If you are looking to hit it big—move on, this article is not for you. If you are looking for healthy returns, healthy dividend income and healthy diversification (especially as certain mega cap growth stocks may seem precipitously overvalued), keep reading, this article might be for you (especially if you also like low fees, low volatility and tow taxes). In fact, all of these things, and more, combine to make the Schwab US Dividend Equity ETF (SCHD) a compelling opportunity for “emotionally intelligent” investors. And after reviewing the fund in detail (including the risks), we conclude with our strong opinion on investing.

Overview:

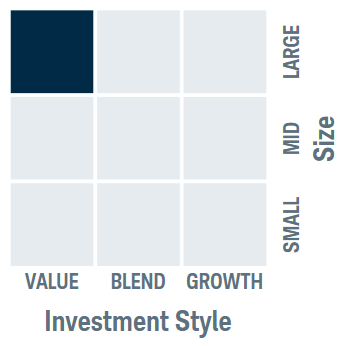

SCHD is a low-cost (0.06% annual fee) exchange traded fund (“ETF”) with ~100 positions diversified across market sectors, but with a tilt towards value stocks instead of growth.

For example, here is a look at SCHD’s recent sector weights, which are concentrated toward value sectors (like financials, health care and consumer staples) and away from growth sectors (like information technology).

For perspective, here is a look at the recent top 10 holdings (noticeably missing the popular mega-cap growth stocks like Amazon (AMZN), Tesla (TSLA), Nvidia (NVDA), Alphabet (GOOGL), Meta (META) and others.

(HD) (ABBV) (CSCO) (AMGN) (CVX) (LMT) (BLK) (VZ) (KO) (UPS)

The fund also offers a relatively large dividend yield (3.6%), and the income (paid quarterly) is focused on qualified dividends (i.e. they’re eligible for the lower qualified dividend tax rate, instead of your ordinary income tax rate).

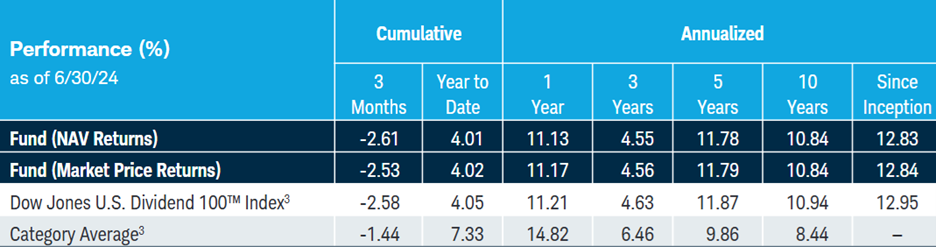

The fund’s goal is to track the total return of the Dow Jones U.S. Dividend 100™ Index (the index is focused on the quality and sustainability of dividends), and it has succeeded so far (the fund’s beta to that index is 1.0).

Furthermore, the fund’s beta to the S&P 500 is below 1.0, an indication that SCHD is less volatile than the overall market (something a lot of investors want). According to Schwab, SCHD invests in “stocks selected for fundamental strength relative to their peers, based on financial ratios.”

Also worth mentioning, SCHD recently had over $54.6 billion in total assets, which basically equates to “cult status” in the ETF world (it’s the 26th largest ETF), and this also helps keep the fund’s total expense ratio down (economies of scale).

Historical Performance: Growth Vs. Value

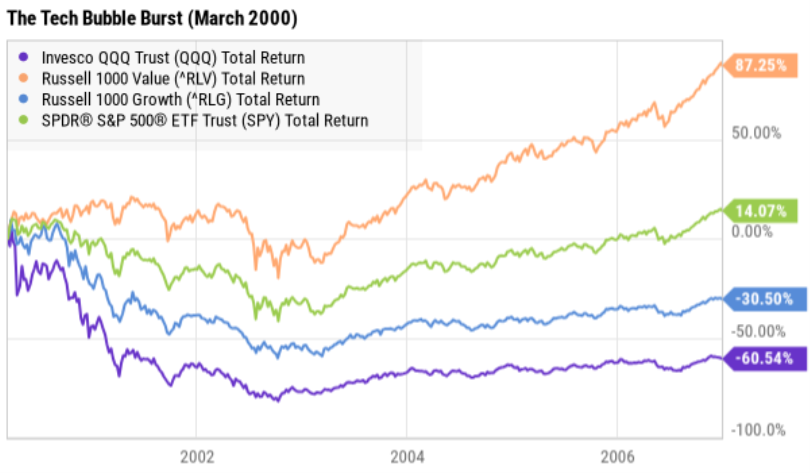

Past performance does not guarantee future results, but given this fund’s distinct value focus (see style box earlier), it is meaningful to consider the relative past performance of value stocks versus growth stocks. And for starters, let’s consider how value stocks performed versus growth stocks when the “tech bubble” burst in 2000, as you can see in the following chart (orange line: value, purple line: tech heavy Nasdaq 100 (QQQ)).

As you can see in the chart above, growth and tech stocks performed incredibly poorly when the tech bubble burst, especially as compared to value stocks.

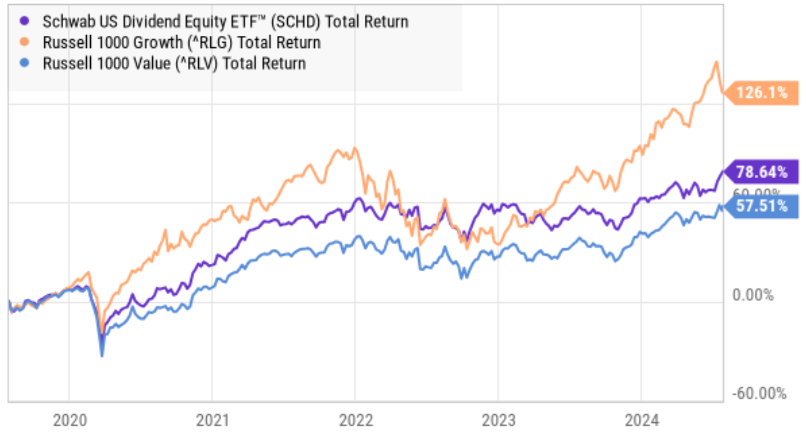

Note: We are using the large cap value index (RLV) as a proxy for SCHD because SCHD didn’t even exist until 2011. However, we can see in the next chart that more recently value (including SCHD) has been underperforming growth.

And of course, timeframe makes a big difference. Here is a look at performance of growth and value since before the tech bubble peaked.

As you can see, value stocks dramatically outperformed growth stocks for years when the tech bubble burst. And this is important today considering growth stocks have performed so well relative to value (an increasing chorus of investors are wondering if we’re due for a major growth stock correction).

Emotionally Intelligent Investing:

It’s worth taking a moment to consider “emotionally intelligent” investing, as it relates to SCHD. For example, you can see in the graphic below, SCHD basically checks all the boxes.

For example, investors don’t typically buy SCHD out of fear or greed (i.e. they’re not trying to “hit it big,” and they’re not burrying their heads in the sand either). Instead, they buy SCHD because they’re looking for lower-volatility performance, from quality companies that offer healthy growing dividends.

Risks:

Of course there are also risks to investing in SCHD. For example:

Market Risk: SCHD owns dividend-value stocks, and even though they’ve historically been less volatile than the overall stock market, they are still volatile and they can still go down in price. We can see this in our earlier performance charts, and investors should keep this risk in mind if they are going to own SCHD.

Style Risk: Although SCHD is diversified across ~100 different companies from across all 11 GICS market sectors, SCHD still has some style risk. In particular, it is tilted toward higher-dividend value stocks. And while these types of stocks can exhibit many attractive qualities, they can also underperform high-growth stocks for extended periods of time (as we saw in our earlier performance charts).

Implementation Risk: SCHD is a fairly straightforward strategy, and Schwab is a fairly-well respected (in some circles) investment company. However, that doesn’t mean the fund cannot make mistakes in implementing its strategy (everything from its use of securities lending, to a small amount of derivatives, and fees) can all lead to mistakes and performance tracking error versus the benchmark. Nonetheless, the fund is not overly complex, and Schwab has a growing track record of success with the strategy.

Conclusion

If you are looking to bet on volatile moonshots, you might consider our recent article on Enovix (i.e. your smartphone needs a better battery). But if you are looking for healthy growing dividends and lower market volatility, you might consider owning SCHD instead (we like it enough to include as an “honorable mention” in our new report, Top 10 Big Yields).

But at the end of the day, above all else, you need to invest in a strategy that is right for you, based on your own personal situation. Disciplined, goal-focused, long-term investing continues to be a winning strategy.