So the latest reports of cooling inflation triggered some market rotation this week, and there could be more to come. One group that may be particularly well-positioned for gains is select software application stocks. For example, the group has been underperforming the market, but the fundamentals have remained strong. In this report, we briefly review changing interest rate expectations, sector rotation, and 3 top software application stocks, especially as the AI boom proliferates beyond just phase one hardware/semiconductors).

Interest Rate Expectations:

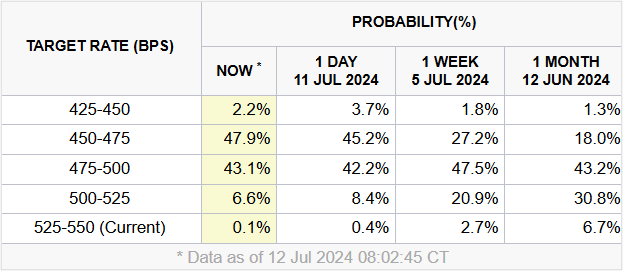

For starters, here is a look at the significant change in market expectations for an interest rate cut before the end of the year. Generally speaking, an interest rate cut is good for the economy becuase it’s easier to fund growth.

The table above shows the market pricing (probability, according to Fed Fund Futures) for an interest rate cut by the Fed’s December 18th meeting. And as you can see, the chance of a rate cut (to the 450-475 range) has increased significantly over the last week and month.

Market Rotation:

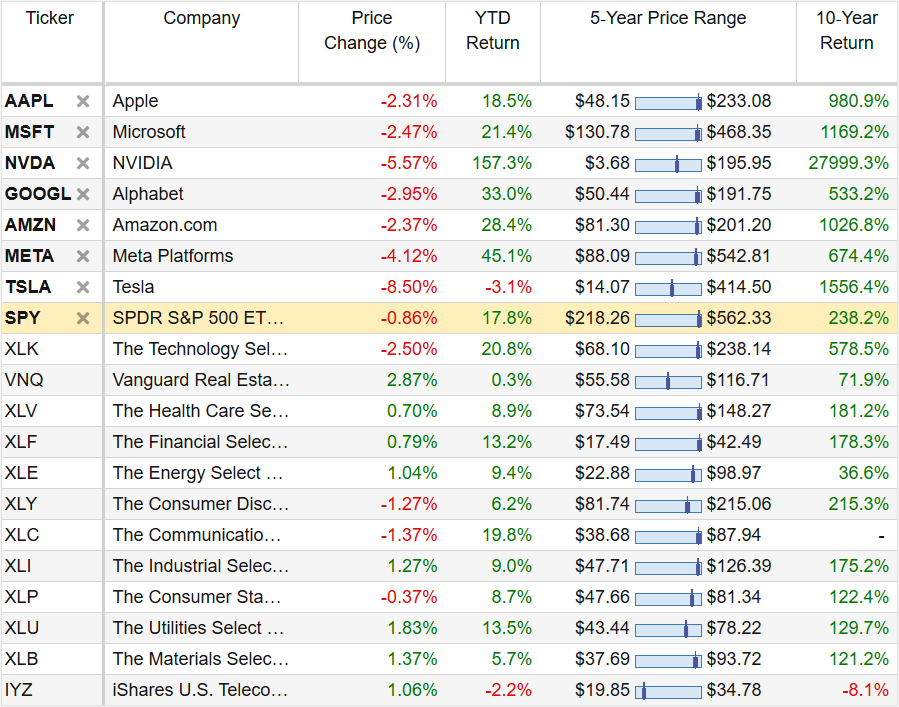

The trigger for the change in interest rate expectations was a slightly cooled inflation reading, which led to some immediate and significant market sector rotation. For example, you can see the Magnificent 7 stocks (where a lot of investors have been hiding out for safety) immediately sold off hard on Thursday (see price change), and so did most of the entire Tech sector.

Conversely, interest rate sensitive stocks (such as Real Estate) gained dramatically and so did “boring” utilities and materials stocks.

Software Application Stocks:

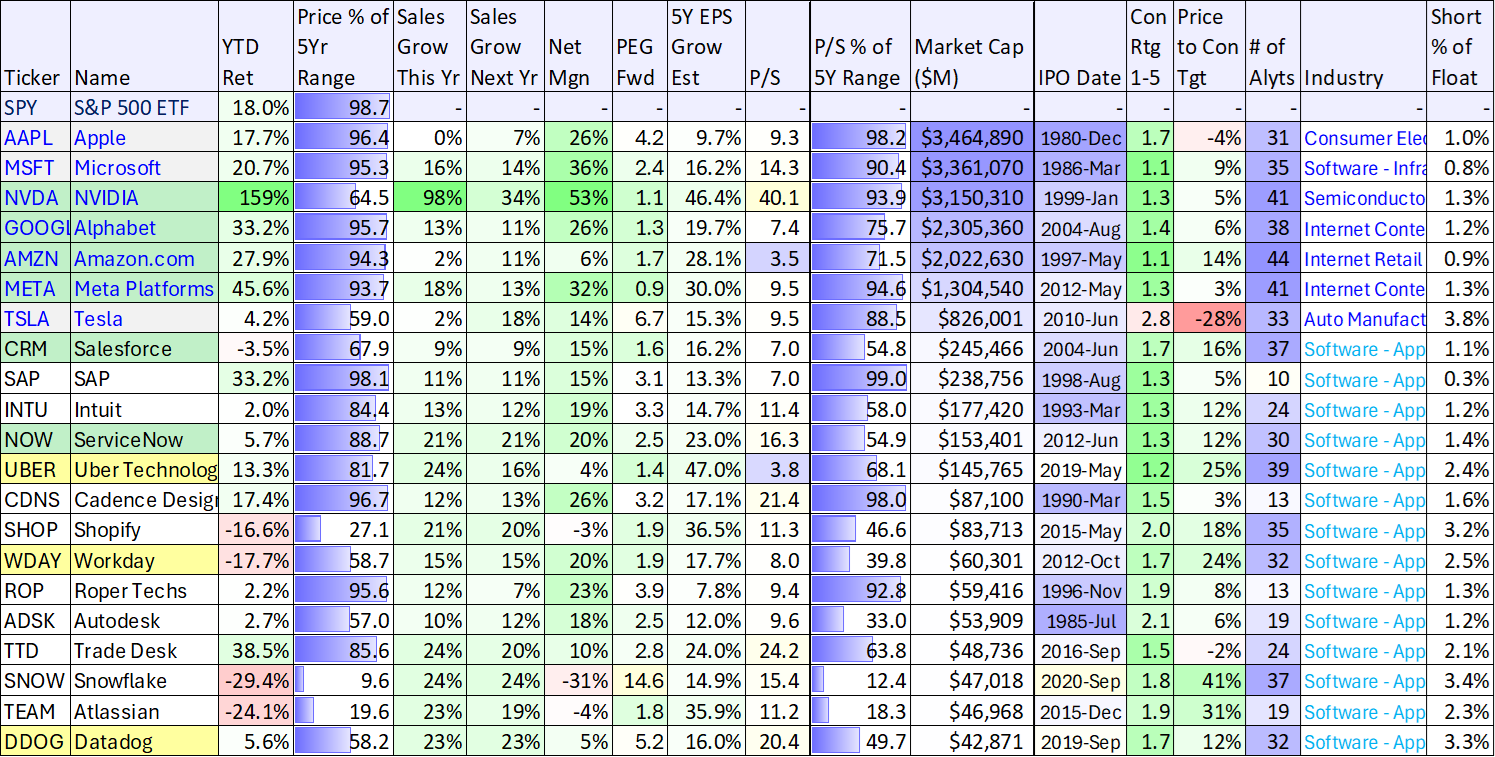

One subset of the Technology Sector that we find particularly interesting is the software application stocks, simply because, unlike a lot of other tech stocks, software application names have been weak (and they probably shouldn’t be). Here is a look at top names in the group (as compared to the Magnificent 7):

As you can see (above), many software application stocks sit well below their 5-year pricing highs (even though the S&P 500 and the Magnificent 7 sit very close to the top of that range).

And what makes software application stocks so interesting is that many of them have very strong fundamentals. For example, names like Salesfore (CRM) and ServiceNow (NOW) have very healthy growth trajectories, strong net profit margins and trade at very compelling valuations (in terms of Price/Earnings/Growth (PEG) especially).

Software application stocks soared during the pandemic bubble, then sold off hard and have by-and-large been out of favor since then. They shouldn’t all be though, in our opinion.

What Comes Next—AI Phase 2:

If Artificial Intelligence Phase One has been the buildout phase, where the beneficiaries have been:

Hardware and Semiconductor makers, such as Nvidia (NVDA) and Super Micro Computer (SMCI).

AI Infrastructure/Cloud Builders, such as Meta (META), Microsoft (MSFT), Amazon (AMZN) and others.

Phase 2 may include a rotation to include software application companies where opportunities exist to implement AI solutions.

