Tsakos Energy Navigation Limited (TNP) is a leading provider of seaborne transportation services to the crude oil and petroleum products industry. We believe the market is not giving the preferred shares enough credit for rising shipping rates and a recent charter extension for an LNG carrier. In this article, we analyze its business model, dividend potential, growth prospects and finally conclude with an explanation on why we ranked it #6 on our recent list of Top 10 Big Safe Energy Sector Dividends. If you are an income-focused investor, it’s worth considering.

Overview:

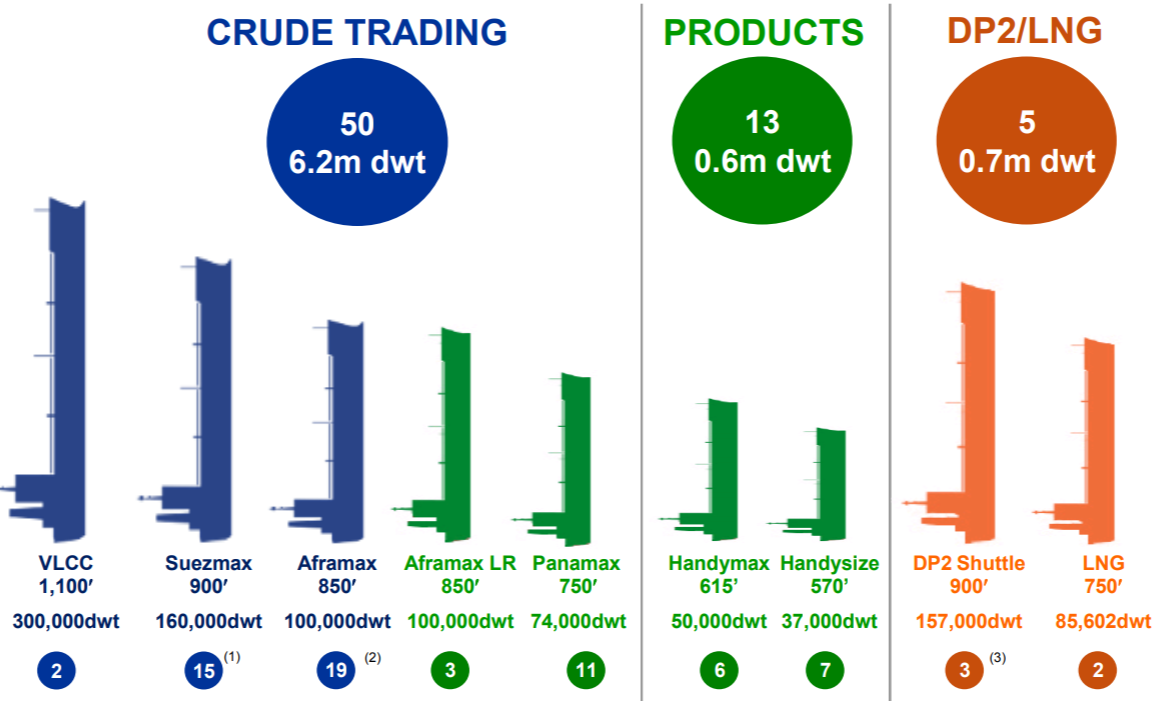

Tsakos Energy Navigation Ltd operates a fleet of 68 marine transportation vessels for crude oil, LNG and other petroleum products as of April 2019 to serve national and other independent oil companies worldwide on long, medium and short term charters. Out of the fleet of 68 vessels, 50 are crude trading tankers which are larger in size and move unrefined crude oil from exploration sites to refineries, 13 are product tankers that are relatively smaller and move refined oil products to areas of consumption, 2 LNG carriers and 3 suezmax shuttle tankers with advanced dynamic positioning technology (DP2).

Source: Tsakos Energy Navigation Limited

Stable cash flows driven by medium to long term contracts

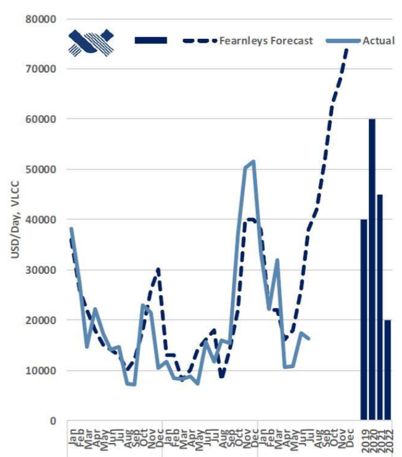

A majority of the company’s fleet is on medium to long term charters that either have a fixed rate or a minimum fixed rate with a profit sharing component. This structure provides the company with stability during downturns in the oil and gas industry. As evident in the chart below, the blue dashed line indicating TNP’s average charter rates have been far less volatile than spot rate of a representative VLCC charter index. Infact, since 2002, the company has never suspended dividends despite periods of major volatility in charter rates during this time.

