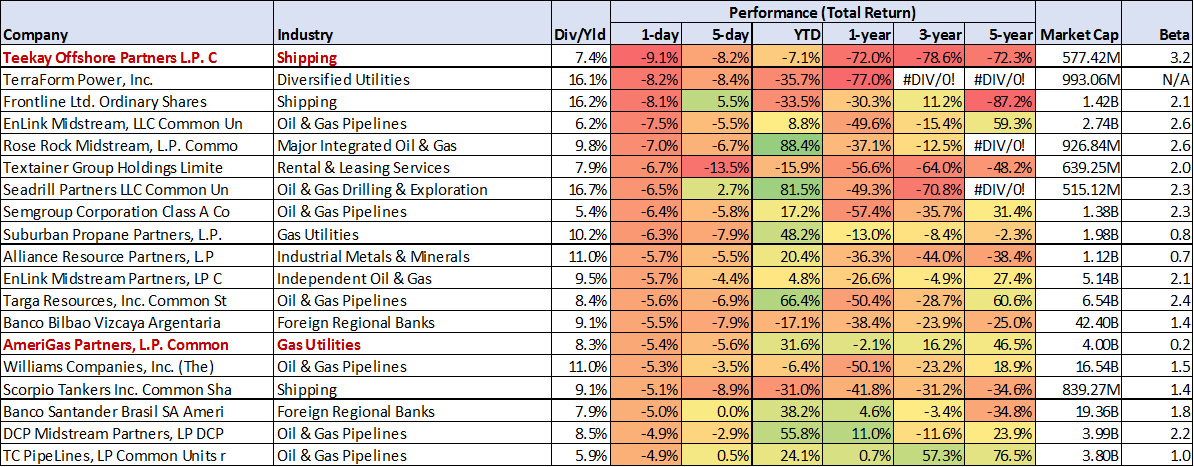

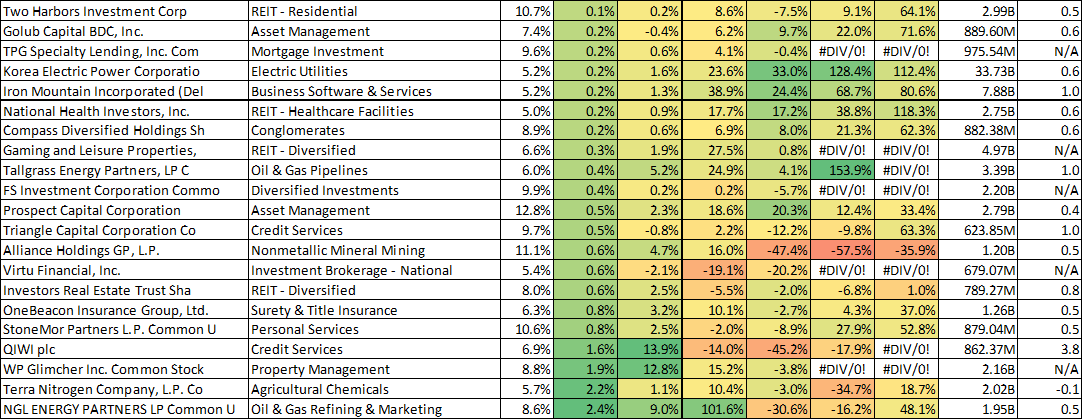

This past Friday (6/10) was not a good day for high yield stocks as the market was in a risk-off mood. For example, the following table highlights the large 1-day declines of fifty stocks that currently yield over 5%. Specifically, the table is based on a simple screen that identified investments with 5% yields, at least $500 million in market capitalization, and at least $100 million in revenues.

Generally speaking, it can be a sign of distress when a company’s yield gets too high. For example, it can mean the stock price has fallen dramatically so the dividend payment, as a percent of the price, has become very high. And it can mean the chances of a dividend cut are increasing. However, we believe five of the companies, in particular, offer attractive investment opportunities for income-seeking investors. For your consideration, here are the five:

5) AmeriGas Partners (APU). Technically, AmeriGas in an MLP, not a stock, but it is still worth considering for income-focused investors. This MLP had a particularly rough day on Friday declining over 5% following a ratings downgrade. Specifically, UBS downgraded it “to Sell while keeping a $39 price target on the shares, saying the shares look relatively expensive at current levels and that its yield is lower than competitors.” However, we completely disagree with the UBS downgrade. In particular, we believe peer comparisons are not the most appropriate way to value AmeriGas, and this is a company with tremendous long-term value. Specifically, AmeriGas (the largest propane distributor in the US) offers low risk, an attractive valuation, and it is uniquely positioned to successfully execute on its growth-through-acquisitions strategy. We also believe the distribution payments are likely safe for many years to come, and if you are an income-focused investor, this is an MLP worth considering (especially after Friday’s 5.4% decline). You can read our full report on AmeriGas here.

4) Teekay Offshore Partners (Preferred Series A). Teekay declined a whopping 9.1% of Friday, and now offers an impressive big yield. However, it is Teekay’s preferred stock (not the common) that we particularly like. Teekay Series A Preferred stock (TOO-A) also declined sharply on Friday, and now it offers an even more impressive yield (currently 9.2%). If you don’t know, Teekay is a marine transportation, storage and production company. We like the preferred shares because the company recently cut its distribution payments to common unitholders, and we believe this is a good thing because it frees up more cash to support the cumulative preferred unit distributions. We believe Friday’s price decline creates an even more attractive entry point, and you can read our full report on Teekay here.

3) Tsakos Energy Navigation (Preferred Series C). Similar to Teekay, Tsakos is a seaborne oil transportation company that was down big on Friday. Also similar to Teekay, Tsakos offers attractive preferred shares that were dragged lower on Friday. In particular, we like the Tsakos preferred series C shares (TNP-C) because of their big 8.9% yield. More specifically, Tsakos has plenty of liquidity through the series-C call date, and net income has been ramping up in recent quarters but the share price has not. You can read our full Tsakos report here.

#2 and #1 are reserved for members only. You can view them here. If you are not already a member, consider a subscription.

