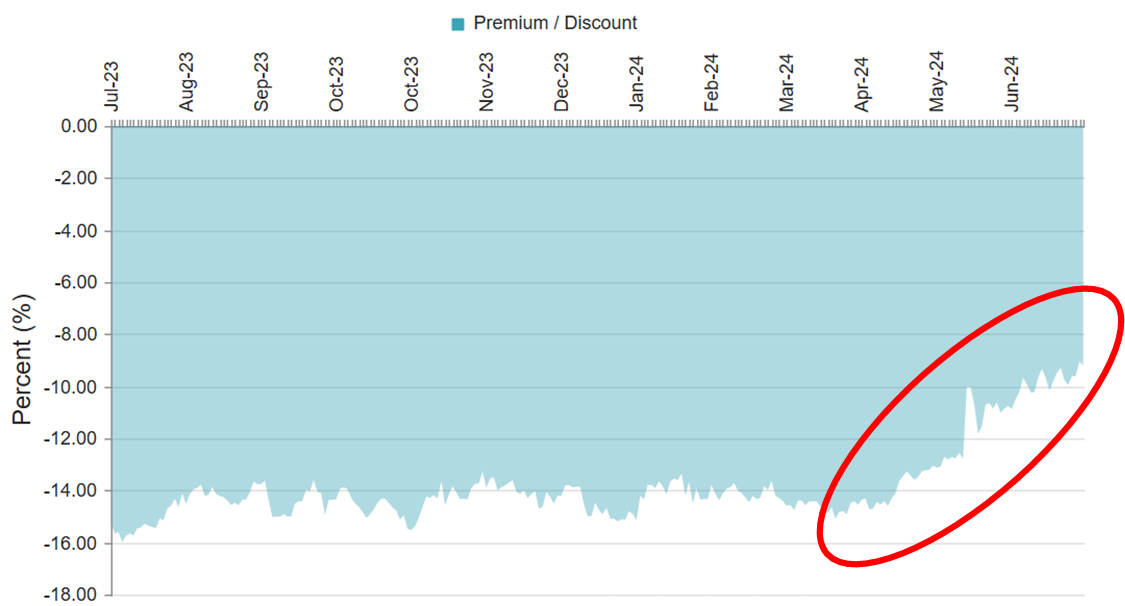

Quick Note: As we wrote about previously, this attractive stock-market closed-end fund (“CEF”) recently announced initiatives to shrink its discount to NAV (good for shareholders). The initiatives include a newly increased distribution to at least 8% per year (up from at least 6% per year), plus a public market tender offer to acquire up to 10% of the shares at 98% of NAV. And as you can see in the chart below, things are going well as the long-time big discount to NAV (previously around 14%) is shrinking (again, good for shareholders). And we think there is more room for gains (i.e. the discount will get smaller).

Adams Diversified Equity Fund (ADX), Yield: 8%+ (paid quarterly).

Of course we are talking about ADX, and you can read the previous press releases (about the initiatives) below, plus our recent full write-up on the opportunity:

ADX press releases: