Will FAANG Continue to Dominate?

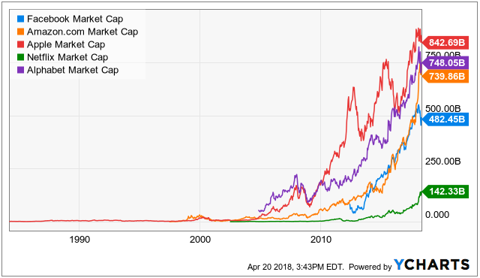

The collective market capitalization of FAANG is nearly $3 trillion, and that's fairly impressive considering the total US market cap of publicly traded equities is only around $28 trillion.

And here is a look at the performance of each FAANG stock versus the S&P 500 over the last five years; FAANG has clearly been dominating, especially considering their collective market capitalization makes up a significant portion of the total US public equity market.

However, important to note, the FAANG stocks tend to have higher levels of market risk, as measured by beta.

Note: Beta is a measure of risk related to general market movements as opposed to stock-specific factors. A beta above one generally means a stock is both volatile and tends to move up and down with the market. Lower beta stocks are often pursued by investors looking to diversify away some of their market risk exposure.

And importantly, high beta stocks generally sell-off more than the rest of the market during market pullbacks such as during the bursting of the tech bubble or the more recent financial crisis in 2008-2009.

If you rely on the income from your investments to help pay the bills, then you probably can’t handle the volatility risks of holding too many FAANG-ish stocks because in a large market pullback you could be forced to sell some shares near the bottom just to generate the income you need for living expenses, and those types of sales can do irreparable harm to your nest egg.

It’s for this reason that many investors chose to own lower market-risk income-producing securities, such as the examples highlighted in this article.

Without further ado, here is our list of...

Top 10 Big-Yield Opportunities:

10. Medical Transcription Billing Preferred (MTBCP), Yield 11.3%

Preferred Stocks are often overlooked, but this lower volatility stock-bond hybrid security can offer some attractive income payments with considerably lower volatility than the general stock market. Our “aggressive” idea (MTBC) in this “preferred stock” category exhibits much lower absolute price volatility than the average stock in the S&P 500 (it's price generally stays close to $25), it offers a very large dividend, the business has been improving, and the price has recently pulled back. We wrote about MTBCP in detail earlier this year, in this detailed article:

And since that time, MTBC has been further improving its position, as revenues and net income continue to grow. However, after reading the above-linked article, if MTBCP is too “aggressive” for your taste, we also like several high-yield preferred stocks within the maritime shipping industry, which we believe offer more “conservative” big-dividend opportunities. For example, we highlighted one such idea in this members-only article:

Additionally, you can access many more conservative higher-yielding preferred stock ideas in this recent free article:

Worth mentioning, interest rate risk is a real threat to many lower yielding preferred stocks. Interest rates are currently low and rising and this puts negative price pressure on preferred stocks similar to the pressure it puts on bonds (as rates rise, prices fall). However, investors can alleviate some of this risk by focusing on higher yielding preferreds whose prices are driven more by company-specific idiosyncracies than by interest rate movements (such as MTBPC). And if the interest rate risk is still too concerning for you, we offer a high-yield fixed-to-floating rate preferred stock idea later in this report, whereby the “fixed-to-floating” rate characteristic helps alleviate some of the interest rate risk.

9. Adams Diversified Equity Fund (ADX), Yield: 9.8%

Equity Closed-End Funds (“CEFs”) are a category of high-income investments that are often underappreciated. Some of the attractive characteristics of this category of can include high income, discounted prices, instant diversification, active management, and the fact that they are “closed-end” so they can better control capital gains and there’s no forced selling (a challenge that mutual funds and often ETFs must deal with).

Our “conservative” equity CEF idea is The Adams Diversified Equity Fund (ADX), which is an internally managed, closed-end fund that is focused on generating long-term capital appreciation and committed to paying at least 6% in annual distributions, paid quarterly (and in better years, ADX pays more than 6%, via a large year-end distribution, for example 9.8% aggregate in 2017). It also provides exposure to a diversified portfolio of large cap equities, and pays close attention to risk management. Oh, and its successful, long-term track record dates back to 1929!

Here are some additional considerations for ADX...

