One of the largest holdings in our “High Income NOW” Portfolio got some good news recently, and the share price is up. We expect this CEF’s price discount (versus NAV) to narrow though year end (a good thing), and the long-term performance to be significantly better than most other big-yield opportunities. In this report, we review the strategy (and its relative attractiveness versus other big-yielders), the good news (and why we expect the current discount to NAV to shrink) and finally our strong opinion on who might want to consider investing.

Adams Diversified Equity Fund (ADX), Yield: 8.0%+

ADX is a legendary closed-end fund thanks to its very long track record of strong performance (it’s been paying distributions for over 85 years straight). However, investors frequently reject the fund (benchmarked to the S&P 500) because of its historically lumpy distribution policy (see below).

Distribution Increase:

Interestingly, that is about to change as the fund recently announced it will increase its quarterly distribution yield to 2.0% (previously 1.5%) and its annual distribution yield to a minimum of 8% (previously 6%), with the same potential for a larger Q4 dividend (as is currently in place) depending on market conditions.

Tender Offer:

ADX also announced a tender offer for 10% of its outstanding shares at a price of 98% of NAV per share. And this “98% of NAV” is significant considering the fund typically trades in the open market at around 85% to 90% of NAV.

We explain why this is an attractive situation (i.e. the NAV will likely shrink through year end—a good thing) later in this report. But first let’s review what exactly ADX does and why it’s special.

Overview:

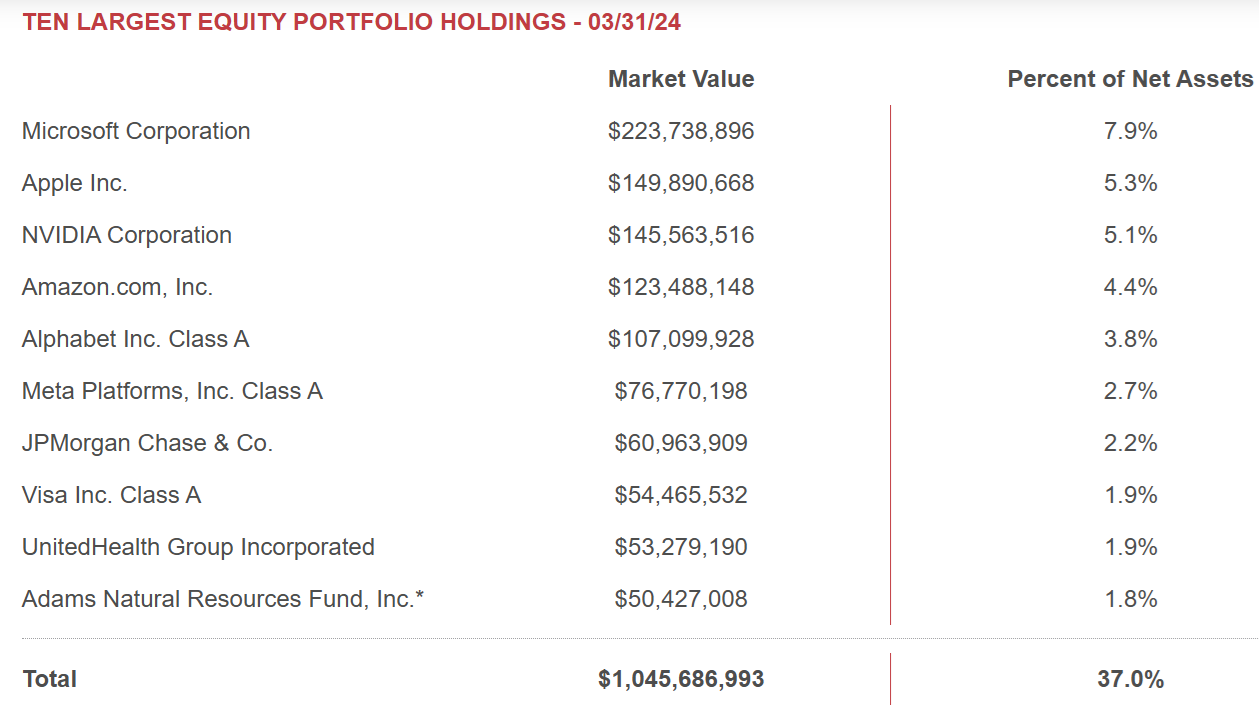

The Adams Diversified Equity Fund is an equity (stock) closed-end fund (“CEF”). You can see its largest holdings and sector allocations in the following graphics.

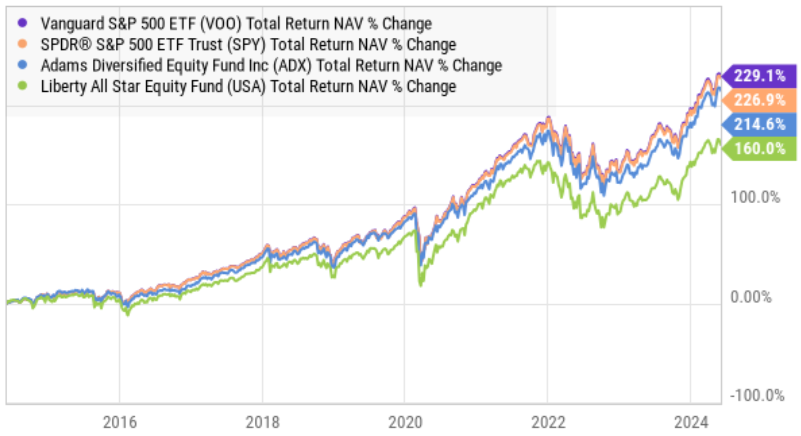

And there are a couple very special things about this fund, starting with its long track record of success. Specifically, the fund has been paying distributions to investors for over 85 years (impressive!) and it has a healthy track record of outperforming the S&P 500, as you can see in the following graphic.

