Donald Trump has taken a stance on a variety of economic issues including foreign currency devaluation, corporate tax rates, corporate inversions, overseas cash balances and H1B visas. Some of his positions are exactly right, while others are questionable at best. However ALL of Trump’s positions are very strategic and politically motivated. Further, Trump’s stance on these issues will undercut a headline-grabbing company that doesn’t like him anyway (Amazon), and boost a conservative-leaning company that provides a lot of middle-class jobs (Caterpillar).

image: donaldjtrump.com

Foreign Currency Devaluation

Foreign currency devaluation is a hot topic in Donald Trump’s presidential campaign that could have a positive impact on Caterpillar while simultaneously undercutting Amazon. Before getting into the hazards of tariffs and the benefits of trade, let’s consider Trump’s comments at a recent debate:

“You look at Caterpillar Tractor and what’s happening with Caterpillar and Kamatsu (ph). Kamatsu (ph) is a tractor company in Japan. Friends of mine are ordering Kamatsu (ph) tractors now because they’ve de-valued the yen to such an extent that you can’t buy a Caterpillar tractor. And we’re letting them get away with it and we can’t let them get away with it.”

In the same debate, Trump also said:

“China is ripping us on trade. They’re devaluing their currency and they’re killing our companies.”

Trump’s comments are strategic and politically motivated because they are capitalizing on the very real hardships American industrial companies are facing. Caterpillar is a specific example of a company with international sales, and it is facing very significant challenges because of the strong US dollar (i.e. other countries are devaluing their currencies which makes their products less expensive relative to Caterpillar products). Additionally, Caterpillar is located in Peoria Illinois, an area that leans Republican and where Trump can pick up votes. Further, bashing foreign countries for devaluing their currencies plays right into Trump’s “Make American Great, Again” theme, and it gives angry voters a way to vent their frustrations.

For reference, the majority of Caterpillar’s sales are outside the U.S (you can see this data in our earlier report: Caterpillar: A Fallen Angel with a Big Dividend), so a strong U.S. dollar hurts them more than say Amazon- a company that is just now starting to ramp up non-US business. And relative to many other aggressive growth stocks, Amazon would be less helped by a targeted “currency war” simply because they do more business domestically (you can see this data in our previous Amazon research report), and they don’t actually manufacture anything anyway (more on Amazon later).

And with regards to implementing a foreign currency war by imposing tariffs that foreign countries will quickly reciprocate- it’s generally a bad idea. Trump may be able to provide some relief to Caterpillar, but reciprocating tariffs from other countries will open a Pandora’s Box of new costs across the market that will make the overall economy worse off. Generally speaking, trading partners (i.e. the U.S. and other countries) can achieve a higher standard of living through free trade. So unless Trump is suggesting tariffs and currency wars simply to gain negotiating leverage with foreign countries (he did write “The Art of the Deal”), then his stance on currency devaluation is questionable at best.

Corporate Tax Rates

Trump’s views on currency devaluation are “questionable, at best,” however his views on corporate tax rates are exactly right, and he would help Caterpillar and severely undercut Amazon. For starters, we already know Trump does not like Amazon and its CEO Jeff Bezos because he recently said this about them:

“And believe me, if I become president, oh do they have problems. They're gonna have such problems."

In part, Trump was talking about Jeff Bezos’ purchase of the Washington Post. Trump explained:

“[Bezos] bought the Washington Post to have political influence… He owns Amazon. He wants political influence so that Amazon will benefit from it. That's not right.”

Once again, Trump’s position is strategic and politically motivated. Bezos is an outstanding target for Trump because he (and Amazon) actively supports liberal politics (they’re big donors to the Democrat party), and they’re not likely to vote for Trump anyway. Further, Trump’s campaign often focusses on attacking lobbyists and donors (like Bezos) who he says have too much influence in Washington DC. And what puts Amazon in a most precarious position is the fact that they pay very little in taxes (said differently, Bezos’ pocketbook should be very afraid of a Donald Trump president).

As we’ve written about before, Amazon pays very little in taxes because they intentionally keep their bottom line net income close to zero. They do this via “tax avoidance” (totally legal, as opposed to “tax evasion” which is totally illegal) whereby they spend so much money on Research and Development (which is an immediate tax write-off) that their net income is almost nothing and they end up paying very little in taxes. You can read more about how “Expensing R&D Hides the Economic Earnings” of Amazon here.

And while Amazon is technically not breaking the law, it’s very easy for a President’s attorney general to extort massive amounts of money from public companies as we saw Obama’s Eric Holder do to the likes of Wall Street banks like Goldman Sachs and JP Morgan (if you don’t know, they took them for tens of billions).

For comparison purposes, the following table shows revenues net income, tax rate, taxes paid and market capitalization for Amazon and Caterpillar.

As the table shows, even though Amazon dwarfs Caterpillar in terms of revenue and market capitalization, Amazon still pays relatively very little in terms of tax dollars. Don’t be fooled by the effective tax rates because Amazon engineers its net income to be artificially low while keeping its stock price very high. If Amazon were to reduce its huge spending on Research and Development ($12.5 billion in 2015) then its net income and tax payments would go up dramatically. Further, if a Trump administration were to go after Amazon (the way the Obama administration went after Wall Street banks) then Amazon would end up paying a lot more money to the government. The bottom line here is that Amazon does an enormous amount of business, they pay a relatively tiny amount of taxes, and they’re a headline-grabbing company that plays into Trump’s anti-big-donor narrative.

Corporate Inversions

Corporate inversions (whereby companies relocate their legal domicile to a lower tax country) are another hot topic in the Trump campaign because they’re eliminating many US jobs and they’re reducing tax revenues for the US government. Trump is 100% percent right on this issue. He believes corporate tax rates are too high in the U.S. relative to other countries, and they’re forcing many companies to leave the U.S. simply so they can be competitive in a global economy. Recent examples of corporate inversions include Medtronic (from Minnesota to Ireland), Valeant Pharmaceuticals (from California to Canada) and Liberty Global (from Colorado to England). Caterpillar in another example of a company that could potentially benefit from a corporate inversion (i.e. they could save a lot of money by moving to another country). Trump wants to prevent more inversions from happening by lowing the tax rates for companies that pay a lot (e.g. Caterpilllar). And this theme fits well with his campaign (i.e. Make American Great, Again), and it is attractive to a large portion of his voter-base (e.g. middle class Americans that lean conservative).

Overseas Cash

Overseas cash is yet another hot topic in Trump’s campaign where he is 100% correct, and it will benefit Caterpillar and undercut Amazon. Caterpillar often receives scrutiny and negative headlines for not paying taxes on large overseas profits. According to page 24 of Caterpillar’s annual report:

“A provision for U.S. income taxes has not been recorded on undistributed profits of our non-U.S. subsidiaries that we have determined to be indefinitely reinvested outside the U.S.”

Companies like Caterpillar (Apple is an even bigger example) could bring back their large overseas cash, but they don’t because the taxes would be enormous. This is an opportunity where a President Trump could work with companies (along with the help of the US Congress) to strike a deal allowing companies to bring back cash that would benefit both the companies and the U.S. In fact, Trump has proposed that “U.S. multinationals would pay a one-time 10 percent tax for the money they bring back home… Going forward, the Trump plan would remove the option for U.S. multinationals to defer taxes on their overseas earnings.”

This is an area where a good deal can be struck because many corporations want to bring back the cash. However, a deal would only help companies with lots of overseas cash (e.g. Caterpillar and Apple) and relatively speaking it would undercut the companies that don’t have a lot of overseas cash (e.g. Amazon).

H1B Visas

H1B visas are another area were Trump’s position seems politically motivated and the economic benefits are questionable at best. However, his stance still works to the benefit of Caterpillar and undercuts Amazon. Trump believes the H1B visa program is being abused to benefit foreign workers to the disadvantage of Americans. According to Trump’s website, he wants to increase the prevailing wage paid to H1Bs, because he believes:

“This will improve the number of black, Hispanic and female workers in Silicon Valley who have been passed over in favor of the H-1B program. Mark Zuckerberg’s personal Senator, Marco Rubio, has a bill to triple H-1Bs that would decimate women and minorities.”

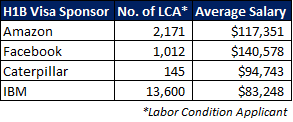

Clearly Trump’s statement takes a shot at Facebook (Mark Zuckerberg is founder and CEO). However, the data doesn’t necessarily support Trump’s claim as the follow table shows.

(data source: Myvisajobs.com)

For starters, Facebook does utilize a significant amount of H1B workers, but they pay them well. If they were abusing the program to attract low-paid international workers then the average salary would likely not be so competitive. Further, if Trump really wanted to attack the program he might have gone after IBM (because they utilize way more H1Bs, and they pay way less), but old-school blue-chip IBM doesn’t play into Trump’s narrative of attacking west-coast, liberal-leaning, companies that don’t support Trump anyway. Regardless, Trump’s narrative still benefits Caterpillar (a Midwest industrials company with conservative-leaning voters) and disadvantages Amazon (a big west coast donor to the Democrat party). The bottom line here is that Trump’s views on H1B visas make more political sense (for Trump) than they do economic sense (for America); and based on his comments during the most recent March 3rd debate, he may be backtracking on this position already (contrary to his website, during the debate he said “I’m changing. We need more highly skilled people” when asked about his stance on visas).

Conclusion

Some of Donald Trump’s campaign positions make economic sense and some of them seem completely ridiculous. However, all of them are strategic and politically motivated. They help him tell a narrative that appeals to his base and raises concerns for many that oppose him. Specifically, Caterpillar is a company that may benefit from Trump’s policies, and it is also a company in an area with many voters that lean conservative. On the other hand, Amazon is a company that Trump may continue to scapegoat because its people likely won’t vote for him anyway, and they may be very vocal in opposing him (e.g. Jeff Bezos is a vocal Democrat party donor that recently bought the Washington Post so he could have a bigger voice). Further, Amazon is an attractive scapegoat for Trump because it’s a company that garners a lot of media attention.

It will be very interesting to watch this election cycle move forward, and to see if Trump (and all of the candidates, for that matter) can focus their positions in ways that will be economically (and perhaps socially) beneficial, instead of simply posturing for their own personal political gain.