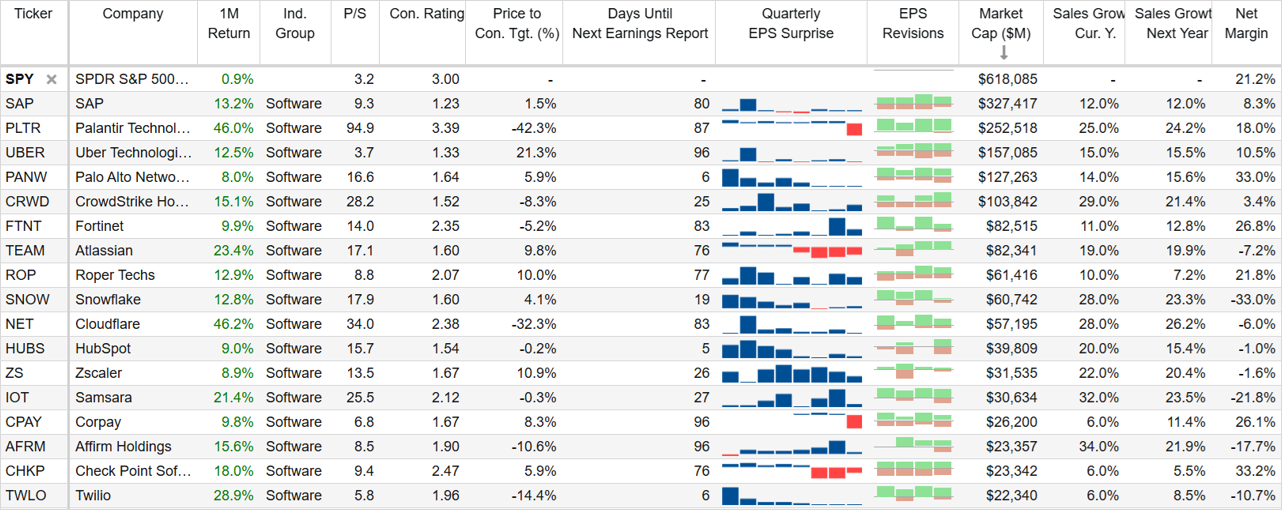

Software stocks have been on fire lately, with names like Palantir, Fortinet and Atlassian posting big post-earnings gains. Here is a look at the most highly-rated software stocks set to report earnings over the next 3-weeks, with the potential for more big post-earnings surprise gains ahead (below), plus a closer look at Palo Alto Networks in particular.

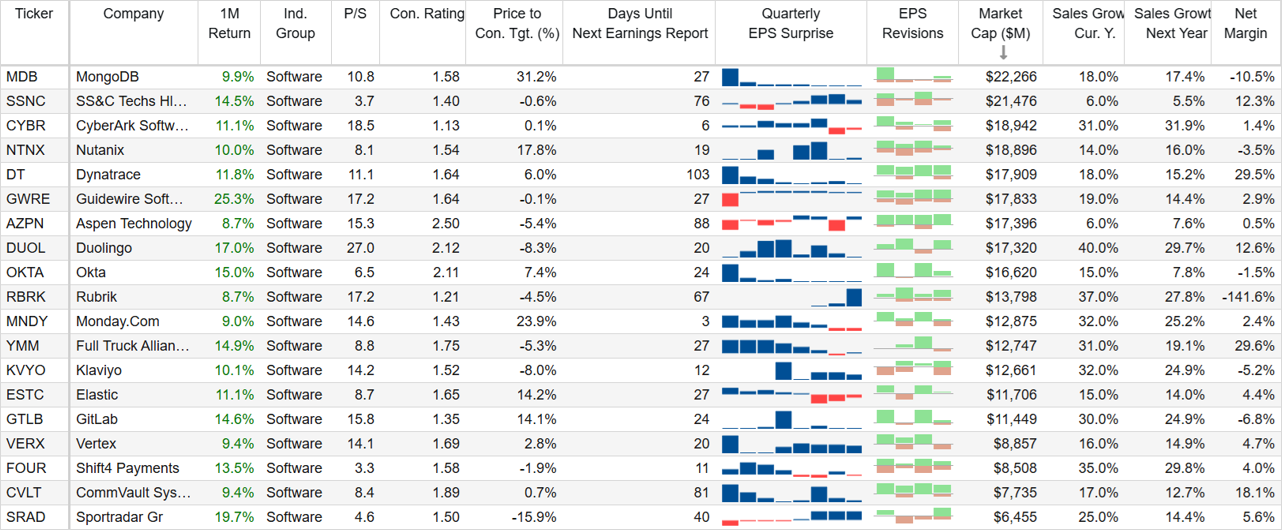

In particular, names that stand out include: Palo Alto Networks (PANW), HubSpot (HUBS), Monday (MNDY), JFrog (FROG), Shift 4 Payments (FOUR), Zeta (ZETA), Okta (OKTA), GitLab (GLAB), CrowdStrike (CRWD), Zscaler (ZS) and MongoDB (MDB).

Worth noting, you can see in the tables above how these companies rank in terms of price-to-sales, expected growth and net profits, to name a few.

Palo Alto Networks (PANW):

PANW is one particular software stock (in the table above) that is worth a closer look, especially as we head towards its earnings release on Thursday (2/13). Here are a few things in particular to consider:

Cybersecurity: For starters, Palo Alto has a strong market position in cybersecurity (i.e. it is a leading provider across network, cloud, and endpoint security). And in particular, its strategy of platformization (where they aim to be the sole security provider for clients) positions them to benefit from the cybersecurity megatrend and the trend towards consolidation.

Healthy Financials: PANW also stands out for its high growth, strong net profits and healthy earnings revisions (upward) as you can see in the earlier software stock table.

Expansion in High-Growth Areas: Additionally, the company is significantly expanding in areas with high growth potential like cloud security and AI-driven security solutions. Further, their annual recurring revenue for next-generation security (NGS) products grew by 40% year-over-year, signaling strong customer demand and adoption.

Positive Analyst Sentiment: You can also see in our table, Wall Street analysts are largely bullish on the shares (“strong buy”) thereby reflecting confidence in the Palo Alto’s growth trajectory and market leadership.

Innovative Use of AI and Machine Learning: Further still, the company is leveraging AI to enhance its security offerings, which may increasingly prove vital in combating increasingly sophisticated cyber threats. And the focus on AI not only helps in threat detection but also positions the company to tap into the growing AI-based cybersecurity market, expected to see dramatic growth.

Risk: Intense Competition: Important to note, the cybersecurity industry is highly competitive with numerous players both large (like Microsoft, Amazon) and niche (like CrowdStrike, Zscaler). Palo Alto Networks must continuously innovate and may face increasing challenges from competitors.

The Bottom Line

Software stocks have been strong so far this earnings season, which may bode well for those yet to announce (see our earlier table). One name in particular that stands out is Palo Alto Networks (thanks to its established and innovative position in the growing cybersecurity space combined with its strong financials, as well as AI).

Software stocks, and Palo Alto Networks in particular, are worth considering for a spot in your prudently concentrated long-term growth portfolio (especially ahead of this week’s upcoming earnings).