A lot of income-focused investors would miss out on the power of diversified stocks if it weren’t for closed-end funds like the Liberty All-Star Equity Fund (USA), currently yielding 10.0% (paid quarterly). However, a look under the hood reveals this popular fund is only an incremental improvement for many investors, and it omits many of the qualities that make many other CEFs so attractive. In this report, we review USA (including the strategy, distribution, expenses, leverage, holdings and price versus net asset value (NAV)). We conclude with our strong opinion about investing in USA.

Overview:

USA is popular big-yield closed-end fund that describes itself as a:

“Multi-managed fund that allocates its portfolio assets on an approximately equal basis among several independent investment management organizations (currently five in number) having different investment styles recommended and monitored by ALPS Advisors, Inc., the Fund's investment advisor.”

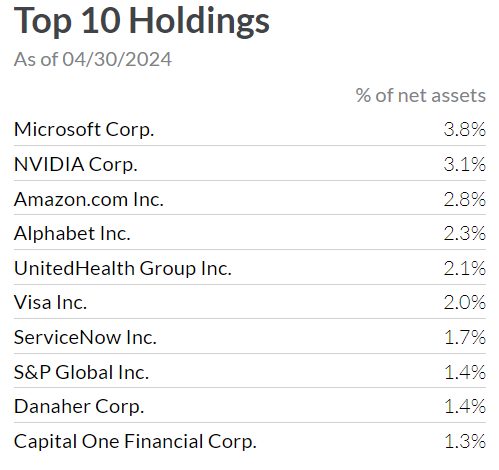

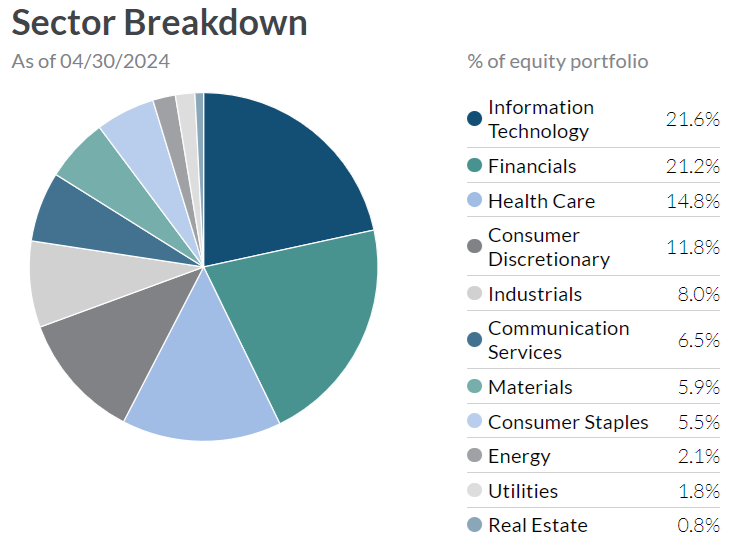

In particular, the fund has three value managers and two growth managers. And you can view the top holdings and sectors in the graphics below.

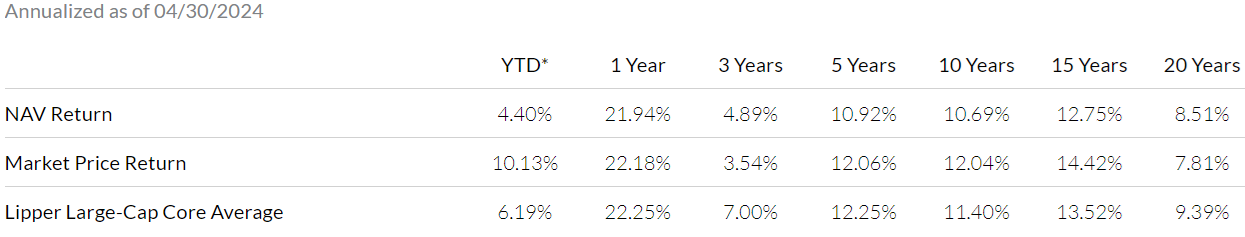

Also, worth highlighting, you can see the fund’s historical performance in the table and chart below.

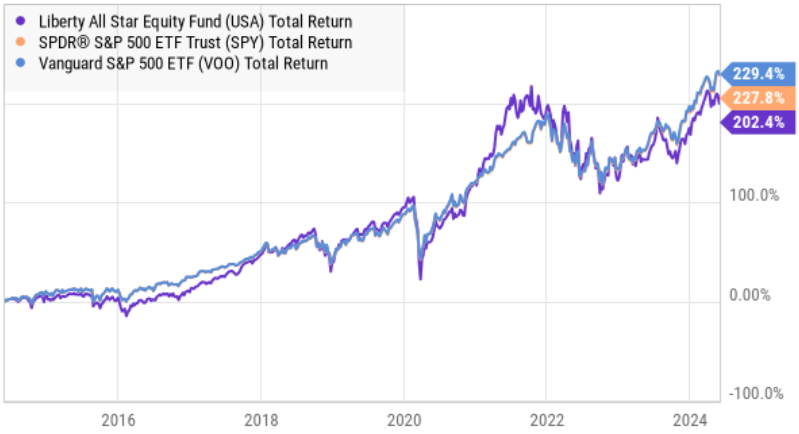

As you can see above, performance has been very positive over the years (a good thing), but it has consistently (and significantly) underperformed its own benchmark index (on an NAV basis) throughout history (not a good thing). Also, you can see USA’s performance generally tracks very close to the S&P 500, but tends to lag over time (more on this later).

Nudging Novices Towards Improvement

One of the best things about USA is that it nudges many income-focused investors to include more stocks in their investment portfolios, particularly stocks in sectors that are NOT known for big dividends, such as technology (see sector allocation chart earlier) and value (USA actually has two growth managers, as mentioned earlier).

For example, a lot of income-focused investors have portfolios concentrated in bonds (or bond CEFs), REITs and BDCs (financials) because these are the typical “high-income” sectors and styles. But by investing in USA investors get important risk-reducing diversification (because USA owns stocks across many sectors and styles). This can be a very good thing for USA investors.

How the Distribution is Sourced

You may be wondering how USA sources its big 10.0% yield (paid quarterly) considering it owns a bunch of stocks that typically yield between 0% and 3%. Afterall, we saw the top holdings (earlier), and the USA distribution policy is:

“The current policy is to pay distributions on its common shares totaling approximately 10 percent of its net asset value per year, payable in four quarterly installments of 2.5 percent of the Fund's net asset value at the close of the New York Stock Exchange on the Friday prior to each quarterly declaration date. The fixed distributions are not related to the amount of the Fund's net investment income or net realized capital gains or losses and may be taxed as ordinary income up to the amount of the Fund's current and accumulated earnings and profits. If, for any calendar year, the total distributions made under the distribution policy exceed the Fund's net investment income and net realized capital gains, the excess will generally be treated as a non-taxable return of capital, reducing the shareholder's adjusted basis in his or her shares. If the Fund's net investment income and net realized capital gains for any year exceed the amount distributed under the distribution policy, the Fund may, in its discretion, retain and not distribute net realized capital gains and pay income tax thereon to the extent of such excess”

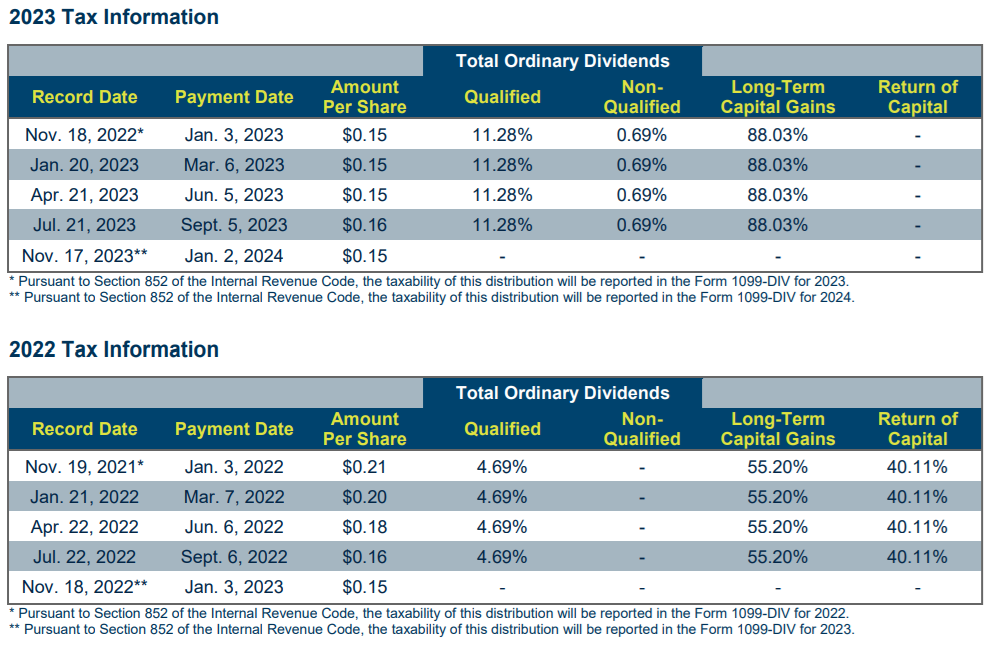

And here is a look at the sources of USA’s distribution (inlcluding taxation) for the last two calendar years.

