If you are looking for low-risk low-reward dividend stocks, this article is NOT for you. However, if you’re looking for higher income yields, and risks that are tilted in your favor, then you may want to consider the ideas highlighted in this article.

The ideas span a variety of investment types including high-yield stocks, real estate investment trusts (REITs), mortgage REITs, business development companies (BDCs), high-yield bonds, alternative fixed income strategies, master limited partnerships (MLPs), closed-end funds (CEFs), income-generating options strategies, and the importance of diversification and tax-efficient capital gains.

Without further ado, here is the list…

High Yield Bonds – It’s not all about interest rates!

Sometimes debt is better than equity. Investors often incorrectly assume bonds are unattractive because yields are so low and rising interest rates will put downward pressure on prices. However, high yield bonds trade more based on company specifics than on interest rates. And some bonds offer juicy coupon payments as well as significant price appreciation potential. Yes, high yield bonds are riskier than investment grade bonds, but they’re not as risky as some investors believe, and many of them offer improving fundamentals and plenty of cash flow. For example, we like Frontier bonds.

15. Frontier Communications 2022 Bonds, Yield: 10.1%

Frontier’s stock price has been ugly lately. It’s down about 38% since late February. But as we wrote back on February 24th (right before the stock started to tumble)… “If it's big safe yield that you're after, consider Frontier's high-yield bonds, not the stock. Frontier will cut the huge dividend on its stock long before it defaults on its debt.” Not surprisingly, Frontier bonds have held up very well since the stock has started to crash. For example, we like Frontier’s 2022 bonds offering a 10.5% coupon, and a 10.1% yield to maturity.

Specifically, these bonds are off only about 2.6% since the equity market bloodbath started, and we believe the bonds are money good. You can read our previous write-up on Frontier bonds here: Frontier: How To Play The Dividend Cut Fear.

Equity REITs – High income on sale

Real estate investment trusts (commonly known as REITs) are one particular corner of the market that is known for offering high dividend yields. The reason for the high yields is because REITs can generally avoid paying US federal income tax if they pay out at least 90% of their taxable income as dividends. With regards to equity REITs (not to be confused with mortgage REITs, as discussed previously), these are companies that own and often operate income-producing real estate such as apartment buildings, office buildings, shopping centers, hotels and industrial warehouses, to name a few.

REITs have recently underperformed the market (as shown in the chart above) because many investors fear rising interest rates will negatively impact the real estate sector which relies on borrowing to fund its operations. Also, many dividend stocks in general have fallen out of favor as the pro-growth "Trump Rally" has continued to run. In our view, investor fear is already baked into REIT prices, and the group currently provides an attractive contrarian opportunity, especially for income-focused investors.

One specific high dividend yield equity REIT that we believe is worth considering for some investors is New Senior Investment Group

14. New Senior Investment Group (SNR), Yield: 10.2%

New Senior is a small healthcare REIT that pays a big dividend (10.2%). Its shares are currently very cheap relative to other healthcare REITs because it faces challenges such as a slim margin of safety on its dividend, concentration risk among its operators, and several underperforming assets.

However, if New Senior can get through near-term challenges (which we believe it can) then there are multiple paths to big gains ahead considering its growing foothold within the very large and growing healthcare real estate industry. You can read our recent write-up on New Senior here: New Senior: This 10.2%-Yield REIT Looks Like A Buyout Target. And if New Senior to too risky for you, we’ve highlighted a few additional attractive high-yield REIT opportunities (including Omega Healthcare, Welltower, and Realty Income) in this recent article: 10 Big-Dividend REITs Worth Considering.

Closed-End Funds (CEFs) – Look under the hood!

Closed-end funds issue a fixed number of shares, the shares usually trade on a recognized exchange, and the share price fluctuates based on supply and demand, NOT necessarily the underlying value of the assets the fund holds (this disconnect between share price and asset value creates some interesting opportunities, more on this later). Many closed end fund are able to pay very attractive distribution payments to investors based on a combination of dividends from the underlying holdings, capital gains, and in some cases a return of capital. Many investors are attracted to CEFs because of the big distribution payments. However, it is important to look under the hood. The distributions may be supported by imprudent leverage and an undesirable return of capital. However, if you like the high-income and diversification benefits of CEFs, you might want to consider the Nuveen Real Estate Income Fund or the GAMCO Global Gold and Natural Resources & Income Trust (see #8)...