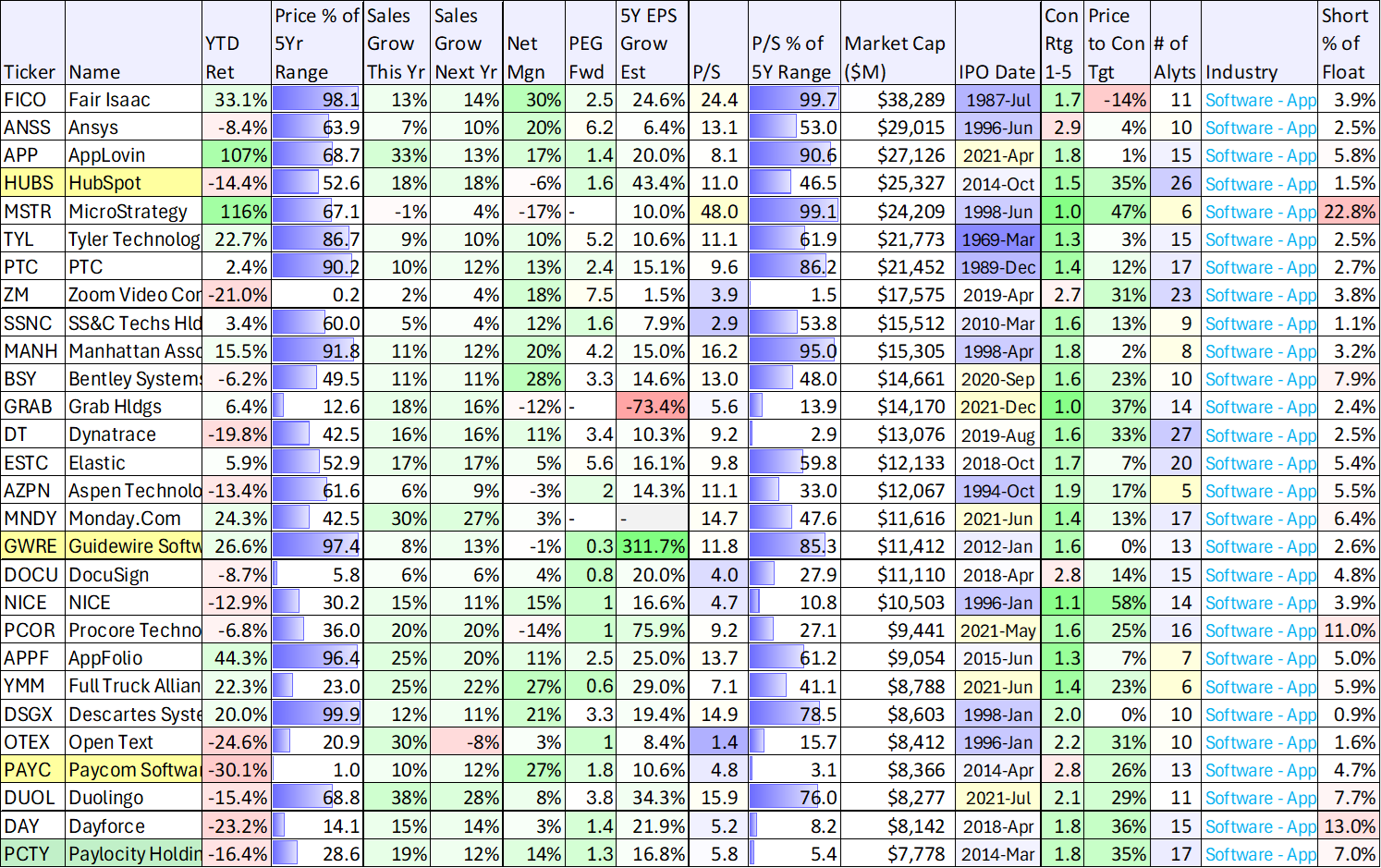

In particular, we like (and own) the following names:

Salesforce (CRM)

ServiceNow (NOW)

Paylocity (PCTY)

Each of these names has compelling growth, profits and valuation (again, we like PEG ratio here). In particular, we could see a reacceleration of growth (outside of the Magnificent 7) now that inflation is cooling, rate expectations are lowering and sector and industry rotation may continue. All three names (CRM, NOW and PCTY) service businesses with Software-as-a-Service (“SaaS”) applications, and as the economy accelerates beyond the Magnificent 7, these thee business could be beneficiaries in terms of more new customers and valuation multiple expansion.

The Bottom Line

As always, goal-focused investing in everything. If you are a high-income focused investor—contrats on the incredible gains we saw for that goup on Thrusday of this week (there could be more to come, considering rates expecations). And if you are a long-term growth investor—now could be another good opportunity to consider opportunities beyond just the Magnificent 7 (as inflation/interest rates cool and sector/industry rotation may continue.

You can view all of our current holdings here.