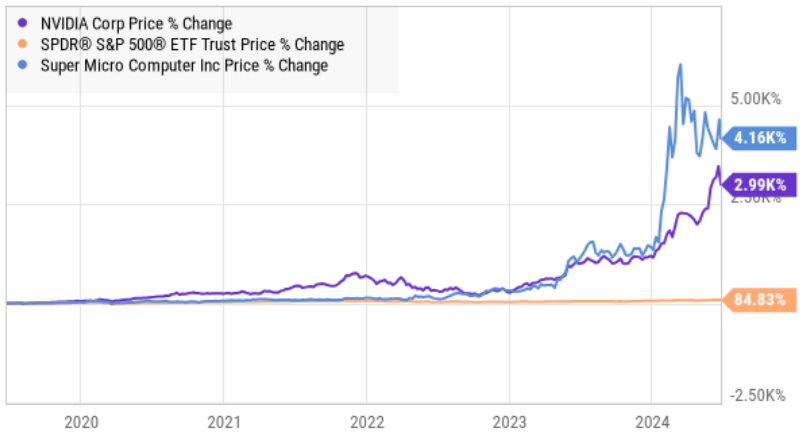

Owning top businesses for the long-term doesn’t mean turning a blind eye to the risks and rewards of market rotation. While Main Street is just now hearing about Nvidia for the first time (it’s up nearly 3,000% over the last 5-years), most investors know chip stocks (like Nvidia) are notoriously cyclical and (despite powerful long-term megatrends, like AI) 50% pullbacks are not uncommon. In this report, we countdown our top 10 growth stocks (July edition) with a special focus on market cycle risks and outstanding opportunities with big long-term upside.

Market Rotation:

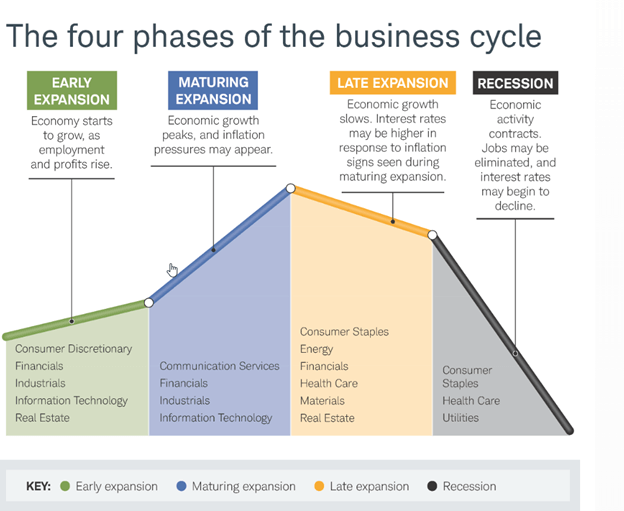

In theory, it’s pretty easy to draw a market cycle (for example, see the illustration below), but in reality it’s not realistic to perfectly time the top and/or bottom (that’s a bit of a fool’s errand, actually).

Based on current macroeconomic conditions, we’ve arguably entered a “late expansion” stage as higher interest rates (in response to inflation challenges and lower unemployement) may cause a new set of market leaders to increasingly emerge (i.e. a “changing of the guards” of sorts, whereby recent market leaders pass the torch to a new batch of opportunities).