13. Nuveen Real Estate Income Fund (JRS), Yield: 8.9%

The Nuveen Real Estate Income Fund is a closed-end fund (CEF) that offers a big 8.9% distribution yield. As a CEF, it trades on an exchange (NYSE), and its price fluctuates throughout the course of each trading day. However, because it’s a CEF, its price can deviate significantly (discount or premium) relative to its net asset value (the aggregate market value of the individual holdings within the fund) thereby creating some very attractive opportunities. For example, JRS currently trades at a discount to its NAV (we believe it’s better to buy low than high), as shown in the following graph.

We also like this particular fund because we believe we believe the real estate sector is attractive right now, especially from a contrarian standpoint. As shown in the following chart, real estate has underperformed the rest of the market this year as investor fear rising interest rates will have a negative impact on real estate companies because they generally rely on borrowing to fund their growth. We believe the market has over reacted considering many of the companies within this fund have ample funds from operations to keep supporting their big distributions and to contne healthy operations.

For reference, you can access some of the latest data from Morningstar on this fund here.

And you can read our full write-up on JRS from earlier this year here.

Business Development Companies (BDCs) – Don’t overlook them!

Many investors often overlook Business Development Companies (BDCs) because of their small size (their market capitalizations are often under $1 billion). However, publicly traded BDCs are another corner of the market where attractive high yields can be found. Like REITs, most BDCs pay little or no corporate income tax as long as they meet certain distribution requirements (i.e. most BDCs avoid corporate income tax by distributing at least 98% of taxable income). BDCs were formed by congress in 1980 to invest in (and help grow) small and mid-sized businesses. And despite changing market cycle conditions, many BDCs continue to offer healthy dividend yields and attractive valuations.

12. Medley Capital Corporation (MCC), Yield: 11.5%

Medley Capital is an externally managed BDC. Its objective is to generate current income and capital appreciation by lending to privately-held middle market companies. Importantly, Medley’s investments are diversified across a variety of industries and geographies. However, because of the types of loans in its portfolio, we consider Medley to be slightly riskier than some of its BDC peers. However, we also believe the market is overly fearful of Medley and the risks are already baked into the price. Given our current position in the market cycle, we believe Medley will continue to pay attractive dividends for years to come, and it is worth considering if you are an income-focused value investor. You can read our recent write-up on Medley here: This 11.5% Yield BDC Is Worth Considering.

Worth noting, if you are uncomfortable with the higher risk profile of Medley’s portfolio, you may want to also consider one of the lower yielding internally managed BDCs, such as Main Street Capital (MAIN), currently yielding 5.8%. However, per our earlier price-to-book chart (see above), be aware that you are paying up handsomely for the moderately higher quality portfolio.

Alternative Fixed Income Strategies – optimize your income!