ADX Sources of Income:

Considering this fund invests in large-cap stocks that generally pay dividends of around 2.5%, you may be wondering how the fund is able to consistently pay out at least 6% every year (distributions are paid quarterly). The answer is a combination of dividend income and capital gains. The management team’s track record of efficiently making these large distributions available to investors has enabled many investors to sleep well at night for many many years.

ADX Track Record:

The inception date for this fund is 1929. And that’s not a typo. This fund has been paying distributions for over 80 years! The current management team, however, has not been in place that long, but they are continuing the track record of efficiently distributing cash to investors. (more information on the fund’s management). And you can view the funds attractive long-term performance track record here.

ADX Discount to NAV:

Important to note, the difference between NAV return and Market Price return (in the performance track record link above) has to do with the discount/premium of closed-end funds, and it helps explain one of the reasons this fund (ADX) is attractive right now. Specifically, in recent years, the NAV return has become increasingly better than the market price return in terms of the spread or difference between the two. This is because the discount at which this fund trades in the market versus its NAV has been increasing as shown in the following chart.

Unlike open-end funds, ADX is a closed-end fund, and this means “creation units” are not used by the management team to keep the market price close to the NAV and therefore big distributions and premiums may occur based on supply and demand. In the case of ADX, it trades at a big discount, and in our opinion this creates an even more attractive buying opportunity.

The discount likely exists because investors have unwisely (in our view) been chasing more glamorous funds that offer higher distribution yields and pay monthly (instead of quarterly like ADX), and instead been shunning ADX (remember closed-end funds trade largely on supply and demand). However, in order to achieve the higher yield, the other funds are taking on higher risk through the use of leverage, and by generating a high percentage of the distribution with return of capital (i.e. when the market goes south they’re often forced to sell holdings at discounted prices just to maintain their big yields). ADX has a 0.0% 1940 Act Leverage Ratio (note: the fund does occassionally borrow very small amounts for operating purposes, but not to magnify returns like many other funds do), and this is a big part of the reason the fund has been successful since 1929.

For reference, as this link shows, ADX distributions are sourced from dividends and capital gains, NOT a return of capital. For perspective, other popular large cap CEFs often use a return of capital to support the distributions instead of sourcing it from dividends and capital appreciation like ADX. And that practice can lead to bad outcomes in stressed market conditions such as the financial crisis, a situation most income-focused investors want to avoid. ADX, is conservatively and prudently managed in our view, which has helped it deliver such a long history of healthy returns.

We are also attracted to the holding of ADX from both a style and sector weight stand point. For reference the style box at this link shows the fund holdings tilt slightly towards growth.

Generally speaking, we prefer value stocks at Blue Harbinger over growth stocks, but in this case the exposure is acceptable for a variety of reasons. First, it’s not deep growth, it’s actually close to the middle (core-growth). Second, the growth vs value long-term performance difference is historically not as strong in the large-cap space as it is in the small-cap space (over the long-term, +10-years, value stocks tend to outperform growth stocks, but this difference is more pronounced in the small-cap space, not the large-cap space). Additionally, we like to have some diversification into the large cap growth space, as this can help reduce aggregate portfolio risks, and ADX allows us to do this while still generating high income.

You can view more about ADX holdings and sector diversification here.

ADX Risks:

The Adams Diversified Equity Fund does face risks that should be considered.

Equity market exposure: For starters, ADX is an equity fund, which means it will suffer many of the same ups and downs as the general equity market. However, because of the big distribution payments from this fund, market volatility should be somewhat muted, and it should be easier for investors to handle because they’ll most likely continue to receive big distribution checks every quarter.

Leverage: Another important consideration is leverage. Many equity CEF’s use up to 33% leverage to magnify their returns, but of course leverage introduces more risk. For example, if you are levered when the market declines you could be forced to sell holdings at distressed prices just to meet the distribution payments. However, in the case of ADX, the only leverage is usually only very small amount (it’s currently 0.0%, but it will occasionally rise into the low single digits) to help manage operating expenses (so the fund can stay more fully invested in the market so as to avoid missing out on long-term capital gains) but has not been using speculative leverage like many of its peers, and this reduces the possibility for very big gains, but also prudently reduces the possibility for very big losses.

