If you are an income-focused investor, EPR Properties (EPR) stands out. It’s a real estate investment trust (REIT) that offers a big growing monthly dividend (5.0%, annualized), it has exhibited low volatility and attractive diversification benefits, and the market is expecting the business to grow.

About:

EPR currently invests in in over 270 properties located throughout North America.

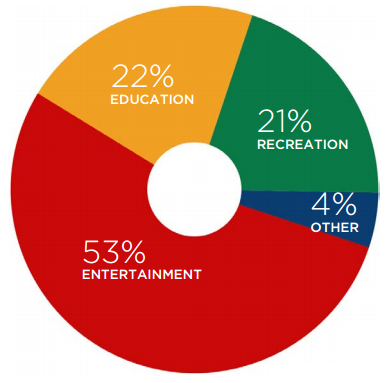

The company’s investment portfolio can be broken down into four primary segments: Entertainment, Education, Recreation and Other. The Entertainment sector is the largest in terms of net operating income as shown in the following chart.

For reference, the Entertainment segment consists of investments in megaplex theatres, family entertainment centers, and entertainment retail centers. The Education segment includes investments in public charter schools, early education centers and K-12 private schools. The Recreation segment consists of investments in metro ski parks, resorts, waterparks and golf entertainment complexes. And EPR’s Other segment consists of construction in progress and land held for development.

EPR’s business has been experience significant growth, and management expects continued growth in the future. For starters, the following chart shows the company’s investment growth over the past ten years.

And management expects growth to continue going forward. For example, the company’s most recent investor presentation describes the market opportunity in the Education segment alone to be $4.5 billion, which is significant considering they’ve only invested approximately $1 billion in the segment so far (see previous chart). Additionally, the Recreation segment continues to experience rapid growth. For example, according to EPR’s recent investor presentation “Topgolf continues to exceed expectations and strengthens with each new location.”

And EPR continues to exhibit growth in the Entertainment segment by expanding megaplex amenities and through new and unique concepts such as bocce ball and the observation deck on the 94th floor of the John Hancock building in downtown Chicago.

(John Hancock Observation Deck, Photo by Blue Harbinger Research)

Quantitatively Speaking:

From a quantitative standpoint, EPR stands out among big dividend securities because of its low volatility and attractive diversification benefits. For example, the following charts show EPR’s historical volatility relative to other retail REITs and other big dividend securities in general (note: the charts include securities with dividends greater than 4%, market caps over $500 million, and revenues over $100 million).

EPR compares favorably to other retail REITs as shown by its relatively low volatility. Also worth noting, EPR has a historical beta less than one which can be an important diversification benefit within the constructs of a larger investment portfolio (i.e. it zigs a little when the market zags). And relative to other, non-REIT, big dividend securities, EPR’s volatility is extremely low as shown in the chart.

Generally speaking, if a security offers a high yield it can often be a sign of distress (i.e. the yield may be high because the price has fallen dramatically, and a dividend cut may be imminent). However, in the case of EPR (and many other REITs), the dividend is high because, as a REIT, they’re required to pay out 90% of their income as dividends. Simply put, EPR Properties is a healthy growing business.

Dividend Payment:

EPR’s monthly dividend payments are big, healthy, and growing. For example, the following chart shows the dividend relative to price, and it shows the recent dividend payment increases.

And also an important gauge of dividend health, the next chart shows EPR’s dividend to Funds From Operations (FFO) ratio.

This is an important ratio for REITS because it helps demonstrate an ability to maintain the dividend. Specifically, the lower the ratio the better, and a ratio above one signals potential challenges in sustaining the dividend payments. Worth noting, EPR’s Dividend to FFO ratio compares favorably to another, very popular, monthly-dividend-paying, retail REIT, Realty Trust (O).

Of course EPR is exposed to many unique risks that Realty Trust is not exposed to, and we will cover some of the more significant risks later (see Risks).

Valuation:

A common valuation metric for REITs is the price to FFO ratio. And as the following chart shows, EPR’s price to FFO ratio has recently been climbing to historically high levels (for some perspective, we also included Realty Income’s ratio—obviously the companies are exposed to many similar and many different risks).

One explanation for the high EPR ratio (by its own historical standards) is that the market is increasingly trusting the company to deliver big steady dividend payments, and they’ve bid up the price (the numerator) accordingly. Another explanation for the high price to FFO ratio is that the market is expecting increasing growth from EPR. For example, EPRs adjusted FFO per share grew by only 5.7% and 5.9% in 2013 and 2014, respectively, before growing at 8.0% in 2015 (Annual Shareholder Letter, p.1). Further, management has already provided FFO guidance of $4.70 to $4.80 per share for 2016 (Investor Presentation, p.58) representing a healthy 6.5% growth rate, and the company has a history of beating estimates (StreetInsider http://www.streetinsider.com/ec_earnings.php?q=EPR) and exceeding its own guidance. If EPR delivers strong FFO growth again in 2016 then its price to (historical) FFO ratio should be high because the market is expecting healthy growth.

It’s also worth noting that it’s often easier for small/mid-sized companies like EPR ($4.3 billion market cap) to grow than it is for larger companies such as Realty Income ($14.9 billion market cap) simply because the bigger company needs to generate so much more growth to achieve the same percentage growth as the smaller company.

Risks:

EPR faces a lot of risks. For starters it’s a specialty REIT with exposure to unique business segments. These business segments are less diversified than the business segments of other REITs such as Realty Income, for example, which has exposure to 48 activity segments. Additionally, as shown in the following chart, EPR’s top five tenants make up 50% of total revenues. This concentration exposes EPR to additional risk if one (or more) of those tenants were to file for bankruptcy.

Further, a single tenant represents a substantial portion of EPR’s revenues. Specifically, in 2015, approximately 20% of EPR’s revenues came from AMC, one of the nation’s largest movie exhibition companies. In aggregate, these less diversified exposures (i.e. segments and customers) may help explain why EPR does not trade at as high of a price to FFO ratio as Realty Income as shown earlier in this report (i.e. Realty Income has more diversified risks).

Also worth noting, many of EPR’s customers, consisting of tenants and borrowers, operate in market segments that depend upon discretionary spending by consumers. A reduction in discretionary spending by consumers could reduce the demand for EPR properties and/or financing solutions. Even though EPR’s “beta” has historically been less than one, it still has significant exposure to the market and the impacts could be increased under distressed economic conditions.

The credit markets pose another significant risk for EPR. For example, an adverse change in EPR’s credit rating could impair the company’s ability to obtain additional financing on favorable terms. Because EPR must payout 90% of its earnings as dividends, the company relies heavily on the capital markets to fund future growth. As shown in the following chart, EPR uses a significant amount of debt within its capital structure.

More broadly speaking, market interest rates could have a negative impact on EPR. Specifically, many investors have invested in EPR because the dividend yield is attractive relative to other rates available. If market interest rates were to rise significantly, it could have a significantly negative impact on the value of EPR’s shares.

Another significant risk factor is EPR’s investment in a planned casino and resort (the Adelaar) which is now subject to ongoing litigation. The future of the project is uncertain.

Regulations are another risk. For example, public charter schools are operated pursuant to charters granted by various state or other regulatory authorities and are dependent upon compliance with the terms of such charters in order to obtain funding from local, state and federal governments.

Finally, the general illiquidity of real estate investments pose another risk for EPR. Should EPR desire (or be required) to sell a property to meet liquidity needs, the company may be forced to sell at undesirable prices.

Conclusion:

EPR Properties’ big dividend is safe. Additionally, its total returns have exhibited very low volatility. Further, it has significant growth prospects ahead. That said, It can still be difficult to hit the buy button on a security that has just rallied like EPR has. However, we believe the recent stock price gains are warranted, and there are additional long-term gains ahead. We don't condone market-timing, but at the very least, if you are an income-seeking investor, add this one to your watch list, and consider buying on the next pullback.