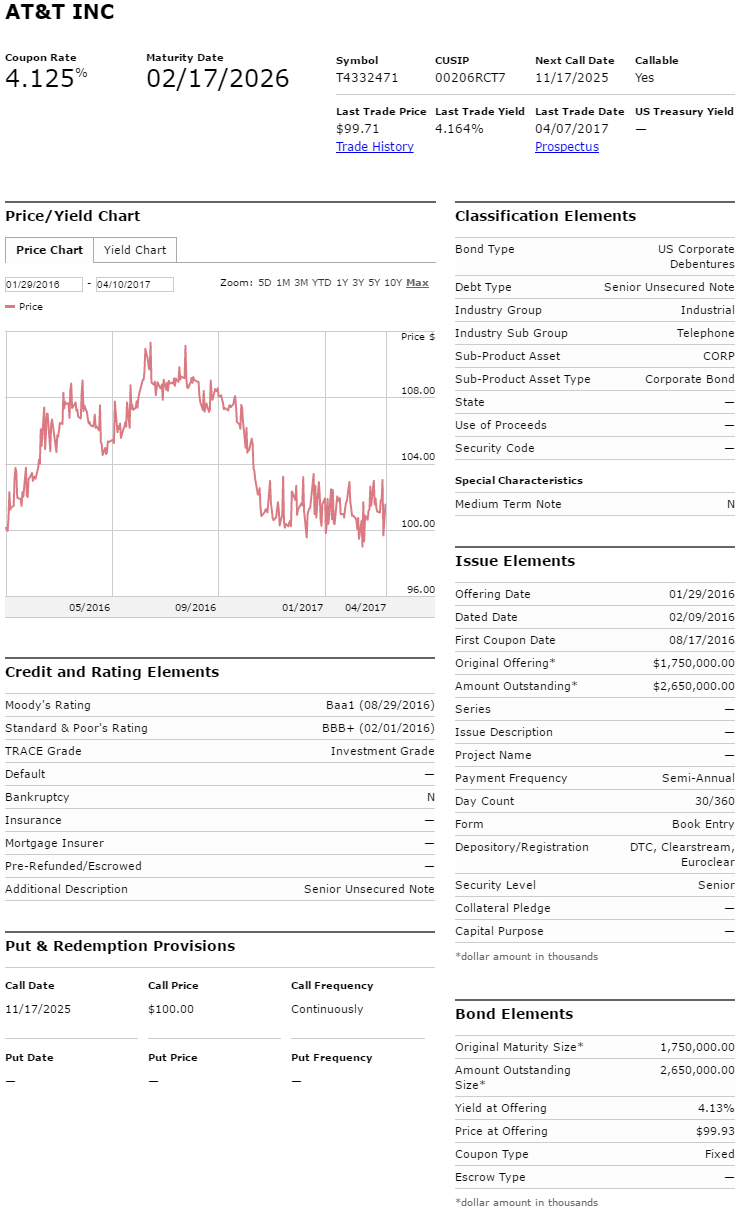

If you cannot get comfortable with the risks of high yield securities, then you might want to consider investing in investment grade bonds (high credit quality) using the techniques deployed by many alternative investment managers and banks. For example, “risk parity” strategies used by alternative investment managers will often borrow money to invest in very safe fixed income securities in order to generate higher yield (on the spread) while simultaneously keeping their overall portfolio risk relatively low. For example, consider AT&T bonds.

11. AT&T 2026 Bonds, x2, Yield: 7.0%

Many investors believe the dividend on AT&T stock (currently 4.8%) is one of the safest dividends in the world. And if you agree that the dividend yield is safe then you should also believe that the bonds offered by AT&T are even safer. After all, debt is higher than equity in the capital structure, and AT&T would cut its big dividend payment long before it would ever default on its bonds (in fact, AT&T would cut its big dividend payment just to support its bonds if it had to).

If you can borrow in your Interactive Brokers account at around 1% and use the money to invest in ultra-safe AT&T bonds at 5%, why wouldn’t you consider this strategy? You can hold the AT&T bonds to maturity thereby locking in the coupon payments and essentially insulating yourself from interest rate risks (the bonds will pay in full when they mature). As we mentioned previously, many alternative investors believe this strategy is more attractive than investing in risky high yield bonds or volatile stocks. And we believe it‘s worth considering for an allocation within your diversified investment portfolio.

And as a side note, if you think 2026 is too long to wait for your bonds to mature. You can do the same thing with Prospect Capital (PSEC) bonds. Many people love the 11% dividend yield on this business development company (“BDC”), but in our view, the bonds are much safer (because PSEC will cut the big dividend to support the bonds if it needs to), and you only have to wait 3 years to see this strategy though to fruition as the bonds mature in 2020.

High Dividend Yield Stocks – Be selective!

Generally speaking, it is usually a big red flag when a stock is yielding 10% or more. It often means a company is in distress and a dividend cut may be imminent. However, this is not always the case. In some instances, a high dividend yield is an opportunity to pick up some attractive income at a deeply discounted price. For example, we have highlighted one high dividend yield stock below that we believe may be worth considering for some investors.

10. CVR Energy (CVI), Yield: 11.2%

CVR Energy is engaged in petroleum refining and nitrogen fertilizer manufacturing, and Carl Icahn is currently the chairman of its board. Mr. Icahn is also a special advisor to President Trump, and Icahn has been lobbying for environmental RIN credit regulation changes while simultaneously shorting the RIN market via CVR Energy. There are a lot of additional interesting things going on like the multi-entity ownership structure of CVR Energy, CVI Refining (CVRR) and CVR Partners (UAN), but the man pulling the strings (Mr. Icahn) benefits most directly from CVR Energy. Before investing in this big yielder, investors should remember to first follow the money. You can read our previous full write-up on CVR Energy here: CVR Energy: 10.2% Yield, Trump-To-Icahn 'Kickback' Pending. Worth noting, CVI’s stock price is down sharply on volatility over the last several days thereby making for a more attractive entry point for contrarians.

9. Tax Efficient Capital Gains Harvesting – It can be worth a lot more than 7%!

You can increase your annual net income by far more than 7% in a single year simply by taking prudent, tax-efficient, capital gains. Not only does this strategy provide a diversified source of income, and give you an opportunity to manage your risks through rebalancing, but it can also reduce your tax bill, by a lot!

Before getting into the detail, it is important to note that we do understand that not all investors are comfortable counting on capital gains to provide income when they need it the most. For example, if you were relying on capital gains for income during the financial crisis, you’d have been forced to sell some of your positions at fire-sale-prices… not ideal and actually intolerable for some investors. However, if you do have the financial wherewithal to count on capital gains for a portion of your income there are a few clear advantages.

One advantage is that it allows you to reduce risk by assembling a better diversified portfolio. For example, some investors make the mistake of dramatically overweighting equity REITs within their investment portfolios (because of the higher yield and perceived lower risk). However, real estate has been the worst performing sector over the last year (especially since President Trump got elected and the Fed ramped up interest rate expectations). The opportunity cost of not owning other sectors of the market has been significant. For example, if you had an allocation to low dividend paying technology stocks (the best performing sector over the time period) you’d have made an extra 19% return on those assets.

As another advantage, qualified dividends are generally taxed at the same lower tax rate as long-term capital gains, but investors have more control over when they take long-term capital gains and this can make a big tax difference. For example, if you know you’re going to be in a lower tax bracket next year, you might consider postponing your stock sales until January 1st so you can pay the lower tax rate on your capital gains (you can’t do this with dividends). Or if you know you have a big capital loss on something this year then you might want to also recognize the capital gain this year to offset your tax liability. Having control over the timing of your tax liabilities can make a big difference.

Overall, a diversified portfolio of quality investment allows you to reduce risk while keeping your expected returns and income high. It also helps you more efficiently manage your tax liabilities. It may sound basic, but diversification and generating income with tax efficient capital gains can be worth a lot more than 7%!

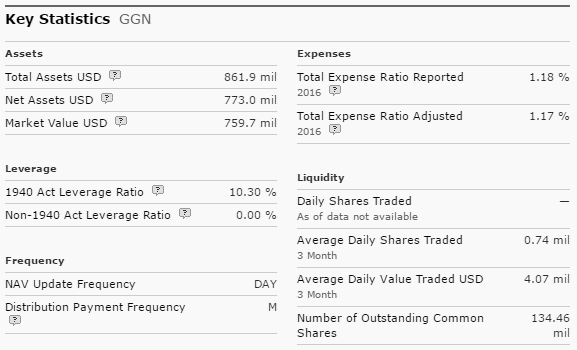

8. GAMCO Global Gold Natural Resources & Income Trust (GGN), Yield: 10.6%

If you are a contrarian, income-focused investor, and you’re concerned about inflation, then you may want to consider the GAMCO Global Gold, Natural Resources & Income Trust. This is a closed-end fund (“CEF”) that offers a 10.6% yield (annualized), paid monthly. The fund also trades at a discount to its Net Asset Value (-3.17%).