Management Fees: Management fees are another risk for closed-end funds. At Blue Harbinger, we generally despise paying management fees, and work hard to help investors avoid them as much as possible. However, in the case of closed-end funds, the higher fees may be acceptable for some investors, specifically for the reasons described in this write-up. Importantly, ADX charges extremely low management fees relative to other closed-end funds. Specifically, it’s not uncommon for a closed-end fund to charge 1.5% to 2.0% in management fees, but the Adams Diversified Equity Fund (ADX) only charges 0.56% which is extremely attractive if you need the big distributions that this fund generates.

“Aggressive” Equity CEFs: If you like the benefits of closed-end funds, there are a few others you may want to consider such as the very attractive and more “aggressive” small cap CEF’s we have highlighted in this members only article:

The two small cap CEFs in this article are very attractive for many of the same reasons we like ADX. And we currently own all three (ADX plus the two small cap CEFs).

8. Macerich Company (MAC), Yield: 5.1%

Real Estate Investment Trusts (“REITs”) are a category of big-dividend securities that have caught the eye of many contrarian income-focused investors because the sector has been significantly underperforming the market, and they offer some large divided yields. Macerich is our “conservative” idea in this REIT category because of its high yield, low beta, and attractive valuation, but it too faces risks, of course.

Macerich is a mid-cap retail REIT ($8.5 billion market cap). And before we get into the obvious retail REIT industry fears (mainly rising interest rates and growing internet competition) its worth mentioning that the non-large cap REITs may have an advantage over the large cap REITs, in our view. Specifically, as this sector struggles, we may see increasing consolidation (mergers and acquisitions), and we believe the large cap REITs will increasingly consider acquiring the smaller cap REITs, and when this happens—the large cap companies usually pay a premium and the small cap companies usually receive a premium. All else equal, smaller market caps would be more attractive (obviously all else is NOT equal, and we’ll get into that in a moment).

Regarding M&A activity, we believe it is a good sign for the industry overall because it suggests some smart, deep-pocketed, institutional investors believe the space is undervalued. For example, Unibail-Rodamco, Europe’s largest REIT, is buying Westfield (a mall owner in the US and the UK), and Brookfield Property Partners is trying to take over Chicago-based GGP (you can see GGP’s rent and sales per square foot, compared to SPG, in our earlier chart). As another example, European REIT Klepierre has recently pursued an acquisition of UK-based Hammerson. We believe there will likely be more M&A discussion throughout the industry, and the fact that these types of discussions are occurring is a good sign for mall REITs in general, in our view.

Another important differentiator for Macerich is that it is one of the higher quality retail mall REITs. Specifically, the location of its properties allows it to charge higher rent to its tenants, and the tenants are able to generate more sales per square foot, as shown in the following chart.

In our view, the less desirable real estate owners such as WPG and CBL (as shown in the above chart) will continue to face more challenges from store closures, tenant bankruptcies, undesirable rent concessions and growing internet competition. On the other hand, the highly trafficked, desirable location, experiential properties like Macerich will not only continue to exist, but they will thrive, and their shares are currently relatively inexpensive. We wrote more about retail REITs in general, and Macerich in particular, in this article from December:

One of the common responses from many investors when considering retail REITs is “don’t try to catch a falling knife.” We’re certainly not saying retail REITs have bottomed, but we are saying they are cheap from a valuation perspective as described in the above linked article. And if you are still not comfortable with investing at these prices, we offer a highly compelling income-generating options strategy for retail REITs later is this article (for example, see the Simon Property Group section, below).

And if retail REITs still aren’t your cup of tea, then consider some of the healthcare REITs and data center REITs, which also offer high yields and attractive prices without the exposure to the risks of changing consumer shopping habits (i.e. online retail). In the healthcare space, we offer both a “conservative” and “aggressive” investment idea in these reports:

Additionally, data center REIT, Digital Realty (DLR) is also worth considering based on its current valuation as we wrote-up in this free article:

Overall, the REIT space currently offers a variety of attractive higher income opportunities, and discounted valuations.

7. BlackRock Credit Allocation Income Trust (BTZ), Yield: 6.4%

Debt-Focused Closed-End Funds (“CEFs”) are another category of high income securities that income-focused investors often overlook. Our “conservative” idea in this category is BTZ.

