As the Yahoo data breach cloud hangs over the Verizon acquisition, it's worth considering just how much Verizon needs Yahoo (for the cash flow and for the growth potential) as we've written about in the past...

There are a variety of relatively easy fixes that could unlock tremendous value for Yahoo shareholders (e.g. cost cutting, focus, patience, and realigning the workforce), but the leadership team is so prideful and dysfunctional that they’re going to let “anyone-other-than-shareholders” (e.g. private equity, Verizon, or other) recognize these huge profit opportunities.

Verizon and AT&T are big dividend, low volatility, stocks that are exposing themselves to new risks as their business models evolve. Yahoo recently announced it is considering a sale of its core business, and if Verizon or AT&T were to acquire it (which they might), they’d cut its costs to the bone just to feed their big dividends. Verizon and AT&T shareholders should be aware of potential dividend policy changes and price return differences as the companies take on new risks.

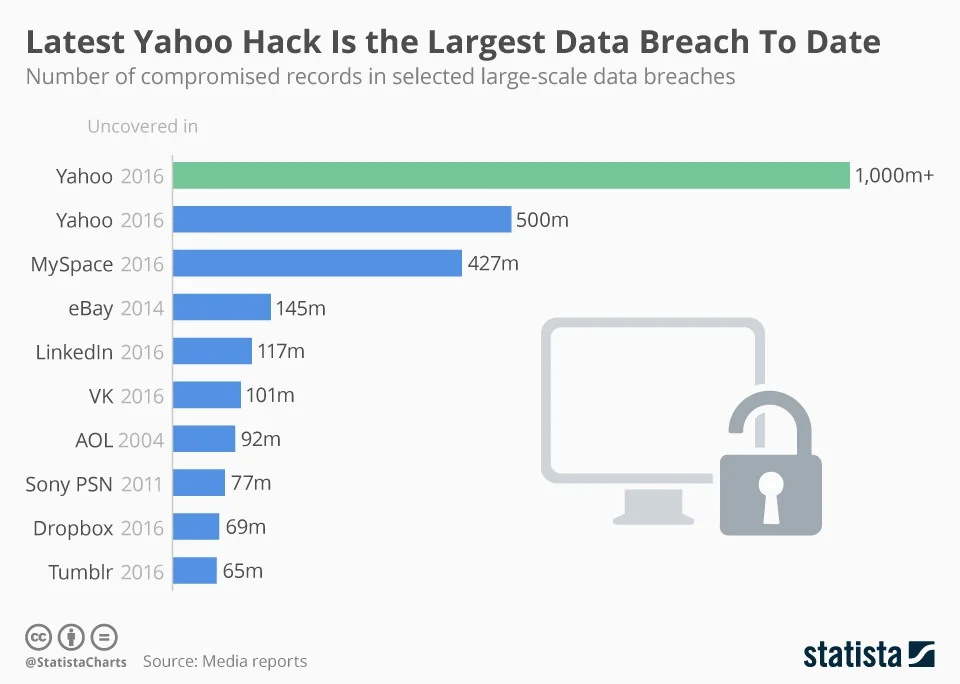

And to keep things in perspective, here is a reminder of just how big the Yahoo data breach was...

And for reference, you can read our most recent Verizon report here...

When Verizon conducts its quarterly conference call in a little over a week, we will perhaps learn more about its plans for acquiring Yahoo since the recent revelation that Yahoo’s data breach was dramatically more far-reaching than originally reported. We believe Verizon still needs Yahoo for two big reasons...