying opportunities). We continue to own shares of NRZ (and have owned them for several years now). However, we recognize there are massive yet negligible tails risks, as well as risks created by the current aging market cycle. We continue to monitor NRZ, we view it as attractive on a risk-versus-reward basis, and we continue to enjoy collecting the big dividends it pays. We’ve ranked NRZ #6 on our list of Top 10 Big-Dividend REITs.