The above table is really important because you can see only a small portion of USA’s big 10.0% distribution is “qualified” (i.e. eligible for the lower tax rate—if you own it in a taxable account) and the remainder of the distribution either comes from long-term capital gains (also taxed at a rate lower than your ordinary income tax rate) or a Return of Capital (generally not immediately taxed, but it will reduce your cost basis so you have a bigger gain and potentially a bigger capital gains tax if/when you do finally sell your shares).

So to be clear, USA is not just buying stocks that yield 10.0%, it’s buying stocks with small dividends and then sourcing the remainder of the big 10.0% distribution from capital gains (which are taxed at a lower rate than your ordinary income rate IF they are long-term—more than 1 year holding period) or returning your own capital to you (and calling it a distribution).

Is the 0.93% Expense Ratio Worth It?

According to the USA website, the fund’s expense ratio is 0.93%. That means, if there was no expense ratio then your net return would be 0.93% better each year. To some investors, this is absolutely worth it. Specifically, they can just buy USA and then sit back and watch those big quarterly distributions hit their account like clockwork every quarter.

However, it is worth noting, as an alternative, you can just buy similar stocks as USA (or even buy a simple S&P 500 index fund) and then withdraw 10% from your account every year (2.5% per quarter) and call it a distribution. And you would likely beat USA’s return by 0.93% every year. Afterall, that’s basically all USA is doing on your behalf anyway (and they’re charging you 0.93% per year for it). Also recall (from earlier in this report) USA’s performance just tracks the S&P 500 very closely (and the expense ratio on an S&P 500 index fund (such as Vanguard’s (VOO) is only ~0.03% pear year, or 0.90% LESS than USA’s).

Other CEF Needle Movers

Of course there are other factors that can make CEFs more attractive than buying an index fund or just building your own ETF.

Leverage: For example, leverage (or borrowed money) is popular among many CEFs, and leverage can magnify returns and income in the good times (especially over the long-term as stock markets, for example, tend to go up). And closed-end funds can generally implement leverage better than your and I (because they get lower borrowing rates than individual investors, and funds have teams in place to maintain discipline and reduce risk). HOWEVER, USA typically doesn’t use much leverage (recently 0.01%).

Unique Holdings: Another advantage many CEFs have (over ordinary investors) is CEFs can buy things ordinary investors cannot (such as institutional bonds, bank loans, derivatives and more). HOWEVER, USA typically doesn’t do any of this. USA is just buying common stocks that you and I can easily buy on our own anyway.

Discount to NAV: Another potentially huge advantage of buying a CEF (instead of building your own CEF) is that actual CEFs often trade in the market at large discounts to NAV (i.e. the net asset value of all their underlying holdings). So when you buy a CEF at a discounted market price (versus its NAV) its like you’re getting all its underlying stocks at a big sale price. A big discount can actually offset a large expense ratio in some cases. HOWEVER, USA doesn’t typically trade at a large discount (the current discount is only ~2.3%), so in this case there really isn’t much of an advantage to buying USA versus building your own CEF (with stocks or a simple S&P 500 ETF).

The Bottom Line:

If you currently own mostly bonds (for the steady income) or if you don’t currently own too many stocks (or if you’re concentrated in REITs or BDCs—for their high yields), then USA can be a great incremental needle mover to nudge you into important market styles and sectors (that increase diversification, reduce risks and have the potential to increase long-term returns) while still maintaining a very high yield (10.0% per year). In this case, USA can be a smart move in the right direction.

However, there really isn’t much special about USA versus just buying similar stocks (or even an S&P 500 index fund) and then creating the 10.0% annual distribution yield (2.5% each quarter) on your own by withdrawing dividends (instead of reinvesting) and by selling some of your shares (to harvest capital gains and/or to return some of your own capital). And if you do create your own CEF (and big distribution) in this fashion—you can avoid that 0.93% annual expense ratio and add it as a direct improvement to your bottom line wealth.

Every investor’s situation and needs are different. And I’m not knocking anyone for owning USA (after all it’s a great “lazy man” way to get 10% of your account converted to cash each year). But I am saying, there really isn’t too much special about USA (no leverage, no unique holdings, no big discount to NAV), and if you are inclined you can simply create your own 10.0% annual distribution and avoid USA’s 0.93% fee altogether. Be smart. Do what is right for you.