Source: Blue Harbinger Research

Progress on deleveraging

Despite a slump in the crude tanker market, the company has reduced its debt by $221 million in the last 18 months to $1,542 million. The company’s interest coverage ratio is around 2.5 times which provides the management reasonable cushion going forward. Additionally, the company has roughly $2.8 billion in vessels on the balance sheet and therefore the debt is backed by hard assets.

Company’s roaster of preferred stock instruments

The company has five sets of preferred stocks currently outstanding after the company recently redeemed series B at face value. Series B preferreds became callable on 7/30/2018. Not surprisingly, the company’s series C which became callable on 10/30/2018 are trading at a slight premium to face value as investors expect a possible near-term redemption.

Series E and F are yielding the highest as they don’t become callable until 2027-28 and also turn into floating interest rate preferreds from a fixed coupon instrument post the call dates. Additionally, the company has recently issued series G preferreds in a private placement to an institutional investor. These preferreds are convertible into common stock.

Series D becomes callable in April 2020. In addition to yielding 9.8% in dividends, it is currently trading at a discount of 11% to its face value. We believe this discount will narrow as we move closer to the call date and thus series D also provides investors the prospect of capital gains along with income.

Source: Blue Harbinger Research

Dividend Safety

As mentioned earlier, the company has never suspended a dividend despite volatility in charter rates as a result of its medium to longer term fixed to semi fixed charter rate contracts. Additionally, all the preferreds are cumulative and therefore any unpaid dividends accrue and become a liability for the company. Despite historically low charter rates, the company’s current EBITDA generation capacity is far more than what the company pays out in dividend, further aiding our conviction levels (and as a reminder, Tsakos has been deleveraging, as described earlier).

Source: Tsakos Energy Navigation Limited

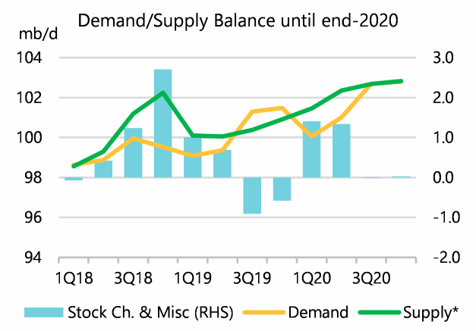

Oil Tanker Market Set to Recover in 2020

International Energy Agency (IEA) expects energy demand and supply to increase over the next few quarters as evident in the chart below. Increased US energy production coupled with increased demand from emerging markets such as China and India will help support the oil and gas demand/supply equilibrium. Increased volumes will naturally support the pricing for transportation services.

Source: IEA

Additionally, the supply of oil tanker fleet is set to see pressure which will have a positive impact on charter rates. During 2016/17, the crude tanker fleet saw above average fleet growth of between 5-6% annually which had a negative impact on charter rates. Depressed profitability in the industry led to increase scrappage of old ships which reduced crude taker fleet growth to just around 0.5% in 2018 which helped support charter rates last year, especially in the back half.

Going forward, the industry is set to experience a supply shock due to upcoming regulations. IMO 2020 regulations call for a substantial decrease in the Sulphur content of the fuel used for maritime transportation. The lower Sulphur content fuel costs more and fitting scrubbers on tankers that help ships reduce sulphure content of high Sulphur content fuel can be expensive. It is estimated that $4-4.5 million of investment would be required per ship to retrofit scrubbers that help lower Sulphur content of high Sulphur fuel. The new regulation will lead to increased scrappage as using higher cost fuel or investing in old ships to be able to operate post new regulations will be prohibitive especially given low charter rates.

These changes will help well capitalized companies such as TNP that have the balance sheet to invest in complying with new regulations. Additionally, slower supply growth will benefit charter rates for tankers. Below is a chart with forecast from Fearnleys, a leading industry focused brokerage and market intelligence firm. The firm expects a record rise in charter rates next year.

