Despite the Fed’s recent announcement, artificially low interest rates aren’t going away any time soon, and this continues to create very real challenges for income-focused investors (i.e. it’s hard to find attractive yield). As a result, many investors have shifted their focus to dividend stocks (instead of bonds) because they can offer more attractive yields and the potential for price appreciation. And some investors have taken things one step further by attempting to generate even more income by writing covered calls on the stocks they already own. For example, Cisco Systems (CSCO) is a popular stock with a big dividend (3.3%), it has achieved significant price appreciation this year (it’s up 18.4% versus only 7.6% for the S&P500, on a total returns basis), and it may seem like an attractive covered call stock to many income-focused investors. However, we believe now may be a good time to exit Cisco altogether because of the growing commoditization of its main products, the company’s increasing irrelevance with regards to cloud-based data centers and the white box solutions of Amazon and Google, its shifting financial wherewithal, and its recent restructuring. We offer four specific options that we consider more attractive than Cisco covered calls for long-term income-focused investors.

Generating Income with Covered Calls

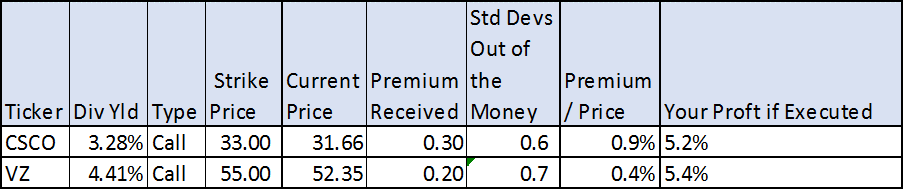

Yes, the Fed’s artificially low interest rates have successfully forced many savers to invest more heavily in stocks (this is how the Fed has been trying to stimulate the economy), but what the Fed perhaps did not correctly anticipate is how heavily those investors would skew towards stocks with big dividends. Another perhaps unexpected result has been the increasing use of options by some investors to eke out extra income. For example, covered calls. If you don’t know, writing covered calls is a strategy whereby investors sell a call option on a stock they already own thus giving someone else the right to buy that stock away from them in the future at a predetermined price in exchange for an upfront premium. The premium is a source of income for the call seller, and they get to keep the premium whether or not the call option is ever exercised before it expires. For example, the current premium for selling Cisco call options with a November 18, 2016 expiration date and a $33 strike price is $0.30 (more on this example later).

About Cisco

Cisco is a supplier of data networking equipment and software, and it pays a big dividend (currently 3.3%). And like many other big dividend stocks, it has experienced significant price appreciation this year as shown in the following chart:

For a variety of reasons, we believe the market is overly optimistic about Cisco, and the price has gotten ahead of itself. But before getting into our views on the company, we first review the bull case for Cisco.

The Bull Case for Cisco

If you value stocks based only on historical data, Cisco is extremely attractive. Not only does it have a big growing dividend (it yields 3.3%, and the dividend payment has been increasing sharply since 2011), but it also has a mountain of cash ($65.8 billion on its balance sheet), and it generates massive free cash flow ($12.4 billion for their year ended July 31st). It also has a wide operating margin, and its return on capital invested (40.8%) is enormous. And if you factor in a small 2% annual growth rate, a discounted cash flow model (assuming a 9.2% weighted average cost of capital) suggests that Cisco is worth more than $214 billion once you adjust for cash and debt. That’s about 35% upside versus its current stock price. The problem: we believe the 2% growth rate is overly optimistic, and it will be much more challenging than it was in the past for Cisco to grow at all.

Our View on Cisco

We believe Cisco may not achieve the level of growth the market expects for a variety of reasons. For example, competition may put significant pressure on Cisco’s margins. Specifically, HP and Dell offer lower cost switching products. Switching is Cisco’s largest source of revenue as shown in the chart below.

Further, Chinese manufacturers (such as Huawei and ZTE) could increasingly detract from Cisco’s Asia-Pacific revenues and margins. For reference, the following table shows Cisco’s revenue breakdown by geography.

Another reason we believe Cisco’s growth may be challenged is because the industry may shift to white box cloud solutions. For example, Amazon and Google have roughly one million servers installed and connected with white-box solutions (note: a white-box is a server without a well-known brand name). This trend could significantly slow growth in Cisco’s large switching and routing businesses, and it could also cause Cisco to lower prices (thus reducing margins) just to be competitive.

Another reason we believe Cisco’s growth may be challenged is simply because the market may be over-optimistically extrapolating past results. For example, this price-to-earnings chart (below) suggests Cisco may be relatively inexpensive, but the earnings part of the ratio is only backwards looking.

According to Goldman Sachs, three of the key levers that have driven historical earnings-per-share growth for Cisco are now largely exhausted. First, server share gains are now leveling off. Second, operating margins are now at a 10-year peak (i.e. they may get worse in the future). And third, share buybacks may slow now that the dividend has recently been increased again.