Further, the fund has 94 holdings, diversified mainly across “metals & mining” and “energy & energy services.” These allocations are attractive from a contrarian standpoint (i.e. these categories have underperformed the market as shown in the chart below), and if you are concerned about protecting your assets from the threat of inflation (real assets are often used as an inflation hedge, and considering the monetary policies since the financial crisis, inflation protection may soon become increasingly important).

The Fund seeks high current income with capital appreciation through investment in equity securities issued by gold and natural resources industries and through utilizing an options strategy (mainly covered calls). The fund uses a very conservative amount of leverage (10.3%) relative to many closed end funds that often lever up to 30%, or more. Plus, the management fee (1.17%) is very reasonable for a closed-end fund.

For reference, the top 5 holdings in the fund recently included the following.

Further, the fund is managed by GAMCO, a highly-respected firm founded in 1976 by Mario Gabelli. You can learn more about this particular closed-end fund in its fact sheet here. Overall, if you are looking for significant yield, and a contrarian inflation hedge, trading at a discount to its NAV, then GGN is worth considering.

And for reference, you can access some of the latest data from Morningstar on this fund here.

Collecting Insurance Premiums (selling puts) – Not all volatility is bad!

We often utilize options to generate additional high income and to gain access to attractive value stocks. For example, the “insurance writing” strategy (selling put options) we describe below takes advantage of investor fear and market volatility. It can also generate an annualized income stream exceeding 10%. The “downside risk” of this strategy is that we could end up owning an attractive company at a greatly discounted price.

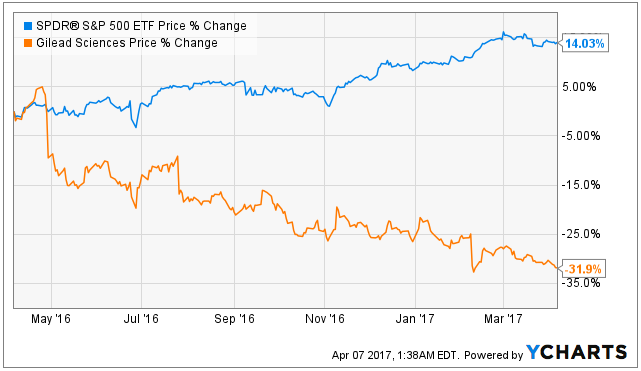

7. Gilead (GILD) Options, Annualized Yield: +10%

If you are a contrarian income-focused investor, the healthcare sector offers a variety of interesting opportunities given the ongoing Affordable Care Act "Repeal and Replace" efforts and news cycles. For example, many investors remain fearful of biopharmaceuticals company Gilead, and this has created an attractive high-income value opportunity within the options market. In addition to Gilead, we consider Omega Healthcare and Welltower (including selling Welltower puts) to be attractive opportunities for income-focused value investors. You can read our full write-up here.

6. Omega Healthcare Investors (OHI), Yield 7.3%

Omega Healthcare Investors (OHI) is an attractive, big-dividend (7.3%), real estate investment trust (REIT). Omega price is just starting to perk up this year but it has still delivered very poor performance over the last 12 months because of macroeconomic headwinds that caused REITs to pullback, heightened Affordable Care Act (ACA) uncertainty (especially following the recent “repeal and replace” effort failure by the US Congress), and the market’s overly pessimistic view of skilled nursing facilities (for example, short-interest is significantly high). We believe these three big risks (i.e. macroeconomic headwinds for REITs, ACA uncertainty, and overly pessimistic sentiment) have created an attractive opportunity for diversified long-term investors. We currently own shares of Omega. We wrote about Omega late last fall, and you can read that full write-up here.

The Top 5

The Top 5 attractive 7% yields are reserved for members only. We believe the investment ideas presented thus far are worth considering, but the top 5 are extremely attractive for income-focused value investors. In fact, we own all five of the top five. If you are not currently a member, consider joining today.