Sharing Updated Data: Big-yield BDCs have been particularly weak over the past few weeks (following earnings), especially in light of widening credit spreads (i.e. lending risk) and a looming rate cut by the fed (which will negatively impact some floating rate recipients more than others). Sharing updated comparison data on 35+ big-yield BDCs, plus a brief opinion on whether now is the time to buy or head for the hills.

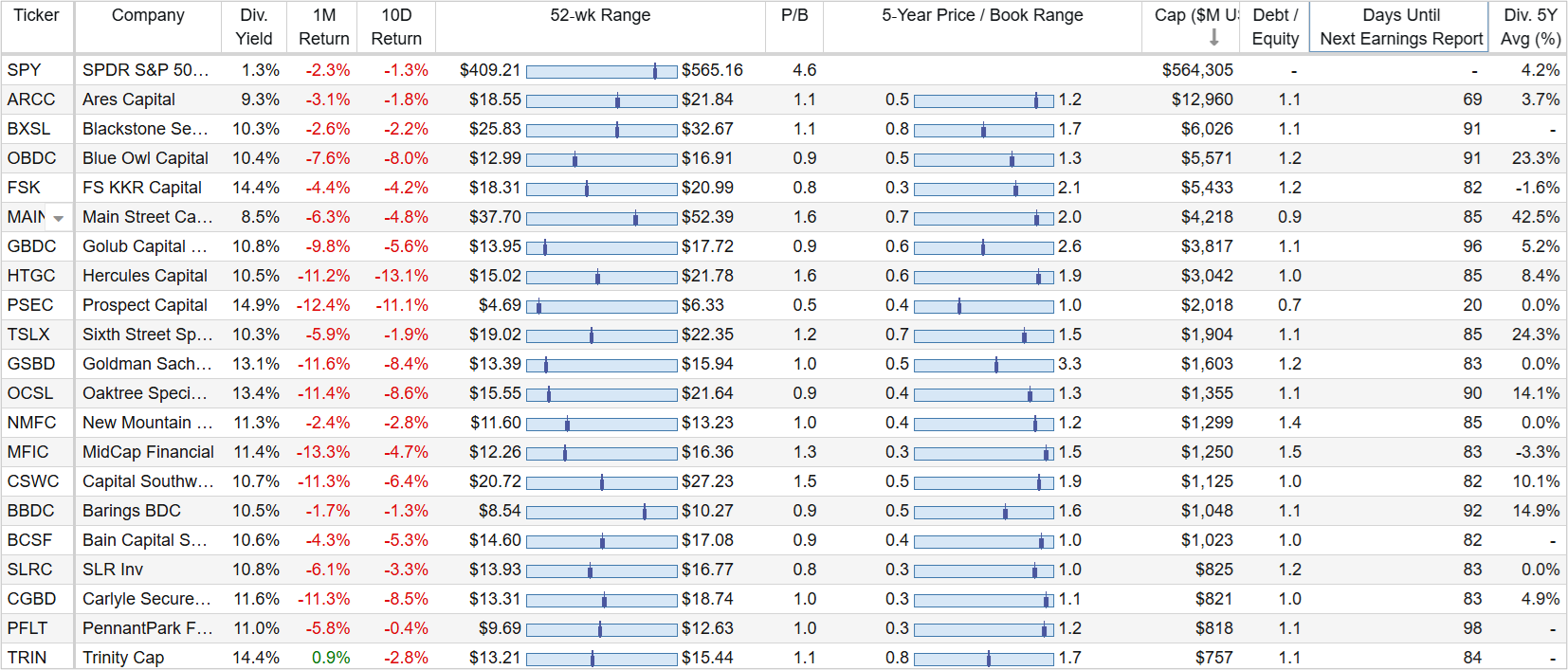

As you can see in the table below (sorted by market cap, with the S&P 500 at the top for comparison), BDCs are down in recent weeks and sit well below their 52-weeks highs (unlike the S&P 500 which is still fairly close).

Most BDCs announced quarterly earnings within the last two weeks (as you can see in the “Days Until Next Earnings Report” column, where ~90 days equals a quarter), and the results were not especially strong. Two things plaguing the group are credit spreads and looming interest rate cuts.

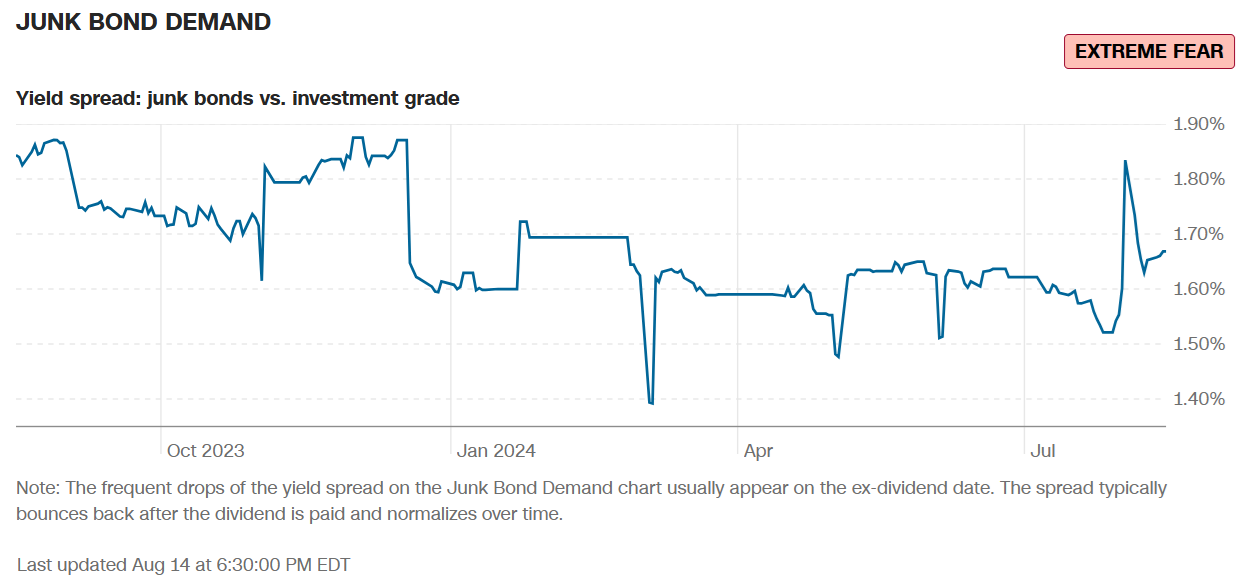

Credit Spreads:

Credit spreads (in this case the difference between junk and investment grade bonds) have widened. This is typically an indication of risk and fear, and accordimg to the CNN “Fear & Greed Index” spreads currently indicate “extreme fear.”

When spreads blow out, junk bonds (and riskier lending in general, such as BDCs) sell off (when price goes down, yield goes up), and this is part of what has happened to BDCs in the last few weeks (i.e. they sold of as spreads widened).

In reality, spreads are NOT that wide by historical standards (and they’ve already come back down a bit), an indication that BDCs (which haven’t rebounded much yet from the recent sell off) may be attractively priced. And unless the market deteriorates dramatically from here, BDCs are attractive.

Rate Cuts Loom:

With the latest inflation reading, market participants are increasingly predicting rate cuts at the upcoming September 18th fed meeting (according to fed funds futures, there is a 47% chance of a 25 basis point cut and a 53% chance of a 50 basis point cut). And if/when rates are cut, BDCs will be impacted differently, but it could have a significantly negative impact on many.

For example, BDCs that receive a lot of floating rate interest payments (on the loans they have made) will receive less interest income on their investments. Of course there are a lot of moving parts (with rate floors and limits) and BDCs can be widely different (many focus on riskier refinancing loans, while some offer financing to venture-growth investments, for example). But in aggregate, the rate cut potential adds risk for many.

Importantly however, the expectation for interest rates cut is already baked into prices (i.e. part of the reason prices have come down).

Interestingly, you can see in the last column of our earlier table many BDCs have successfully increased their dividend payments over the last 5 years, a trend that may continue to slow.

Bottom Line:

While a a lot of investors are increasingly nervous about BDCs, we view the recent selloff as an increasingly attractive contrarian opportunity. We curently own 4 BDCs in our Blue Harbinger High Income NOW Portfolio (one of which was added in the last two weeks), and expect them to continue to weather the storm (of rate cuts and credit spreads) while also continuing to pay attractive big dividend income to investors.