The BlackRock Credit Allocation CEF (BTZ) is a portfolio of actively selected fixed income securities (bonds), it offers a steady 6.4% yield (paid monthly) and it trades at an attractively discounted price versus its net asset value (“NAV”) (more on this in a moment). Two more things that we really like about this fund is that it is a closed-end fund (which means it can avoid the dangerous “forced-selling” situation that can be so damaging to bond mutual funds and bond exchange traded funds), and it is able to get low institutional borrowing rates for the small, conservative and prudent amount of leverage this fund uses (currently 22.2%).

For reference, this fund invests in mostly investment grade debt (this is safer than non-investment grade debt) as shown in the following graphic.

We like this investment grade allocation because marketwide credit spreads are currently relatively low (which means the market is highly confident that nothing “bad” is going to happen, and as contrarians we know overconfidence can be a bad thing). Considering that risk and volatility may pop back up at any time, we’d rather be holding more, safer, investment grade debt, such as the mix of bonds in this fund.

Also, the current discount versus NAV that is available for purchasing this fund is a highly attractive 12.01%. For reference, this discount is relatively large compared to recent historical standards of the fund, as shown in the following chart.

And the amazing thing about purchasing this CEF at a discounted price is that you are getting more yield for your buck. Given the low level of risk, you could not purchase safe yields this high in the open market (because you’d have to pay full price). Because they are “closed-end,” CEFs trade at premiums and discounts to their NAVs based on market purchasing and selling forces. We greatly prefer to buy low.

Overall, if you are looking for safe high income (paid monthly), the BlackRock Credit Allocation Fund (BTZ) is worth considering because of its attractive qualities and its discounted priced. And in addition to BTZ (we currently own shares of BTZ), we also own another, more “aggressive” and higher yield (+8.6%) bond CEF, which we have written about in detail in this members-only article:

The yield on the more aggressive bond CEF we own has come down slightly since we purchased in late January (as the share price has appreciated), but it’s still attractively priced if you’re looking for a more “aggressive” but still relatively low volatility, bond CEF.

6. Pioneer Municipal High Income (MHI) CEF,

Yield: 5.6%, Tax Equivalent Yield +8.6%

Municipal Bond CEFs: One of the drawbacks of bond investing is that the income payments are taxed at your ordinary tax rate instead of the reduced qualified dividend rate that many equity securities are eligible for. This higher tax rate can be particularly frustrating if you are in a high tax bracket. However, municipal bond CEF’s can offer tax-free income as well as all the other attractive benefits of CEFs, in general.

The Pioneer Municipal High Income Fund has a variety of attractive qualities that you may want to consider for an attractive high-yield diversifier, especially if you are in a high tax bracket. For starters, if you’re in the 35% tax bracket for 2018, the taxable equivalent yield for this fund increases to a very compelling 8.6%.

This fund invests in investment grade municipal securities, and it pays its investors monthly. And what is also very attractive, aside from the high-tax exempt yield, is the distributions have historically been 100% income (not capital gains or return of capital) which is a good thing; CEF investors need to pay attention to the sources of income distribution because capital gains and return of capital can generate unexpected tax consequence.

Anther thing we like about this fund is that its closed-end structure allows management to hold the bonds until maturity, thereby eliminated the forced-selling risks that many ETFs and mutual funds are forced to deal with. This also helps control interest rate risk volatility as the management team can essentially hold the individual bonds until maturity at par, thereby locking in the yields at which they purchased.

Further still, this fund uses a prudent amount of leverage (26.1%) to improve performance and efficiency. And importantly, the fund is able to obtain this leverage at institutional rates (i.e. lower rates than most individual investors are eligible for).

Also very important, the fund currently trades at a discount to its net asset value, which essentially means investors are buying the high yield at a discounted price. This is a very attractive way to boost your income. You can read more details about this fund using this link.

And while MHI is our "conservative" option within our municipal bond CEF category, our more "aggressive" option is reserved for members only. We consider the aggressive option more aggressive because it uses more leverage, offers a higher yield, and trades at a historically attractive discount to NAV.

The Top 5:

Our Top 5 Big-Yield ideas span a variety of market sectors and asset classes, and they include multiple double-digit yields. The Top 5 are reserved for members only, and you can view them in this report: