Last week was volatile and painful for many higher-yielding securities. For example, REITs, BDCs and MLPs (all known for high-yield) sold off significantly (see charts below). We are in no way suggesting last week was a bottom (or suggesting an immediate rebound) for any of these securities, but we do believe some high-quality companies have sold off thereby making for more attractive entry points for long-term investors. This article highlights 100 high-yield equities that sold-off last week, and then reviews 10 specific opportunities that long-term income-focused investors may want to consider.

For starters, here is the list of 100 high yield equities that sold off.

(Data source: Stock Rover. Data dates: 4/28/17 - 5/4/17).

Before getting into the ten specific opportunities, first we review a few reasons for the sell-off. For example, declining oil prices hurt the energy sector, which clearly had a big impact on many of the Master Limited Partnerships (MLPs) in the group because they are largely energy-related.

And here is a look at the recent performance of the Alerian MLP Index.

However, in addition to hurting the energy sector, declining oil prices also hurts many high yield debt securities. Specifically, here is a look at the high-yield bond ETF (JNK) versus the S&P 500 over the last week.

And interestingly, as high yield sells-off, BDCs often sell-off too. The reason is because BDCs provide financing (generally debt) to riskier middle-market companies (BDC’s are often essentially riskier high-yield debt funds). And here is a look at the BDC index performance versus the S&P 500.

Additionally, REITs are also sensitive to the debt markets because they rely on outside capital to finance growth. REITs have significantly underperformed the market (SPY) over the last year because investors fear the negative impacts of rising interest rates, especially considering the aggressive growth agenda of the Trump Administration. Here is a look at how REITs have performed over the last year and over the last week.

(Note: REITs made up a lot of ground on Friday, but not all of them did as we'll see later in this report).

And here is a look at the decline in interest rates (long-dated treasuries) over the last week.

Overall, it was a tough environment for REITs, BDCs and MLPs last week, and that helps explain the declines. However, we also believe the declines have created some attractive entry points for long-term investors. For example, here are ten specific high-yield investment opportunities that income-focused investors may want to consider given the recent decline in prices.

Real Estate Investment Trusts (REITs)

1. Welltower (HCN), Yield: 5.0%

Welltower is a big-dividend healthcare REIT that was down 2.3% the last week. It is one of the more blue chip opportunities in the healthcare REIT space, and it currently trades at an attractive 15 times Funds from Operations (FFO).

Welltower is “well-diversified across senior housing (triple-net and operating), outpatient medical and long-term post-acute.” It also benefits from strong demographic tailwinds of an aging population and growing healthcare needs. If you are looking for a high-quality REIT that pays a big dividend and trades at an attractive price, Welltower is worth considering.

2. Realty Income (O), Yield 4.5%

Realty Income is an income-investor favorite because it pays big safe monthly dividends. And as the following chart shows, its price came down significantly last week.

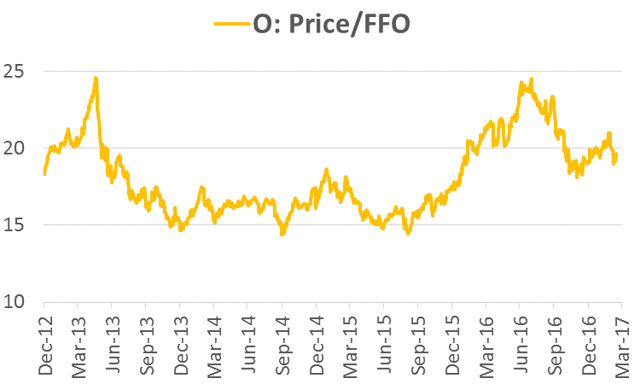

Additionally, the dividend payment has increased for 77 consecutive quarters. We believe O is worth considering now because its business remains strong but its valuation has also come down. Specifically, the following chart shows that Realty Income's price versus its Funds from Operations (“FFO”) has come down significantly since last summer (i.e. the shares are on sale).

Plus, Realty Income only expects to pay out ~ 83% of its adjusted FFO as dividends in 2017, which is a healthy margin of safety for this low beta company. If you are a long-term, income-focused, value investor, Realty Income is worth considering, especially after this week’s decline.

3. Omega Healthcare Investors (OHI), Yield: 8.0%

In our view, Omega is an exceptionally attractive, undervalued, big-dividend healthcare REIT. And its price has become decidedly more attractive over the last week.

Besides the sell-off in REITs, Omega was already on sale due to uncertainty surrounding Congressional efforts to repeal/replace the Affordable Care Act. Simply put, investors are afraid. Omega's price has also been dragged lower as the entire REIT sector is down due to rising interest rates fears. In our view, both of these fears are baked-in and overblown, and Omega currently represents an exceptional contrarian opportunity to invest in a big safe dividend.

With regards to healthcare reform, here is what Omega had to say in its most recent investor presentation.

Specifically, Omega believes the healthcare reform fears are overblown because alternative payment models will expand under Medicare. And regarding Medicaid, the phase-in process will be long thereby allowing states to offset the burden, and Omega's geographic diversification will help minimize the impact of rate changes in any one state.

On a comparative basis, skilled-nursing facilities REITs (like Omega) have lagged the overall healthcare REIT space because of the regulatory reform uncertainty. Also, these REITs still have some of the highest short interest as fearful investors continue to place their bets. Worth noting, despite the high short-interest, Omega has a relatively high expected annual earnings growth rate of 15.8% over the next five years (largely because the demographics of a growing aging population with increasing healthcare needs are strongly on Omega's side).

Also, as we mentioned previously, the entire REIT group has sold off because investors are afraid that rising rates will negatively impact these highly levered companies (i.e. they use a healthy amount of debt to run their businesses). However, this fear is already significantly baked in (the prices are down), and Omega has the strong ability to continue to generate FFO to cover and grow its dividend. In fact, Omega recently raised its dividend (again) and announced that their earnings expectations continue to rise.

Overall, we recognize Omega faces unique regulatory reform risks, but we believe it is a risk worth taking. If you are an income-focused value investor, Omega is absolutely worth considering (especially after this week’s sell-off).

4. Physicians Realty (DOC), Yield: 4.7%

Physicians Realty is another attractive healthcare REIT that sold-off significantly this week, as shown in the following chart.

As we wrote two weeks ago…

“Physicians Realty Trust is a differentiated, high-income, contrarian opportunity in the Medical Office Building REIT space. The company faces risks related to healthcare reform and rising interest rates, but its valuation remains attractive given the high growth opportunities. If you are an income-focused investor, Physicians Realty Trust is worth considering for an allocation within your diversified investment portfolio.”

You can read our full write-up on Physicians Realty here: Physicians Realty: Attractive Yield And Defensive Growth.

Master Limited Partnerships

5. CVR Energy (CVI), Yield: 9.4%

Though technically not an MLP, CVI is a holding company that controls two partnerships (CVRR and UAN). It also pays a big-dividend, and the shares sold-off significantly over the last week, as shown in the following chart.

CVI is certainly not a “widows and orphans” stock (i.e. it is very risky), but it also has a couple power forces on its side. Mainly, Carl Icahn and Donald Trump. Specifically, Icahn is a highly seasoned and successful investor that controls CVI, and he is also currently a special advisor to President Trump. We recently wrote in detail about the risks and rewards of this opportunity in our article titled: “CVR Energy: 10.2% Yield, Trump-To-Icahn 'Kickback' Pending.” The shares are up since our article was posted back in late March, but the recent pullback may be giving investors another bite at this apple. If you are a long-term income-focused investor (will an iron stomach), CVI may be worth considering.

6. Teekay Offshore (TOO), Yield: 9.4%

We’ve been following Teekay for over a year now, and its 10.2% price decline over the last week makes it more interesting, in our view.

If you don’t know, Teekay is a provider of marine transportation (mainly oil production, storage, long-distance towing and offshore installation and maintenance and safety services to the offshore oil industry in North Sea, Brazil and the East Coast of Canada)

The maritime shipping industry as a whole has been in distress over the last 18-months as companies struggle with declining commodity prices and an oversupply of shipping capacity. Teekay appears to be one of the companies that will survive. Even though it dramatically cut its dividend a little over a year ago (and its price declined sharply) it is still in business and paying a dividend (unlike many of its peers that have cut their dividends to zero, or filed for bankruptcy altogether). This one is not for the faint of heart, but if you believe the economy will continue to recover, Teekay may be worth considering.

7. Teekay Preferred Shares (TOO-A), Yield: 8.8%

If the common stock is too risky for you, then you might consider the preferred shares which are far less volatile and sit higher in the capital structure. Unlike the common shares, the preferred shares haven’t cut the dividend, and the price was down only about 4% over the last week. You can read our write-up on the preferred shares from May 2016 here: Teekay Preferred Units: Attractive 10.1% Yield. Incidentally, the shares are up since our article was written, but they still trade below their $25 redemption price (Teekay can redeem them at $25 per share after April 30, 2018). The shares are down 4% over the last week, and they currently trade at $20.59.

8. Ares Capital (ARCC), Yield: 9.2%

Ares Capital is a big dividend BDC that has experienced a 5.5% price decline over the last week.

In particular, the shares were down after a sluggish first quarter earnings release (in this case it isn’t all about the macro, it’s company-specific too). Specifically, core earnings were only $0.32 per share versus $0.37 a year ago, and estimates of $0.38. CEO Kipp deVeer attribute the declines to a competitive market environment. In our view, the BDC industry as a whole faces challenges such as high valuations, less opportunities, and more competition (for more information, please see our recent article: 3 Overcrowded High-Yield BDCs: Prospect, Main Street And Fidus. However, ARCC is a large BDC with deep relationships to source deals, and we like that the recent price decline brings its shares back closer to par with its book value. You can read our earlier report on ARCC here: Ares Capital: Big Dividend, 3 Big Risks.

9. Medley Capital (MCC), Yield: 11.7%

Sticking with the BDC theme, Medley Capital is another big-dividend name that is down significantly over the last week.

To be upfront, MCC is a high-risk opportunity, and is likely not for everyone, but if you are interested in higher risk reward opportunities, MCC may be worth considering. Specifically, we believe that Medley’s dividend is healthy despite challenging market conditions. Also, relative to peers, and on an absolute basis, Medley's valuation is attractive. You can read our recent write-up on Medley here: Medley Capital: This 11.5% Yield BDC Is Worth Considering.

10. Stag Industrial (STAG), Yield: 5.4%

Stag Industrial is a big-dividend industrial REIT, and its shares are down significantly over the last week.

Many investors appreciate the monthly dividend payments provided by Stag, and we also like its valuation at around 14.3 times FFO. The company announce earnings earlier this week whereby FFO was in-line with expectations, and revenues were better than expected. We wrote more about the attractiveness of STAG last fall (read that article here), and we still consider it attractive despite its price gains so long as the economy remains strong.

Conclusion

The combination of recent earnings announcements, rising interest rates, and declining energy prices has resulted in significant price declines for many high-yield REITs, BDCs and MLPs. However, we believe investors should be selective. Just because the yield is high, doesn’t mean it is a good investment. Investors should always work to cater their investment selections to meet their individual needs and risk tolerances within the constructs of a diversified investment portfolio.

Want access to Blue Harbinger's current holdings and 100% of our members-only content?

Consider a subscription...