High dividend Master Limited Partnerships (MLP) have been decimated as measured by the Alerian MLP index which is down roughly 50% since August 2014. Once the darlings of income-seeking investors, fear has set in as many investors sold out of their positions believing low energy prices would create a vicious circle whereby MLPs would be unable to obtain new capital and their healthy growing dividends would inevitably be cut. However, not all MLPs are created equal, and the market turmoil has created some impressive opportunities. In particular, we believe Enterprise Products Partners’ (EPD) big 6.4% dividend yield is very safe, it will continue to grow, and buying now offers investors an opportunity for big price appreciation to boot.

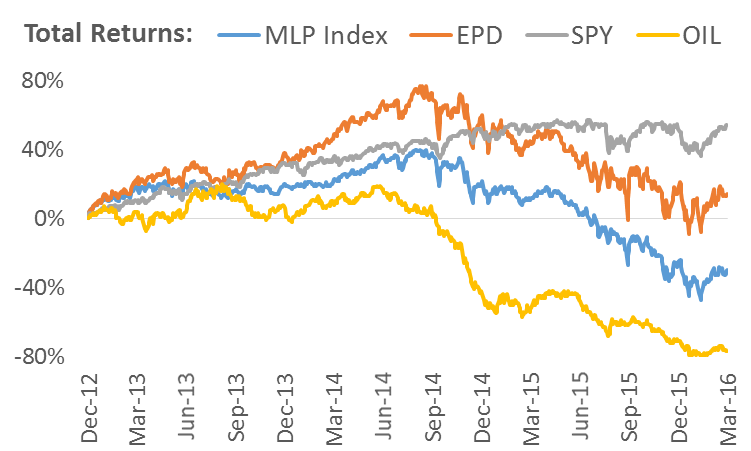

For perspective, the following chart shows the recent performance of the MLP index compared to the overall market (i.e. the S&P 500), and we’ve also included the performance of Enterprise Products and oil.

As the chart shows, the market started to stall as oil prices began to fall in mid-2014, and MLPs (including EPD) fell precipitously right along with oil. In our view, EPD should not have sold off with other MLP’s because of its uniqueness and financial strength. But before getting into the details of EPD, it’s worth briefly considering what exactly a Master Limited Partnership is and why they sold off so dramatically.

What is an MLP, and why have they sold off?

A Master Limited Partnership is an organizational structure that qualifies for significant tax benefits. Specifically, MLPs are not taxed at the entity level (this is different from typical corporations) as long as they generate 90% of their income from “qualifying” sources such as the production, processing and transportation of oil, natural gas and coal. Additionally, if you own an MLP you may be able to deduct some of the MLPs depreciation expense on your own income tax return (you’ll receive a K-1 tax form at the end of the year to help you track this). Historically, both of these tax benefits have made it much easier for MLPs to attract cheap capital and to grow their big dividends.

However, the recent decline in energy prices has increased uncertainty (and increased capital costs) for many MLPs. Specifically, higher capital costs have made it very challenging for some MLPs to raise the capital necessary to grow their business and fund their precious dividends. And as fears of possible dividend cuts have increased, MLP prices have declined dramatically.

Why is EPD Different?

For many investors, all they need to know before investing in Enterprise Products is that is has a long history of paying (and increasing) its dividend. Specifically, “Enterprise has paid 70 quarterly cash distributions to unitholders since its initial public offering of common units in 1998... [And] on January 4, 2016, the partnership declared its 46th consecutive quarterly increase.” (2015 Letter to Shareholders). For perspective, the following chart shows the compound annual growth rate of EPD’s dividends since its initial public offering:

We have great appreciation for EPD’s strong dividend track record, but we believe there are several other important reasons why EPD is an attractive investment right now.

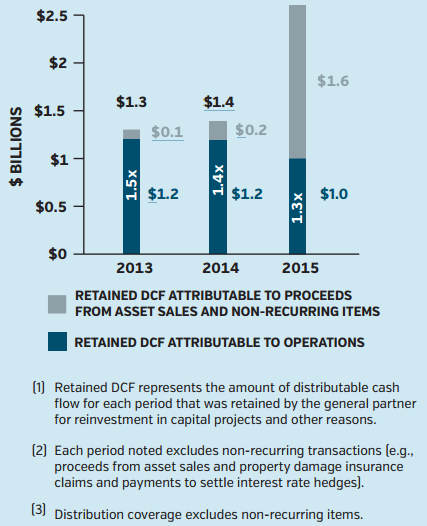

One of the main reasons why we believe EPD is an attractive investment right now is because they have access to additional capital (via their own retained earnings) that many other MLPs do not. Unlike some MLPs, EPD actually retains a significant portion of their earnings (for a rainy day) instead of paying out almost everything as dividends like other higher yielding MLPs do. The following chart shows that amount of “distributable cash flow” (DCF) from operations that EPD retains is enough to cover its distributions by 1.3 times, and the number increases further if you include DCF from sales and non-recurring items.

Further, according to EDP’s most recent (3/21/16) investor presentation (p.3) , the company has $4.8 billion of retained DCF over last 5 years (excludes non‐recurring items) that can be used to meet future capital needs.

Considering a “rainy day” has arrived (we’re at a lower point in the energy market cycle), EPD is still able to fund new projects and grow their dividend whereas other MLPs are not. And what makes EPD even more attractive is that it has been lumped in and sold off with other MLPs making right now an attractive entry point (more on valuation later).

Another reason why EPD is an attractive investment right now is that it has one of the highest credit ratings among MLPs: Baa1 / BBB+ (investor presentation, p.3). This gives EPD a lower cost of capital and more financial flexibility than many of its peers, which is critically important considering current energy market conditions.

Enterprise’s highly diversified business is another reason why it is an attractive investment. It is one of the largest integrated midstream energy companies, and its integrated system allow the company to reduce the impact of cyclical commodity swings. The following charts demonstrate EDP’s consistency throughout market cycles.

This first chart shows EPD has been able to consistently grow its operating margin and distributable cash flow through the energy market cycle (the red line is WTI crude).

And this second chart shows that EPD has been able to consistently grow distributions throughout the energy market cycle.

EPD’s Growth capital projects are another reason why it is an attractive investment right now. Specifically, EPD currently has $6.8 billion of growth capital projects under construction slated to begin operations between now and mid-2018. These projects are underwritten by long-term contracts with creditworthy customers, and they’ll add to the company’s ability to steadily grow its dividend.

What is Enterprise Worth?

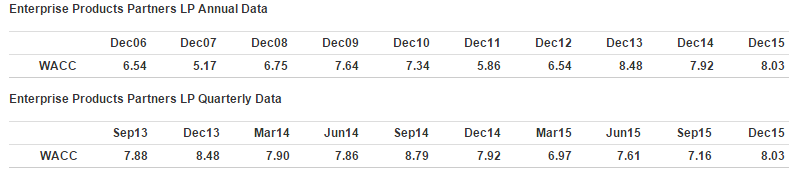

By discounting EPD’s 2015 distributable cash flows from operation using a weighted average cost of capital (WACC) of 6.9%, we can back into the company’s current market capitalization by assuming a negative 1.2% growth rate into perpetuity. A negative growth rate seems unreasonable considering the company’s growth projects (mentioned previously), financial strength, and track record of growth. More likely, we believe the market has incorrectly lumped EPD in with other MLPs causing it to be oversold. Instead, if we assume only a 1% positive growth rate (not unreasonable) then EPD is worth approximately $67.8 billion, giving the stock roughly 36% percent upside potential.

Also worth noting, EPD’s WACC is near the higher end of recent history which means the market is charging the company more for capital funding, which we believe may be somewhat inappropriate given the company’s financial strength.

If capital costs revert to lower levels in the future (particularly the cost of equity) then that gives the stock even more upside potential (because it will be cheaper to fund new projects).

Another way to value Enterprise is simply how badly do you need the dividends? Many academics love to tell you that you should be indifferent between dividends and price appreciation, but income investors know they cannot afford to be selling shares for income during a market crisis (such as 2008-2009) because the opportunity cost is too great. If you sell shares at the bottom (for income) you may never recover. Here is a rare paper about uncertainty risk / volatility that explains what smart income-investors have intuitively known for years: Stock market returns are very hard to predict, but “dividend yield exhibits the strongest relation to expected return.” (Pastor and Stambaugh, p.14). We believe Enterprise’s big dividends are relatively safe, and the EPD MLP can be an extremely valuable addition to a diversified income-seeking investment portfolio.

Risks:

Before investing in EPD it is worth considering some of the larger risks. First, because EPD’s beta (a measure of volatility or systematic risk) is less than one that means it could experience a relatively lower price increase in a sharply rising market. However, depending on your viewpoint, this may be acceptable if you are investing in EPD primarily for the steady dividend payments and secondarily for price appreciation.

Volatile oil prices pose another big risk for EPD. Even though EPD is less susceptible to this volatility than other MLPs, it still poses a risk. The company describes this risk in their most recent 10K as follows: “Changes in demand for and prices and production of hydrocarbon products could have a material adverse effect on our financial position, results of operations and cash flows.”

Debt levels pose another risk for EPD, particularly if interest rates rise due to macroeconomic or company-specific factors. Because EPD pays such a big dividend, they retain less earnings for growth (still more than many other MLPs), and rely heavily on debt (debt-to-assets currently sits at nearly 50%) to finance growth. If the market were to perceive EPD as more risky, their high credit rating could fall thus making it harder (more expensive) to issue debt to fund future growth. Similarly, if macroeconomic interest rates rise, this too could make it more challenging (expensive) for EPD to fund future growth.

Regulation poses another risk for EPD. First, EPD operates in the fossil fuel industry which comes under increasing scrutiny due to its hydrocarbon impact on the environment. If significantly more stringent environmental regulations were to go into effect, it could have significantly adverse effects on EPD’s bottom line. Secondly, if tax laws for MLPs were to change, then that too could negatively impact EPDs profitability and its ability to pay and grow its big dividend.

Conclusion:

We like EDP’s big dividend and price appreciation potential. In fact, we like it so much that we’ve ranked it number seven on our list of Ten Big Dividend Investments Worth Considering. We believe EPD’s divided is safe because of the company’s financial strength (specifically, its continued access to capital funding to grow the business). Further, we believe it has inappropriately sold off with other MLPs giving it significant price appreciation potential. If you are an income-seeker, now may be an excellent time to add EPD to your diversified, long-term, investment portfolio.