So if you are an income-focused investor, ADX has been special.

ADX Versus Other Big Yield Opportunities.

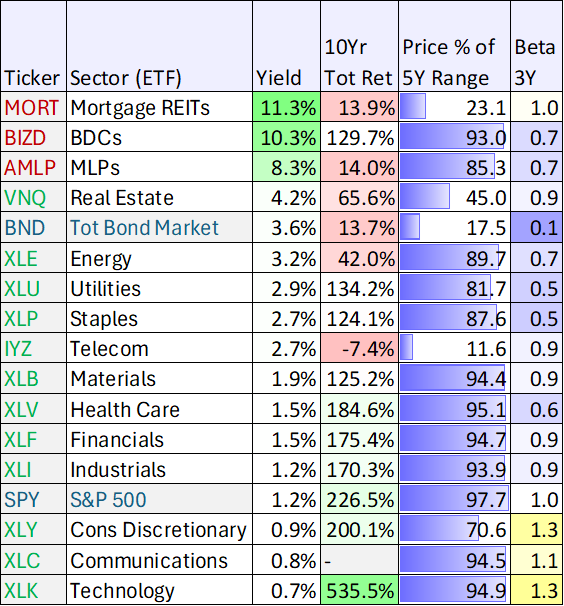

And one thing that makes ADX particulary compelling (if you are an income-focused investor) is that it gives you exposure to equities, particularly diversified high-growth equity sectors, that many big-yield funds omit. And this gives investors the benefit of better diversification and more long-term total return protection.

ADX: Big Discount Versus NAV:

As you can see below, ADX has typically traded at an ongoing discount to NAV. This is a good thing for investors because it means you can buy all of the fund’s underlying holdings at a discount, but then the fund (i.e. you) still receive the ful price appreciation potential and dividends (you just bought them on sale). This attractive discount is part of the reason why ADX performance has been strong.

Why the Policy Change?

To shrink the discount and to make the yield more compelling versus other big-yield equity CEFs, such as the Liberty All-Star Equity Fund (USA) which we wrote about here, ADX is increasing its minimum quarterly distribution from 1.5% to 2.0% (with the potential for a larger Q4 dividend.

Note USA trades at a much smaller discount to NAV (see chart below), and we expect the ADX discount to move in that direction towards year end (a good thing because it should cause the share price to perform relatively better than other equity funds).

Also, ADX has a lower management fee than USA (0.65% versus 0.93%), also a good thing. Further still, the two have tended to perform similar over time (i.e. very similar to the S&P 500).

How The Distribution is Sourced:

In the case of equity (stock) funds liike ADX, it’s really important to understand how the distribuion is souced. As you may have realized, ADX’s underlying stock holdings don’t pay dividend yields anywhere near 8.0% a year, so the distribution has to come from somewhere else. And that somewhere else is price appeciation (and potentially some return of your own capital, over time).

For perspective, the S&P 500 has averaged around 12.5% total returns (price appreciation, plus dividends as if they were reinvested) over the last 10 years. So if this trend continues (i.e. 12.5% annual return) then ADX will be able to pay its 8% annual distribution with and extra 4.5% of captial gains to spare. Of course the market is volatile from year-to-year, so the cushion is nice, especially considering the fund can build up long-term unrealized capital gains that it can use to source the distribution in future years (even in years when the market returns less than the 8.0% minimum annual distribution).

And what makes this strategy special (i.e. sourcing some of the distribution from long-term capital gains) is that it helps income-focused investors feel more comfotable investing in diversified stocks (which have great long-term price appreciation potential) instead of being overly concentrated in things like risky high-yield “junk” bonds and often dangerous (highly-leveraged) mortgage REITs (which may have less long-term appreciation potential) and a lot more risks and expenses.

The Bottom Line:

If you a retired income-focused investor that just wants to set everything on auto-drive, ADX can be a great strategy (because you can count on that 8% yield rolling in each year, and you have the potential for healthly long-term pice gains too).

Further, the newly announced distribution hike and tender offer should act to reduce the current big discount to NAV (we expect it to move closer to 0% by year end, in line with other equity CEFs like USA) and this will impove the ADX performance relative to other equity funds.

Of course, if you are inclined, you can just buy a low-cost passive stock market ETF (such as (VOO)) and then create your own quarterly distributions by selling some of your shares when you need cash (after all, ADX performance tends to be extremely similar to the S&P 500 anyway) and you’ll save 0.90% in expenses each year (plus it’s more tax efficient to recognize capital gains and losses when its most beneficial to you if you invest through a taxable account).

However overall, and depending on your goals, ADX has been a highly successful big-distribution equity fund, and we expect this to continue (especially through year end in light of the distribtution hike and tender offer). We are long ADX in our Blue Harbinger “High Income NOW” Potfolio, and look forward to healthy long-term gains and income in the years ahead.