American Capital Agency (AGNC) is a real estate investment trust (REIT) with a huge 12.6% dividend yield. It trades for less than its book value, and we agree with management’s view of “lower for longer” interest rates. The company’s 7.3x leverage ratio is reasonable and manageable, barring any extreme market events (such as another housing crisis or a rapid rise in interest rates). If you can get comfortable with the tail risks, then American Capital’s huge monthly dividend payments are worth considering.

About

American Capital’s principal objective is to preserve its net asset value (book value) while generating attractive risk-adjusted returns for distributions to stockholders through regular monthly dividends (American Capital homepage). The company accomplishes this goal through a combination of net interest income and net realized gains and losses on investments (it invests in mainly agency mortgage backed securities). American Capital’s monthly dividend payment is currently $0.20 per share (the share price is $19), and its current book value ($22.09) suggests the market may be undervaluing the stock considering it trades at a 14% discount to book value. And for reference, the following charts shows American Capital’s current portfolio mix, leverage ratio and book value per share history.

Also worth noting, American Capital has generated outstanding total returns (dividends plus price appreciation) since its IPO in 2008 as shown in the following chart.

Risk Factors

American Capital faces a variety of risk factors that should be considered by investors. Perhaps the greatest risks are related to the challenges the company would face if another housing bubble and/or financial crisis were to occur. The chance of these events seem remote considering the new regulations (e.g. Dodd Frank, Basel I, II and II) and the general risk aversion in place following the last financial crisis, but we still consider them to be remote “tail risk” possibilities. For example, if real estate values decline significantly, then the value of American Capital’s investments would decline significantly, and so would the stock price. The company describes this risk as follows (Annual Report, p.18).

Declines in value of the assets in which we invest will adversely affect our financial condition and results of operations, and make it more costly to finance these assets. We use our investments as collateral for our financings. A decline in their value, or perceived market uncertainty about their value, could make it difficult for us to obtain financing on favorable terms or at all, or maintain our compliance with terms of any financing arrangements already in place.

The company’s use of leverage is another significant risk. American Capital describes this in their annual report (p.17) by saying:

Our strategy involves significant leverage, which increases the risk that we may incur substantial losses. We expect our leverage to vary with market conditions and our assessment of risk/return on investments. We incur this leverage by borrowing against a substantial portion of the market value of our assets. By incurring this leverage, we could enhance our returns. Nevertheless, this leverage, which is fundamental to our investment strategy, also creates significant risks. For example, because of our significant leverage, we may incur substantial losses if our borrowing costs increase or if the value of our investments declines.

Dramatic moves in interest rates pose another significant risk. According to the company’s annual report (p.33) “an increase in market interest rates may cause a material decrease in the market price of our common stock.” For example in the first quarter, the 10-year US treasury declined less than the 10-year swap rate, and this spread had a negative impact on performance. The company describes this risk in their first quarter earnings release (p.27) as follows:

The 10 year swap rate in the U.S. moved significantly during the first quarter, declining 70 basis points from 2.19% at the beginning of the quarter to a low of 1.49% in early February, ultimately closing the quarter at 1.64%, a 55 basis point decline for the quarter. The 10 year U.S. Treasury rate performed slightly better, closing the quarter down 49 basis points. The aggregate spread differential between the market yield on agency MBS and benchmark interest rates underlying our interest rate hedges widened modestly during the quarter and was the primary driver of the -2.2% decline in our net book value per common share to $22.09 per common share as of March 31, 2016, from $22.59 per common share as of December 31, 2015.

Management’s wide range of discretion also poses a significant risk to the company. For example, American Capital’s board of directors has approved broad investment guidelines for management, and as a result the company “may experience significant short-term gains or losses and, consequently, greater earnings volatility as a result of [its] active portfolio management strategy” (annual report, p.16). As another example, management has taken the view that interest rates will remain “lower for longer” and they have positioned their investment portfolio accordingly (Q1 earnings release,p.28). And while we agree with management’s “lower for longer” view, it also poses significant risks to earnings if they are incorrect.

The management structure in general poses risks to American Capital. For example, American Capital’s annual report note that “there are conflicts of interest in our relationship with our Manager and American Capital. Because we have no employees, except for employees of our wholly-owned subsidiary Bethesda Securities, LLC, or BES, our Manager is responsible for making all of our investment decisions. Certain of our and our Manager's officers are employees of American Capital or its affiliates and these persons do not devote their time exclusively to us.”

Additionally, management’s fees are high. Specifically they are 1.38% plus another 0.31% in operating expenses (Q1-16 Investor Presentation, p.17). Worth noting, the management agreement was “not negotiated on an arm's-length basis and the terms, including fees payable, may not be as favorable… as if they were negotiated with an unaffiliated third party.” Also there could be conflicts of interest as noted in the annual report:

Our Manager's management fee is based on the amount of our Equity and is payable regardless of our performance, which could result in a conflict of interest between our Manager and our stockholders with respect to the timing and terms of our equity issuances, share repurchases and the realization of gains and losses on our investment portfolio.

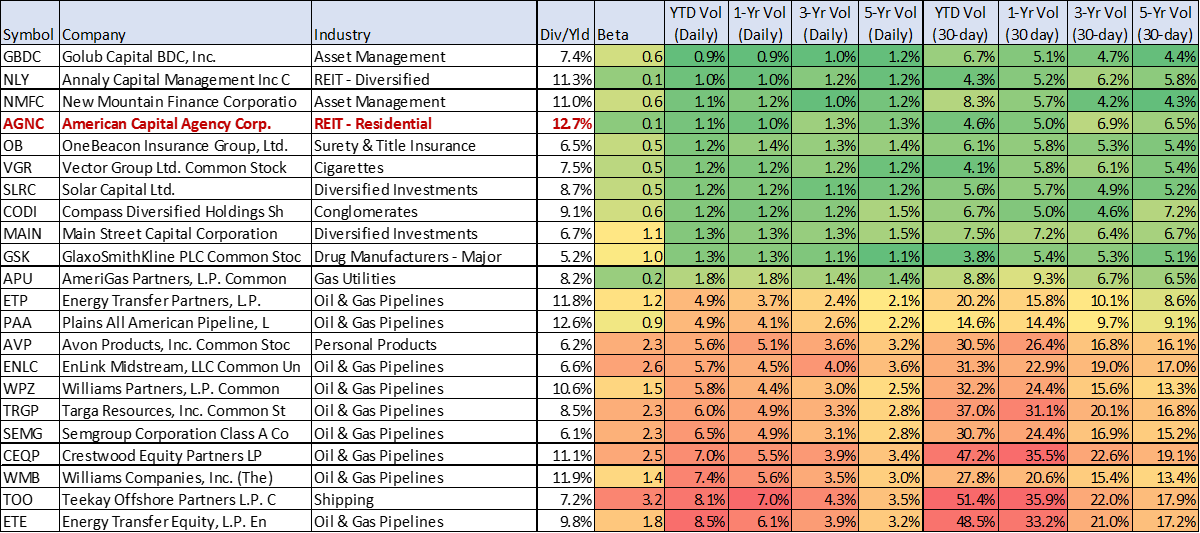

Historically speaking, American Capital’s volatility has been extremely low as compared to other big dividend investments as shown in the following chart.

(the full unabridged version of this chart is available here).

However, past performance does not guarantee future results, and we believe this chart does not capture the unique tail risks American Capital presents (i.e. the havoc that would be created for American Capital if the housing market collapsed again or if interest rates were raised very significantly very quickly). In reality, we believe these tail risks are unlikely, and American Capital may continue to be less volatility relative to many of its big dividend peers. And worth noting, as shown in the chart above, American Capital’s beta is very low. A low beta is a sign of a valuable diversifier within the constructs of a wider investment portfolio.

American Capital’s decision to operate as a REIT also poses significant risks. For example, distributions payable by REITs do not qualify for the reduced tax rates available for some dividends. Also, REIT distribution requirements could adversely affect American Capital’s ability to execute its business plan. Specifically, complying with REIT requirements may cause American Capital to forgo otherwise attractive opportunities.

Worth noting, on January 7, 2016 management announced that it is soliciting offers to purchase American Capital or its various business lines. Management offered no information on the status of the solicitation or the nature of any possible transaction that may result from it. Further, there is no assurance that this solicitation will result in any transaction at all.

Preferred Shares

Also worth noting, American Capital offers preferred shares. The price of the preferred shares (both series A and series B) tend to be less volatile, but they also offer lower dividend yields. We prefer the higher-risk/higher-reward common shares, but the preferreds are cumulative and may interest slightly more risk averse investors. Both the A and B shares trade at small premiums, but the yields are still relatively attractive.

Conclusion

We believe American Capital’s big dividend is attract for a variety of reasons, but it does not come without risks. In our view, the most significant risks (such as another housing crisis or rapidly increasing interest rates) are remote possibilities, and for this reason we have ranked American Capita #15 on our list of 20 Big Yield Investments Worth Considering. It seems most likely that American Capital will have the financial wherewithal to continue paying its big dividend for many years to come, and (as long as you’re comfortable with the risks) we believe it is worth considering this REIT for the higher risk portion of your diversified, long-term, income-focused, investment portfolio.