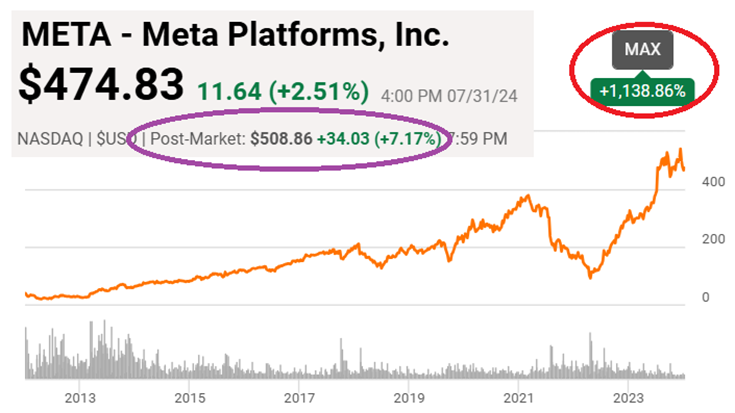

Quick Note: Meta announced strong quarterly results (beating expectations on earnings and revenues) as its family of apps (and innovation) continues to grow. The shares were up signficantly. However, for a company as large as Meta, the earnings results are always skim and not detailed, except to say the high-level numbers are good:

Second Quarter 2024 Operational and Other Financial Highlights

Family daily active people (DAP) – DAP was 3.27 billion on average for June 2024, an increase of 7% year-over-year.

Ad impressions – Ad impressions delivered across our Family of Apps increased by 10% year-over-year.

Average price per ad – Average price per ad increased by 10% year-over-year.

Revenue – Total revenue was $39.07 billion, an increase of 22% year-over-year. Revenue on a constant currency basis would have increased 23% year-over-year.

Costs and expenses – Total costs and expenses were $24.22 billion, an increase of 7% year-over-year.

Capital expenditures – Capital expenditures, including principal payments on finance leases, were $8.47 billion.

Capital return program – Share repurchases were $6.32 billion of our Class A common stock and dividend payments were $1.27 billion.

Cash, cash equivalents, and marketable securities – Cash, cash equivalents, and marketable securities were $58.08 billion as of June 30, 2024. Free cash flow was $10.90 billion.

Headcount – Headcount was 70,799 as of June 30, 2024, a decrease of 1% year-over-year.

Money-Printing Machine:

If you don’t know, Meta is basically a money printing machine as its advertising services are extremely high margin (it doesn’t cost Meta much to run an add). However, the company is contantly spending heavy on research & development, something it takes heat for, but also something that has continued to pay off over the long run. For example, people didn’t understand:

2011: Why care about “The FB?”

2012: Why pay $1B for Instagram?

2013: Why care about Mobile?

2014: Why pay $16B for WhatsAp?

2024: Why buy so many Nvidia AI Chips?

2024 Why care about Reality Labs?

The truth is, all of these things things seemed like a ridiculous waste of money initially, but they’ve all paid off in spades over time. And the latest, Reality Labs, is currently a huge money loser, but that will likely change over time just like all the company’s other major assets (e.g. Facebook, Instagram, WhatsAp).

We are long Meta (large position) in our Blue Harbinger Disciplined Growth Portfolio.