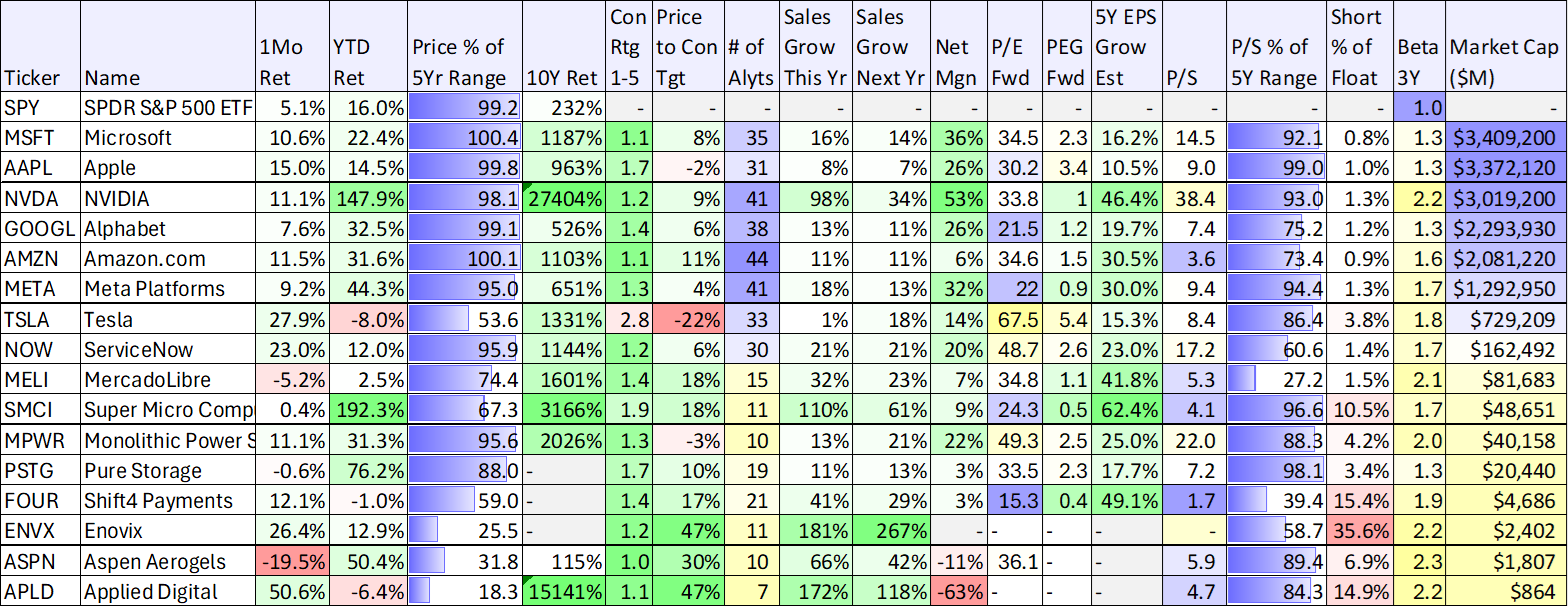

Of course there are individual businesses that are so powerful (disruptors and megatrend beneficiaries) they can succeed in almost any market environment. But that doesn’t mean you shouldn’t at least consider lightening up on some of them (such as Nvidia and/or Super Micro Computer, after their incredible recent price rallies courtesy of the cloud and AI megatrends, see chart below).

For a little perspective, famous value investor, Seth Klarman, once said:

“The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.”

*Honorable Mention: Nvidia (NVDA):

Before getting into the official top 10, we’re including Nvidia as an “honorable mention” on this list. As you likely already know, Nvidia makes computer chips (semiconductors) that are powering two long-term mega trends. One, the great cloud migration (Nvidia chips are used in the datacenters behind the cloud) and two is artificial intelligence (AI requires massive computational power, and Nvidia chips are the leading solution).

And considering the massive long-term growth potential for Nvidia, it might sound ridiculous to suggest selling even one share. However, just know that chips stocks are notoriously cycical, and Nvidia has a history of pulling back dramatically more than the S&P 500, as you can see in the following chart (i.e. Nvidia shares have sold off more than 50% four times since 2000, and it can happen again).

Nvidia is a critically important part of the global economy, but if your position in the stock has grown dramatically over the last few years (as the share price has climbed), it might be a good time to consider rebalancing your portfolio to bring Nvidia’s weight back down to a level you are comfortable with.

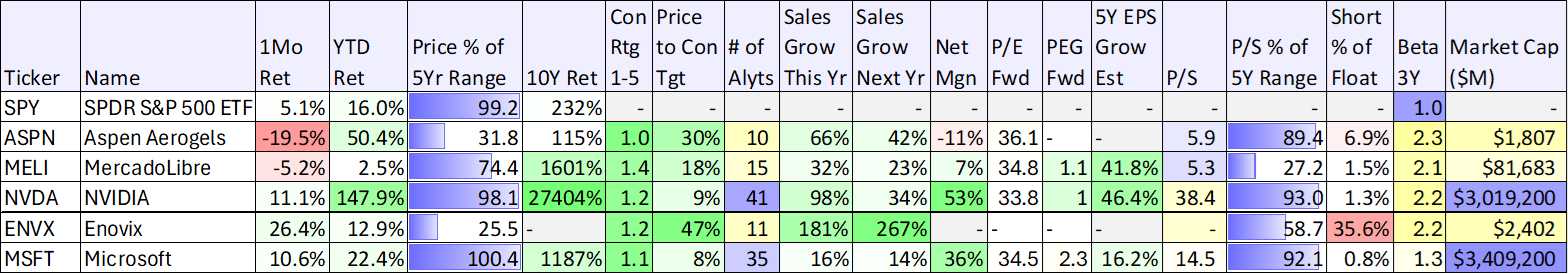

For example, there a lot of computer chip and hardware companies (see table above) that have peformed extremely well over the last year (courtesy of AI and the cloud), and if they’ve grown to very large positions in your investment portfolio (for example, over the last year, we’ve owned Nvidia, Super Micro, Monolithic Power and Pure Storage), you might want to consider a little rebalancing (when they fall, they fall hard), depending on your personal goals and investment situation.