Source: Tsakos Energy Navigation Limited

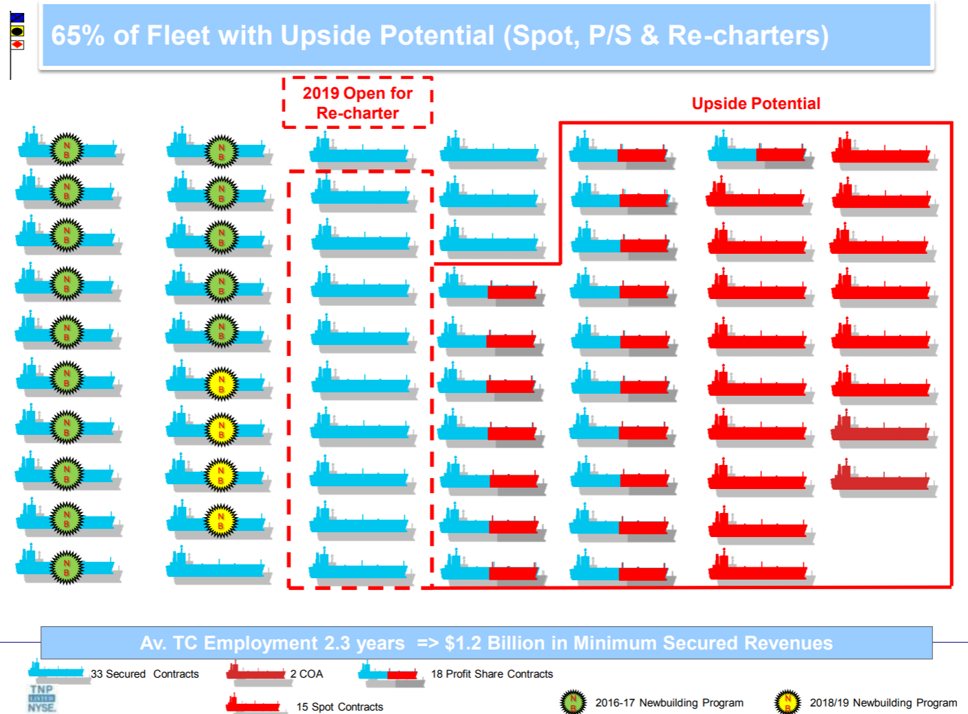

Despite a significant fixed component to the company’s contracts, around 65% of the company’s capacity has some level of upside potential as spot rates move as depicted in the chart below. The exposure to spot rates is through contracts that have both a fixed component as well as a profit-sharing element. Additionally, a portion of the capacity is chartered at prevailing spot rates.

Source: Tsakos Energy Navigation Limited

LNG Opportunity

Additionally, the company is moving forward in diversifying its energy fleet with expansion in the LNG segment by growing its LNG fleet to 4 vessels and contracting with major international natural gas production and trading entities. LNG consumption is expected to grow at a faster pace than traditional energy markets. In fact, in 2018, the LNG market grew by 8% and the market has grown by around 30% since 2015. Not surprisingly, the company recently re-chartered its 2 LNG vessels at rates that are much higher than the vessels’ all in breakeven.

Risks

High volatility in charter rates out of the cyclical nature of tanker industry

Tanker charter rates are highly cyclical and volatile. As such as the company’s earnings power can see volatility as well. Having said that, the company’s policy of locking in fixed rates through medium and long term contracts on a majority of its ships helps the company partially insulate itself from the volatility.

Higher than average tanker fleet supply growth could depress pricing further

If more tankers get introduced into the market than can be absorbed by demand, charter rates could stay weak longer than expected. The risk is somewhat contained in the near term as the upcoming IMO 2020 regulation is implemented.

Conclusion:

Tsakos Energy Navigation Limited’s series E preferred stock offers an attractive instrument to lock in superior yields as well as position for capital appreciation. The company has a consistent track record of managing the volatility in charter rates as well as balance sheet risks. Additionally, the next 12-15 months could bring recovery in the fortunes of the crude tanker markets due to capacity exits as well as growth in energy demand.

Note: If you are looking for additional attractive big-dividend ideas, be sure to check out our recent report: Energy Sector: Top 10 Big Safe Dividends.