This report is about generating easy alpha and big steady income from a balanced core portfolio of ETFs (such as Vanguard’s S&P 500 ETF (VOO)) and augmented with optional satellite single-stock investments as per your personal preferences (we give multiple top idea examples). This strategy will beat the pants off your peers and create an easier life for you (“chi”). After reviewing the details and advantages of VOO (and a balanced core-satellite portfolio), we conclude with our strong opinion on how best to implement this highly-customizable strategy to achieve your personal investment goals.

Easy Alpha: S&P 500 ETF (VOO):

As passive ETF investing continues to gain momentum (over active stock picking), we’ve all heard the common refrain, which usually goes something like this:

“Most people can’t beat the market anyway, so you might as well just buy a passive low-cost S&P 500 index fund.”

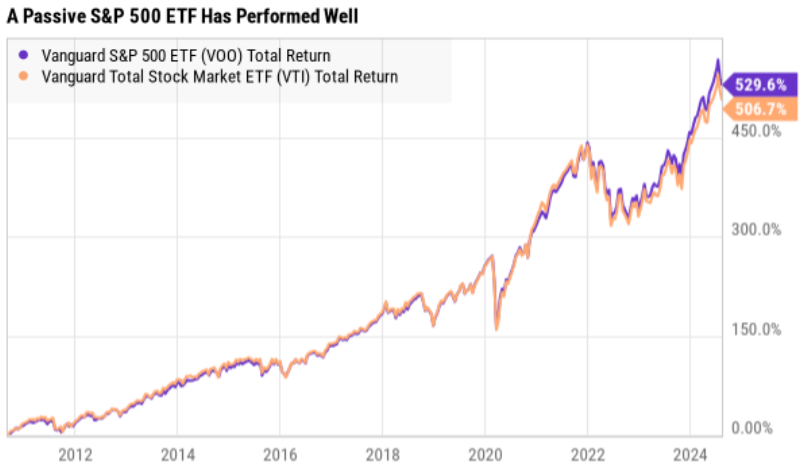

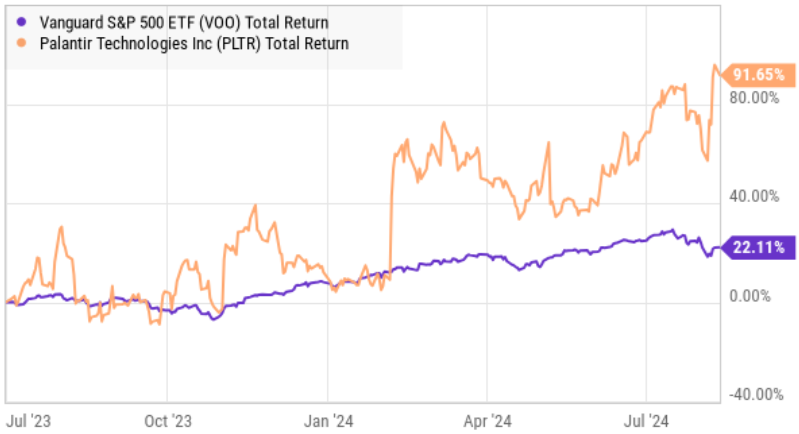

For example, Vanguard’s S&P 500 Index ETF (VOO) fits the bill, and it has performed very well in recent years, as you can see in the chart below.

Before getting into the details on why so many investors cannot beat an S&P 500 index fund, let’s first consider what the S&P 500 actually is:

“The S&P 500 is a stock market index that tracks the prices of about 500 of the largest U.S. public companies across all sectors of the economy. It is a market-capitalization-weighted index, meaning the companies are weighted by the value of their outstanding shares available for public trading. The S&P 500 is used as a benchmark for the performance of the U.S. stock market and the U.S. economy as a whole. It is one of the main tools and indicators that investors, economists, and news reports use to follow the trends and movements of U.S. stocks.