Here are a few tips we wrote on position sizing and tax strategies (for Nvidia, in particular) if you’re considering a little rebalancing.

Top 10 Growth Stocks

So with that backdrop in mind, let’s get into the official top 10 ranking and countdown. We currently own all 10 names on the list (in varying weights, more on this later), and we have attempted to include an attractive mix of two types of top growth stocks…

Blue Chip Growth Stocks: benefiting from powerful megatrends, and currently trading at attractive prices (relative to their long-term value).

Disruptive Growth Stocks: with massive (albeit volatile) upside potential.

We start with #10 and count down to our very top ideas.

10. Aspen Aerogels (ASPN)

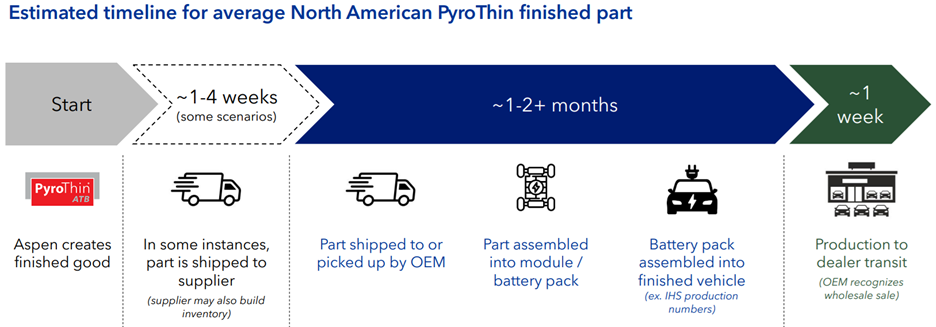

The world is changing, and whether you like them or not—electric vehicles are a global megatrend. And even though Aspen Aerogels does NOT make electric vehicles, this materials company (founded in 2001) is achieving new growth in recent years from its aerogel insulation products used in lithium-ion batteries in electric vehicles.

The company continues to win deals with major automakers and expects more through the end of the year. it’s also highly rated (“strong buy”) by the 10 Wall Street analysts covering this $1.8 billion small cap stock (see rating in table below).

We previously wrote this one up in detail here, and if you are looking for attractive long-term growth from a company in the materials sector, Aspen Aerogels is worth considering. We’ve owned shares for just over 6 months now (in our Blue Harbinger Disciplined Growth Portfolio), and look forward to more gains ahead.

(Data as of Tues, July 2nd. source: StockRover)

9. Mercado Libre (MELI)

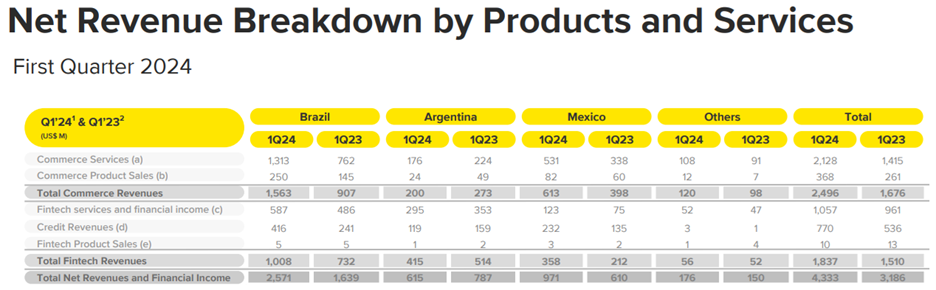

Mercado Libre is the leading Latin American online commerce platform, and it offers some attractive undervalued long-term growth potential. With revenue growing well over 20% per year, and the shares trading at only 1.1x forward PEG, Wall Street has a “strong buy” rating, and we think there is room for significant long-term growth as the market opportunity is large and Meli is the clear leader.

Mercado Libre’s ecosystem of solutions includes its commerce marketplace plus payments/lending (Mercado Pago/Credito), shipping (Mercado Envios) and ads (Merado Ads). The company continues to grow its user base initially with low-cost (subsidized) shipping and membership rewards (“MELI+”), as well as an easy-to-use listing platform for sellers.

