On Friday, the market immediately tumbled from its earlier highs when Fed Chair Janet Yellen said:

“In light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months.”

Many higher yielding REITs were hit particularly hard by the prospect of higher rates because it may soon be more expensive for them to borrow the money required to operate their businesses, and because rising rates may shift investor demand to other income generating opportunities. We ran a screen to identify stocks yielding over 6% (we also required a minimum $500 million market capitalization and at least $250 million in annual sales) and there were 20+ REITs in the results. Of the 20+ REITs, we believe three in particular are worth considering because of their well-managed balance sheets and compelling long-term strategies.

The following table shows the REIT results of the 6% yield screen we described previously, and many of them were down sharply on Friday following Janet Yellen’s hawkish tone.

Of these 20+ REITs, we believe three in particular are worth considering.

Lexington Realty Trust:

Lexington Realty Trust (LXP) is a higher yield (6.4%) self-managed and self-administered REIT that owns a portfolio of equity and debt investments in single-tenant properties and land. It was also down 2.2% on Friday following the Yellen’s statement. We consider Lexington attractive for a variety of reasons including its manageable debt load, its low FFO payout ratio, its low price to FFO ratio, its diversified investment portfolio, and its laddered lease maturities.

For example, the following table shows Lexington’s debt maturity profile and describes efforts to manage its exposures.

Also attractive, Lexington has a low FFO payout ratio, and a relatively attractive price to FFO ratio.

Additionally, Lexington’s investments are well-diversified without any overly concentrated exposure to a single tenant.

And its lease expirations are well spread out.

Finally, we appreciate Lexington’s efforts to more attractively position its investment portfolio as shown in the following graphic.

Investors Real Estate Trust:

Investors Real Estate Trust (IRET) is a higher yield (7.8%) self-advised equity REIT that owns a portfolio of primarily high-quality multifamily and healthcare properties. It was down 2.1% on Friday following Yellen’s statement. We consider Investors Real Estate Trust to be attractive because of its well-managed balance sheet, and its competitive advantages as it shifts to become the only pure-play multi-family REIT.

For starters, the following chart shows IRET’s debt to assets ratio is approximately 50% which is not unreasonable relative to peers, and it helps manage IRETs exposure to rising interest rate risks.

Additionally, IRET’s debt is well-laddered (as shown in the following chart) which also helps it operate efficiently as interest rate expectations evolve over time.

We also believe IRET has some competitive advantages as it transitions into a pure-play multi-family REIT. The following chart shows the progress of the transition so far.

Regarding competitive advantages, IRET is uniquely positioned to buy and operate multifamily assets in the Upper Midwest. For example, IRET can quickly bring institutional capital to buy institutional-quality assets when competing with local private investors.

Senior Housing Properties Trust:

Senior Housing Properties Trust (SNH) is a higher yield (7.1%) healthcare REIT. It was down 1.8% on Friday. We consider SNH attractive for a variety of reasons including its limited exposure to government funding, its diverse geographic and tenant exposure, its attractive FFO payout ratio, its laddered debt maturity schedule, its low G&A expenses, and its attractive long-term growth opportunities.

For starters, SNH has limited exposure to government funding (skilled nursing in particular) which is a good thing considering the risks of changing healthcare laws which can (and has) quickly changed the profitability of some healthcare REITs.

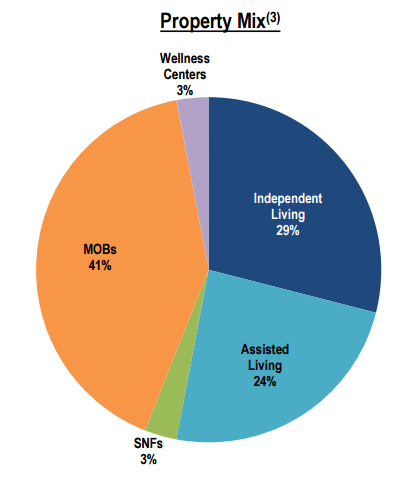

SNH also has diverse property-type and geographic exposures.

Also, SNH’s FFO payout ratio is an attractive indication of dividend sustainability.

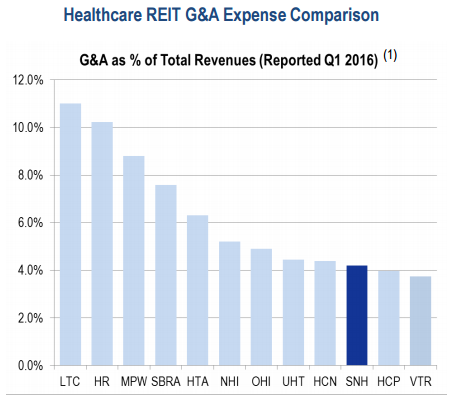

Further, SNH’s balance sheet debt is scheduled to mature at laddered intervals, and its general administrative expenses are very low relative to its peers as shown in the following charts.

Finally, SNH has attractive long-term demographic growth opportunities as suggested by the following chart.

Conclusion:

REITs have enjoyed a rally this year. And despite the Fed’s increasingly hawkish tone, many of them will be able to easily maintain their big dividend payments. Realistically, it remains unlikely the fed will raise rates enough to scare investors away from REITs. We prefer REITs with well managed balance sheets (i.e. lower amounts of debt with laddered maturities) and compelling long-term investment strategies (such as the three mentioned in this article). And if you are interested in non-REIT investments with big yields, you can access the full results of our 6% yield screen here.