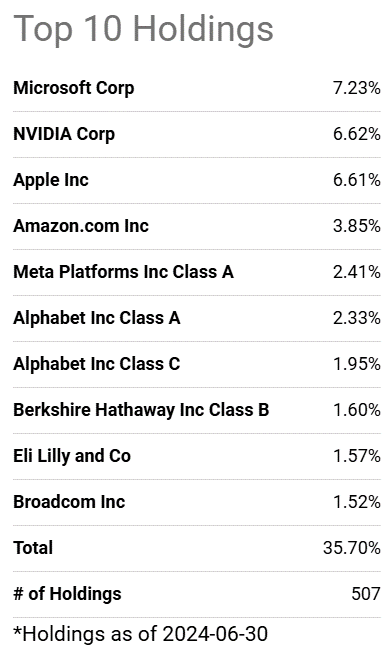

So for example, you can see the top 10 largest positions in the S&P 500 (and in VOO) in the following chart.

Specifically, VOO tracks the performance of the S&P 500 by using a full-replication technique (which means it owns all ~500 stocks in the index, and in essentially the same weights).

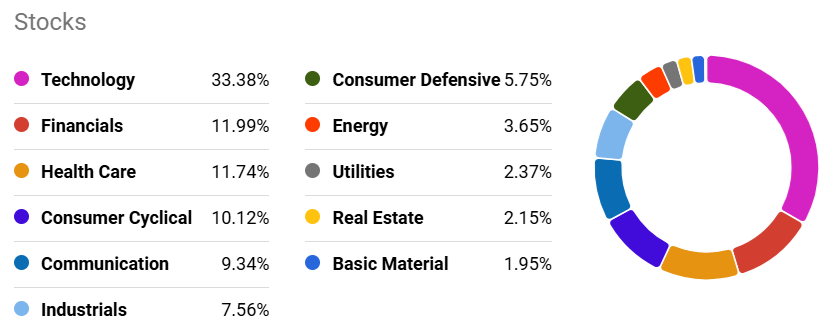

Also worth mentioning, VOO invests in large-cap stocks of companies operating across diversified market sectors, including both growth and value.

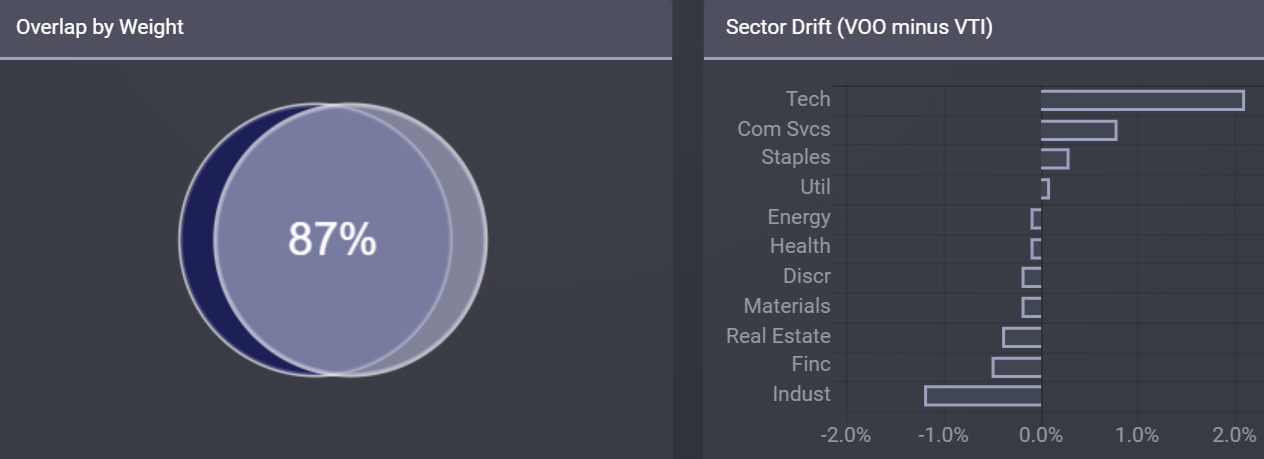

Also important to mention, even though the S&P 500 invests in “large-cap companies” only, it still encompasses ~87% of the entire US stock market (by market cap) because the 3,000+ additional smaller-cap US stocks don’t have nearly as much market cap (and thereby making the S&P 500 a good proxy for the entire US stock market).

And if you want to also include the mid-cap and small-cap stocks VOO is missing, you can use Vanguard’s Total Market Index ETF (VTI) which owns over 3,600 stocks, including all market caps. Yet because large caps make up most of the total market cap, you can see VOO and VTI tend to perform very similarly (see our earlier chart: “A Passive S&P 500 ETF Has Performed Well”).

So with that backdrop in mind, let’s consider why so many investors cannot beat the performance of the S&P 500.