In a highly-competitive marketplace Meli has a huge competitive advantage (“moat”) due to its first mover advantage and growing economies of scale (not to mention its powerful self-reinforcing ecosystem). This already very profitable business is attractive, especially as margins continue to improve. Lots of room for continuing long-term growth (5-year EPS growth estimate is over 40% per year). We own shares in our BH Disciplined Growth portfolio.

8. Enovix (ENVX)

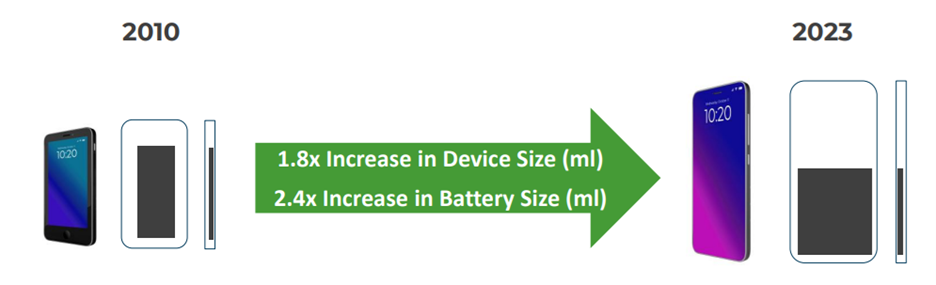

As smart phone energy demands grow (especially with the proliferation of AI apps), Enovix is working to scale its disruptive battery architecture to improve efficiency and capacity. And the company’s total addressable market (“TAM”) is enormous, expanding beyond just smart phones and into wide-ranging Internet of Things (“IoT”) devices and electric vehicles.

To be clear, Enovix is not yet profitable, and the risks are significant, but if it can keep moving towards scale, the upside is enormous. Wall Street rates it a “strong buy,” and we’re including it here in our top 10 list as a very attractive, albeit risky, long-term growth opportunity.

If you have room in your long-term growth portfolio for a higher-risk opportunity, Enovix has massive upside potential, and the shares are worth considering. You can read our new full report on Enovix here.

7. Microsoft (MSFT)

Simply put, Microsoft is an amazing business. Thanks to Microsoft Windows, Microsoft Office and Microsoft Azure (cloud), the company has extremely high margins (wide moat) and it continues to spend heavily on innovation and growth opportunities (a good thing, especially as Azure continues to make up ground on the number one cloud service provider, Amazon Web Services).

And despite recent price gains, Microsoft still trades at a reasonable 2.3x forward PEG multiple and 34.5x forward PE ratio. One of only two publicly-traded stocks with a “AAA” credit rating (not even the US government is rated this high), Microsoft will likely be trading much higher in the years and decades ahead. We are very long Microsoft, and you can read our previous full reports and writeups on the company here.

6. ServiceNow (NOW)

ServiceNow is a exceptional “software application” business (basically end to-end workflow automation software-as-a-service for enterprises). It also has high profits (29-30% Non-GAAP net margins, 19.3% GAAP), strong customer retention (98%+ renewals) and high revenue growth (above 20%). Yet its valuation (Price-to-Sales and Price/Earnings to Growth) remains reasonable. Wall Street likes the business too (“strong buy” 1.2 consensus rating).

In a nutshell, ServiceNow is a great business, with a reasonable valuation, and over the long-term (many years) it’s likely going much higher (and at a faster rate) than the overall market (thanks in large part to its very sticky “land-and-expand” customer base). You can read our previous reports on ServiceNow here.

5. Alphabet (GOOGL)

Powerful growth, powerful margins and strong ratings from Wall Street analysts make Alphabet hard to ignore (especially considering it has a lower beta and likely much lower volatility than other top growth stocks). The company’s vast ecosystem across Google and YouTube (not to mention it’s the 3rd biggest cloud services company) basically gives Google an impenetrable moat to fend off competition (and to keep growing).

Trading at only a 1.3x PEG ratio, and with strong earnings growth expected, Alphabet is an extremely attractive stock to own now and over the long-term (it’s bascially an undervalued, blue chip juggernaut with a powerful long-term growth trajectory). You can read our previous reports on Alphabet here.

