If you are an income-focused investor, Real Estate Investment Trusts (“REITs”) can be attractive. And one REIT that stands out for its growing dividend yield (and growing funds from operations) is VICI Properties (an “experiential” REIT best known for its Caesar’s Palace and MGM Grand properties on the Las Vegas strip). In this report, we review VICI’s business (including what makes it special), dividend safety, valuation and risks. We conclude with our opinion on investing.

Overview: VICI Properties (VICI)

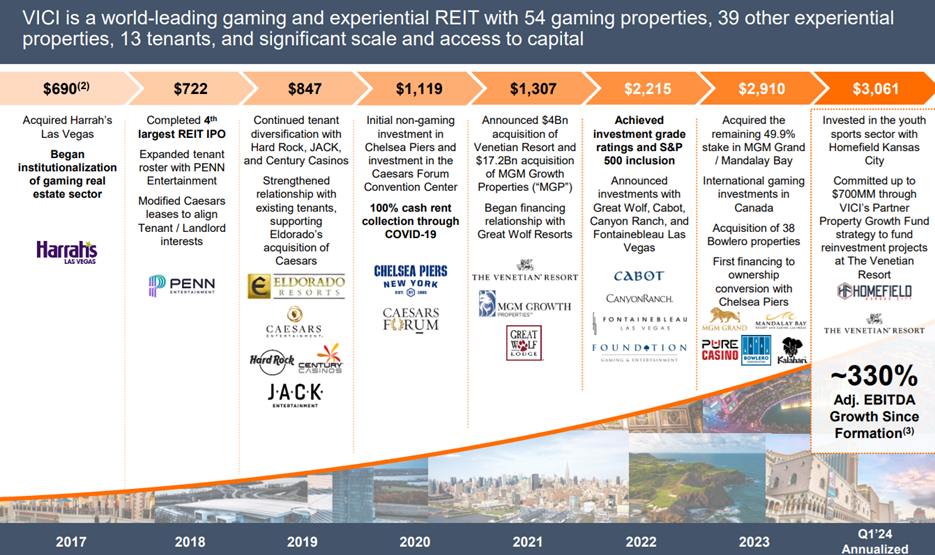

VICI is an S&P 500® experiential REIT that owns one of the largest portfolios of market-leading gaming, hospitality and entertainment destinations. The company frequently touts its diversified portfolio of 93 experiential assets across geographies (including 54 gaming properties, 60,300 hotel rooms and 500 restaraunts, bars, nightclubs and sportsbooks).

However, it’s important to note 74% of its annualized rent comes from just two tenants, Caesar’s Entertainment and MGM Grand Resorts.