Emotional Investing Mistakes

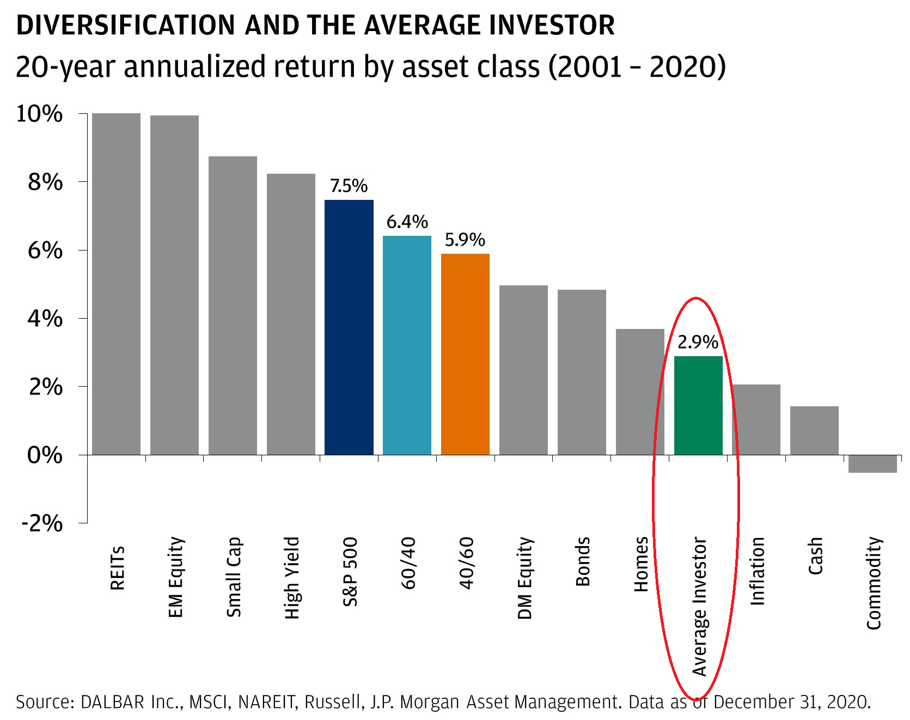

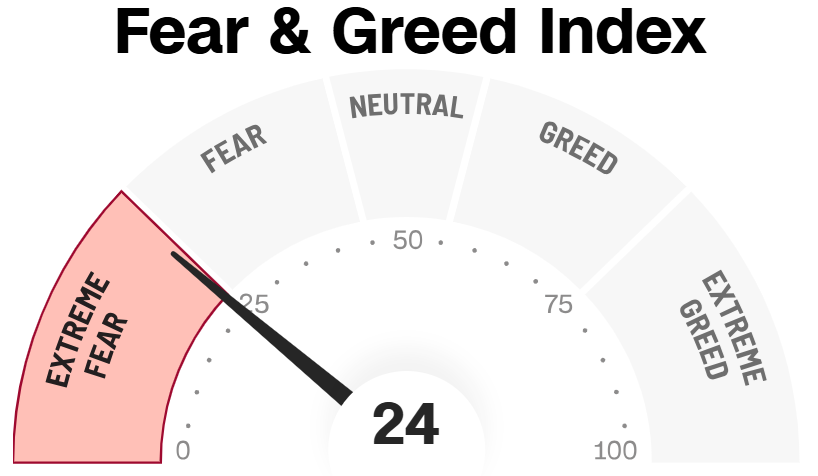

The reason most investors cannot beat the S&P 500 is not simply because they are terrible stock pickers (although a lot of them are), but more broadly it’s because they have widely different goals (which we will cover in the next section) and because they make ugly emotional mistakes.

For example, you can see the two sharp declines in our earlier S&P 500 chart (above) in 2020 (when the pandemic hit) and in 2022 (as the subsequent pandemic bubble burst). Sadly, many investors panicked when the market declined in 2020, they hit the sell button, and then they missed out on the subsequent market rebound. And then they compounded their terrible performance by buying near the top in 2022 (fear of missing out) and then got caught in the selloff (i.e. they got most of the downside with basically none of the upside), a round trip of ugly emotional mistakes.