4. Applied Digital (APLD)

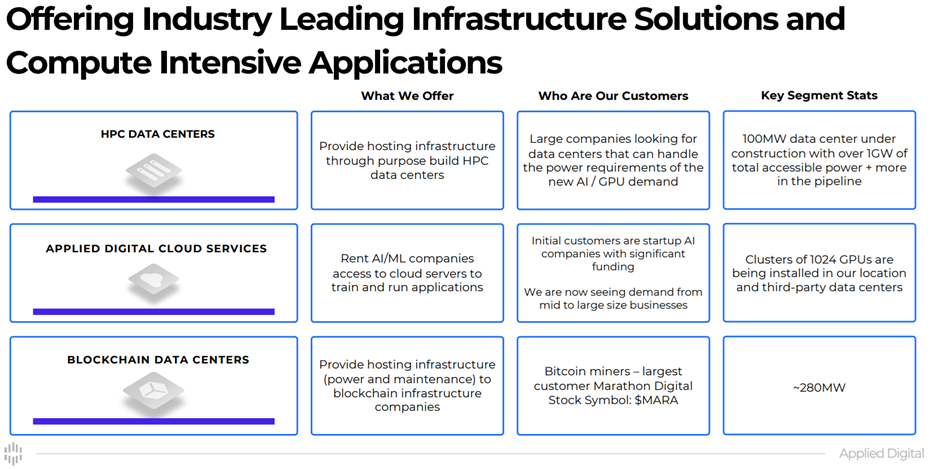

Applied Digital develops and operates next-generation datacenters for the rapidly growing high performance computing (“HPC”) industry. The company believes its solutions are better suited for “compute intensive applications” (such as AI), and it believes the demand for such datacenters will drive customers to Applied Digital soltuions.

The company has recently faced significant unexpected challenges due to power outages and also the need to strenthen their balance sheet (with $160 million of asset sales and additional financing transactions). Nonetheless, the company is in a healthier financial postion, trading at a lower price, and still positioned for powerful industry growth.

Wall Street analysts rate this one a strong buy with significant price appreciation potential (Applied Digital is essentially one big customer away from massive growth and share price appreciation). The company is one of the more speculative growth names on our list, but the upside potential is impessive. You can read our previous report on Applied Digital here.

3. Meta Platforms (META)

Meta Platforms (parent of Facebook, Instagram and Whats App) continues to print money. It has extremely high net margins (32%), high growth and a low (attractive) 0.9x PEG ratio. The market didn’t like the very high capex speding in the most recent quarter (they bought a ton on Nvidia chips), but the company is focused on growth (particularly spending on data centers) and this is a good thing. Also a good thing, WhatsApp is now over $1B annual revenue run rate (from click through ads and paid messaging) and it has continuing huge growth potential. Meta shares can be volatile, but the ongoing long-term growth potential make this an attractive top tier investment opportunity. You can access our previus Meta reports here.

2. Shift4 Payments (FOUR)

Shift4 Payments is a software-based solution that allows for in-person and online payments serving a wide and growing variety of industries, including restaurants, websites, hospitality (e.g. hotel/vacation destinations), specialty retail, sporting events and others. The company was founded by its current CEO (Jared Isaacman) in the 1999 (when he was 16). The comany basically built a payments solution (they’re continually improving it), and now they are selling the heck out of it to a wide variety of end users (impressive growth!).

We recently wrote ths one up in detail here, but overall it is an attractive high-growth company (its forward PEG ratio is an impressive 0.4x), with a large market opportunity and lots of room for growth).

1. Amazon (AMZN)

Amazon has four big growth drivers (Amazon Web Service (“AWS”), Prime Video Ads, Artificial Intelligence, and Massive Free Cash Flow for Innovation). And Amazon also has an extremely attractive valuation (it trades at only 1.5x forward PEG) and EPS is expected to grow at over 30% per year, on average, over the next five years (lots of room for margin expansion, and CEO Andy Jassy is into it, moreso than Bezos ever was).

Relative to the other megacaps, investors are underappreciating the contiuing powerful growth and margin expansion on the horizon. We wrote Amazon up in detail here.

(Data as of Tues, July 2nd. source: StockRover)

The Bottom Line

There are many attractive growth opportunities in the market today, and they’re not all named Nvidia. If Nvidida’s explosive outsized growth was phase one of the new AI revolution, we could see impressive outsized growth in phase two from companies using Nvidia chips (e.g. Microsoft and Meta just bought a ton). And of course attractive growth exists in other industries too (such as the names on this list).

If you are a growth investor, you need to construct a growth portfolio that is right for you, based on your own individual situation and needs. Disciplined, goal-focused, long-term investing continues to be a winning strategy. You can access our complete Disciplined Growth Portfolio holdings here: