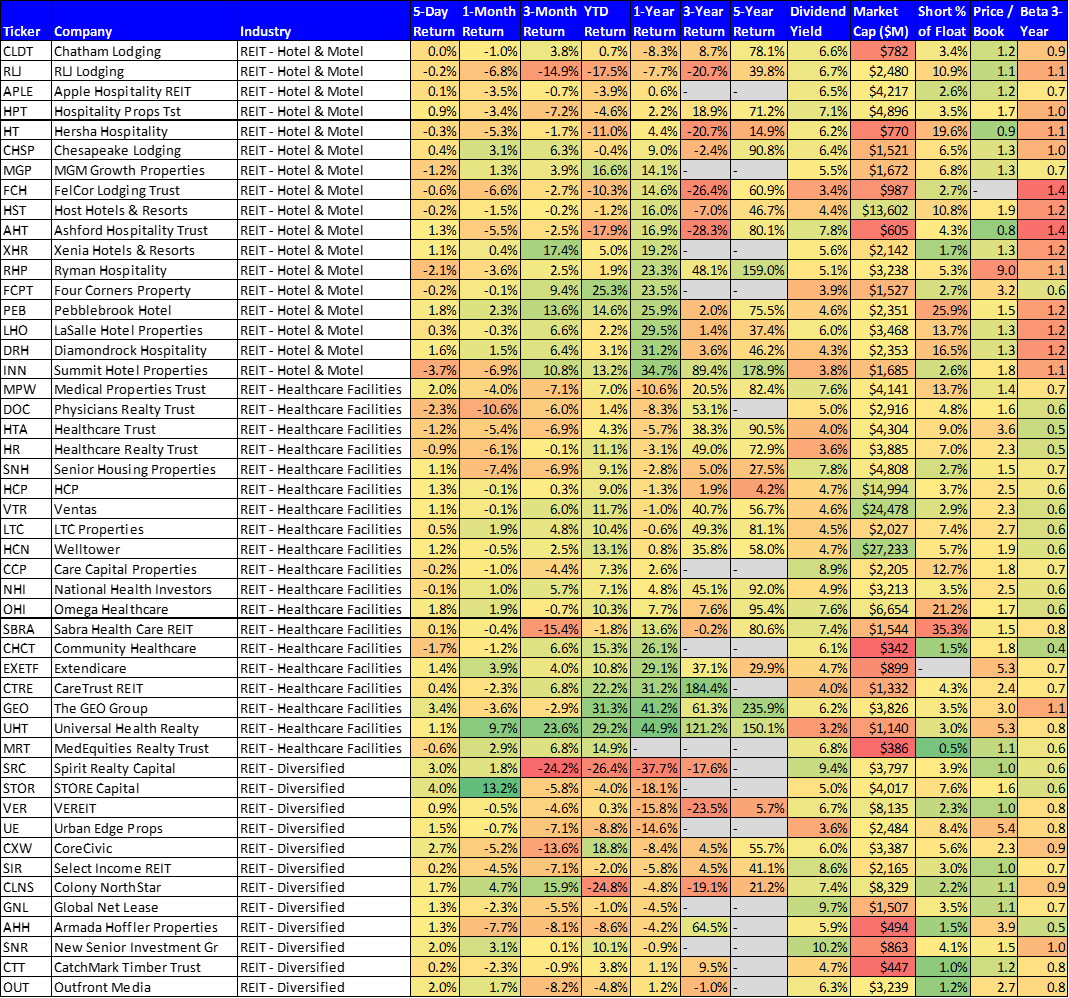

There is a reason why Omega Healthcare Investors’ (OHI) yield (7.7%) and short-interest (21.2%) are so high. And yesterday’s release of the new GOP healthcare bill did nothing to improve the situation (i.e. the party still plans to largely roll-back the Medicaid Expansion of the Affordable Care Act, and this will create new challenges for many of Omega’s operators, and ultimately Omega). This article reviews several bad reasons to invest in Omega (e.g. yield-chasing, backward-looking financials), explains two big reasons why the stock is underperforming the rest of the market (e.g. efforts to reduce the federal deficit, and a negative market narrative about REITs), and concludes with our views on the right way to think about this high-yield RIET. And worth noting, we have ranked Omega on our recent list of 10 High Income Investments Worth Considering.

Before getting into the details, we believe this cartoon is worth reviewing...

We like this cartoon because it reminds us of how lots of investors view the REIT sector right now. Specifically, the group is significantly underperforming the S&P 500 (see the following chart) and we see new articles regularly about how to “catch a falling knife” and/or invest in a “dead cat bounce.”

But to be clear, unless you’re the guy whose name is featured on the following piece of metal, you cannot time the market.

Overview of Omega

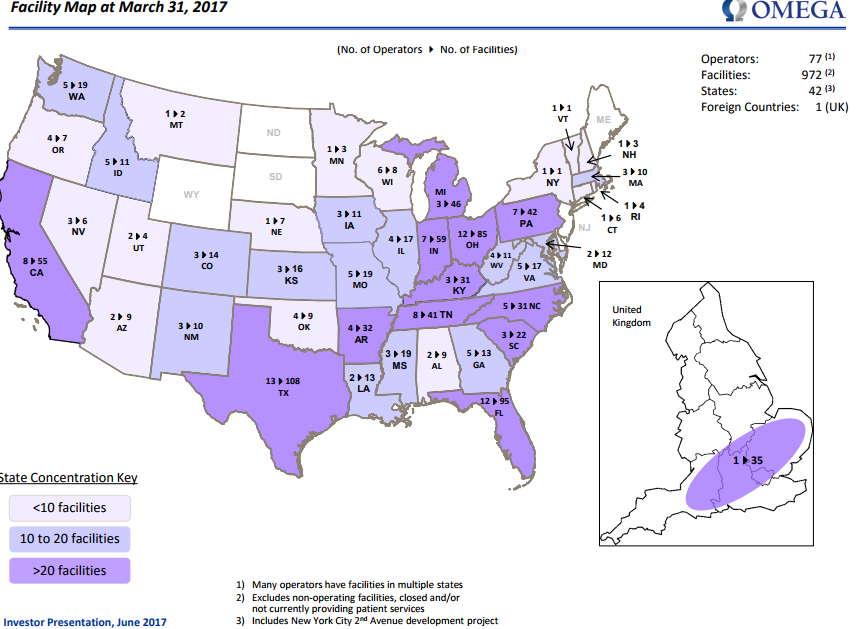

Omega is the largest Skilled Nursing Facilities (“SNF”) focused REIT with a portfolio of 972 operating facilities spread out across the US and internationally as shown in the following map.

And it is well-diversified across operators, as shown in the following chart.

Further, Omega has an attractive history of growth, and a low dividend payout ratio relative to its adjusted funds from operations (“AFFO”) as shown in the following graphics.

And importantly, Omega has attractive industry demographics on its side (i.e. an aging population with growing healthcare needs).

Further still, the company has no upcoming lease expirations and no senior note maturities until 2023.

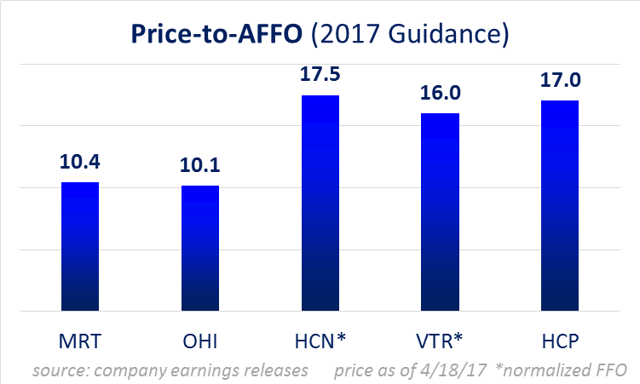

Also, important, from a valuation standpoint, Omega is inexpensive relative to its own history. For example, it currently trades at only 9.7 times the midpoint of its 2017 AFFO guidance. This is very low compared to its own history (it has traded close to above 12 and 13 times historically). Further, it trades very inexpensively relative to other healthcare REITs. For example, here is one of our charts comparing OHI to peers from earlier this year.

Overall, Omega has grown its business and achieved an attractive track record of success. Yet many investors continue to invest in Omega for all the wrong reasons.

The Wrong Reasons to Invest In Omega

Irregardless of Omega’s business, many investors continue to invest for all of the wrong reasons. For example, much of the information presented in the previous section of this article is backward-looking. Past performance is not a guarantee of future success, yet many investors continue to extrapolate past performance into the future. However, this is the wrong way to invest because the market is not backward-looking, it is forward-looking (we’ll have more to say about Omega’s forward-looking prospects later).

Another inappropriate reason many investors are attracted to Omega is because they are yield-chasers. Investors often flock to REITs (and end-up overweighting REITs within their portfolios) simply because they are chasing after the high yields in the sector. And considering Omega’s yield is higher than many, many investors are specifically attracted to Omega without understanding much more than it pays a big yield (note: this is not a good way to invest; investors should understand the company they are investing in, not just chase high yields).

Still another inappropriate reason why many investors are attracted to REITs (and to Omega) is because they are blind contrarians, and they figure anything that has underperformed the market lately must surely be “due for a rebound.” This is a terrible way to invest. For example, a lot of lazy contrarian analysts thought the “big banks” looked cheap on a price-to-book basis in the early innings of the financial crisis (early 2008), and then ended up losing their jobs when those banks fell much, much further because the “book values” were more a figment of an accountant’s imagination than reality. It’s okay to be a contrarian investor, but it’s important to understand why something has underperformed instead of just haphazardly chasing after things that have recently underperformed.

Two big reasons why Omega has underperformed to S&P 500

The first big reason why Omega is underperforming is because of current Congressional efforts to “Repeal and Replace” the Affordable Care Act (“ACA”). Specifically, plans put forth by the controlling party (currently the GOP), include an effort to roll-back the Medicaid expansion plans of the ACA. And the latest bill put forth on Thursday ) shows this effort remains intact.

The reason rolling-back Medicaid expansion is so bad for Omega is because many of its property operators (52.6%) rely on Medicaid for revenue, as shown in the following table.

(source)

And if Omega’s operators receive less Medicaid reimbursement than they previous expected under the ACA, it could negatively impact their ability to pay Omega. For some perspective, many of these operators are currently facing challenging financial situations already. For example, Genesis Healthcare (GEN), one of Omega’s larger operators (7% of revenue, as shown in our earlier graphic) said this in their latest annual report:

"Reductions in Medicaid reimbursement rates or changes in the rules governing the Medicaid program could have a material, adverse effect on our revenues, financial condition and results of operations…. Medicaid is our largest source of revenue, accounting for 55% of our consolidated revenue during 2016 and 53% in 2015.” (source)

For added perspective, here is a look at Genesis Healthcare’s negative earnings in recent years

Any cuts to Genesis revenues will make operations even more difficult, and this may reduce their ability to pay Omega. Further, Genesis is not alone in its challenging situation; other Omega operators face similar challenges, and are a growing issue for Omega.

And if you’re not sure exactly how a struggling operator can negatively impact a REIT, you need look to HCP (HCP) and Quality Care Partners (QCP) over the last couple years. HCP is a healthcare REIT that was having such difficulty with its largest operator, ManorCare, that its price performed terribly, and it was ultimately forced to spin-off ManorCare (and almost all of its SNF properties) into a separate new REIT altogether (QCP). Stockholders were not happy with returns, and this is a recent example of how a troubled operator can negatively impact a healthcare REIT.