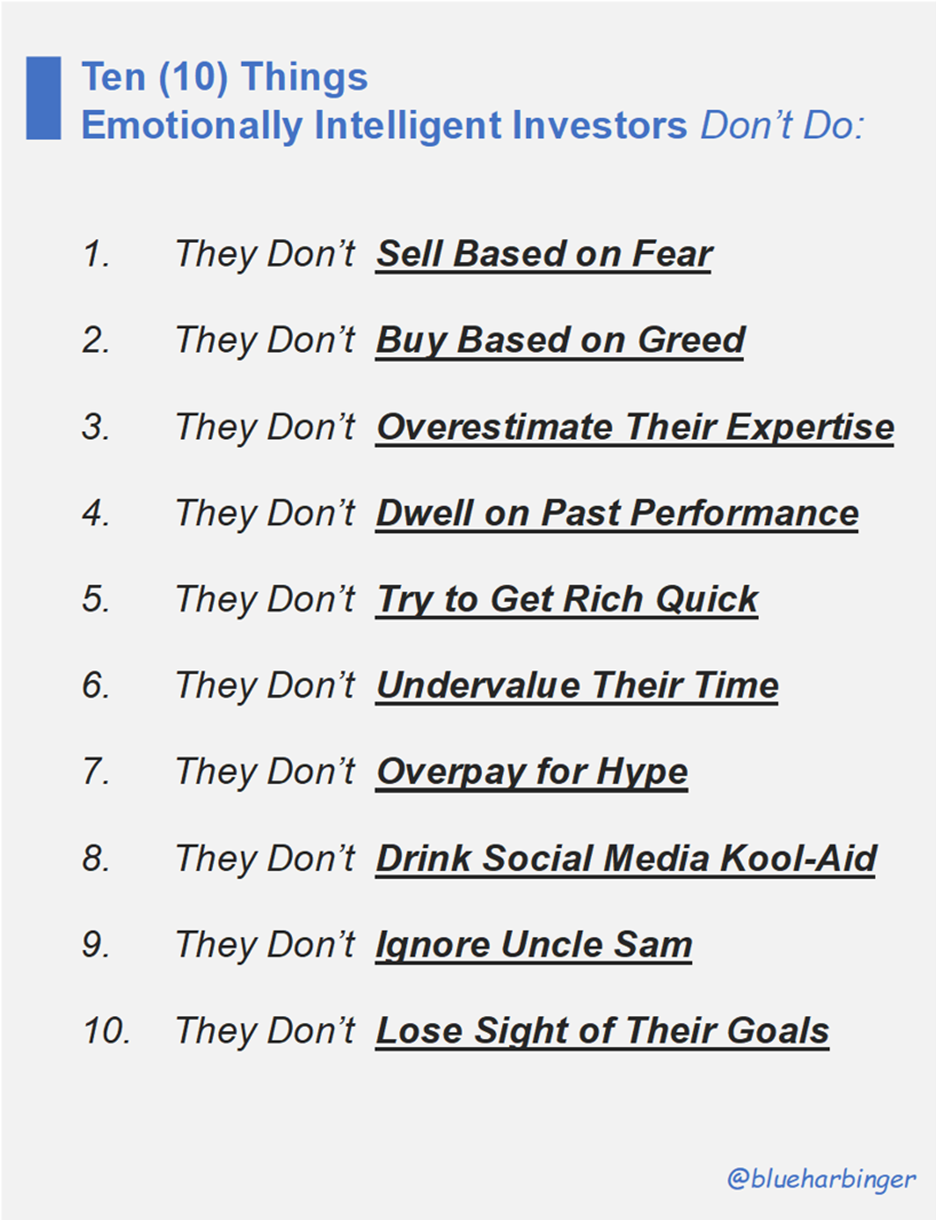

In addition to trading out of fear, here is a list of additional things “emotionally intelligent” investors do NOT do:

However, by investing in an S&P 500 index fund (like VOO), investors can avoid a lot of these mistakes. Specifically, because the S&P 500 includes ~500 stocks, the aggregate index is far less volatile than the individual stocks (diversification can reduce volatility) and this can help reduce the urge for many investors to “panic sell” there stocks at the exact wrong time. In fact, according to a study from Vanguard, a little “behavioral coaching” (i.e. emotional discipline) can help investors add up to 2% in “alpha” each year.

