STAG Industrial (STAG) is a REIT that pays a big monthly dividend (5.0%), and it's been delivering outstanding price returns, but it's also riskier than many investors realize. This article provides an overview of STAG's strategy, details on the three main factors that drive its price performance, an explanation of why it has performed well in its relatively short life, why investing in the company is a little bit like "lipstick on a pig," an explanation of what could happened to STAG's price, and our views on how to "play" an investment in it.

About STAG

STAG Industrial (STAG), Inc. is a real estate investment trust ("REIT") focused on the acquisition and operation of single-tenant, industrial properties throughout the United States. It also offers a big (5.0%), relatively well-covered (83.9% AFFO payout ratio) dividend that is paid monthly.

Further still, STAG has been delivering very strong total returns (dividends plus price appreciation) since it's became public as shown in the following chart:

One of the things that makes STAG unique is its strategy. Specifically, the company invests in industrials properties that have historically been considering too risky for other REITs to consider. However, STAG believes by constructing a portfolio of "less desirable" properties, it can reduce the risk through diversification, while simultaneously keeping expected returns high.

And to some extent, STAG's strategy makes sense. Specifically, constructing a diversified portfolio can reduce risks and keep total expected returns high, when done correctly. The problem with the company's properties is that even though they diversify across many properties (more on this later), they're still concentrated in "non-primary location" industrials properties, and when the economy eventually turns south, STAG may suffer much more than the overall economy because of its risks (more on this later).

Three Factors That Determine The Stock Price

There are three very significant factors that investors should consider with regards to how STAG's stock price moves:

(1) STAG is highly sensitive to the market cycle. For example, here is a closer look at its recent stock price:

It's important for investors to recognize that when the market pulls back, STAG generally pulls back more. The above chart shows this was the case when the market dipped in mid-2015 and early 2016, as the company's price pulled back even more than the market (as measured by the S&P 500 (SPY)). This is because STAG is more sensitive than the average stock to overall economic and market moves. For example, its beta is over 1 (currently 1.41 over the last year, 1.23 over the last three years). The average stock beta is only one, and typically REITs are known for having betas of less than one (because they're usually far less sensitive to overall market conditions). STAG is significantly more volatile and risky than many other REITs.

(2) STAG is the opposite of "recession proof." Even though STAG's price rebounded shortly after the pullbacks in our earlier chart, this may not be the case in a recession. The reason STAG's price has been so strong since it became public is because the company has only existed in an economic recovery period. Market conditions have been ideal for a higher-beta, big-dividend stock like STAG. However, when the next recession does arrive, the company will get hit much harder than the average stock, and it will likely take a very long time to recover (if ever, depending on the severity of the recession) because many of STAG's tenants (which are non-prime location renters) will go out of business (lower-quality companies like STAG's tenants go out of business before higher-quality tenants) and there will likely be no one else available to step in and rent the vacant properties (again because they are not in prime locations).

(3) STAG is highly correlated with other REITs. Because so many stocks trade in baskets, such as ETFs, similar stocks (e.g. REITs) all trade together (their prices go up and down at the same time). In the case of REITs, they're also very sensitive to interest rates. Specifically, because REITs offer big dividends, they've been an alternative to traditional bonds in recent years because interest rates have been so low. But now that interest rates are rising again, bonds are becoming increasingly attractive to some investors instead of REITs. This phenomenon is a significant factor in the movement of STAG's price.

Lipstick On A Pig

They say in real estate, it's all about "location, location, location." STAG owns tertiary properties (not primary locations, not secondary locations, but tertiary location properties). As long as the industrials market is good, so too will the company be likely. But when the cycle turns, STAG will likely falter, and it may fall hard.

For some perspective, let's consider STAG's investment grade credit rating (it's currently rated BBB). However, this investment grade credit rating is a little like what led to the financial crisis: bundling up a lot of less desirable loans (in this case, non-investment grade tenants) and saying because of diversification they're now investment grade (again, STAG is rated BBB, investment grade). We don't believe its price is going to come crashing down anytime soon (in fact, it'll likely keep going higher for as long as the economy remains strong), but when the market turns (and it eventually will), STAG will fall, and it may fall hard.

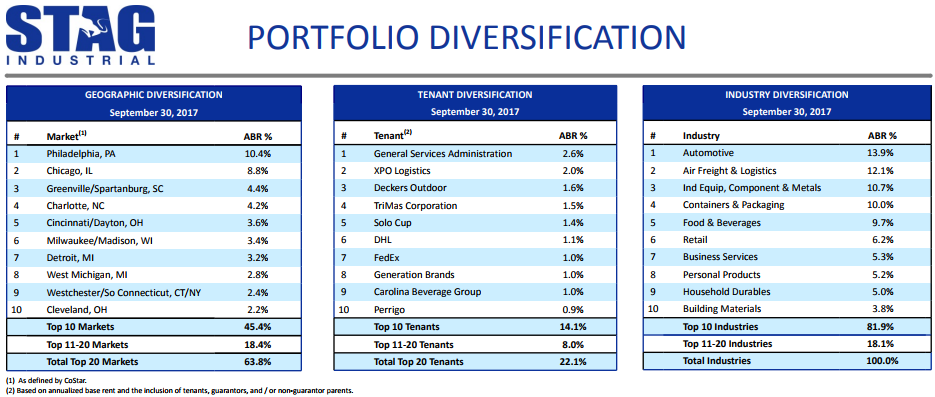

The company likes to brag about its strong diversification. For example, see the chart below:

But remember, STAG is not really as strongly diversified across industries as the above chart may lead you to believe. Specifically, even though it owns real estate across different industries, it's still almost entirely industrial real estate that is located in less desirable (non-prime) locations. So what we are saying is that when "the stuff hits the fan," STAG's diversification likely won't really have as much value as management seems to want investors believe.

Next check out this peer comparison that management likes to brag about:

Management claims STAG is more attractive than peers because it pays a higher dividend and it trades at lower valuation multiples. But in reality this is NOT because it is more attractive, but rather it's indicative of STAG's higher risks. The market recognizes these risks, and STAG's price has adjusted accordingly. The company is more risky than many of its peers.

What Could Happen To STAG In The Future

If the market keeps booming like it has since Donald Trump won the election, then STAG will likely do alright (it has been facing rising interest rate headwinds, but it's also been able to raise rents and business has been strong). But recall the three factors that affect STAG's stock price as described earlier. Things could get very bad for the company. Specifically, when the market cycle turns, industrials will boom less. More specifically, industrial-related stocks are early stage cycle rallying stocks, as shown in the following chart:

And secondly, if we enter a recession (it typically happens once every 8-9 years, give or take a few), then STAG will likely fall, and it will likely fall hard (for the reasons described earlier).

Conclusion

Despite the risks, we believe STAG remains an attractive REIT with more room to run, and for this reason, we've ranked it #8 on our recent list of Top 8 High-Income REITs Worth Considering. However, STAG is not as safe as many investors seem to believe (and for this reason we didn't rank it higher on our list).

Specifically, it's important for investors to understand what they are investing in (i.e. non-primary, non-secondary, but yes many tertiary property locations), and to understand how STAG's price will likely react under different market conditions. For example, when the market pulls back, the company tends to pull back more (this can create an attractive opportunity to add shares, so long as you believe the pullback isn't the first leg into a larger market-wide recession). And if you plan on riding your current position in STAG higher, until the next market recession comes, consider owning it within a diversified investment portfolio. For example, when we manage client accounts, we're careful to appropriately diversify across market sectors (not just REITs, and certainly not just industrial REITs).

Overall, as long as the economy keeps booming, so too will STAG likely keep booming. But when the next recession hits (depending on severity), STAG may get slaughtered. Specifically, the company may lose lots of tenants if/when the market turns south, and be unable to replace them because of the less sought-after tertiary locations of many of STAG's properties. STAG has more room to run, but watch it closely.