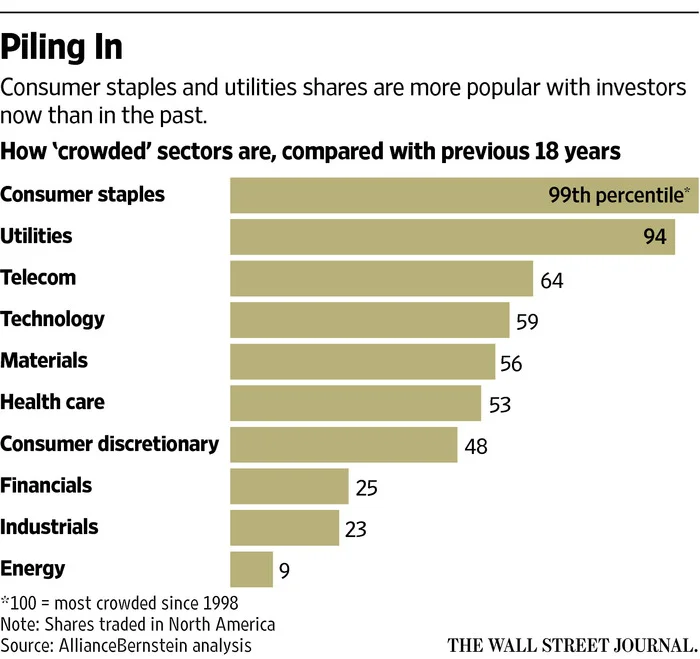

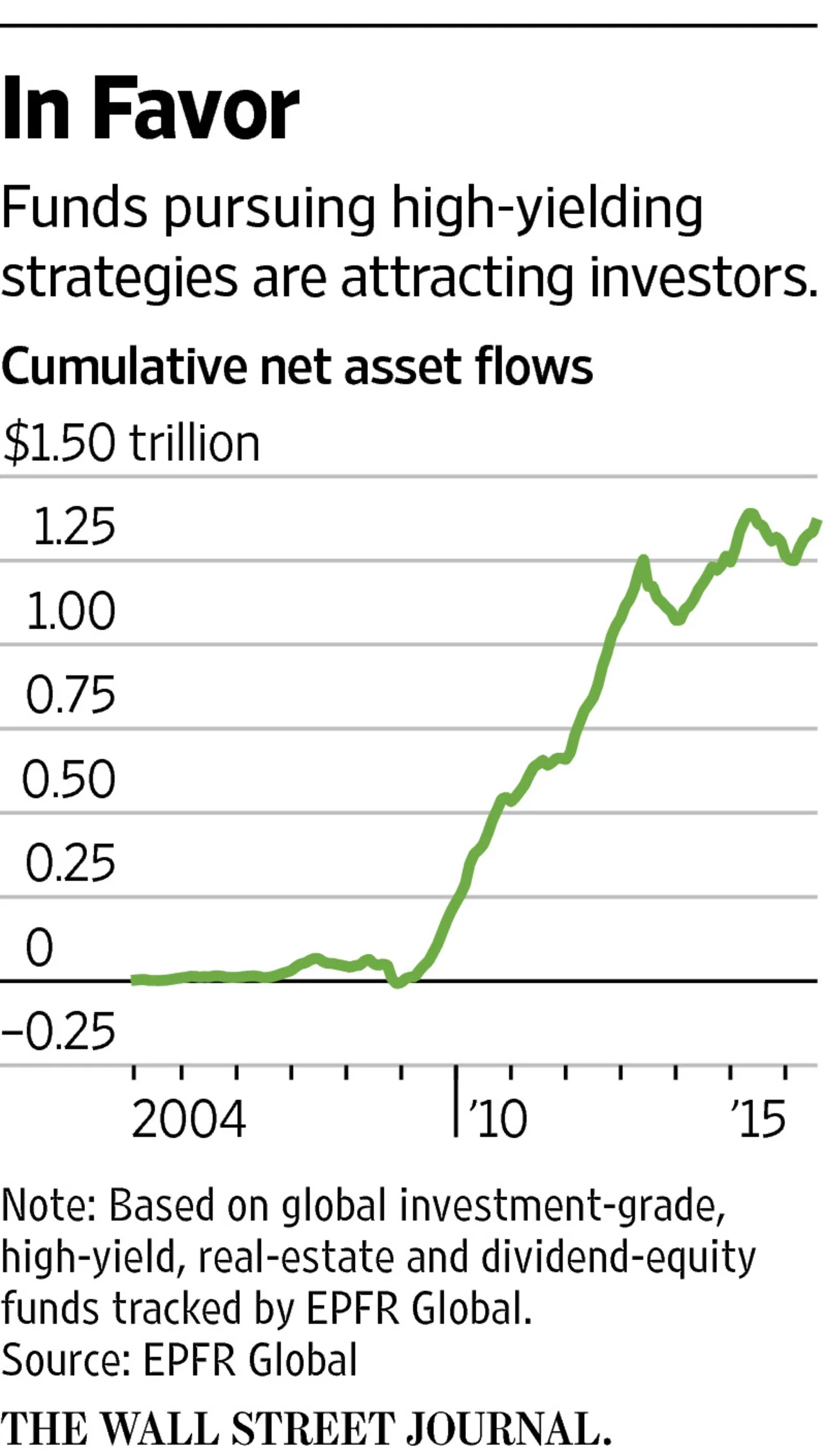

...a person who takes an opposing view, especially one who rejects the majority opinion, as in economic matters*. With regards to investors, Warren Buffett has described the "3 I's."** First come the innovators, who see opportunities that others don’t. Then come the imitators, who copy what the innovators have done. And then come the idiots, whose avarice undoes the very innovations they are trying to use to get rich. Check out these overcrowded trades...

In our view...

...two of the most important characteristics of a good investment strategy are:

Diversify: Don't pile all your investments into the same sector, and certainly don't pile into the most crowded trades as a Johnny-Come-Lately.

Do Your Homework: Understand your investments. Fundamental analysis is key. For example, just because something pays a big dividend doesn't mean it's a good investment.