Big Income: A Balanced Core Portfolio

Excluding dividends, the S&P 500 has returned over 10.5% annually for the last decade, but most people realize you cannot simply withdraw ~10.5% each year as if it were some “big income” dividend (because the 10.5% is an average, and the actual index is up dramatically more in some years and down big in others).

Yet despite this well-known stock market volatility, many investors (who should NOT be 100% invested in stocks), pour everything they own into the stock market and then panic sell when it sells off (i.e. one of the ugly emotional mistakes we discussed earlier).

Fortunately, there is a better way.

A balanced core portfolio (of VOO, plus a simple bond market index ETF (BND)) allows many investors to enjoy a significant portion of long-term stock market gains with far less volatility and steadier high income (which ultimately allows them to achieve their “easy alpha” and “big income” goals). For example, you can see in the chart below how a mix of stocks and bonds can reduce volatility (which can lead to a reduction in emotional mistakes too) thereby producing steadier returns that you can use as a “dividend” (as we discuss in the next section).

Customizable Big Yield

Some “experts” argue “The 4% Rule” which states you can “safely” withdraw 4% from your 50/50 stock/bond nest egg each year (as if it were a “dividend”) without ever running out of cash during retirement (even after giving yourself an annual raise on that 4% to account for inflation). But some investors will argue the amount is actually much higher than 4% (based on your personal situation and volatility tolerance). We’ll give some specific examples (including big-income “satellite investments”) later in this report.

Very importantly however, this balanced portfolio withdrawal rate can help many investors avoid common “undiversified mistakes,” such as yield chasing (e.g. buying only investments that yield 10%+ can be an emotional mistake that often destroys alpha) and the unbalanced mistake of investing in 100% stocks (when they should also own some “fixed income” based on their personal situation and goals).

Optional Single-Stock Satellites:

One of the additional advantages of a balanced core portfolio consisting of mainly ETFs (aside from sleeping better at night) is you can augment it with attractive individual stock and bond strategies to meet your personal needs, as shown in the graphic below (i.e. the core ETF ticker symbols are shown in the center, with optional customizations as “satellites”).

For perspective, the above graphic may assume a 60% stock (mostly US) and 40% bond & high-income (also mostly US) allocation strategy, and this mix is not entirely different from many typical target date funds from Vanguard (depending on where you are in the lifecycle, with more stocks for younger investors and more bonds for older investors). However, it is customizable in the sense that you can add individual stocks and bond strategies based on your personal situation (while still adhering to the 60/40 allocation target, or whatever your personal targets may be).

3 Top Satellite Examples:

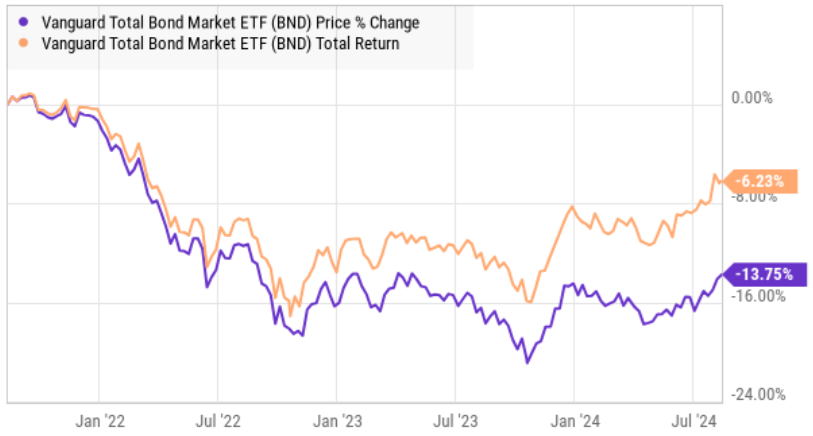

For more perspective, we are including three satellite investment ideas for you to consider (i.e. to augment your core ETF portfolio) below. But worth mentioning, a lot of investors a disgusted by the idea of investing in a bond ETF, such as the Vanguard Total Bond Market (BND) considering its low yield (currently ~3.4%) and its horrendous performance in recent years (see chart below).

Just know that the bond market performed historically poorly in recent years because of the fed’s unprecedented rapid hikes to interest rates (to combat the very high inflation they helped create in the first place) (i.e. when rates rise, bond prices fall, all else equal). And it would be an “emotional investing” mistake to assume the past performance (of the last few years) is indicative of future performance. In fact, if the fed starts cutting rates, bond prices will go up (all else equal). Also, keep in mind the longer-term returns on bonds have been significantly better than the last few years.

So with that in mind, let’s get into some specific “satellite investment” ideas.

PIMCO Dynamic Income Fund (PDI), 14.1% Yield: PIMCO is the industry leader in big-yield closed-end bond funds (“CEFs”) revered by many investors for a long track record of paying big steady income. Rather than owning 100% of your target fixed income exposure through a passive, lower-yield bond ETF like (BND), many investors like to add some PDI to customize their results. Despite market price volatility, PDI has provided steady big income (paid monthly) to investors. We recently wrote up this big yield investment in detail here.

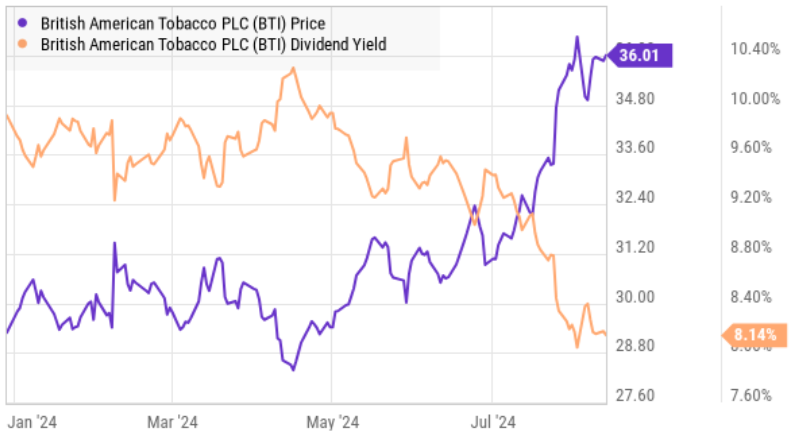

British American Tobacco (BTI), 8.3% Yield: If you can get passed the unhealthiness of tobacco, we had been pounding the table about the attractiveness of British American Tobacco’s dividend since December.

We still own shares, but we just recently reduced the amount after a strong stock price rally (i.e. when the market got volatile in July, investors flocked to British American Tobacco for safety—driving the shares significantly higher). You can read our previous writeup on the stock here.

Palantir (PLTR): Switching gears from income to growth, Palantir is a stock that is hated by Wall Street (they rate it much lower than other growth stocks), but one we’ve been pounding the table on as attractive for a while.

Palantir benefits from the incredible growth opportunities in Artificial Intelligence, as we wrote up in detail (prior to its recent powerful rally) here.

Depending on your personal situation, the three names described above are examples of satellite investments you may want to consider (we currently own all three). Rather than “betting the farm” on any one of them (which can be far too risky) using individual stocks (such as these) to augment your core strategy can help you achieve alpha and peace of mind.

Chi: Balance Your Risks & Rewards

You may have heard of the Chinese concept of “chi energy,” a “life force” permeating your being that when in balance (between positive and negative) can dramatically improve your mental and physical health. Well, it applies to investing too, and if you have too much (or too little) “risk” in your portfolio then your mental and physical health may suffer from being out of balance.

For example, if you are losing sleep at night because of the recent stock market volatility that could be an indication you have too much risk in your portfolio. Perhaps from too many individual stocks, or perhaps from not enough fixed-income investments. And, building a more core-satellite portfolio (with more passive ETFs and/or more fixed-income investments) may be a better strategy for you.

Similarly, some investors may not need stocks anymore because their nest egg is large enough to live off steady fixed-income investments forever. While others may take the opposite view, having a pension plus social security to cover all their living expenses and now instead want to focus on more aggressive long-term growth stocks (especially because they’ve already built the financial wherewithal to handle any short-term market volatility).

Additionally, investors have widely different preferences in terms of the time they spend on investing. And a core-satellite strategy (perhaps including more VOO or VTI) may help some individuals spend as much (or as little) time on investing as they want.

Conclusion:

If you're stressing out over your investments, that could be a good indication that your risk-versus-reward are out of balance, and there could be a better way to achieve the easy alpha and big income you want and need (such as a customized core-satellite strategy with a healthier dose of passive ETFs like VOO, as well as better satellite investments too, such as the ones described in this report).

At the end of the day, you need to do what is right for you, based on your own personal situation. Disciplined, goal-focused, well-implemented, long-term investing continues to be a winning strategy.