The market sold off hard on Friday (the S&P 500 was down 2.5%) and big dividend stocks sold off harder (for example, the Vanguard REIT ETF was down 4%). For your consideration, we listed below 75 High Yield (>4%) REITs, and then provided specific details for our 12 favorites after Friday’s big selloff.

12. Senior Housing Properties Trust

Senior Housing Properties Trust (SNH) is a big dividend (7%) healthcare REIT that declined a whopping 6.1% on Friday. SNH may be attractive to you if you like the favorable healthcare industry demographics (i.e. the aging population and increasing demand), but you are uncomfortable with the large exposure to government reimbursement faced by many other healthcare REITs. Approximately 97% of SNH’s net operating income comes from private pay properties (investor presentation, p.3) which means they don’t face the same large scale risks as many of their peers if the government changes healthcare reimbursement/coverage amounts and laws. The company’s most recent quarterly normalized FFO payout ratio was 83%, suggesting the dividend payment is well-covered.

11. STAG Industrial

STAG Industrial is a highly-diversified, well-managed, big-dividend (5.9%) Industrial REIT that was down 5% on Friday. Stag operates in secondary and tertiary real estate markets where there is less competition, but also more risk (these properties are not “prime locations”). Stag believes they can reduce the risks by building a diversified portfolio of properties, and they have been able to successfully do so since their initial public offering in 2011.

The following SIOR Commercial Real Estate Index suggests industrial real estate market conditions continue to remain in Stag’s favor (values significantly higher than 100 indicate strong market conditions), but Stag also has a high beta and is very sensitive to market wide downturns (more so than many other REITs).

From a valuation standpoint, the following Funds from Operations (FFO) graphs suggest Stag is attractively priced relative to peers, but the lower valuation is also partially due to Stag’s risks.

If you are comfortable that the sky is not falling, then Stag’s recent price decline has created an attractive entry point.

10. Welltower

Welltower (HCN) is a big-dividend (4.7%) healthcare REIT that sold off 4.7% during Friday’s market tumble. However, the dividend is relatively safe and well covered (HCN’s FFO payout ratio is only 75%, and its FAD payout ratio is 83%). Additionally, FFO continues to grow steadily (as shown in the following chart) while HCN maintains an attractively low beta (closer to zero than one).

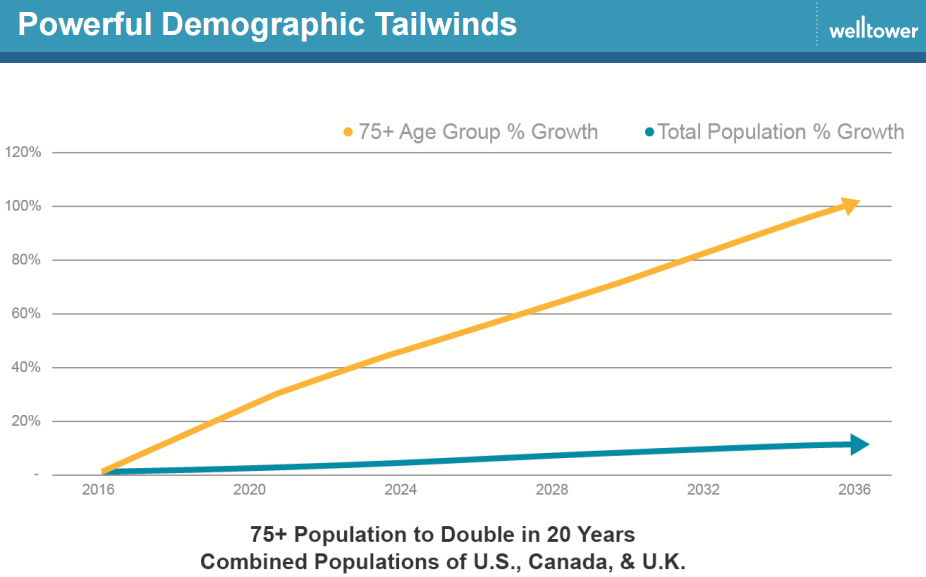

And Welltower’s price to FFO ratio (15.8) is not un-attractive. Further, the firm has a low amount of debt relative to peers as well as some attractive demographic tailwinds at its back as shown in the following two charts.

From a risk standpoint, Welltower faces some risk of changing government reimbursement rates related to skilled nursing facilities, but we believe those risks are already significantly baked into the price. If you’re looking for a relatively safe big dividend then Welltower is worth considering. For additional perspective, you can read our recent full report on Welltower here…

9. EPR Properties

EPR Properties (EPR) is a self-administered REIT, it has a big 5% dividend, and it sold off 3.8% on Friday. And if you are an income-focused investor, it stands out because of its low volatility, attractive diversification, and expected growth. EPR invests in a diversified portfolio across three main segments: Entertainment, Education, and Recreation. We consider EPR an attractive long-term income play, and you can read our recent full report here…

8. Liberty Property Trust

big dividend (4.8%) REIT that was down 4.3% on Friday as the market sold off. And as the following chart shows, LPT has nearly completed its 5-year plan to transition out of suburban office properties and into more industrial and some office spaces.

For some background, Liberty cut its dividend during the financial crisis (like many other REITs did), but it hasn't increased it since then as it has focused on its transition plans. With the transition nearly complete, we won't be surprised to see Liberty resume dividend increases within the next year. The stock price has risen dramatically this year, but it has the portfolio performance to back it up in terms of increased occupancy, increased rentals, decreased leasing costs, and a strong development pipeline. And despite the strong year-to-date performance, Liberty's dividend yield is still attractive and safe. And further, as the company finishes disposing of suburban office assets this year, an attractive special dividend could be in the works. You can read our full report on Liberty from earlier this year here….

7. HCP Inc.

HCP Inc. is an attractive big dividend (5.9%) healthcare REIT that has significantly underperformed its REIT peers this year, and it was down 3.7% on Friday. Year-to-date HCP has underperformed because the market is overly fearful about challenges with its largest tenant (HCR ManorCare) and its upcoming spinoff of that tenant into a separate standalone REIT. However, we believe the risks are more than baked into the price, and HCP has significant profitability ahead. Plus, its valuation is attractive as shown in the following chart

Important to note, not all of the healthcare REITs in the chart are the same, particularly with regards to their exposure to skilled nursing. Specifically, Omega Healthcare (OHI) is focused on skilled nursing (and assisted living), whereas Ventas (VTR) already spun off its skilled nursing, and Welltower (HCN) and HCP still have some exposure to skilled nursing. The point is that skilled nursing is perceived to be riskier, and therefore commands a lower price to FFO ratio, and this is reflected in the graph. Also important, based on its current business mix, HCP is not particularly overpriced. If you can get comfortable with the HCR ManorCare risks, then we believe HCP is worth considering. You can read our recent full-report on HCP here…