If you are an income-focused investor, and you believe in the power and safety of real assets, then this particular closed-end fund (CEF) may be worth considering. Especially from a contrarian standpoint because its two largest sector exposures (equity REITs and Utilities) have recently underperformed the rest of the market, and the fund is currently trading at an attractive discount to its net asset value.

Diversified Real Asset Income Fund

(ticker: DRA, Yield 8.3%)

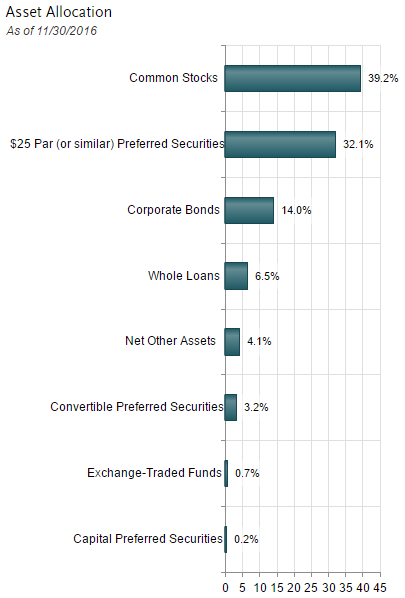

The investment objective of Nuveen’s Diversified Real Asset Income Fund (DRA) is to provide a high level of current income and long-term capital appreciation. The fund invests across the capital structure in mainly common stocks, preferred stocks and corporate bonds, as shown in the following chart.

And the fund’s investment strategy is to focus on infrastructure and real estate securities, and that bears out in the fund's top 5 industry exposures, as shown in the following table.

Additional fund characteristics worth considering are included in this next table.

From a diversification standpoint, the fund is well-diversified across 322 holdings, 37.9% of which are non-US. And the holdings are spread across large-, mid- and small-cap companies. As for the bond holdings, they have an average coupon of 6.3%, and they trade at roughly $0.79 on the dollar. The higher yield and discounted prices indicate that the fund’s management team believes the market is overly pessimistic about the bonds in the portfolio (i.e. management is not just buying them for the yield, they’re also likely expecting some capital appreciation too).

Sources of Income:

You may be wondering how the fund generates an 8% yield when the bonds it holds pay only a 6% coupon and the stocks it owns generally yield a considerably lower amount (in the general range of 3% - 5%). The main answer is leverage, but the fund also has the ability to generate additional cash for distributions via capital gains and in rare cases a return of capital. However, thus far, the fund has only generated income from the income on its investments as shown in the following table (note: the fund’s inception date is 9/8/2014).

Also important to note, because the fund has been paying out only income, the distribution amount has varied as shown in the following graph.

However, based on the fund’s current holdings, it should have no problem generating a continued high monthly distribution payment for its shareholders. And the distribution payment will continue to vary so long as the fund continues to pay out only income. However it’s important to recognize the fund does have the ability to distribute income from capital gains (and in rare cases a return of capital) if need be.

Contrarian Opportunity:

In addition to the big monthly distribution payments, we also like this fund from a contrarian standpoint. First, the fund’s two largest sector exposures, REITs and infrastructure/utilities (benchmarked by the Real Estate and Utilities ETFs, XLRE and XLU, respectively) have recently underperformed the market (as measured by the S&P 500) as shown in the following chart (bear in mind, these returns are price returns, not total returns – they don’t include the dividends/distributions).

We can argue the reasons why real estate and utilities have underperformed lately (e.g. rising interest rates impact these highly levered sectors more negatively, or bullish market sentiment has made these “safe haven” sectors less attractive), but the important observation is that they have underperformed, and from a contrarian standpoint this may be attractive (e.g. what performed worst last year, often performs better this year, and “mean reversion” is real). Additionally, if the soon-to-be aligned White House and Congress follow through on the heavy infrastructure spending that many people expect, this could be a boon for infrastructure and utilities stocks, and the coming inflation could make real assets (such as real estate) appreciate in value nicely.

Discount to Net Asset Value:

Another contrarian reason we consider this fund attractive now is because it currently trades at a big discount to its net asset value (NAV) as shown in the following chart.

Specifically, because DRA is a closed-end fund, its price can deviate significantly from the aggregate market value of all of its individual holdings (i.e. its NAV). The possibility of trading at a large discount (and sometimes a premium) is simply a characteristic of closed ends funds (largely because CEFs don’t have creation units like ETFs), and in this case we consider it attractive (we’d rather buy the shares at a discount than a premium). We could argue the reasons why the large discount grew in 2016 (for example, aversion to interest rate sensitive and safe haven sectors like real estate and infrastructure could have increased the selling pressure on this fund, and supply and demand caused the discount to grow), but the point is that the discount has grown and it creates a more attractive buying opportunity, in our view (remembering, of course, there are no guarantees the discount will ever go all the way back to zero, and it could actually get bigger).

Risks:

In addition to the attractive qualities of this investment opportunity, it is also important to consider some of the more significant risks involved with investing in DRA. For example, as we just mentioned in the previous paragraph, there is no guarantee that the discount will ever get better, and it could actually get bigger which would be a detractor from your long-term investment performance.

Leverage: This fund uses a relatively significant amount of leverage, and that is a risk. Specifically, the fund’s current leverage ratio is 29.45%. This means for every $1 this fund has, it can get exposure to approximately $1.29 worth of investments. This can be very attractive in the good times (i.e. when the market goes up, this fund could go up more) but it can also be very unattractive in the bad times. For example, if the market declines, this fund could decline more (because of the leverage), but it could also be forced to sell its holdings at distressed levels to maintain a reasonable distribution to meet investor needs if the individual holdings in the fund cut their dividends or default on their interest payments. It’s generally not good to be forced to sell things at distressed prices.

Management Fees: Another risk factor for this fund is the management fee. At Blue Harbinger, we generally despise management fees because we understand fees detract from long-term investment performance. However, in some cases, it may be acceptable to pay the management fee. For example, if you are a mature, retired (or semi-retired) investor, and you need the regular big distribution payments to meet your living expenses, then it may be worthwhile to invest in this fund. However, if you are a younger investor still saving for retirement, then this fund is probably NOT a good investment for you (i.e. you’d be better off investing a very low cost ETF because you don’t need the big distribution payments yet, and the value of your investment will growth faster over the years as the benefits of the fee savings compound over the years). For reference, this fund’s expense ratio was recently 1.12% which is significant, but not unreasonable for a closed end fund. And for disclosure purposes, this fund’s total expense ratio was 2.22% if you factor in the cost of the leverage it uses (for regulatory purposes, CEFs using leverage must report interest expense as part of their total expense ratio).

Market Exposure: Another big risk of this fund is simply market risk exposure. For example, the majority of this fund’s holdings are equities (common and preferred) and if the stock market declines, this fund will likely also decline. Further, this fund’s equities are concentrated in a few sectors (mainly REITs and utilities) so if these sectors decline, then the fund will likely be impacted negatively. However, worth noting, because of this fund’s big monthly distribution payments, it may be much easier for investors to tolerate the ups and downs of the market. Additionally, funds that pay big regular distribution payments (like this one) generally decline significantly less when the overall market declines (i.e. the big distribution payments help cushion it from declines).

Conclusion:

If you are a contrarian, income-focused investor, this Diversified Real Asset Income Fund (DRA) may be worth considering. Specifically, we like that it provides access to real assets across the capital structure (common, preferred, debt), and we like the specific sectors that it invests in (real estate and utilities/infrastructure). We also believe its currently discounted price (versus its NAV) makes now an even more attractive time to consider this fund for an allocation within your overall, diversified, income-focused, investment portfolio.