Another reason we believe Cisco’s growth may be challenged is because of the current restructuring plan. Cisco recently announced:

“a restructuring enabling us to optimize our cost base in lower growth areas of our portfolio and further invest in key priority areas such as security, IoT, collaboration, next generation data center and cloud. We expect to reinvest substantially all of the cost savings from these actions back into these businesses and will continue to aggressively invest to focus on our areas of future growth.”

First of all, the restructuring plan is an admission that business as usual is not good enough. And second of all, the restructuring introduces new risks, and there is no guarantee that the plan will even work.

Earlier, we valued Cisco using a discounted cash flow model and a 2% growth rate, but if the factors listed above (e.g. competition, industry changes, financial wherewithal, and restructuring) negatively impact growth and margins, and Cisco’s growth slips to, for example, negative 2%, then the company is currently overvalued. And even though Cisco’s dividend is likely safe for many years to come, why invest in a stock with potentially zero (or negative) upside when there are so many better opportunities. Even after factoring in the extra income from selling covered calls, we believe there are better options than Cisco for income-focused investors.

4 Better Income Generating Options

For your consideration, here are four opportunities that we consider better options for generating income than writing covered calls on Cisco.

1. Verizon (VZ): Writing Covered Call Options

We consider Verizon covered call options more attractive than Cisco covered call options for a variety of reasons. For starters, we’d rather own Verizon instead of Cisco. Not only is Verizon’s dividend bigger (4.4% dividend yield), but its business is more stable, predictable, and less likely to deliver negative surprises. Yes, Cisco has wider margins and high returns on capital, but we believe those may shrink causing the stock to potentially lose more value than you’d make by writing the calls. And even though the premium on Verizon calls is smaller than the premium on Cisco covered calls, we believe the combination of dividend, plus call premium, plus price safety makes Verizon a more attractive covered call stock than Cisco. We like the November 18, 2016 calls with a $55 strike price because even if the shares get called you’ve still picked up 5.4% gains (premium plus price appreciation) in less than two months, and that doesn’t even included the $0.5775 dividend to be paid on November 1st.

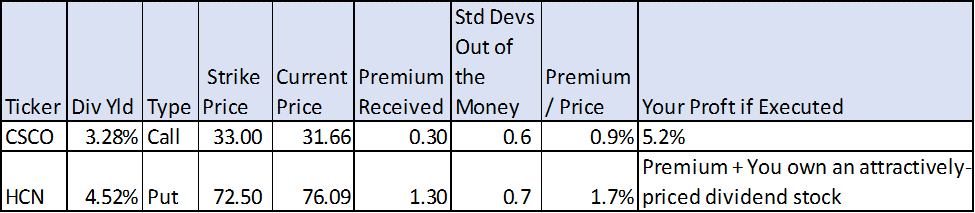

2. Welltower (HCN): Selling Put Options

We consider selling Welltower put options more attractive than selling Cisco call options. Selling put options gives someone else the right to sell a stock to you at a predetermined price. Welltower is a stock we’d like to own (because of the relative safety of its big dividend), but we’re not anxious to buy at the current price (it’s significantly outperformed the S&P 500 on a total returns basis this year). The puts allow us to collect a premium now and it may result in us buying the stock later at a more attractive price. And not only are many put price premiums significantly larger than similarly out-of-the money call premiums, but we particularly like the November 18th, 2016 puts as shown in the following table because the put premium is nearly double the call premium for options that are a similar (but more conservative) number of standard deviations out of the money.

3. Utilties Sector (XLU): Selling Put Options

The utilities sector ETF has been on a tear this year, and now is a good time to consider selling puts on it. There is some concern that (because of the recent run) utilities are due for a pullback, and for this reason put buyers are willing to pay a healthy premium. For example, the following table shows you can collect an attractive premium for selling puts on safe boring utility stocks.

And if the shares do get put to you then you own a big dividend paying (4.0%), lower risk ETF, at a more attractive price. We consider selling XLU puts more attractive than writing CSCO calls.

4. REIT ETF (VNQ): Selling Put Options

The Vanguard REIT ETF (VNQ) is an attractive way to pick up some extra income (it yields 3.8%) but we’re uncomfortable buying it after its very strong one-year rally. However, by writing puts on this ETF we can pick up some attractive income now, and we may end up owning it in the future at a more attractive price. The following table shows VNQ’s premium relative to volatility compared to CSCO covered call options, and we believe selling VNQ puts is the more attractive option for income investors.

Conclusion

Writing covered calls on stocks you already own can be an attractive way to pick up extra income. However, we don’t recommend the strategy on stocks you wouldn’t want to own in the first place. For example, we believe Cisco Systems is a relatively unattractive dividend stock, and we are not interested in owning Cisco just so we can write covered calls on it. We believe there are more attractive options for increasing income, and we’ve described four of them in this article. More research on the stocks mentioned in this article is available in our recent report titled 12 Attractive Equity Options for Income Investors. And if you are frustrated with the Federal Reserve’s artificially low interest rates, you are not alone.