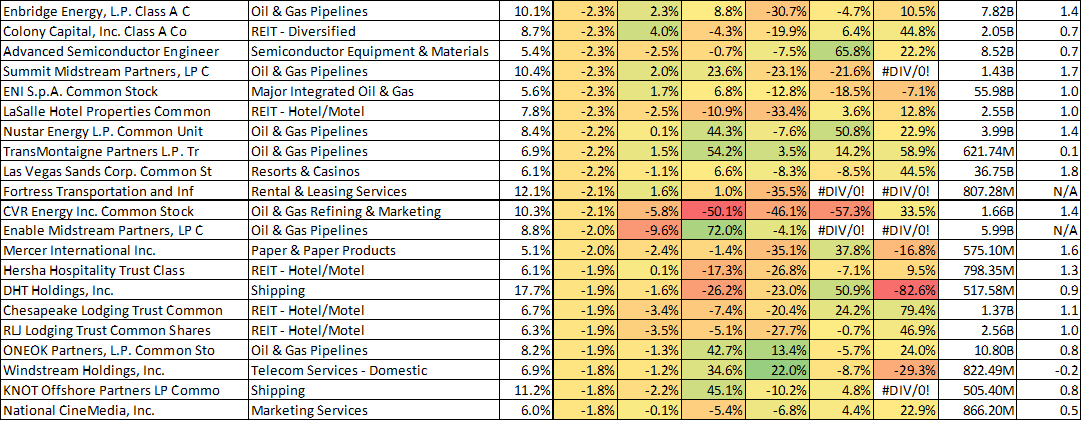

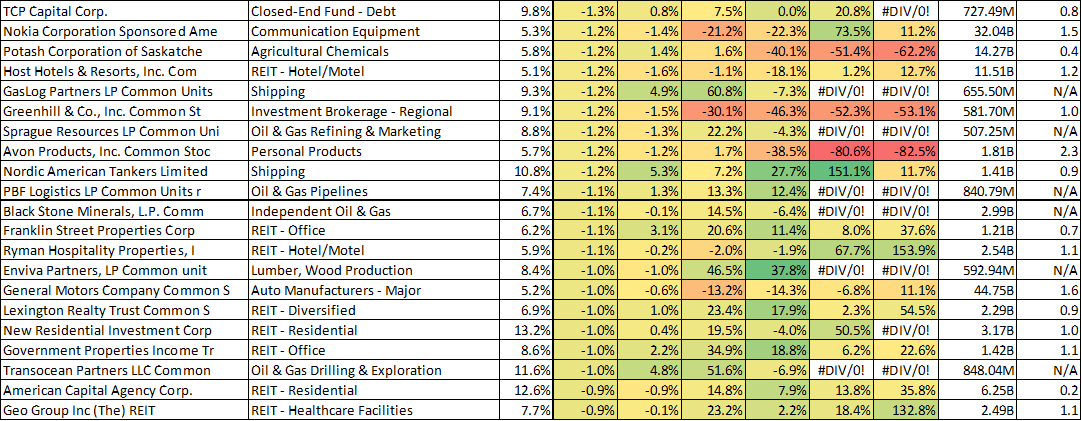

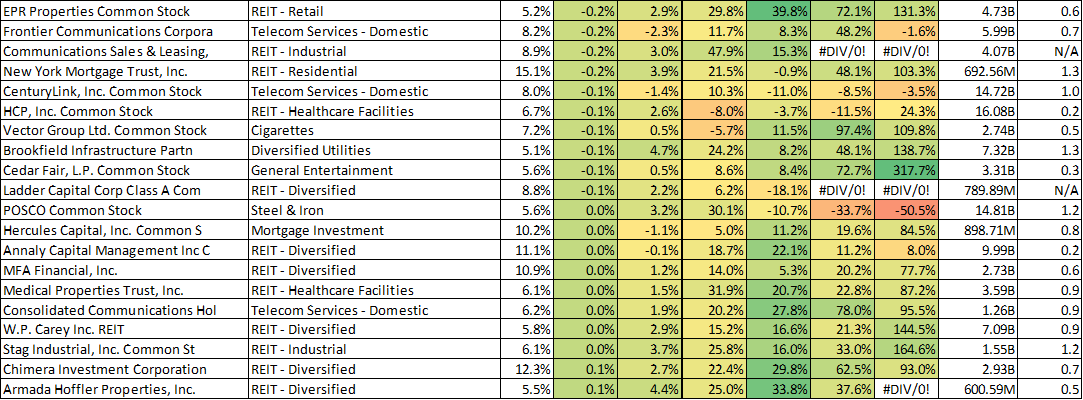

And for your information, our screen (5% yield, $500 million market capitalization, and $100 million revenues) resulted in more than just the fifty stocks shown above. The results included 225 specific investments (as shown below), and we have highlighted six additional investments that we believe are worth considering.

6) Main Street Capital is an attractive Business Development Company (BDC) that offers a big 6.6% dividend yield. And if you factor in the semiannual supplemental dividends, the yield climbs to nearly 9.0%. We believe Main Street offers additional price appreciation potential with relatively low volatility as well as important diversification benefits. If you are an income-focused investor, it’s worth a closer look. Our full Main Street Capital article is available here.

5) Frontier Communications is a big dividend (8.2%) telecommunications company that is currently trading at an attractive price. Frontier has created a niche for itself by operating in heavily subsidized regions, and they deepened their foothold in that space with their recent $10.5 billion acquisition of Verizon assets. If you are an income focused investor, we believe Frontier is worth considering. You can view our full Frontier report here.

4) HCP Inc. is an attractive healthcare REIT that passed our big yield screen. It pays a 6.7% yield, and it has a 31 year track record of increasing its annual dividend payments. HCP’s price has declined this year (-8%) as it works towards spinning off challenging business related to its HCR ManorCare operations. We believe the spinoff is a smart move, and HCP’s big dividend is worth considering. You can view our full HCP report here.

#3, #2 and #1 are reserved for members only. Members can access them here. If you are not already a member, consider a subscription.

Conclusion:

Of course no one can say with certainty where the market will go tomorrow. But if you are a diversified, long-term investor, then the investments highlighted above may be worth considering for the higher risk portion of your income-focused portfolio.