Palantir is a controversial investment because, despite its incredible healthy growth, the valuation is very high (and because the software is used to kill bad guys). Let’s take a brief look at its latest earnings report, current valuation, and powerful business growth trajectory.

What Does Palantir Do?

Briefly, Palantir (PLTR) develops and deploys software platforms for data integration, analysis, and decision-making.

Their key products (Palantir Gotham and Palantir Foundry) help organizations (particularly in government and large enterprises) manage, analyze, and secure vast amounts of data (Gotham is used for counterterrorism, defense, and intelligence, while Foundry supports business operations by integrating siloed data).

Palantir's tools are known for enabling real-time data analysis, enhancing operational efficiency, and aiding strategic decision-making across sectors like healthcare, finance, and energy.

Their work often involves sensitive data, emphasizing privacy and security.

Palantir Earnings

Palantir reported its Q4 2024 earnings on Monday, and here are a few key highlights:

Revenue Growth: Palantir achieved a revenue growth of 36% year-over-year, reaching $828 million for the quarter.

U.S. Revenue: U.S. revenue specifically grew by an impressive 52% year-over-year and 12% quarter-over-quarter, totaling $558 million.

Segment Performance:

U.S. Commercial Revenue: Increased by 64% year-over-year and 20% quarter-over-quarter to $214 million.

U.S. Government Revenue: Grew by 45% year-over-year and 7% quarter-over-quarter to $343 million.

Guidance: Palantir issued FY 2025 revenue guidance expecting 31% year-over-year growth, surpassing consensus estimates.

Stock Market Reaction: Following the earnings release, Palantir shares experienced a significant jump, attributed to strong performance and exceeding expectations in both revenue and guidance.

These results underscore Palantir's strengthening position in the AI and data analytics market, with notable growth in both its commercial and government sectors.

Palantir’s Valuation:

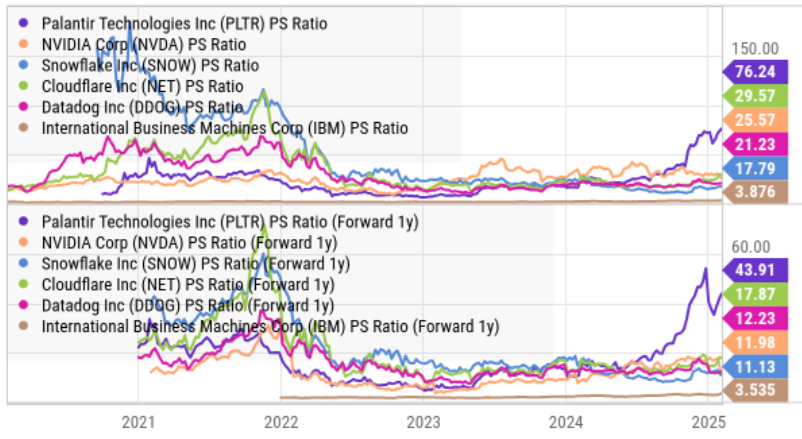

Despite the incredible growth, Palantir shares are very expensive. For example, here is how it compares to several other high-growth technology companies on a price-to-sales valuation metric.

Notably, at 76 times sales, Palantir shares are astronomically expensive; historically speaking, when other companies have gotten this expensive—their share prices eventually crashed hard. This doesn’t mean Palantir won’t eventually grow into this valuation (5+ years down the road), but for the time being the company’s shares are scary expensive.

But to be far, that’s what a lot of people recently said about Nvidia right before its share price climbed incredibly higher. Nvidia and Palantir are very different types of companies, but they both benefit from the explosion in demand for Artificial Intelligence (AI) software.

And Palantir is special versus other software companies because its custom software designs cannot easily be replaced once they are in place (i.e. Palantir is creating durable high-quality software solutions for customers).

Palantir’s Strong Growth

The quarterly earnings numbers shared above demonstrate the company’s powerful growth, but to add color, here are two telling quotes from CEO Alex Karp in his latest shareholder letter.

We are still in the earliest stages, the beginning of the first act, of a revolution that will play out over years and decades.

We still remember the quizzical looks of potential early investors when we attempted to explain that we were building enterprise software—at a time when the floodgates of Silicon Valley had opened to fund consumer trinkets, online shopping websites, and other quite forgettable experiments in sating the needs of the late capitalist mind.

Palantir is building long-term growth while other companies are just trying to hit superficial short-term growth numbers. Palantir is different, and that is a good thing.

The Bottom Line

I wouldn’t bet the farm on Palantir at this point in time considering the current valuation is so high. Unless, of course, you truly are taking a long-term (10+ years) view, in which case the shares may well trade much higher.

High-quality disruptive-growth stocks rarely get cheap, but they do pullback from time to time. We own some shares of Palantir, but we have been trimming the size as it grows. Some consider that a mistake, but considering high-valuation stocks frequently crash hard, we believe disciplined position sizing is prudent.

*Long Palantir.