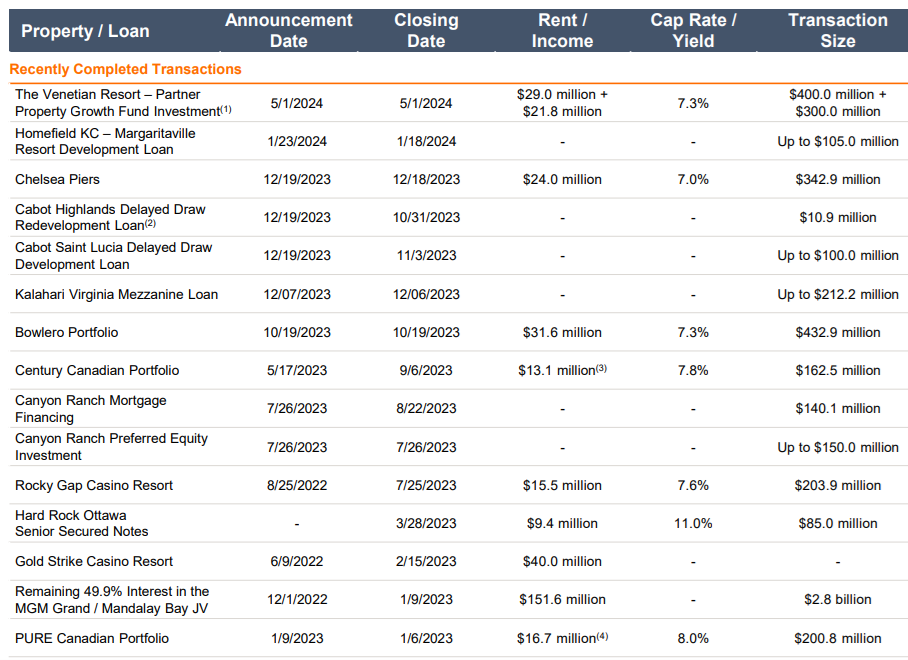

Aside from the big tenants, VICI also has a growing roster of real estate and financing partnerships with leading operators in other experiential sectors, such as Bowlero, Cabot, Canyon Ranch, Chelsea Piers, Great Wolf Resorts, Homefield and Kalahari Resorts. Plus, VICI owns four championship golf courses and 33 acres of undeveloped and underdeveloped land adjacent to the Las Vegas Strip.

One of the company’s overall goals is to “create the highest quality and most productive experiential real estate portfolio through a strategy of partnering with the highest quality experiential place makers and operators.”

Also interesting to note, as of December 31, 2023, VICI had just 28 employees (all of which are full-time). According to the company:

“All of our employees are employed at VICI LP in support of our primary business as a triple-net lease REIT and are primarily located at our corporate headquarters in New York, New York.”

Per the company’s annual report:

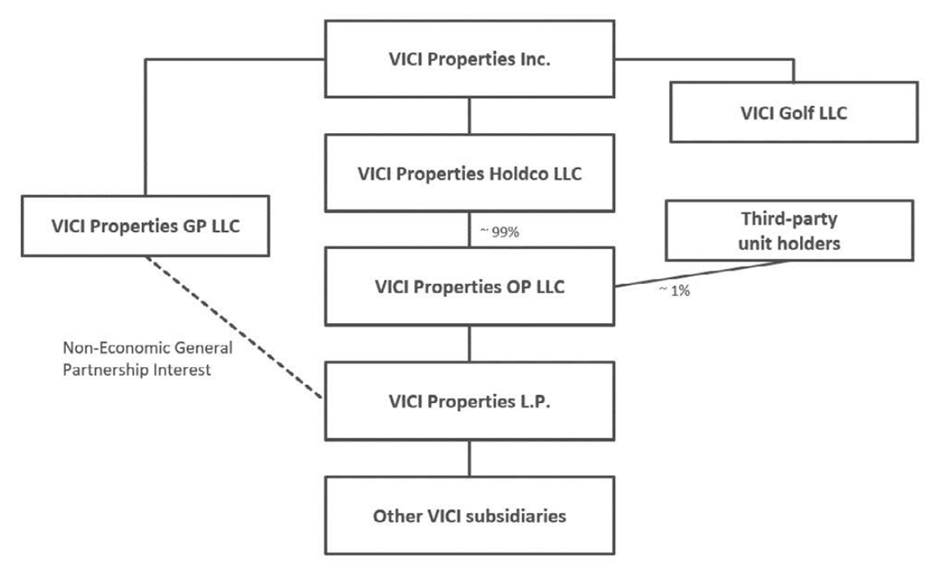

“VICI is a real estate investment trust (“REIT”) that is the sole owner of VICI Properties GP LLC, the sole general partner of VICI LP. As of December 31, 2023, VICI owns 100% of the limited liability company interests of VICI Properties HoldCo LLC (“HoldCo”), which in turn owns approximately 98.8% of the limited liability company interest of VICI OP (such interests, “VICI OP Units”), our operating partnership, which in turns owns 100% of the limited partnership interest in VICI LP. The balance of the VICI OP Units not held by HoldCo are held by third-party unit holders. The diagram above details VICI’s organizational structure as of December 31, 2023.”

Why VICI Is Special:

VICI is special, compared to other REITs, for a variety of reasons.

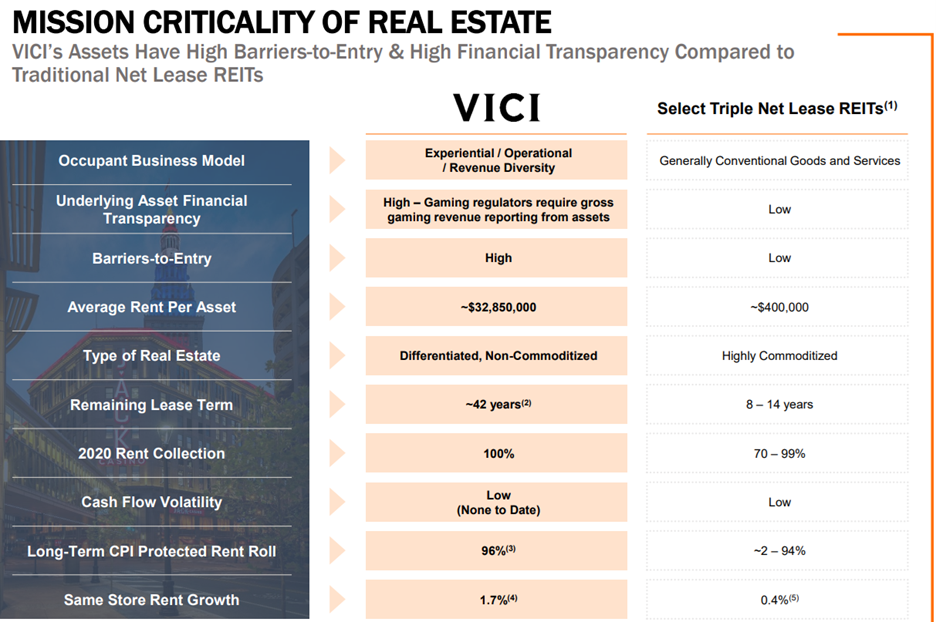

Unique Properities: For starters, VICI’s main properites, on the Las Vegas strip, are unique and not commoditized (they are a signficant source of competitive advantage, i.e. “moat”).

100% Occupancy: Unlike a lot of other REITs that are struggling with occupancy (such as office REITs and Retail REITs, because working from home and shopping online are increasingly common), 100% of VICI’s properties are occupied. This provides a predictable level of rental revenue to support future cash distributions to investors. VICI also has 100% rent collection since its formation in October 2017.

Triple-Net Leases: VICI is a triple-net lease REIT, which basically means the tenant (not VICI) pays all expenses, including real estate taxes, building insurance, and maintenance (and this is in addition to utiities and rent). And while triple-net lease REITs are not extraordinarily special, they do increase the attractiveness of VICI in our view.

Built-In Rent Escalators: VICI has contractual rent escalators with inflation protection. For example, ~50% of rent rolls with CPI-linked escalation in 2024 and ~96% of rent rolls with CPI-linked escalation over the long-term (subject to applicable caps).

Long-Term Leases: On average, the leases on VICI’s properties have 42 years remaining. This compares favorably to typical triple-net lease REITs, commonly with 8-14 years remaining, according to VICI (see earlier graphic).

Growth: VICI continues to achieve growth by partnering with new experiential property operators, as you can see in the following recent investment activity graphic.

Dividend Safety:

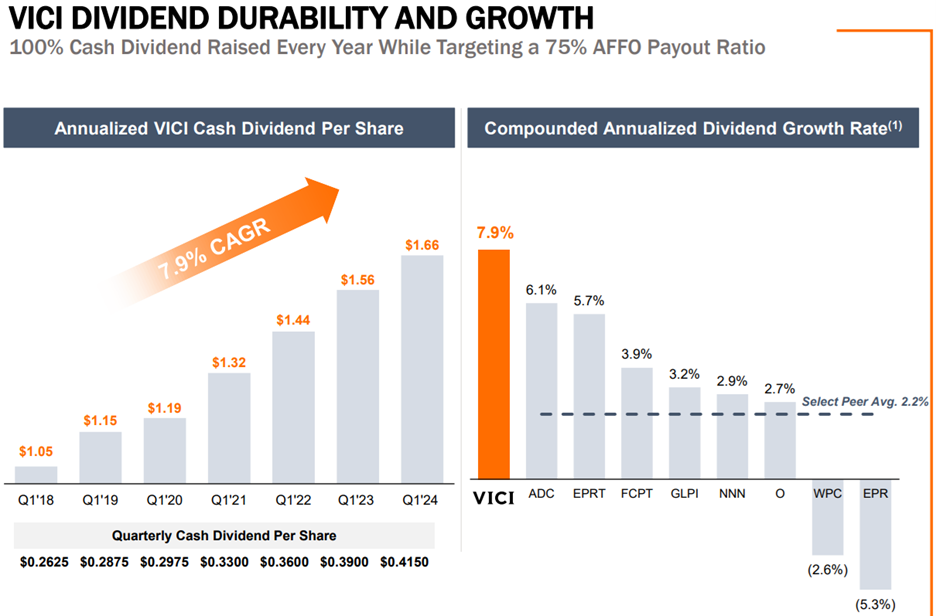

The main reason many investors own VICI is for the dividend. And VICI’s dividend has been growing steadily and is well covered by Adjusted FFO, as you can see in the graphic below.

