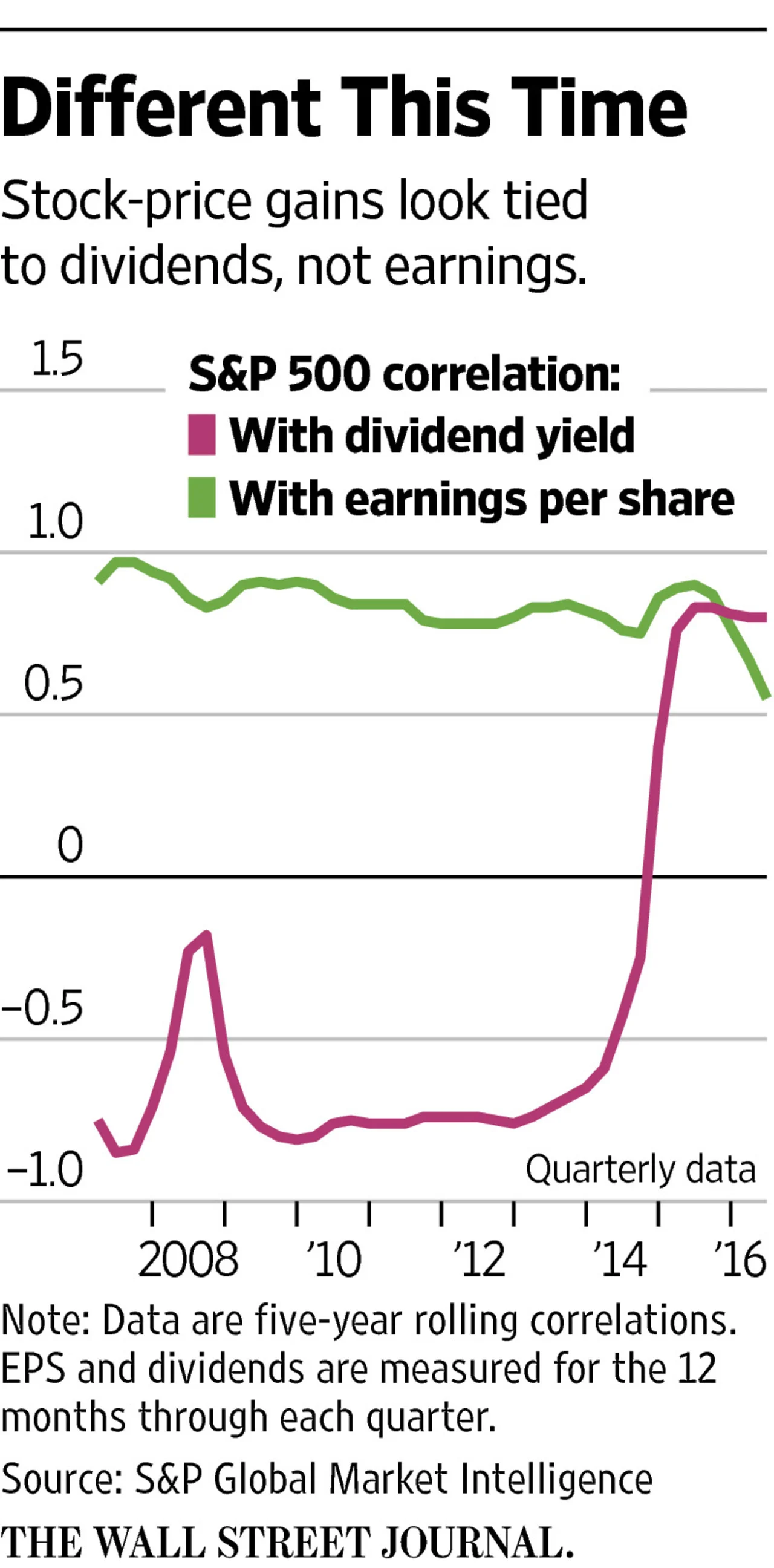

Income investors are frustrated with artificially low interest rates, but this chart really helps put that into perspective. Rather than being driven by earnings, S&P 500 stock returns are being driven by the size of their dividend yield. The bigger the yield, the better the return. At least that’s seems to be the case as shown by the five-year rolling correlation between S&P 500 companies’ dividend yield and the index’s performance.

For added perspective on the dividend stock frenzy, look to big-dividend preferred stocks. According to the Wall Street Journal:

"A kind of buying panic has broken out. The iShares U.S. Preferred Stock exchange-traded fund, which seeks to track the market, has taken in $2.2 billion in new money so far this year. Historically, the price of preferred stocks almost never rises, with virtually all their return coming from the fixed dividend rates they offer; this year, however, nearly half the 7% total return of the S&P preferred index has come from climbing prices."

The risk with preferred stocks is that many of them could get called at par which is significantly lower than their current market prices. And this does happen. For example, in 2007 preferred stocks lost 12.2%, in 2008 they lost 25.8%, and in the third quarter of 2011 alone they lost 7.6%.

Because of the risks associated with chasing only one type of undiversified investment (such as high dividend payers) we prefer to diversify across many categories including high yield, value stocks, ETFs, market capitalizations, market sectors and geographies, to name few. Such diversification helps minimize risks, but still allows for investments to be catered towards a particular need. For example, the Blue Harbinger Income Equity strategy focuses on income-paying equities, but it does so in a diversified fashion. More information about all of Blue Harbinger’s investment strategies is available on our membership page:

Finally, famous value investor Warren Buffett is often quoted for having said: “be fearful when others are greedy and greedy when others are fearful.” When it comes to dividend stocks, it seems some investors may be starting to get a little bit greedy.