So the bad news is, Omega's operators will likely lose revenues if Medicaid reimbursement is capped (Congressional legislation under consideration is expected to change federal funding to states from the current matching program to a capped per capita program). And these operators budgets are already stretched pretty thin (as described in our Genesis example, previously).

However, the good news is: (a) there will likely be a slow phase in of the Medicaid changes (b) a growing population and improving demographics will likely offset some of the challenges, (c) Omega was slowly increasing private pay anyway (i.e. not dependent on government reimbursement), and (d) Omega is diversified across states (states have handled the ACA differently) and this will minimize the impact of any one state if/when the laws are changed. Net net, we believe any new healthcare legislation won't have a draconian impact, and a lot of the fears are already baked into Omega’s stock price.

And for perspective, here is a look at how much of the federal budge is on healthcare spending (28%).

REIT Interest Rate Fears

The second big reason why Omega has underperformed the S&P 500 has to do with investor fear about how rising interest rates may negatively impact REITs. We’ve seen this phenomenon play out as the fed has continued to raise rates and as the pro-growth Trump rally took off after last November’s election. For perspective, here is a chart of how REITs have performed versus the S&P 500.

The basic fear is that because REITs rely on borrowing to fund growth (they generally have to pay out 90% of income as dividends to avoid corporate taxes), and because interest rates are expected to keep rising, REITs could be in trouble (i.e. rising rates could keep returns lower). However, we believe the market’s fears about rising rates may already be baked into prices, and in reality interest rates may not rise very dramatically at all.

For perspective, as we mentioned earlier, the federal government is working to reduce the deficit. And as you may have noticed in our earlier pie chart, interest payments (on the US government’s outstanding debt) is actually a significant portion of federal spending. And if the government truly wants to get the debt under control then there is incentive to keep interest rates low for longer because raising rates would dramatically increase the amount of interest payments by the government (to places like China, a country that holds a lot of US treasury bonds). In fact, it wasn’t that long ago that former fed chair Ben Bernanke is reported by Reuters to have said he does not expect the federal funds rate to rise back to its long term average of around 4% in his lifetime.” And if rates do stay low for longer, then this makes growth less expensive for REITS.

The Wrong Reason to Avoid Omega

Another common mistake investors make when considering Omega is to view it as a stand-alone investment instead of as a part of a diversified investment portfolio. This is an absolutely terrible way to think about investing. It’s been proven over and over again throughout history both empirically (William Sharpe, Eugene Fama) and via common sense (don’t put all your eggs in one basket) that owning a diversified portfolio is a far better way to invest, yet many investor still don’t appreciate the true power of diversification. A simple way to think about diversification is that it allows you to keep your returns high and your risks lower. And the wrong way to think about investing in Omega is as a stand-alone investment instead of within the constructs of your own diversified investment portfolio.

Regardless, a common bad argument investors make is “why invest in Omega when there are other healthcare REITS that offer decent yields without the risky SNF exposure?” The answer of course has to do with risk versus reward. One of the basic concepts in investments is the risk-reward trade-off; the higher the risk, the higher reward. Yet by owning a diversified portfolio, you can keep your risks far lower than owning any one individual stock, while simultaneously keeping your expected return just as high. Unfortunately, many investors view risk on a case by case basis (instead of as a portfolio), and they end up owning a lower yielding portfolio of undiversified stocks.

Conclusion:

There are a lot of terrible ways to consider investing in Omega (e.g. yield-chasing, knife-catching, and focusing on backward-looking data). On the other hand, considering an investment’s future prospects, and how it fits within the constructs of your overall diversified investment portfolio (instead of simply as a stand-alone investment) is the right way. We own shares of Omega Healthcare within our Blue Harbinger Income Equity portfolio, and it’s one of only two REITs we currently own in the strategy (like Omega, the other REIT is outperforming the REIT sector this year, and we believe both have more upside and lots of big dividend payments ahead). Critically important, all three of our Blue Harbinger investment portfolios are diversified across sectors and styles in order to keep risks low and returns (and income) high.

Note: We own shares of Omega Healthcare Investors (OHI)