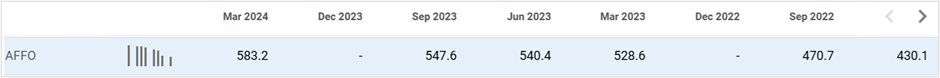

For example, in 2023 VICI increased its dividend and paid a total of $1.61 per share in dividends versus $2.15 of AFFO per diluted shares (i.e a healthy coverage ratio).

source: Seeking Alpha

VICI has increased its dividend every year since its initial public offering, and another dividend increase is expected this year (especially as revenue and AFFO continue to rise).

Valuation:

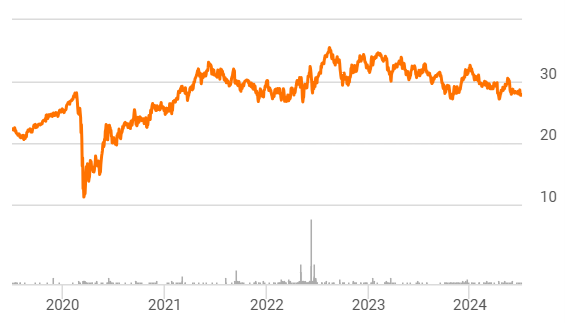

VICI has a well-covered dividend and is growing. For example, management has reaffirmed 2024 AFFO guidance of between $2.22 - $2.25 per share (representing growth over $2.15 in 2023 and $1.93 in 2022). Yet the shares continue to trade at the low end of their price range since the start of 2022.

The shares currently trade at less than 12.5x 2024 AFFO guidance, which is attractive and also below the valuation at this time in 2022 and 2023 (15.9x AFFO and 14.4x AFFO, respectively).

Considering the steady business, ongoing growth, and well-covered dividend, we view VICI’s current valuation as compelling.

Risks:

VICI faces risks that need to be considering.

Property Concentration: For starters 74% of VICI’s rent payments come from just two tenants (Caesar’s and MGM). Both are healthy publicly-traded business, although Caesar’s shares recently had 8.6% short interest and MGM had 4.5% short interest (an indication that some investors are betting against them). Additionally, as VICI seeks new growth opportunities, they will likely come from non-trophy assets (such as Caesar’s and MGM) which could be less attractive.

Credit Rating: VICI has an investment-grade credit rating (a good thing), but it’s only rated BBB- (the lowest investment grade rating). If for any reason the shares get downgraded, this will have a materially negative impact (for example, future refinancings will be at higher rates, and VICI’s future borrowing abilities may be significantly limited). Given the current health of the business (and the “stable” outlook from the ratings agencies), there is no need to be overly worried, but it is a metric to monitor.

Inflation: Inflation presents another risk factor because VICI’s contractual rent escalators may not result in fair market lease rates over time if inflation is particularly high. According to the company:

“Sustained inflation rates that are above any CPI escalator cap could, over time, result in our receiving rental income below fair market lease rates, which could adversely impact the fair value of the assets, our results of operations and cash flows.”

Interest Rates: If interest rates rise it can cause VICI’s share price to fall because investors will require a higher dividend yield (mathematically, as the share price falls, the dividend yield rises, all else equal). Additonally, according to VICI’s annual report:

“elevated interest rates would likely increase our borrowing costs and potentially decrease our cash available for distribution.”

Subdued Price Appreciation Potential: VICI is not a “high-flying” technology stock with seemingly unlimted upside price appreciation potential like many popular growth stocks today. Instead, VICI is a steadier businesses (which is another reason why many investors choose to invest in VICI). Also, the company has engaged in a variety of heding and derivative transactions with may limie gains and/or result in losses.

Conclusion:

VICI doesn’t have the explosive upside potential of many popular technology stocks today, but it does have a well-covered dividend (current yield is 6.0%), a steadier (less volatile) business (exactly what a lot of people want), an attractive valuation especially considering the ongoing growth in AFFO.

Said differently, if you are looking for steady income, VICI is attractive and worth considering for a spot in your prudendly-diversified, long-term, income-focused investment portfolio.